McKee Administration Releases Plan Recommendations for Offshore Wind Jobs

[By: Rhode Island Commerce]

Building on more than a decade of leadership in the fast-growing offshore wind industry, the McKee Administration today released details on the development of Rhode Island’s strategic plan to further develop the state’s offshore wind supply chain.

Prepared by Providence-based consulting firm OSWind Partners in conjunction with the Rhode Island Commerce Corporation (Commerce), Rhode Island’s “Strategic Plan for Offshore Wind Jobs and Investment” was developed following an extensive review of global industry demands and current and upcoming U.S. offshore wind projects, as well as an audit of Rhode Island’s existing offshore wind supply chain, physical assets, workforce development programs and more. The goal of this strategic plan is to integrate stakeholders at every level of the industry to create opportunities for Rhode Island companies and workers to significantly contribute on offshore wind projects in development along the east coast.

“Rhode Island has proudly served at the forefront of this exciting, job-creating sector for more than a decade, and we have the tools, infrastructure, and workforce we need to build on this momentum in the future,” said Rhode Island Governor Dan McKee. “This strategic plan provides a path to amplify the deep Rhode Island offshore wind resources and coordinate groups across the state to provide industry solutions throughout the wind farm lifecycle.”

The release of the early, core recommendations of this strategic plan comes as Rhode Island Energy, the state’s leading energy utility, prepares to issue a Request for Proposals to solicit approximately 1,200 megawatts of new offshore wind power to strengthen New England’s regional grid and help Rhode Island advance its clean energy goals.

“Developing clean energy sources is of paramount importance, not only for environmental reasons, but for economic and social reasons as we work towards a more sustainable and prosperous future,” said Rhode Island Commerce Secretary Liz Tanner. “We look forward to continuing to work with our colleagues and partners across the offshore wind industry as we implement this strategic plan in a way that creates jobs and opportunities for Rhode Islanders.”

The strategic plan includes six core recommendations:

- Cluster Development: Aim to amplify the state’s industry strengths and create connections between locally based businesses, specifically targeting companies specializing in Permitting and Ocean Science, Logistics, Operations & Maintenance, and Precision Manufacturing.

- Education Awareness: Take proactive steps to engage local companies that have the capability and capacity to contribute to the offshore wind supply chain and connect them with opportunities up and down the east coast.

- Coordination: Ensure that all developers, manufacturers and top-tier offshore wind companies are aware of and can easily access Rhode Island’s assets, resources and talent as they embark on new projects and look for best in class solutions and partnerships.

- Opportunity Awareness System: Invest in a new, web-based portal through which contractors can easily find, evaluate and engage with Rhode Island companies to support project workflows at all phases of a wind farm life cycle.

- Regional Leadership: Work with neighboring states to share resources and best practices to create efficiency and cost savings as new projects are approved and constructed.

- Communications: Clearly communicate Rhode Island’s offshore wind strengths both internally and externally to build the state’s ecosystem and respond to the changing demands of the industry.

An executive summary of Rhode Island’s Strategic Plan for Offshore Wind Jobs and Investment is available online by clicking here. Commerce is planning regular meetings with industry stakeholders with the goal of finalizing an implementation timeline in the coming months.

The products and services herein described in this press release are not endorsed by The Maritime Executive.

Defects Delay Startup of Japan’s First Floating Offshore Wind Farm

The Japanese consortium Goto Wind Farm LLC has temporarily delayed commissioning of the Goto offshore wind farm in Southwest Japan. The project is Japan’s first floating wind farm and was initially scheduled for January 2024.

However, discovery of defects in a floating structure has necessitated rescheduling for January 2026, according Toda Corporation, which is leading the project’s construction operations.

“An application was filed to revise the project’s public occupancy plan, which was approved by the national government (Ministry of Economy, Trade and Industry and Ministry of Land& Infrastructure) on September 22, 2023,” said Toda in a press statement.

Toda first discovered the defects back in May in two floating structures while under construction at an onshore yard. Subsequent investigations confirmed the structural problems and corrective measures are ongoing.

Additionally, Toda has also promised it will conduct inspections of a floating structure already installed off the coast of Sakiyama to verify the existence of defects. One of the three floating structures installed off the coast of Sakiyama will be landed on the yard in Fukue Port where the integrity of the floating structure will be verified. Based on the results, Toda plans to decide whether to inspect the remaining two floating structures.

Goto floating offshore wind farm is expected to have a 16.8 MW generation capacity. It will feature eight Hitachi 2.1 MW wind turbines installed on spar-type, three-point mooring floating foundations. (Norwegian oil company Equinor has transitioned away from a proprietary spar-type foundations in favor of a triangular platform design, which has less complexity.)

The Goto Floating Wind Farm LLC Consortium was awarded the tender for the project in June 2021. It happened during Japan’s first offshore wind auction since the country’s Renewable Sea Area Utilization Law came into power in 2019.

According to the Japan Wind Power Association, Japan has potential to generate around 90 GW of offshore wind energy. Most of this offshore wind capacity would have to come from floating wind farms, as Japan’s vast coastline is characterized by deep coastal waters.

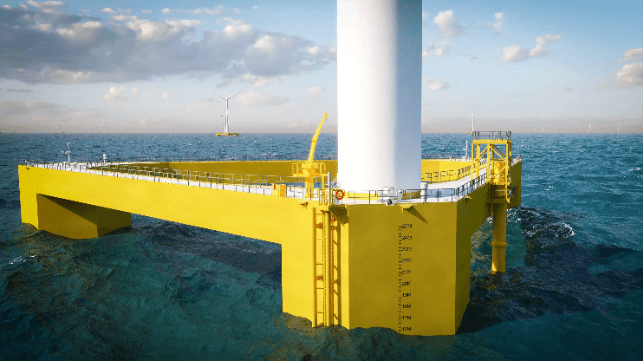

New Floating Wind Platform Leverages Offshore O&G Construction Methods

The California-based offshore wind tech firm Principle Power has come up with a new design for a floating offshore wind platform, and this one draws more than ever before on the methods of the offshore oil and gas industry.

Most floating offshore wind systems have roughly the same layout: a triangular steel base with cylindrical sections at the corners, reinforced with diagonal steel pipe sections in between. Principle Power's initial designs were emblematic of this layout and have been installed at four sites around the world. But drawing on lessons-learned from these projects, Principle Power has redesigned its platform base for easier mass production and deployment.

The new "Windfloat F" design has pontoons and hexagonal columns, like a modern semisubmersible drill rig. It is built out of flat panel sections, which are easier to make on automated fabrication lines, and designed with block subcomponent construction in mind. This is within the capability of second-tier shipyards, and much of the fabrication can be done indoors, year-round. These construction methods are also familiar to offshore shipbuilders, who have used the same techniques for decades for building offshore oil and gas infrastructure.

Operationally, the new design also has benefits during deployment. The pontoons add enough buoyancy that the columns can be designed with a smaller diameter, opening up different options for building, moving and assembling them.

The design also reduces the water depth required alongside the pier during wind turbine integration. With pontoons, the Windfloat F only draws 30 feet when loaded, allowing developers to consider a broader range of seaports to support the initial construction and installation phase of the windfarm.

"The new product portfolio, together with our industrialization strategy, is an entirely new way of thinking about efficiency and scale. It’s our vision for a planet powered by floating wind," said Aaron Smith, Chief Commercial Officer for Principle Power.