EU Offers $4B in Support for French Offshore Wind Development

Last week, the European Commission (EC) approved the release of $4.4 billion to support rollout of offshore wind energy in France. The scheme was approved under the State aid Temporary Crisis and Transition Framework, adopted by the EC to accelerate green transition.

The funding will be used to support construction and operation of two floating offshore wind farms in the Golfe du Lion. The aid will be granted before December 31, 2025. It will run for a period of 20 years, with the two beneficiaries set to be identified through a tender process by the French government scheduled for next year. Each wind farm is expected to have a capacity of 230 to 280 MW, and could generate 1.1TWh of electricity per year.

This aid will take the form of a monthly variable premium under a two-way contract for difference (CfD), which will be calculated by comparing a refence price with the market price for electricity. When the market price is above the reference price, the developer will have to pay the difference between the two prices to the French authorities.

“This [$4.4 billion] scheme will allow France to accelerate deployment of renewable offshore wind capacities, in line with the EU’s Offshore Renewable Energy Strategy. The scheme will also help France reduce its dependence on Russian fossil fuels, in line with REPowerEU Plan, while ensuring that any potential competition distortions are kept to the minimum,” said Didier Reynders, EU Commissioner in Charge of Competition Policy.

Despite having abundant wind resources and a long coastline, France has been lagging behind its European neighbors in offshore wind energy. However, this is changing, as France enacted Renewable Energy Acceleration Law early this year, which is expected to boost progress in the country’s offshore wind sector. France aims to have a total offshore wind capacity of 2 GW by 2025, 7.8 GW by 2030 and 40 GW by 2050.

Japanese Research Studies Wake Effect’s Impact on Floating Wind Farms

The Japanese Government's New Energy and Industrial Technology Development Organization (NEDO) is funding a research project to enable large-scale deployment of floating offshore wind turbines. Japan expects to become one of the leaders in the deployment of floating offshore wind turbines and this project is the latest step to focus on the optimal design methods based on the geographical challenges of Japan.

The project focuses on the research required to develop technology that will evaluate a phenomenon known as wake effect that is unique to floating wind turbines. It is one of the major challenges to be overcome in the development and deployment of floating wind turbines and this project seeks to comprehend the challenges.

Wake effect occurs downwind of turbines during blade rotation. According to the project organizers, in large wind farms comprised of a large number of turbines, wake effect results in several negative outcomes. One of the challenges is greater turbulence around the wind farm. In addition, there is a reduction in the electricity generation on the downwind side of the wind farm and an increase in the load acting on the turbines.

Project organizers report that the wake effect is mostly understudied to date. The research team believes their work will solve the technical issues for large floating offshore wind farms and make a significant contribution to enabling the introduction of the technology at scale.

The researchers will be working to develop a greater comprehension of the wake effect and the mutual interference phenomenon. They will be working to develop technology for the prediction and evaluation which they believe will provide the basis for further academic-industry collaboration.

NEDO selected the partners for the project in June 2023 and the research will be taking place in a large wind tunnel facility at Kyushu University in Japan. Other participants in the project include Toshiba Energy Systems and Hitachi Zosen, as well as NSK, a Japanese bearing company.

As part of the project's research, NSK will be working to enhance the reliability of bearings for wind turbines. One of the challenges of wake effect is load changes acting on the turbines and NSK will be working to understand the attributes that result from the wake effect. Understanding the impact on the turbines will enable the company to enhance the reliability of the bearings which in turn they believe will support more widespread adoption of floating wind for power generation.

Op-Ed: Offshore Wind in Asia Pacific: A Global Approach to a Local Issue

The Asia-Pacific region boasts substantial potential for offshore wind energy as a clean and renewable power source, with extensive coastlines and favorable wind conditions.

China, Japan, South Korea, Taiwan, the Philippines, and Vietnam have kick-started their offshore development projects, while India, Malaysia, and Australia are looking to develop their offshore capabilities by the late 2020s.

The growing significance of offshore wind underscores the prediction made by the International Renewable Energy Agency in a recent report that Asia-Pacific is “poised for a remarkable offshore wind energy expansion, with planned installations in China, Taiwan, South Korea, Japan, and Vietnam expected to reach a combined capacity of over 60 GW by 2030.”

Even now, the region already boasts more than half of the 260 offshore wind farms in operation worldwide as of January 2023, according to a Statista report that tracked data from Global Energy Monitor.

But, it is not a united bloc of nations with simplified, streamlined customs and regulations. My decade of experience in the region has demonstrated that no two countries have the same risk profile during project planning, contracting (budgeting), and execution.

The greatest risks to any project are assumptions wrongly made during the planning phase based on previous experience elsewhere, with project managers all too often left to “make it work” with strained time and budget constraints.

Collaboration between the various parties involved in offshore installations, from project managers and developers to logistics and energy support service providers and shipping lines providing offshore supply and installation vessels, is now more vital than ever. Transparency and longevity must be at the heart of such collaboration.

That need for openness is a must in tackling the regulatory minefield of offshore wind farm development in the region.

Partners also need to brace themselves for the regulatory headwinds that can make developing an offshore wind farm truly viable. Inadequate policy frameworks, delays in issuing permits, and lack of government support slow offshore wind project development, limiting opportunities to reduce project costs. Asia-Pacific can learn some valuable lessons from the experience of Europe in this respect.

