Enrichment operations start at US HALEU plant

12 October 2023

US nuclear fuel and services company Centrus Energy Corp has begun enrichment operations at the American Centrifuge Plant in Piketon, Ohio. The company said it expects to begin withdrawing high-assay low-enriched uranium (HALEU) product later this month.

.jpg?ext=.jpg) The HALEU cascade at the Piketon site (Image: Centrus)

The HALEU cascade at the Piketon site (Image: Centrus)Centrus said the American Centrifuge Plant is the only HALEU facility in the USA licensed by the Nuclear Regulatory Commission (NRC) and the first new US-owned, US-technology uranium enrichment plant to begin production since 1954.

"This moment holds great pride - and promise - for the nation," said Centrus President and CEO Daniel Poneman. "We hope that this demonstration cascade will soon be joined by thousands of additional centrifuges right here in Piketon to produce the HALEU needed to fuel the next generation of advanced reactors, low-enriched-uranium to sustain the existing fleet of reactors, and the enriched uranium needed to sustain our nuclear deterrent for generations to come. This is how the United States can recover its lost nuclear independence."

HALEU fuel contains uranium enriched to between 5% and 20% uranium-235 - higher than the uranium fuel used in light-water reactors currently in operation, which typically contains up to 5% uranium-235. It will be needed by most of the advanced reactor designs being developed under the US Department of Energy's (DOE's) Advanced Reactor Demonstration Program. The lack of a commercial supply chain to support these reactors has prompted the DOE to launch a programme to stimulate the development of a domestic source of HALEU.

Centrus began construction of the demonstration cascade of 16 centrifuges in 2019 under contract with the DOE, and last year secured a further USD150 million of cost-shared funding to finish the cascade, complete final regulatory steps, begin operating the cascade, and produce up to 20 kg of HALEU by the end of this year.

In June, Centrus announced it had successfully completed its operational readiness reviews with the NRC and received approval from the regulator to possess uranium at the Piketon site - the last major regulatory hurdle prior to beginning production.

Since then, Centrus has been conducting final system tests and other preparations so that production could begin.

The company noted it met every required milestone on time and on budget during construction of the cascade and is starting production two months earlier than scheduled under the competitively-awarded, cost-shared contract the company signed with the DOE in 2022.

Centrus said the capacity of the 16-centrifuge cascade is modest - about 900 kilograms of HALEU per year - but with sufficient funding and offtake commitments, the company could significantly expand production. It says a full-scale HALEU cascade, consisting of 120 centrifuge machines, with a combined capacity to produce some 6000 kilograms of HALEU per year, could be brought online within about 42 months of securing the necessary funding. Centrus said it could add a second HALEU cascade six months later and subsequent cascades every two months after that.

Holtec applies to restart shuttered Palisades plant

06 October 2023

The Palisades plant in Michigan could become the first successfully restarted nuclear power plant in the USA following Holtec International's submission of a filing with the Nuclear Regulatory Commission (NRC) to formally begin the process of seeking reauthorisation of power operations at the plant, which was shut down in May 2022.

.jpg?ext=.jpg) Palisades (Image: Holtec)

Palisades (Image: Holtec)

Holtec said the filing follows a series of public meetings with NRC staff to lay out the path to reauthorise the repowering of Palisades within the NRC's existing regulatory framework.

"Our licensing submittal is a significant step in exploring the potential for Palisades to continue contributing to the region’s energy and economic needs, while adhering to the highest safety and regulatory standards," said Jean Fleming, Holtec International Vice President of Licensing, Regulatory Affairs and Probabilistic Safety Analysis. "We understand the importance of nuclear power in our nation's energy mix and the critical role it plays in providing safe, reliable, carbon-free electricity here in Michigan.

"Palisades' safety and operational performance met the industry's highest standards when it was taken offline last year. Its systems and equipment remain well maintained and in excellent material condition. This licensing submittal is the first of a series of submittals intended to return Palisades to full operation."

