Minto Metals shutters Yukon copper mine

North of 60 Mining News - May 15, 2023

Minto Metals Corp.

An aerial view of Minto prior to Pembridge Resources' 2019 acquisition of the copper mine in Canada's Yukon.

Yukon takes over, hires JDS Mining to maintain site; mine closure may sink Minto Metals and Pembridge.

Inundated by the forces of nature and finance, Minto Metals Corp. is shuttering operations at its Minto copper mine in Canada's Yukon.

"Needless to say, ceasing operations at the Minto mine was an extremely difficult and disappointing decision, that was not taken lightly," said Minto Metals President and CEO Chris Stewart.

Unable to continue to meet its financial obligations and safely operate the mine, Minto Metals has handed the keys to the Yukon government, which has already hired JDS Mining to ensure environmental protection is maintained at the Minto mine site.

"We are acting responsibly in coordination with the Yukon Government to avoid any damage to the environment," Stewart added.

In April, Yukon Minister of Energy, Mines and Resources John Streicker directed Minto Metals to begin transferring water into one of the previously mined open pits if the available storage capacity in the tailings management facility drops below 300,000 cubic meters, which is about 79.25 million gallons.

The governmental directive was issued to both mitigate potential short-term environmental risks and ensure longer-term operations at Minto.

The added costs and potential operational disruptions associated with the directive was the final straw for Minto Metals, which was already having difficulties paying back loans made by its parent company, London-based Pembridge Resources PLC.

JDS Mining, a contract miner familiar with Minto and experienced with mine site care and maintenance in the Yukon, has been mobilized to continue with water treatment and management to ensure the environment remains protected.

"We are working closely with the contractor and the Selkirk First Nation to ensure that the environment remains protected at all times," said Streicker. "Swift action will support the continuity of environmental protection at the site."

The Yukon government is utilizing financial security for the Minto mine to pay JDS Mining for care and maintenance of the site until the end of June, with the option to extend as needed.

"We support responsible mining across the territory," Streicker added. "I recognize that this is a challenging time for Minto employees, subcontractors, and the community."

Pembridge plummets

Short of a quick financial rescue, the shuttering of the Minto copper mine likely means insolvency for both Minto Metals and Pembridge Resources.

In 2019, Pembridge agreed to buy the idled Minto mine from Capstone Mining Corp. for US$20 million. The London-based company reopened and operated the mine until the formation of Minto Metals at the end of 2021.

As a publicly listed Canadian company, it was expected that Minto Metals would be able to pay back Pembridge with cash flow from the operation and money raised on the stock exchange, if needed.

Only about six months after going public, however, Minto Metals had to invest an extra C$8 million (US$5.9 million) into a water treatment plant with the capacity to handle a winter accumulation of snow in the Yukon that was 417% above normal.

"With our investment into the water treatment plant over the past twelve months, we are in a much better position to treat and discharge larger volumes of water coming into spring freshet this year," Stewart said upon the Yukon directive in April. "Although water treatment is very capital intensive, we are prepared to allocate the necessary resources to ensure any water events do not put the company out of compliance with this order."

Less than a month later, however, Minto Metals decided to hand over operations to the territorial government.

This means that it is highly unlikely that Minto Metals will be unable to make the roughly C$250,000 monthly installments needed to repay the C$2 million owed to Pembridge this year.

Given that its investment in Minto Metals accounts for roughly 90% of Pembridge's assets, the prospect that there will be no cash flowing from the Yukon copper miner will likely sink the London-based company.

In a May 15 release, Pembridge said it has a US$350,000 of short-term liabilities but only about US$126,000 of cash.

Capstone Copper Corp.

Barge ferries a truck with two trailers of copper concentrate from the Minto Mine across the Yukon River en route to Japan.

Following the weekend news that Minto Metals is shutting down operations at the Yukon copper mine, Pembridge's share price plummeted to 30 British pound sterling (US37.5 cents), 79% lower than the previous closes of 1.45 British pound sterling (US$1.81) per share.

"Minto is unlikely to be able to repay Pembridge as scheduled, despite all the support provided to Minto by its shareholders, including Pembridge," said Pembridge Resources Chairman and CEO Gati Al-Jebouri. "As a result of this material uncertainty to the company, the board has no option but to carefully assess the financial viability of the company, consider delisting from the London Stock Exchange as well as obtaining appropriate professional advice on the restructuring and insolvency options available."

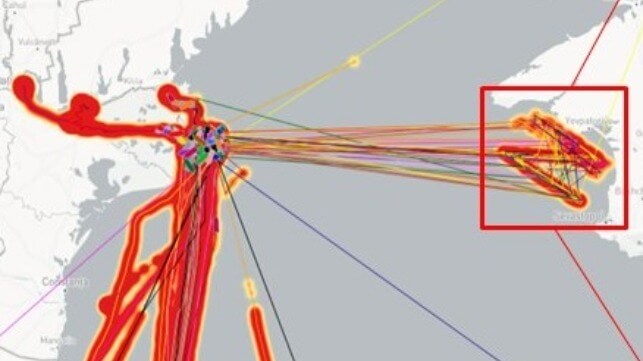

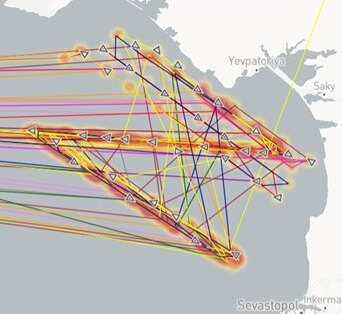

This month, a large number of merchant ships in and around the Bystry Canal region of Ukraine had their AIS locations remotely spoofed to the coastal waters of Russian-occupied Crimea. However, instead of a random pattern or a cluster, the AIS positions form a clear "Z" shape, the de facto symbol of support for the Russian invasion. (This precision AIS spoofing could also be performed in a simpler manner by transmitting false AIS signals, supplementing the ships' accurate AIS transmissions with corrupted duplicates.)

This month, a large number of merchant ships in and around the Bystry Canal region of Ukraine had their AIS locations remotely spoofed to the coastal waters of Russian-occupied Crimea. However, instead of a random pattern or a cluster, the AIS positions form a clear "Z" shape, the de facto symbol of support for the Russian invasion. (This precision AIS spoofing could also be performed in a simpler manner by transmitting false AIS signals, supplementing the ships' accurate AIS transmissions with corrupted duplicates.)