Canada turns to Nuclear power after 30-year pause to meet demand surge

, Bloomberg News

Nuclear energy is gaining significant momentum in Ontario, with new plans to expand an existing plant to become the world’s largest and a pledge to add three small modular reactors to a site where another is already being built.

The news marks a shift for an industry that has been stalled for decades amid fears about safety and cost overruns. It’s also seen as a critical step in modernizing an aging power grid that needs to add capacity without boosting already-high electricity costs, or threatening emissions goals.

The 2011 Fukushima Daiichi meltdown — the worst disaster since Chernobyl — slammed the global brakes on nuclear power plans. The Vogtle debacle in the US also provided grist for nuclear’s opponents, in the form of years-long delays and a price tag US$16 billion over budget.

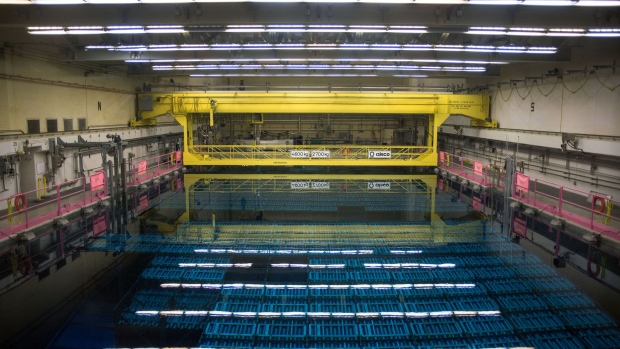

Still, Ontario is charging ahead. The newly announced expansion at the Bruce Power facility marks the first large-scale nuclear build in Canada in over three decades, suggesting nuclear policy may finally be becoming unstuck. The province is home to all but one of the country’s 19 nuclear reactors, most of which were built from the 1960s to 1980s, during which time the Candu reactor became a global favorite.

“We are returning to our nuclear roots, and it couldn’t happen at a more important time,” said John Gorman, president of the Canadian Nuclear Association. As global demand for clean energy soars, Canada is once again poised to be a supplier of nuclear reactors domestically and internationally, he said.

