The Canadian Space Agency (CSA) has contracted the Sudbury, Ont.-based Centre for Excellence in Mining Innovation (CEMI) to help identify Canadian earth-bound mining assets, capabilities and innovators that could help develop and establish a space mining industry.

The target? Water on the moon in the form of tiny ice crystals. The ice is trapped in a fine dusty top 2-metre surface layer called regolith. Once extracted, the water can be split into two valuable commodities in space using simple electrolysis – oxygen to sustain human presence and hydrogen, recombined with oxygen, becoming one of the most potent chemical propellants known to humanity.

The goal is to set up lunar infrastructure and a midway space staging area orbiting the Moon, from where deep space exploration to Mars and beyond can be contemplated.

According to Dale Boucher, who has been researching space mining technologies for over two decades and is working with CEMI on the CSA project, mining on the Moon will not resemble anything we’re used to on Earth.

However, he told an Apr. 13 CEMI-hosted webinar on the emerging space mining economy the clock is ticking to find suitable mining methods applicable to the moon.

With the successful completion of the Artemis I moon flyby, Canada is set to play an increasingly important role in space exploration and mineral extraction. In 2024, Canada is set to send astronaut Jeremy Hansen to orbit the Moon as part of Artemis II, the first crewed mission of the Artemis program.

“Thanks to our contribution of Canadarm3 to the Lunar Gateway, Canada has not only secured two astronaut flights to the Moon’s orbit but also benefits from a range of opportunities to conduct cutting-edge lunar science, technology demonstration and commercial activities,” François-Philippe Champagne, the minister responsible for the CSA said in a December statement following the safe return of NASA’s Orion capsule after a 25.5-day mission around the Moon.

By December 2025, the Artemis III program expects to touch down on the moon, by which time the first iteration of prototypical Moon mining equipment will need to be ready, according to Boucher.

NASA’s Apr. 5 Moon-to-Mars strategy aims to bridge the efforts made during the Artemis program, explained CEMI vice-president for business development and communications Charles Nyabeze.

“It aims to reach further down the space development timeline to Mars. It specifically refers to a lunar infrastructure goal to demonstrate the industrial scale of our mining capabilities in support of building that continuous human space presence and creating a robust lunar economy.”

Meanwhile, the United Nations International Space Exploration Coordination Group, or ICG, comprising 27 participating agencies, has developed a space development strategy roadmap.

“The ICG’s goal is to advance the global exploration strategy through coordination and their mutual efforts in space exploration. The global space exploration roadmap is a key deliverable, as well as in-situ resource utilization (ISRU) capabilities (also known as mining on Earth).”

Nyabeze says elements of mining are sprinkled throughout the timeline extending up to 2035. “We believe ISRU spanning the entire mineral value chain will become a key enabler of mankind incrementally building up infrastructure to support longer space expeditions.”

Lots of water

Boucher says the scientific community has found a surprising volume of water on the Moon over the past few years. As of 2016 data, Boucher estimates that about 60 million tonnes of water are on the Moon.

“It’s not as dry as we thought it would be. It is mostly concentrated in the north and south poles,” he said.

The ice is said to be about 2 metres from the surface since that’s the maximum depth to which orbiting sensors can penetrate. Scientists don’t know what lies at depth.

“And that means that if we converted all that water into shuttle fuel, we could launch a shuttle per day for more than 2,000 years just using the water at the north pole. The south pole has a little more water, but I don’t have the numbers,” said Boucher.

However, the big question everyone is looking to solve is how to extract the water effectively —and sustainably.

“The scale of the micro ice crystals are all sub-100 microns, and the average water concentration is about 5% by weight, which means that that is pretty good if it was gold. That’d be an awesome orebody; we certainly don’t get 5% gold per tonne in any of the gold mines in Canada,” he said.

According to Boucher’s back-of-napkin calculations, we need around 50 tonnes of oxygen per mission to the Moon, just gauging by NASA’s stated ambitions. “Now, that’s not an awful lot, but considering the 60 tonnes of water you’ve got to extract to produce the oxygen, that translates to about 5,000 tonnes of excavated regolith per year.”

