Bloomberg News | May 11, 2023 |

Quebec is home to lithium projects in varied stages of development.

The top executive of Sayona Mining Ltd., which just restarted a lithium mine in Quebec, says there isn’t enough electricity in the Canadian province to power the region’s mining projects.

The province that produces North America’s cheapest power faces a looming energy shortfall after years of marketing its hydroelectric power to US states and wooing industry with cut-rate prices. That poses a dilemma for the miners and manufacturers that have been lured to Quebec to build a domestic supply chain for electric vehicles.

“Only a few years ago, you wanted to build a mine, there wasn’t a question of whether you would get the power or not — it was guaranteed,” Sayona’s Chief Executive Officer Guy Belleau said Thursday in a presentation at a mining industry conference in Palm Springs, California. “Today, there’s not enough power for all the projects in the province.”

The Australian company restarted its Quebec lithium mine in March after jointly investing $100 million into the project with Piedmont Lithium Inc. The project plans to ramp up production over the coming year before shipping lithium to South Korean battery maker LG Chem Ltd. and automaker Tesla Inc.

(By Jacob Lorinc)

Brazil seeks investor-friendly approach to lithium in bid to tap EV boom

Bloomberg News | May 11, 2023 |

Brazil may have swung to the left politically but that doesn’t mean it will be following the lead of other Latin American nations by handing control of lithium assets over to the state.

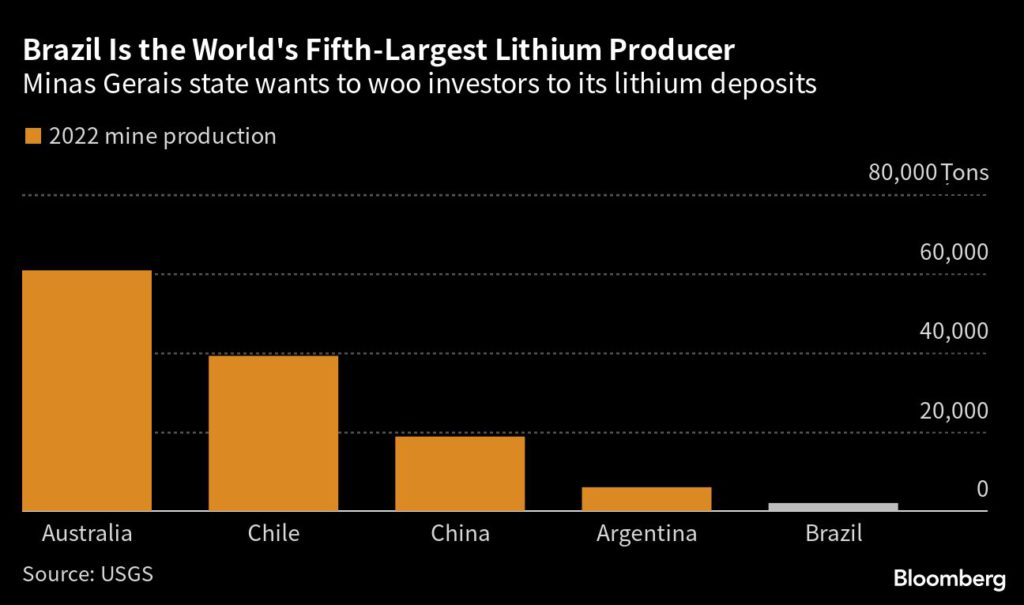

Luiz Inacio Lula da Silva, who replaced Jair Bolsonaro as president on Jan. 1, will use an investor-friendly model similar to Australia’s rather than Chile’s new public-private approach or Mexico’s quasi-nationalization, said the head of Brazil’s mining department.

“We see countries like Chile and Mexico that decided to close themselves internally on lithium. We are very aligned with Australia’s policy,” Vitor Saback, undersecretary of geology, mining and mineral transformation at Brazil’s Mines and Energy Ministry, said in an interview from Bloomberg’s New York headquarters.