Local experience and expertise will be key in identifying and overcoming the unique challenges in each specific location during the planning stage. While offshore development projects are coming thick and fast, we have seen that Asia lacks the necessary experience and supply chain capacity. Potentially, that could hinder project execution, particularly outside of China. Vessels flying the flag of a major Asia-Pacific nation often require a minimum number of local crew members, so developing and harnessing local talent is crucial.

It’s no surprise, therefore, that considerable resources are now being plowed into developing the capacity to stimulate local industries and boost the competitiveness of its energy capabilities. Ports with land space, storage, facilities and deepwater berths to support offshore wind farm development continue to come online but, for now, they are few and far between.

There are players in the region that can help fill that gap until Asia fully establishes its own capabilities, including those with a proven track record in Europe. By working with such proven partners Asia-Pacific will go some way to reaching its lofty offshore wind energy targets.

For now, however, the region must continue to look overseas to understand how to best realize its renewable ambitions and tailor its plans effectively. If the Asia-Pacific region is to realize its potential in developing crucial offshore and renewable energy infrastructure, then remaining flexible, bearing the brunt of regulatory risks, and taking a global approach to a local issue will be vital steps.

About the author: Garth Harrison is Business Development Manager – Asia Pacific & Indian Subcontinent, for the GAC Group.

Second U.S. Offshore Wind Farm Will Generate First Power Before Year’s End

The second, large offshore wind farm in the United States is expected to produce its first power before the end of the year as momentum continues to build for the industry. Developer Avangrid, which is part of the Iberdrola Group, reports it has installed the first five wind turbines at Vineyard Wind 1, a project located south of Martha’s Vineyard, and is set to begin supplying power to Massachusetts.

Before generating first power, Avangrid reports it must complete several critical tests and technical milestones, including final testing of the array and export cables, and energization of the offshore substation. However, the first five GE Haliade-X turbines have been installed at the project as work construction continues. Once energized in the coming weeks, Vineyard Wind 1, will deliver approximately 65 MW of energy from the five turbines, enough to power 30,000 homes and businesses in Massachusetts. The company expects it will happen within the next three weeks, before the end of 2023.

“We have fully installed the first five turbines of this historic project, representing a new frontier for climate action and the clean energy revolution in the United States,” said Avangrid CEO Pedro Azagra. “We look forward to working through the final technical requirements and flipping the switch to deliver these first green electrons to 30,000 homes and businesses in Massachusetts.”

Vineyard Wind 1 will become the second wind farm in the United States to begin generating power this month. South Fork Wind, a project being developed by Ørsted and Eversource located approximately 35 miles offshore from Montauk, New York, energized its first turbine on December 6. While consisting of only 12 turbines to provide approximately 130 MW, South Fork is considered to be the first commercial-scale wind farm in the United States.

Vineyard Wind located 15 miles off the coast of Martha’s Vineyard, however, is a much larger project. When installation is completed in 2024 it will consist of 62 wind turbines able to generate up to 806 MW, which will be enough to power more than 400,000 homes and businesses. Power will come ashore and be transmitted by underground cables to a substation on Cape Cod near Banstable.

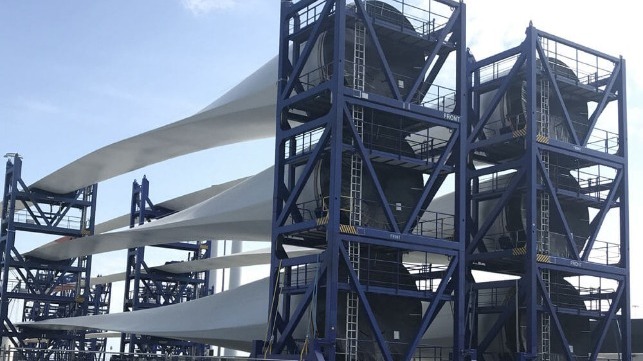

Offshore construction for Vineyard Wind began in late 2022. Materials are being staged at the New Bedford Marine Commerce Terminal with Foss Maritime, a U.S. service contractor operating specially designed US-flagged barges to transport the components to the lease area. The loads, which consist of tower sections reaching more than 200 feet in height, 321-foot-long blades, and the nacelle pods, each weigh more than 1,700 tons. DEME Group’s Sea Installer vessel is stationed at the site receiving the components and completing the installations.

The project achieved steel-in-the-water in June and completed the installation of its offshore substation in July. The first GE Haliade-X Wind Turbine Generator, which at 13 MW is among the largest turbines in the western world, was installed in mid-October.

Other U.S. projects are also moving toward the construction phase. The Bureau of Ocean Energy Management granted permissions to Ørsted and Eversource’s next project Revolution Wind, which will provide power to Connecticut and Rhode Island, as well as to Dominion Energy’s wind farm to be located off Virginia Beach, Virginia. The U.S. Federal Permitting Improvement Steering Council yesterday, December 7, also granted approval for Revolution Wind’s construction.

Addressing the financial and supply chain challenges that emerged for the industry, several Northeast states have announced plans to revise and accelerate their programs. Connecticut, Rhode Island, and Massachusetts are coordinating their next round of solicitations planned for 2024, while both New York and New Jersey sped up their timetables launching solicitations for the first quarter of 2024.

Three grave mounds photographed in Bertnem in the 1920s. Photo: Theodor Petersen.

Three grave mounds photographed in Bertnem in the 1920s. Photo: Theodor Petersen. One of the ship nails after it has been cleaned up by University Museum conservators. Photo: Freia Beer, NTNU University Museum

One of the ship nails after it has been cleaned up by University Museum conservators. Photo: Freia Beer, NTNU University Museum