Ines Ferré

·Senior Business Reporter

Sun, January 28, 2024

Uranium has been hot this year, industry experts say. The trouble is there may not be enough to go around.

The squeeze on the metal, found in rocks and seawater, intensified recently after 22 countries, including the US, recently signed a pact at the UN Climate Change conference to triple their nuclear power capacity by 2050.

"There’s no other way to meet those net-zero carbon goals other than nuclear energy," said Nicole Galloway Warland, managing director of Thor Energy (THORF), an exploration company with projects in Utah and Colorado.

The backdrop to all this is, of course, is the march towards cleaner energy. But the rise of EVs and the anticipated power demands of artificial intelligence computing are also going to create a demand crunch for clean electricity — and nuclear is seen as a power source, unlike oil or coal, without the downside of carbon dioxide emissions.

That means the demand for uranium, the underlying fuel for nuclear plants, will be on the rise for years to come, experts and miners contend.

"Where is that uranium going to come from?," asked Galloway Warland. "There’s not enough to go around. There’s a supply deficit."

Earlier this month, the world's largest uranium miner, Kazatomprom (KAP.IL), warned it will likely not meet its production targets in the next two years because of mine construction delays and a lack of sulfuric acid needed for uranium production. Uranium prices shot up to 2007 levels this month, sitting above $106 per pound.

Uranium-related stocks have also been on fire.

Shares of Canadian giant Cameco (CCJ) have gained 83% over the past year. Kazatomprom, which trades on the London stock exchange, is up more than 60% over the past six months. Shares of US-based Energy Fuels (UUUU) are up about 25% during the same period.

Short on uranium? Geologists examine drilling samples at Wedding Bell Project in Colorado, a Thor Energy mining site. (Thor Energy)

'Uranium is becoming a household name'

A psychological shift surrounding nuclear is clearly helping fuel the market frenzy.

Nuclear power has been out of favor for years. But the Fukushima, Japan, nuclear disaster in 2011 prompted governments to scale back plans and shut down reactors. For much of the last decade, little investment went into the industry. Climate change, however, has changed attitudes.

"Nuclear power now has been realized as the new, vogue way of providing all this baseline power," Duane Parnham, executive chairman and CEO of Madison Metals (GREN.CN), told Yahoo Finance.

"Uranium is becoming a household name," he added.

Silicon Valley celeb billionaires, for example, have talked up the benefits of nuclear energy. Last year Sam Altman, the chief executive behind ChatGPT, announced his special purpose acquisition company would take nuclear energy startup Oklo public. And, of course, Tesla (TSLA) CEO Elon Musk weighed in. He tweeted last year that "The world should increase use of nuclear power!"

In the United States, the shortage is complicated by the fact that much of our uranium is imported from Russia. That's prompted the Biden Administration to seek more supply internally, and from US-friendly states such as Canada, the second-largest producer.

"The US has extensive in-ground uranium resources and quite a bit of idled processing capacity. But we have let our industry and infrastructure atrophy over the past few decades, as nuclear utilities bought cheaper uranium from places like Russia and Kazakhstan," Curtis Moore, senior vice president of marketing at Energy Fuels, told Yahoo Finance.

Now the US is playing catch-up. New uranium mines can take five to 15 years from start to finish, including permits, says Thor Energy's Galloway Warland.

"All of a sudden you’ve got no exploration, you’ve got a lot of old mines coming to the end of their life, you've got geopolitical tensions," said Galloway Warland. "We need to have more exploration, we need more mines coming online."

The Inflation Reduction Act (IRA) passed last year includes a tax credit to help preserve the existing fleet of nuclear plants and tax incentives for advanced reactors. But the IRA also earmarked $700 million to support the development of a domestic supply chain for high-assay low-enriched uranium, commonly referred to as HALEU. The funding is intended to help eliminate US dependence on Russia for nuclear fuel supply.

As for investors, the question is always whether a spike in demand is a big yellow caution flag.

Said Curtis of Energy Fuels: "Prices have skyrocketed, but we don’t think it is a bubble, as the price increases are based on real market fundamentals." He added, "We are likely in the beginning of a multiyear period of elevated uranium prices that will persist for several years until large mines around the world can get into production."

However, some industry watchers are more cautious.

"We’re in a little bit in a bubble in the sense that making this commitment to build this capacity is not realistic. It’s aspirational, but not everybody who signs up to this agreement is well situated to make this happen," said Irina Tsukerman, president of market research and geopolitical risk advisory Scarab Rising.

"It’s possible that there could be disruptions to this process of nuclearization in the future. All it takes is one government changing its position and pulling out, and that’s it," she said.

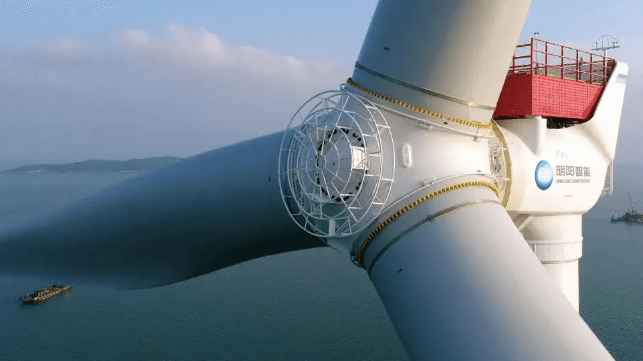

Colorado site of Thor Energy mining project. (Thor Energy)

Bubble or no bubble, the US and other countries are going full force into nuclear. Uranium is expected to stay in high demand, at least until supply catches up.

"We’ve got 60 reactors being built around the world. A hundred more being permitted," Dave Nadig, VettaFi financial futurist, recently told Yahoo Finance. "It’s really going to be a boom era."

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on Twitter at @ines_ferre.