Saback is leading a delegation in meetings with prospective investors in the so-called Lithium Valley Brazil as the mineral-rich nation looks to tap booming demand for the key metal used in electric-vehicle batteries. To attract investors to the southeastern region that’s home to Brazil’s largest lithium reserves, he’s touting the country’s track record of legal security and Lula’s well-received message on environmental protection.

But while the Brazilian government won’t be getting into the lithium business, it will be following the lead of its neighbors by pushing for downstream development. The Industry Ministry is studying measures to encourage development of a lithium-based industry.

“We plan to develop the whole lithium supply chain, including batteries,” Saback said.

Still, the main focus for now is attracting investors to produce and export lithium concentrate from Brazil’s hard rock deposits.

Brazil is also the second-largest iron ore supplier and a significant producer of battery metals copper and nickel. The energy transition offers the country an opportunity to double mining’s share of the broader economy, according to Saback.

To do so, Brazil has to eradicate illegal mining, which currently spans an area larger than that of industrial mining, according to non-government organization MapBiomas. Lula’s government has vowed to crack down on Brazil’s illegal gold rush, removing unlicensed miners, known as garimpeiros, from indigenous lands.

“There is no tolerance for illegality,” he said. “It’s a matter for the Ministry of Justice and the police.”

(By Mariana Durao and Gerson Freitas Jr., with assistance from Vanessa Dezem)

Albemarle aims to expand Chile lithium mine in 2028 with new technology

Reuters | May 11, 2023 |

Brine pools from a Albemarle’s lithium mine. (File image)

Albemarle Corp hopes to expand its lithium operations in Chile’s Atacama salt flat as early as 2028 with direct lithium extraction (DLE) technology under its current government contract, Ignacio Mehech, the company’s Chile manager, told Reuters.

“Depending on environmental and other permits needed in Chile, as well as scaling technologies, we believe (DLE) should be implemented, if everything goes well, towards 2028 or 2029,” Mehech said during an interview at the company’s Atacama lithium mining operations.

Albemarle and SQM, the only two lithium producers in Chile, currently extract the metal using mass evaporation ponds from brine taken from underground reservoirs. President Gabriel Boric has heavily pushed DLE technology. So far commercially unproven, the method could preserve water tables by allowing brine to be reinjected underground after lithium is extracted.

Even so, DLE still requireslarge volumes of freshwater to filter lithium from underground brine. A DLE process developed by Bill Gates-backed Lilac Solutions, for instance, uses 10 tonnes of water for every tonne of lithium produced.

Water is a hot-button topic in Chile, which is suffering a long drought, even more so on the Atacama desert. One of the driest areas of the world, mining water use there can put companies at odds with indigenous communities and threatenflamingo populations and other wildlife.

“We need to get water from other sources,” Mehech said, adding that Albemarle signed a deal with CRAMSA, a local company looking to build a desalination plant in northern Chile and infrastructure to bring desalinated water to the region.

“If more partners sign on, because our demand isn’t enough, we could secure desalinated water for the Atacama basin,” Mehech said, saying that Albemarle’s demands fulfill 500 of the 8,000 liters per second the company needs to supply the area.

When it comes to brine reinjection, Mehech said Albemarle secured environmental permits and plans to have completed a reinjection pilot program by the end of the year.

“With the results we generate from that pilot program, we’re going to start a second bigger pilot campaign to have more certainty about how reinjection should be done in the Atacama salt flat.”

This would allow the Albemarle to increase lithium production under its current agreement with Corfo, Chile’s state development agency the company has a contract with until 2043, he added.

Boric announced a sweeping plan last month to take control of the country’s lithium industry through state-controlled public-private partnerships.

Chile holds the world’s largest lithium reserves, but lost its spot as the top producer as the government failed to expand the industry.

Countries around the world are racing to provide the metal needed to power electric vehicles. Boric’s announcement spooked some investors, sparking interest in competing countries like nearby Argentina.

