P&I Picks its Way Through Challenges on Ukraine's Danube River Routes

Drone attacks on the Danube estuary ports in late August broadened Russian attempts to prevent Ukraine from exporting grain, but other rising risks to regional maritime safety are also calling for special attention from P&I, according to Nick Taylor, Head of Coastal & Inland, NorthStandard.

Drone attacks on the Danube estuary ports in late August broadened Russian attempts to prevent Ukraine from exporting grain, but other rising risks to regional maritime safety are also calling for special attention from P&I, according to Nick Taylor, Head of Coastal & Inland, NorthStandard.

Traffic has been growing fast along the Danube in 2023, and collisions, sinkings and groundings have also become increasingly frequent. The resulting claims have been complicated by owner unfamiliarity with regional conditions and cultures, and a local code of silence following ‘hit and run’ incidents.

Even before Russia quit the U.N.-brokered deal allowing Kyiv to ship its grain via the Black Sea, traffic passing through Ukraine Danube ports was accounting for around a quarter of the nation’s grain exports, says Nick Taylor, Head of Coastal & Inland, NorthStandard.

“Ukraine transhipped 8.1 million tonnes of grain through the port of Constanta in the first seven months of 2023 - over 40% of all grains handled by a port which already deals with exports from Romania itself, Hungary and Serbia,” says Taylor. “In May alone, grain volumes through Danube ports hit 2.2 million tonnes, overtaking exports made via the Black Sea corridor.”

With the Danube route now the principle exit option for Ukrainian grain, Russian firepower will doubtless have a say in the handling capabilities at the Ukraine ports of Reni and Izmail - close to the Romanian border. However, recent Government projections still foresee Danube exports reaching at least 20 million tonnes in 2023 - three times pre-war volumes.

The routing switch and the consequent redeployment by North European owners of inland and coastal vessels to handle the new trade have created new challenges for operational safety along the Danube, according to Taylor.

Congestion challenge

“Where risk is concerned the conflict itself dominates day to day reporting, but the course of events has also caused major vessel congestion. The vessels coming into the market are maintained to the highest standards, but their crews may have little or no experience of working on these waters. In one example, a vessel in convoy came out of the bend in heavy weather on the wrong side of the river, causing a collision.

“With the port infrastructure under strain, there can also be disconnects between international operators and local authorities when incidents or accidents occur. Part of that is about lack of previous contact and different cultures when it comes to getting things done, but there have also been incidents where vessels have been hit, yet nobody seems to have seen anything.”

Taylor adds that, in one instance, NorthStandard set up a meeting between one of its Members and the Maritime Anti-Corruption Network to take forward an investigation into a hit and run incident that led a moored barge to sink. Inquiries reached a dead end.

Nevertheless, NorthStandard has been invited to intervene in incidents on several occasions this year, including to support refloating operations. “We’ve used our experience to coordinate and project manage, with our local correspondents helping to resolve issues where the infrastructure hasn’t been in place, whether that’s been through organizing crane lifts or refloats using balloons.”

C&I considerations

Taylor was appointed to head up NorthStandard’s Coastal & Inland team earlier this year following the merger of North P&I and the Standard Club and says he has been given ambitious targets to grow C&I as a consolidated area of special expertise. A 14-year veteran from the legacy Standard Club side of the business with a broad range of previous senior postings, he oversees Coastal & Inland teams in London and Singapore.

Despite the greater frequency of Danube claims, the Head of Sector stresses that Coastal & Inland premiums are defined by NorthStandard’s overall mutual combined ratio performance, which at the last annual renewal stood at a healthy 95%.

“Clearly there are risks of war, and crew cover needs to reflect the exposure faced, but this is a market which takes its lead from the volume of business we do to support operations all along Europe’s coastline and inland waterways, as well as niche areas for growth identified elsewhere in the world.”

Asked outright whether insurers will respond to the rising frequency in Danube claims with regional premium rises, he added: “We are not the only ones going through this. I cannot speak for others, although it’s possible insurers may become more risk averse in the Danube, with inevitable knock-on effect for charterers, and ultimately receivers.

“In the immediate term, however, where trade needs to be supported on heavily congested routes, Members operating in unfamiliar waters, different shipping cultures apply and crews feel understandable edginess, there are plenty of opportunities to showcase P&I services at their best.”