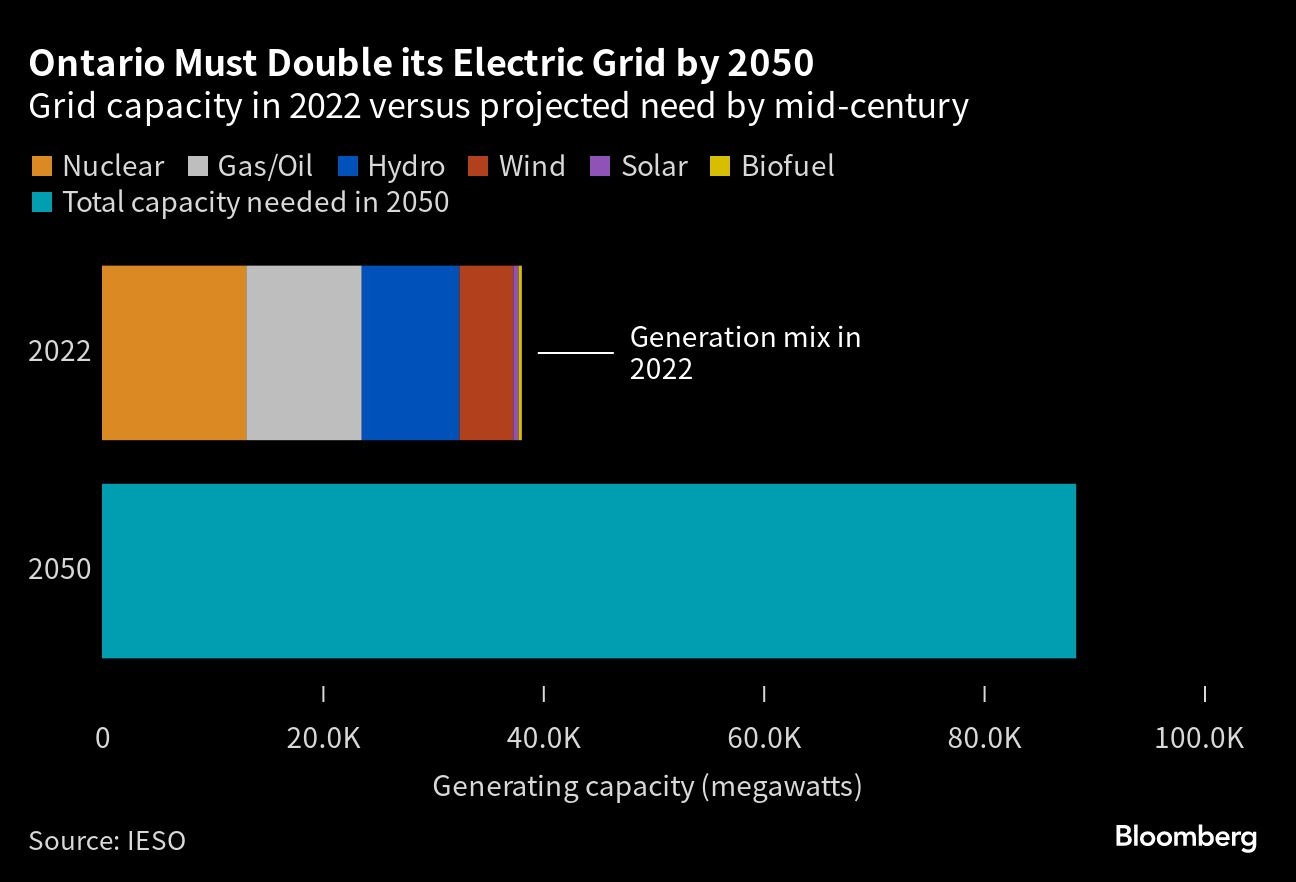

By 2050, Ontario will need to spend about $400 billion (US$303 billion) to double its generating capacity to 88.4 gigawatts, according to the agency that runs the province’s electric grid, as drivers switch to electric vehicles and homes and businesses gradually move away from fossil fuels. Canada’s largest province is also seeing rapid population growth due to immigration.

Thanks to existing nuclear, hydroelectric and wind power, Ontario’s grid is already 90 per cent clean. But growing demand could make that final 10 per cent the hardest to reach. Nuclear projects take many years to finish, and with all three of Ontario’s nuclear sites due for refurbishment this decade, the province will see a temporary cut to generating capacity. While construction is underway, the province plans to backstop supply with more natural gas.

DUMPING POWER

Once complete, the nuclear projects will reduce the province’s reliance on natural gas. They will also lessen the need to use wind and solar power to meet base-load demand — the minimum level of power needed from an electrical grid at any time — which contributes to a costly mismatch between supply and demand.

Electricity demand typically ramps up in the morning, peaks late afternoon, and tapers off at night. But supply from intermittent renewables like wind and solar is weather-dependent, and therefore less reliable at meeting the demand of the hour. Sometimes intermittent sources generate less power than is needed, and sometimes more — in which case operators may need to pause generation at certain plants to avoid overloading the system.

“At night, wind fights with nuclear and hydroelectric. During the day, wind and solar fight each other for the peak. So something has to be curtailed,” said Paul Acchione, a longtime engineer who co-authored a report on electricity price projections for the Ontario Society of Professional Engineers.

Hydroelectric power is usually first to be curtailed because its production carries a water rental tax, Acchione said. “If you put too much wind and solar on the Ontario grid, you end up dumping water into Niagara Falls.”

While intermittent renewables produce the cheapest electricity of any source, they aren’t yet reliable enough to replace natural gas, which is why the latter is still the backstop during times of peak demand and grid outages.

“Wind and solar are really, really cheap sources of power, but you need to be concerned with addressing their intermittency,” said Jason Dion, senior research director of the Canadian Climate Institute. “The challenge grows as their share of overall generation grows.”

That’s where advancements in energy storage come in, allowing excess power generated in periods of low demand to be saved for peak times.

Storage currently covers only about 0.5 per cent of Ontario’s total generating capacity, but the province will grow its battery capacity 24-fold in the next three years, according to a July report by the energy ministry. The government also has future plans to add more pumped storage hydropower, a longer-duration storage option that moves water uphill to be run through a turbine later on.

CONTAINING COSTS

Acchione’s group modeled eight different scenarios for creating a net zero electricity supply in 2035, the year by which the Canadian government has pledged to have an emissions-free grid.

The simulation found expanding both nuclear capacity and long-term electricity storage is the best way to keep rates as low as possible. In the most optimal scenario, nuclear and hydroelectric power would meet base-load demand, while intermittent sources propped up by pumped storage would kick in during peak hours — resulting in a 10 per cent rise in electricity costs. That’s about the same as residents could expect if the province simply expanded its 2021 energy mix, without the added carbon emissions.

The two new projects at the Bruce and Darlington nuclear generating stations will add 6,000 additional megawatts of capacity to the grid once complete. Ontario can achieve Canada’s net zero electricity goal as long as they arrive on schedule, and assuming demand projections are accurate, Acchione said.

“The energy planners here in Ontario are starting to appreciate the various moving parts that play into the design of an energy supply mix,” he said. “It’s a good announcement. It’s a good start.”