On Wednesday, lithium producers Livent and Allkem announced a $10.6 billion merger with a focus on Argentina.

“If you want high-quality, low-cost lithium, Argentina is the country with the best assets out there,” said Livent CEO Paul Graves.

Both SQM and Albemarle have expressed interest in expanding operations in Chile, but differ on when to start renegotiations.

SQM’s contract expires in 2030, and the company has indicated it will soon negotiate with Codelco, the state-run copper company tasked with forming the new agreements.

Albemarle CEO Kent Masters told Reuters last week he is open to negotiating before 2043 and would monitor how negotiations with SQM develop “to give us a bit of intelligence.”

Chilean Economy Minister Nicolas Grau told Reuters that conversations in the Atacama salt flat were going to be “defined during this government,” which ends in 2026, but Mehech sees a new deal happening beyond that.

“We don’t think it’s necessary. We’ve been assured by all government actors that our contract will be respected until 2043,” Mehech said.

“When it’s time, in 2038 or 2040, we’ll sit down to negotiate with the state.”

(By Alexander Villegas and Ernest Scheyder; Editing by David Gregorio)

American Lithium unit gets green light to explore new area in Peru

Reuters | May 11, 2023 |

The Falchani property in Peru. Credit: Plateau Energy Metals

The Peruvian arm of Canadian miner American Lithium Corp said on Wednesday it received authorization from the South American nation’s authorities to carry out additional explorations near its current lithium project.

The new exploration will allow the firm to expand its existing resources in the southern Puno region, bordering Bolivia, said Ulises Solis, chief executive of the subsidiary, known as Macusani Yellowcake SAC.

Along with Chile, Argentina and Bolivia, Peru forms part of the “lithium triangle,” which is believed to contain more than half of the world’s resources of the metal across extensive salt flats.

Solis said in a speech during an industry event that the company received authorization last Friday to develop exploration activities in the Quelcaya area, located a few kilometers from the company’s Falchani project.

Last month, Peru’s economy minister, Alex Contreras, said “conditions were being established” to develop lithium mining projects in the country, a week after Chile launched a plan to boost state control of the industry.

(By Marco Aquino and Carolina Pulice; Editing by Leslie Adler)

Head of new lithium giant building supply chain for Americas

Bloomberg News | May 11, 2023 |

Livent CEO, Paul Graves. (Image by NYSE)