Top image: The Danube River port of Izmail (Yuriy Kvach / CC BY SA 4.0)

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

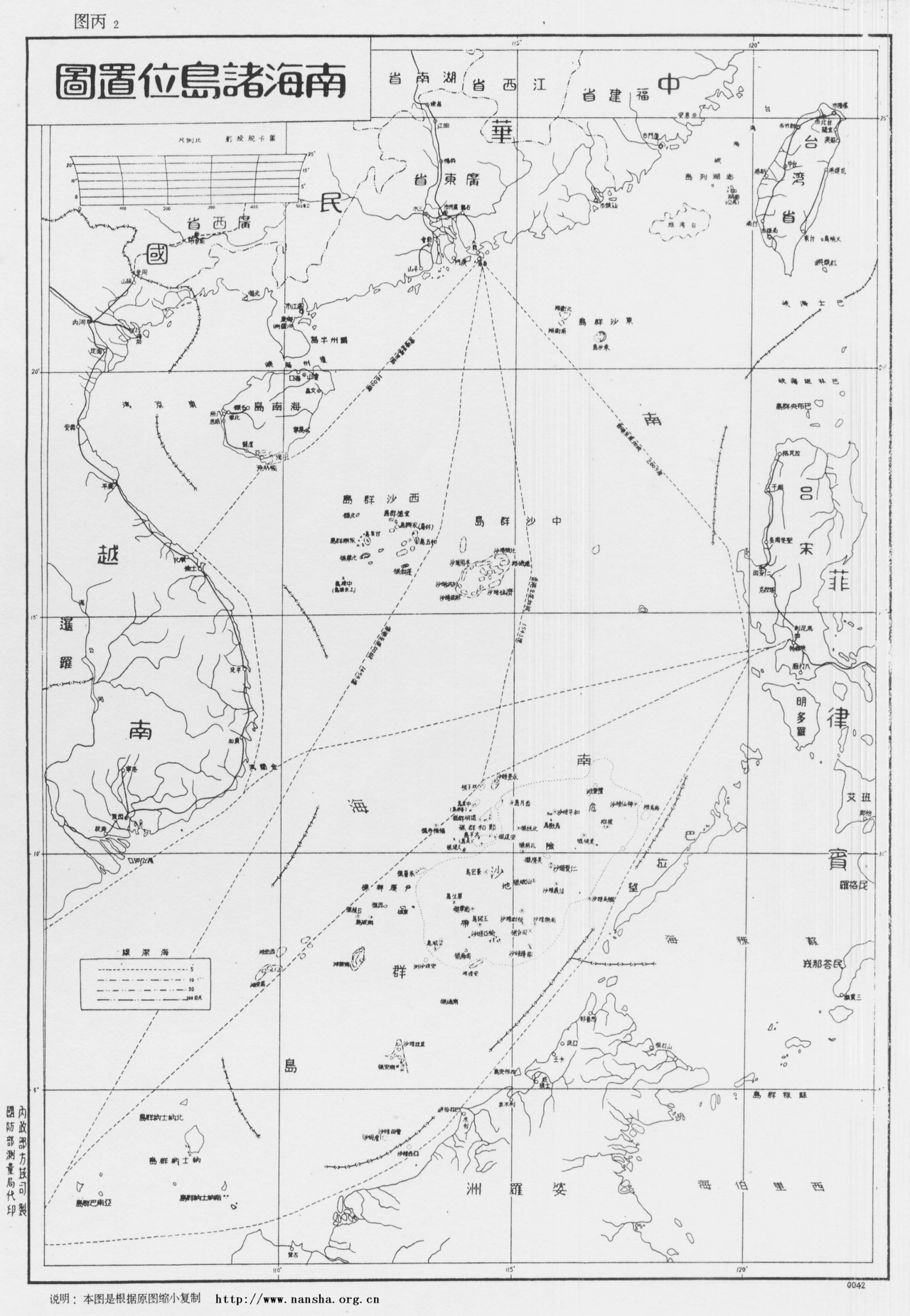

Original chart of the nine-dash line concept, created by the pre-PRC Republic of China in 1947 (ROC)

Original chart of the nine-dash line concept, created by the pre-PRC Republic of China in 1947 (ROC)