Palisades, a single-unit power plant, began commercial operation in 1971. Entergy announced in 2016 its plan to close the plant, with the NRC approving in 2021 the transfer of the licence from Entergy to Holtec for the purposes of decommissioning it. The 805 MWe pressurised water reactor was removed from service - after 50 years - by Entergy on 20 May last year, and defuelled by 10 June.

The sale to Holtec completed later that same month and Holtec announced a few days later that it was applying for federal funding to allow it to restart the plant. It was unsuccessful in the first round of the US Department of Energy's (DOE's) Civil Nuclear Credit programme but announced in December that it was reapplying. Holtec said it is "working cooperatively with the DOE to move the loan application process forward".

On 31 July, Michigan Governor Gretchen Whitmer signed into law the State of Michigan's Fiscal Year 2024 budget, which provides USD150 million in funding for the plant's restart.

Last month, Holtec announced it had signed a long-term power purchase agreement with the non-profit Wolverine Power Cooperative. Under the multi-decade agreement, Wolverine commits to purchasing two-thirds of the power generated from a reopened Palisades, with Wolverine's partner Hoosier Energy purchasing the balance. It also includes a "contract expansion provision" to include one or two small modular reactors that Holtec plans for the site.

Holtec said the repowering of Palisades "will greatly enhance Michigan's carbon-free energy generation, the region's grid reliability and decrease the region's reliance on (expensive) energy imports".

Kelly Trice, President of Holtec Nuclear Generation and Decommissioning, added: "Holtec plans to build up the Palisades site into a mega-clean energy provider to the region with the restarted Palisades power plant as its centrepiece."

US unit cleared to use higher-enriched fuel

03 October 2023

Southern Nuclear has announced it has received authorisation from the US Nuclear Regulatory Commission (NRC) to use advanced nuclear fuel enriched up to 6% uranium-235 at Vogtle unit 2. This is the first time a US commercial reactor has been authorised to use fuel with over 5% enrichment.

.jpg?ext=.jpg) (Image: Southern Nuclear)

(Image: Southern Nuclear)The regulatory authorisation means that manufacture of four first-of-a-kind lead test assemblies (LTA) of the next-generation so-called Accident Tolerant Fuel (ATF) that will use key components from Westinghouse's High Energy Fuel initiative and the EnCore Fuel programme can now begin, Southern Nuclear said. It envisages loading the fuel into the reactor in 2025.

Southern Nuclear signed an agreement with Westinghouse in 2022 to load the four LTAs at Vogtle. The assemblies will feature Westinghouse's trademarked ADOPT uranium dioxide pellets, AXIOM fuel rod cladding and chromium-coated cladding combined with its advanced PRIME fuel assembly design.

ATF is a "game-changing" technology that will advance performance and further strengthen grid reliability, said Southern Nuclear President Pete Sena, who also recognised the regulator for its "thorough yet timely review of this installation to support the future of commercial nuclear power in our country."

Tarik Choho, Westinghouse's President of Nuclear Fuel, said support from members of the US Congress and the Department of Energy (DOE) had been "critical" to the company's ability to advance fuel technology with higher burnup rates. "We are grateful to Southern Nuclear for their trust and look forward to delivering advanced technologies that will bolster the light water fleet and support the low-cost generation of nuclear power in the long term," he added.

ATFs enhance the tolerance of light-water reactor fuel under severe accident conditions, but also offer improvements to reactor performance and economics during normal operations as well as in transient conditions and accident scenarios. Fuel with higher enrichment lasts longer, extending the time between refuelling outages, as well as potentially reducing fuel costs as less fuel assemblies are needed.

But the current existing US licensing approach means it takes a long time to obtain regulatory approval for such fuels. Southern Nuclear - which operates a total of seven units for Alabama Power and Georgia Power including the four units at Vogtle - said it is working alongside the DOE, fuel suppliers and other utilities in a "coordinated, overarching, multi-year effort" in the US Nuclear Energy Institute's ATF Working Group to "expand the regulatory paradigm".