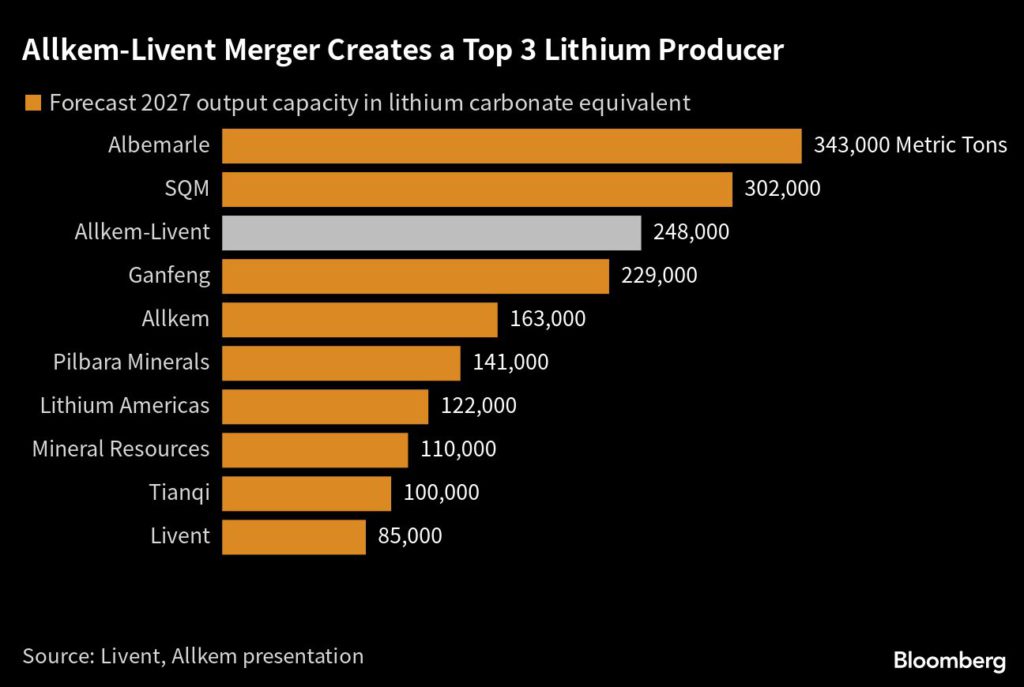

The soon-to-be chief executive of what will become the world’s third-biggest lithium producer says the new company will focus on building a supply chain in the Americas, as US automakers look for non-Chinese sources of the battery metal.

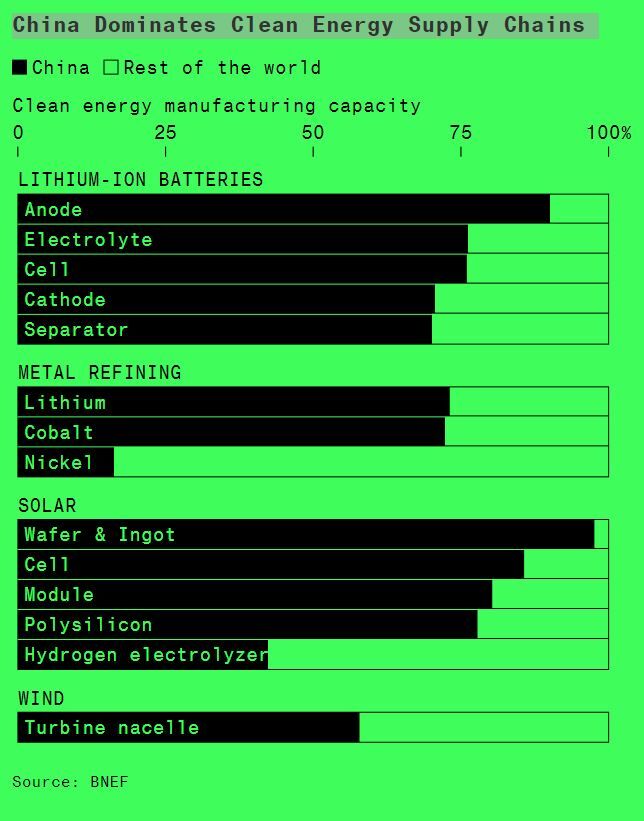

“America-centric is a big differentiator for us with customers, with investors,” Paul Graves said in an interview Thursday, a day after it was announced Livent Corp. will combine with Allkem Ltd. to create a $10.6 billion company. China, where US-based Livent has refineries, “will not be a focus of growth for us in the future,” he said.

The as-yet unnamed company will bring together lithium assets from Argentina, Canada and Australia, allowing it to meet growing Western demand, Livent CEO Graves and his counterpart at Allkem, Martin Perez de Solay, emphasized in the joint interview.

President Joe Biden’s Inflation Reduction Act, which supports domestic production of electric vehicle components, had “turbocharged” the move away from China, Graves said. The law, enacted last August, offers tax credits on EVs that use materials made in the US or its free-trade partners, such as Canada and Australia.

