Jessica Menton, Elena Popina and Bre Bradham

Sun, May 7, 2023

(Bloomberg) -- The selloff in US bank shares is threatening to push them below a technical threshold that could signal more pain ahead for the broader stock market.

With the collapse of First Republic Bank worsening fears about the solvency of regional lenders, investors have pummeled financial stocks, leaving the S&P 500 financials index on the verge of falling back below its 2007 peak. For perspective, after the 2008 credit crash it took over a decade for that gauge to recover the ground it lost.

The financials index has been above the 2007 high since January 2021. If were to fall through that barrier now, it would be an ominous signal for the broader stock market, said hedge-fund manager Jim Roppel, founder of Roppel Capital Management.

Why? Because it could put further pressure on banks to conserve capital and cut back on lending, adding a drag to an economy already at risk of a recession after the Federal Reserve’s steep interest-rate increases over the past 14 months.

“You can’t have a bull market if bank stocks are falling,” said Roppel, who’s a long-term bull but currently is mostly in cash with the rest in defensive plays like gold and gold miners. “It’s like if an Olympic athlete had cinder blocks around their legs.”

Wild Week

Concerns about the stability of the banking system contributed to a tempestuous week as investors aggressively bet against the stocks. While the share prices rebounded on Friday amid speculation the selling was overdone, many remained down steeply, with Western Alliance Bancorp sinking 27% last week and PacWest Bancorp plunging 43%.

Individual investors — who were some of the market’s most reliable dip buyers in 2020 and 2021 — scooped up some bank stocks amid the rout. In the week through Wednesday, they were net buyers in shares of Bank of America Corp., Truist Financial Corp. and SoFi Technologies Inc., data compiled by JPMorgan Chase & Co.’s Peng Cheng show.

But there’s continuing concern on Wall Street that the ongoing turmoil among regional banks could fuel a tightening in lending. In fact, traders are betting that the toll could be so great that they stepped up wagers that the Fed — which just signaled that Wednesday’s rate hike may be its last — will start easing monetary policy as soon as July to stimulate the economy.

Even so, Nancy Tengler, chief investment officer of Laffer Tengler Investments, said it’s too soon to wade back into shares of beaten up banks. Instead, she’s been focused on technology and consumer-related stocks that would benefit from a drop in interest rates, though her firm added shares PNC Financial Services Group Inc. after it delivered strong profit growth and growing deposits.

“It’s not smart to chase some of these other bank stocks,” Tengler said. “You have to let the falling knife fall.”

Friday’s stock-market rebound was fueled by the stronger-than-expected monthly jobs report for April, which tempered fears of a recession. Still, while the 1.9% rally in the S&P wiped out most of last week’s decline in the broad benchmark, the financial stocks in the index lost 2.7% over the five sessions.

Scott Colyer, chief executive at Advisors Asset Management, said the S&P 500 would have to slump to 3,600 or lower for him to become more optimistic about stocks, as valuations remain pricey. It closed at about 4,136 Friday.

“We have to see have financials leading the way for the stock market to be in a sustainable uptrend — but that’s not what’s happening,” Colyer cautioned. “Don’t pick up nickels and dimes in front of a steam roller.”

There's a record $5.3 trillion is cash on the sidelines as investors get more bearish on stocks. Here's why that could mean big gains ahead.

Matthew Fox

Sun, May 7, 2023

A trader works at the New York Stock Exchange NYSE in New York, the United States, on March 9, 2022.Michael Nagle/Xinhua via Getty

Investors can't stop piling up cash, with assets in money market funds ballooning to a record $5.3 trillion.

The surge in cash comes amid a combo of high interest rates and depressed investor sentiment towards the stock market.

But that massive pile of cash could be the fuel needed to drive the next bull market rally.

Investors are hoarding cash at record levels and there's no sign of the trend reversing amid high interest rates and depressed investor sentiment towards the stock market.

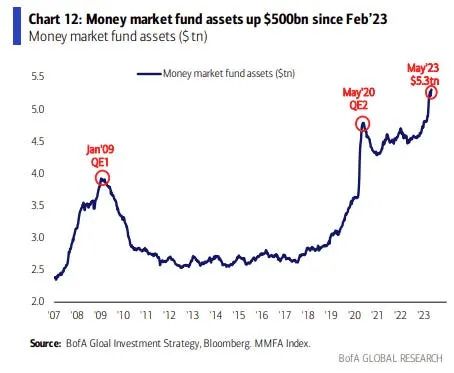

Money market fund assets have ballooned to a record $5.3 trillion, with inflows surging by $588 billion over the past ten weeks, according to a recent note from Bank of America.

That surge in cash held by investors came amid a flight-to-safety sparked by the regional banking crisis, in which three banks with combined assets of nearly $550 billion collapsed over a two-month period.

The recent fund flow surge into money market funds eclipsed the $500 billion fund inflows seen after the Lehman Brothers collapse in 2008, and was about half that of the $1.2 trillion that flooded money market funds during the onset of the COVID-19 pandemic.

Part of the reason why investors are stocking up on cash is to take advantage of a high risk-free rate of return of just over 4%. Another reason is because investors are downright bearish on stocks.

