SASKATCHEWAN

NexGen announces US$110 million uranium financing

NexGen Energy Ltd. [NXE-TSX, NYSE] has announced a US$110 million convertible debenture financing and a strategic purchase of common shares by Australian investment house Washington H. Soul Pattinson and Co. Ltd. (WHSP).

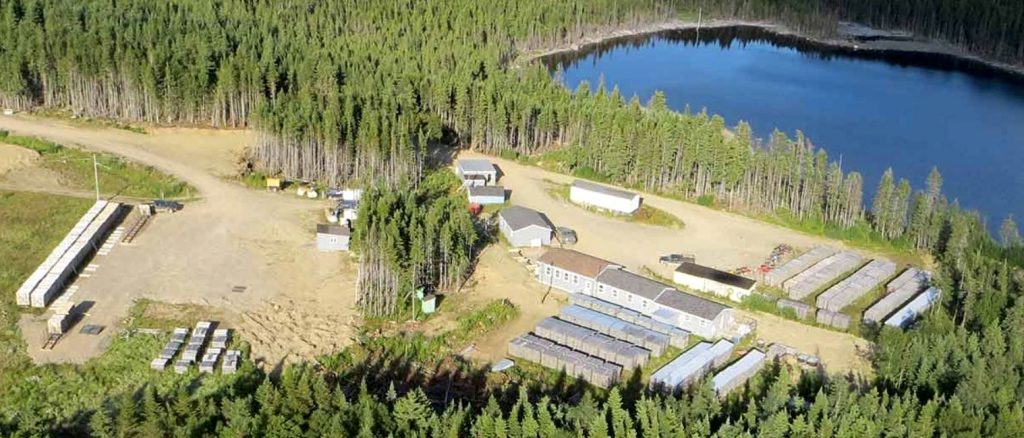

NexGen is developing one of the world’s largest uranium deposits on its Rook 1 property, which hosts the Arrow Deposit. The company is backed by one of Asia’s wealthiest investors Li-Ka-shing. In June, 2016, CEF Capital Markets Ltd., an affiliate of the Hong Kong based conglomerate CK Hutchison Group, which is chaired by Li Ka-shing, subscribed for US$60 million worth of convertible debentures in NexGen.

News of the financing comes after the company recently announced the completion of the Provincial Environmental Assessment Technical Review and submission of the final Environmental Impact Statemen (EIS).

The company said it has entered into binding term sheets with Queens Road Capital Investments Ltd. (QRC) [QRC-TSX] and WHSP in connection with the private placement of US$110 million worth of unsecured convertible debentures. Under the deal QRC will invest US$70 million in new NexGen convertible debentures.

The debentures will be convertible at the holders’ option into approximately 21.97 million shares of NexGen. The actual number of shares is dependent on the exchange rate at the time.

In addition, WHSP has pledged to purchase 8.7 million shares of NexGen from QRC for US$5.20 a share (for approximately US$45 million), a move that will allow QRC to partially fund its debenture purchases.

Proceeds will be used to fund further development and exploration at NexGen’s mineral properties.

NexGen shares eased 1.8% or 13 cents to $7.02 on volume of 731,790. The shares are currently trading in a 52-week range of $7.26 and $4.70.

“Today’s US$110 million financing from two highly respected investors, our long-standing investor QRC and the addition of WHSP in Australia, optimally places NexGen to deliver its stated objectives in the development of the Rook 1 Project,’’ said NexGen CEO Leigh Curyer.

The debentures will carry a 9.0% coupon (the interest) over a 5-year term. The debentures will be convertible at the holders option into common shares, at a conversion price per share of US$6.76 ($9.15 per share at current exchange rates) representing a 30% premium on the volume weighted average trading price per common share on the TSX for the five days ending the day before the date of the financing announcement.

Two-thirds of the interest (equal to 6.0% annually) is payable in cash. One third of the interest (equal to 3.0 annually) is payable in common shares issuable at a price equal to the 20-day volume weighted average price on either the TSX or New York Stock Exchange ending on and including the third trading day prior to the date when such interest payment is due.