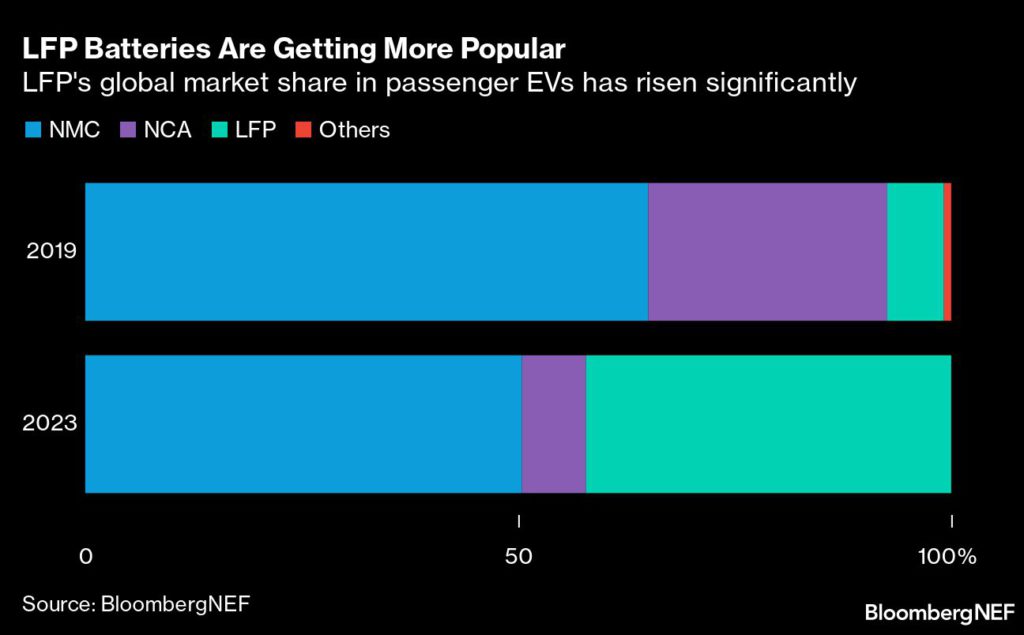

The Livent-Allkem deal shows how the IRA is reshaping supply chains for metals like lithium, and how it’s helping Washington challenge Beijing’s leading role in many sectors that are critical to the energy transition. China is the dominant downstream producer of battery materials, and the only part of the lithium supply chain it doesn’t control is extraction, where Australia and Chile are important.

“The growth area is really investing in Argentina, investing in Canada, investing in localized Western supply chains,” Graves said. Australia, a key ally of the US, would also be a focus for the new company, Perez de Solay added.

While Argentina doesn’t have an FTA with the US, Graves said he was hopeful the White House would make an exception.

“It’s in the US’s interest to qualify Argentina and we expect that they will,” he said, adding he was “getting a favorable response from the US government.”

The deal is due to be completed by year-end, with the new company to be listed in New York. Sydney-listed Allkem’s share price rose as much as 17% in trading Thursday, while Livent closed up 5.2% in the US on Wednesday.

(By James Fernyhough)

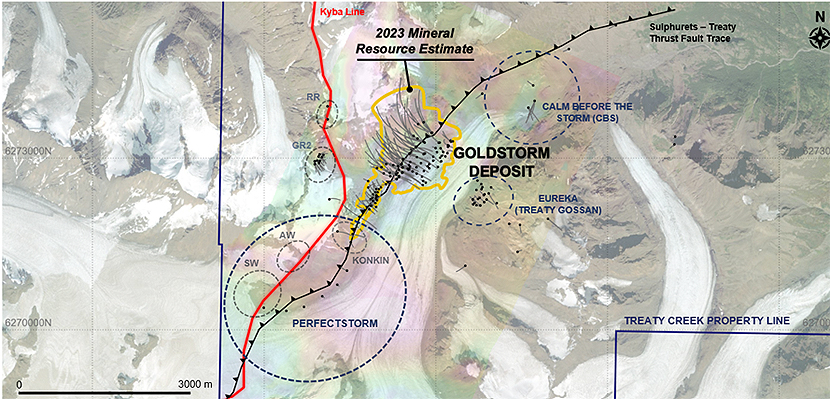

Source: Tudor Gold.

Source: Tudor Gold.