Southern Nuclear installed GE-Hitachi ATF fuel cladding technologies in 2018 at Hatch unit 1 in another ATF "first", with samples subsequently discharged and shipped to Oak Ridge National Laboratory for further testing in 2020. In 2019, it installed four Framatome-developed GAIA lead fuel assemblies - containing enhanced accident-tolerant features applied to full-length fuel rods - in Vogtle 2.

Southern Nuclear said it received the NRC approval on 1 August.

Researched and written by World Nuclear News

_1.jpg?ext=.jpg) The Georges Besse II plant (Image: Orano)

The Georges Besse II plant (Image: Orano).jpg?ext=.jpg) A vision of nuclear thermal propulsion being used in space (Image: USNC)

A vision of nuclear thermal propulsion being used in space (Image: USNC).jpg?ext=.jpg) LEDs in Whitecroft's testing facility (Image: Whitecroft Lighting)

LEDs in Whitecroft's testing facility (Image: Whitecroft Lighting).jpg?ext=.jpg) India's Department of Atomic Energy marked the start of inital fuel loading at Kakrapar 4 on social media (Image: DAE)DAE

India's Department of Atomic Energy marked the start of inital fuel loading at Kakrapar 4 on social media (Image: DAE)DAE.jpg?ext=.jpg) The Darlington plant site (Image: OPG)

The Darlington plant site (Image: OPG).jpg?ext=.jpg) Room to grow: Bruce's existing site has ample space for more capacity (Image: Bruce Power)

Room to grow: Bruce's existing site has ample space for more capacity (Image: Bruce Power).jpg?ext=.jpg) The Bruce site (Image: Bruce Power)

The Bruce site (Image: Bruce Power)

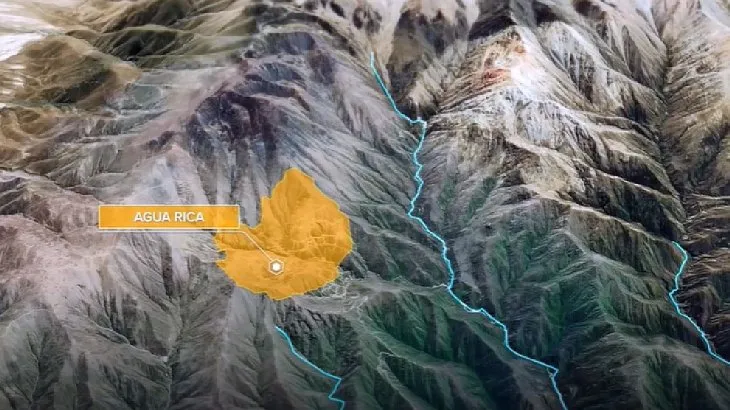

The location of the MARA project amid the mountains, glaciers and water courses of Catamarca. Credit: MARA.

The location of the MARA project amid the mountains, glaciers and water courses of Catamarca. Credit: MARA. “In the early 1990s we didn’t know anything about mega-mining, so we welcomed it in Catamarca with the promise of progress that never came,” says Sergio Martínez. Credit: Julián Reingold

“In the early 1990s we didn’t know anything about mega-mining, so we welcomed it in Catamarca with the promise of progress that never came,” says Sergio Martínez. Credit: Julián Reingold In July 2023, the people of Andalgalá marched for the 700th time in the Walks for Life, a weekly protest that began in 2009. Credit: Marianela Gamboa.

In July 2023, the people of Andalgalá marched for the 700th time in the Walks for Life, a weekly protest that began in 2009. Credit: Marianela Gamboa. The Aconquija snow-capped mountain behind Eduardo Villagra, Ana Chayle and Martínez in the centre of Andalgalá. Credit: Julián Reingold.

The Aconquija snow-capped mountain behind Eduardo Villagra, Ana Chayle and Martínez in the centre of Andalgalá. Credit: Julián Reingold.