“Suddenly, those numbers no longer apply to science experiments in laboratory tests. It can no longer be done in a beaker. It really needs some well-thought-out process to achieve these results at scale,” he said.

Bootstrap into space

The space mining race is quickly evolving. AstroForge, an asteroid-mining startup, is preparing to launch the first of its two missions on Apr. 14. The main objective is to test the firm’s technique for refining platinum from a sample of asteroid-like material.

The company has placed a payload on SpaceX’s Falcon 9 rocket, pre-packed with elements similar to those in asteroids. Working in Earth orbit, the OrbAstro-built cubesat will attempt to vaporize and sort the materials into their elemental components.

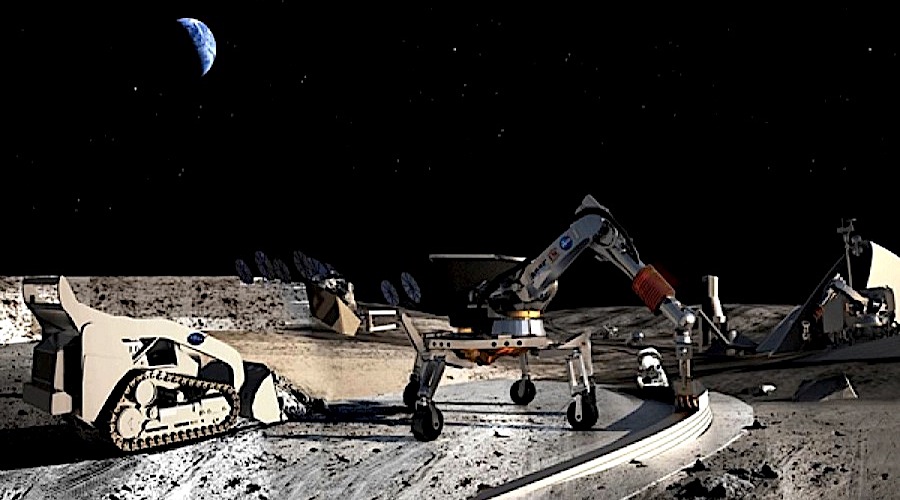

While AstroForge intends to visit asteroids, the Artemis missions revolve around the moon and ultimately Mars. The idea is to extract minerals where they will be used, not to send back to earth. And how it will look like is the stuff of science fiction.

Boucher suggests sending a giant Caterpillar bulldozer to the Moon is obviously out of the question. Instead, he proposes taking small steps in space, each representing a mighty technological achievement. “You can actually bootstrap your terrestrial market onto the Moon,” said Boucher.

He suggests that is the market is there, the technology will find a way to tap it. He calculates there is already an existing potential market for 60 tonnes of water to supply NASA alone with its medium-term space chemical needs.

“The support required for this long-term human presence on the Moon is going to drive a market for the development of larger volumes of product,” predicts Boucher. “And how do you make that sustainable? Again, we only know what’s down 2 metres below surface. It sounds a little bit like it would entail an open pit excavation. But who knows where we’re going to go with this?”

Douglas Morrison, president and CEO of CEMI, also highlighted that aside from finding the best moon mining technologies, there are other essential question marks that need to be dealt with.

“There are outstanding issues regarding legal frameworks in space, security of tenure, property rights – simple things like the National Instrument 43-101: How do you do due diligence on the moon?” he asked. “How do you prove that you can actually extract this stuff? How do you stake a claim robotically, and if you can do it, is it defensible? How do you do automated assays on the moon? How do you manage your claim? How do you manage your communications?”

A further sticking point would be to consider how these polar-based Moon mining operations will be powered when the water is only found in areas without direct sunlight. Are small modular nuclear reactors the answer?

“While these questions remain to be resolved, I see ample opportunities for the terrestrial mining sector to innovate and transpose their experience to space,” Morrison said. “Conversely, any technological advances on the moon stand to benefit the terrestrial industry directly.”