In AAII's most recent investor sentiment survey, which asks investors where they think the stock market will be in six months, bearish responses surged to 45% over the past week, which is a historically high reading for the 30+ year-old survey. The historical average for bearish responses is 31%.

Meanwhile, only 24% of respondents were bullish on stocks, which suggests that most investors are struggling to find a good reason to invest their money into equities amid the heightened uncertainty tied to the ongoing banking crisis.

And Fundstrat'sTom Lee agrees. That is, if the banking crisis continues to spiral out of control. In a Friday note, Lee told investors that "this is a tough time to argue adding risk" given the recent collapse of First Republican Bank and the extreme volatility seen in PacWest Bancorp and Western Alliance Bancorp.

"This raises too many tail risk issues including credit tightening, commercial real estate and wide economic implications," Lee said. And yet, Lee still sees a balanced risk/reward setup for the stock market as the banking sector shows signs of stabilizing and earnings results hold up better-than-expected.

And if ongoing developments in the banking sector, economy, and stock market turn better-than-expected, then there's a massive $5.3 trillion pile of cash that could act as fuel to drive the next bull market in stocks. That's because, according to Lee, much of the cash that's been built up over the past couple of years was withdrawn from the stock market.

"Retail liquidations of S&P 500 and Nasdaq stocks exceeds [retail's] purchases since 2019," Lee told Insider on Friday, referencing data from Goldman Sachs.

"I think stocks are flat vs. [a] year ago and sentiment far worse and there is way more cash on [the] sidelines. So there is definitely [a] flows story that could unfold," Lee said. Lee set his 2023 year-end price target at 4,750, about 15% higher than current levels.

If that massive cash pile starts to unwind, investors have few options on where to put it, and the stock market is likely a top choice.

Bank of America

Matthew Fox

Sun, May 7, 2023

A trader works at the New York Stock Exchange NYSE in New York, the United States, on March 9, 2022.Michael Nagle/Xinhua via Getty

Investors can't stop piling up cash, with assets in money market funds ballooning to a record $5.3 trillion.

The surge in cash comes amid a combo of high interest rates and depressed investor sentiment towards the stock market.

But that massive pile of cash could be the fuel needed to drive the next bull market rally.

Investors are hoarding cash at record levels and there's no sign of the trend reversing amid high interest rates and depressed investor sentiment towards the stock market.

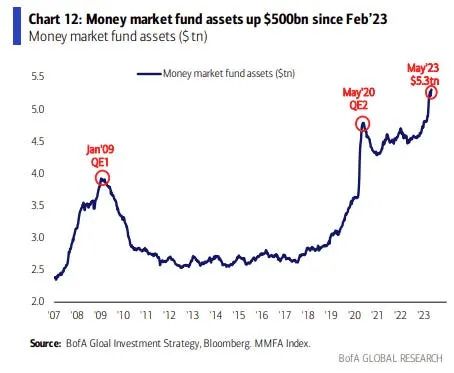

Money market fund assets have ballooned to a record $5.3 trillion, with inflows surging by $588 billion over the past ten weeks, according to a recent note from Bank of America.

That surge in cash held by investors came amid a flight-to-safety sparked by the regional banking crisis, in which three banks with combined assets of nearly $550 billion collapsed over a two-month period.

The recent fund flow surge into money market funds eclipsed the $500 billion fund inflows seen after the Lehman Brothers collapse in 2008, and was about half that of the $1.2 trillion that flooded money market funds during the onset of the COVID-19 pandemic.

Part of the reason why investors are stocking up on cash is to take advantage of a high risk-free rate of return of just over 4%. Another reason is because investors are downright bearish on stocks.

In AAII's most recent investor sentiment survey, which asks investors where they think the stock market will be in six months, bearish responses surged to 45% over the past week, which is a historically high reading for the 30+ year-old survey. The historical average for bearish responses is 31%.

Meanwhile, only 24% of respondents were bullish on stocks, which suggests that most investors are struggling to find a good reason to invest their money into equities amid the heightened uncertainty tied to the ongoing banking crisis.

And Fundstrat'sTom Lee agrees. That is, if the banking crisis continues to spiral out of control. In a Friday note, Lee told investors that "this is a tough time to argue adding risk" given the recent collapse of First Republican Bank and the extreme volatility seen in PacWest Bancorp and Western Alliance Bancorp.

"This raises too many tail risk issues including credit tightening, commercial real estate and wide economic implications," Lee said. And yet, Lee still sees a balanced risk/reward setup for the stock market as the banking sector shows signs of stabilizing and earnings results hold up better-than-expected.

And if ongoing developments in the banking sector, economy, and stock market turn better-than-expected, then there's a massive $5.3 trillion pile of cash that could act as fuel to drive the next bull market in stocks. That's because, according to Lee, much of the cash that's been built up over the past couple of years was withdrawn from the stock market.

"Retail liquidations of S&P 500 and Nasdaq stocks exceeds [retail's] purchases since 2019," Lee told Insider on Friday, referencing data from Goldman Sachs.

"I think stocks are flat vs. [a] year ago and sentiment far worse and there is way more cash on [the] sidelines. So there is definitely [a] flows story that could unfold," Lee said. Lee set his 2023 year-end price target at 4,750, about 15% higher than current levels.

If that massive cash pile starts to unwind, investors have few options on where to put it, and the stock market is likely a top choice.

Bank of America