Marine Insurers Continue to Support Trade in the Red Sea & Black Sea

[By: International Union of Marine Insurance]

At its annual winter meeting in London, the International Union of Marine Insurance (IUMI), confirmed that the global marine insurance market is continuing to support trade in the Red Sea and the Ukraine/Black Sea area.

Since the cessation of the Ukraine grain corridor in September 2023, some 10 million MT of grain has been successfully lifted from Ukrainian ports using international tonnage insured by marine underwriters. This is despite Russia damaging Ukrainian shore-side facilities and mining local waters. Insurance cover has contributed to much of the Ukrainian grain harvest being exported overseas which, in turn, has helped stabilise international agri-commodity prices.

In the Red Sea, the insurance market is providing hull and cargo products at affordable prices and vessel owners are able to obtain the cover they require. The attacks are continuing despite military intervention but, fortunately, vessel casualties have not been catastrophic. The impact on Suez Canal transits and global supply chains are significant but this has not affected the ability of the marine insurance market to provide adequate cover – both for Red Sea/Suez Canal transits or for the longer route around the Cape of Good Hope.

IUMI also reported on restricted movement through the Panama Canal due to low water levels causing a restriction on a vessel’s maximum draught from 50 feet to 44 feet. This has reduced daily transits to around 24 vessels from a norm of 34-36 vessels. Sailings are expected to decrease further to 18 vessels later this month. The result is longer transit times as vessels are re-routed - but voyages have been further compromised by events in the Red Sea. The convergence of these two crises comes in advance of the export surge around the lunar new year shutdowns in Asia. Expected consequences may include a shortage of delivered goods, containers out of position, gridlock at freight handling terminals and congestion at ports.

More positively, it was noted that the growth in global marine insurance premiums experienced in 2022 would likely give momentum to the 2023 results which IUMI will publish at its annual conference in September. The 2024 premium base would be harder to predict, however, due to the supply chain issues already mentioned as well as weaker consumer confidence, high interest rates, and an economic slowdown in some regions; inflationary pressures were easing, however.

IUMI’s report on the global marine insurance market along with discussion and debate on the pressing issues of the day will be featured at its annual conference to be held in Berlin 15-18 September 2024. This year, IUMI celebrates its 150th anniversary which is reflected in the conference common theme “Building on 150 years of enabling global commerce.”

The products and services herein described in this press release are not endorsed by The Maritime Executive.

As War Risk Spikes in Red Sea, IUMI Says Cover Remains Affordable

After reports of surging war risk insurance rates for transits in the Red Sea, the International Union of Marine Insurers (IUMI) is emphasizing that the global marine insurance market still supports trade in the Red Sea, and at an "affordable price."

War risk cover for transits of the Red Sea has increased from about 0.01 percent of vessel value in early December to as much as 1.0 percent in recent weeks, adding hundreds of thousands of dollars onto the cost of a single voyage. The prices have been driven ever upward by persistent Houthi missile attacks on merchant shipping in the region. Several vessels have been hit and have sustained serious damage, like the bulker Zografia and the tanker Marlin Luanda, and many others have experienced near-miss incidents. Despite a series of U.S. and UK strikes on Houthi launch sites, bunkers, radars and other emplacements, the attacks have continued on a regular basis.

The insurance hikes are largest for the vessels that are highest on the Houthi priority target list - that is, ships with links to the U.S., UK or Israel. Brokers report that vessels with ownership ties to these three nations are paying up to 50 percent more for their war risk cover in the area. And some underwriters are simply refusing to write policies for these vessels, according to Reuters.

During its annual conference, IUMI was at pains to emphasize that cover remains available.

"In the Red Sea, the insurance market is providing hull and cargo products at affordable prices and vessel owners are able to obtain the cover they require," IUMI said Wednesday in a statement. "The impact on Suez Canal transits and global supply chains are significant but this has not affected the ability of the marine insurance market to provide adequate cover – both for Red Sea/Suez Canal transits or for the longer route around the Cape of Good Hope."

Virgin Voyages is Taking the Long Way Cruising from Australia to Greece

Virgin Voyages, the cruise brand started by Sir Richard Branson’s Virgin Group, reports it will be the latest cruise line to “take the long way,” to reposition its cruise ship Resilient Lady (108,000 gross tons) from Australia back to Europe. The repositioning had been planned to sail through Asia, India, the Middle East, and the Red Sea at the end of the line’s first Australia summer season, but now is heading to Africa.

“Like many other cruise brands, we have been watching the current conflict in the Middle East closely, connecting regularly with global security experts to consider the impacts to the repositioning voyages planned for Resilient Lady in 2024,” said a spokesperson for Virgin Voyages. “We remain concerned about potential escalations in this part of the world over the next 12 months and the risk that this presents for safe passage through the region. As a result, we have been left with no choice but to make changes to Resilient Lady's repositioning voyage.”

The cruise that had been planned to make stops including Bali, Singapore, India, Dubai, and the Mediterranean via the Red Sea, will instead become what the cruise line is calling a “once-in-a-lifetime sailing around the coast of Africa.” Other cruise lines including AIDA, MSC Cruises, and Silversea Cruises, decided to forego revenue trips deadheading their ships for the long voyage around Africa. Carnival Corporation reported it decided to reroute itineraries for 12 ships across seven brands, which were scheduled to transit the Red Sea through May 2024.

The Resilient Lady is finishing up her first-ever season in Australia having arrived in Sydney on December 4 and then continuing to Melbourne which became the base for its cruises to Australia, New Zealand, and Tasmania. The cruise line scheduled a total of 17 cruises during the Australian summer and reports it will return for a second season starting in December 2024.

Departing Australia as originally scheduled on March 27, the cruise ship will now call in Mauritius, South Africa, Namibia, Cape Verde, Santa Cruz de Tenerife, Morocco, Spain, and Malta, arriving as scheduled on May 9 in Piraeus, Greece. The trip is being offered in three segments with extended sea time to make up for the extra mileage. Virgin Voyages is offering booked passengers guaranteed spots at no additional cost or the option of canceling due to the changes.

“We know that based on our conversations with passengers and travel partners, they understand the complex geopolitical challenges that have arisen making this change necessary,” said the line’s spokesperson.

It comes as the latest in a series of changes as global events challenged the start-up of the cruise line. The company was forced to delay its first revenue cruise for more than a year due to the pandemic and delayed delivery of its later ships. Today, the company has three of its four ordered cruise ships, with the last one Brilliant Lady still delayed as the company considers its deployment.

“With the very likely continuation of this escalated regional conflict top-of-mind, and in an effort to minimize further disruptions to our passengers’ future vacation plans, Virgin Voyages is now conducting a full review of other geographically similar repositioning voyages and linked sailings,” the company reports.

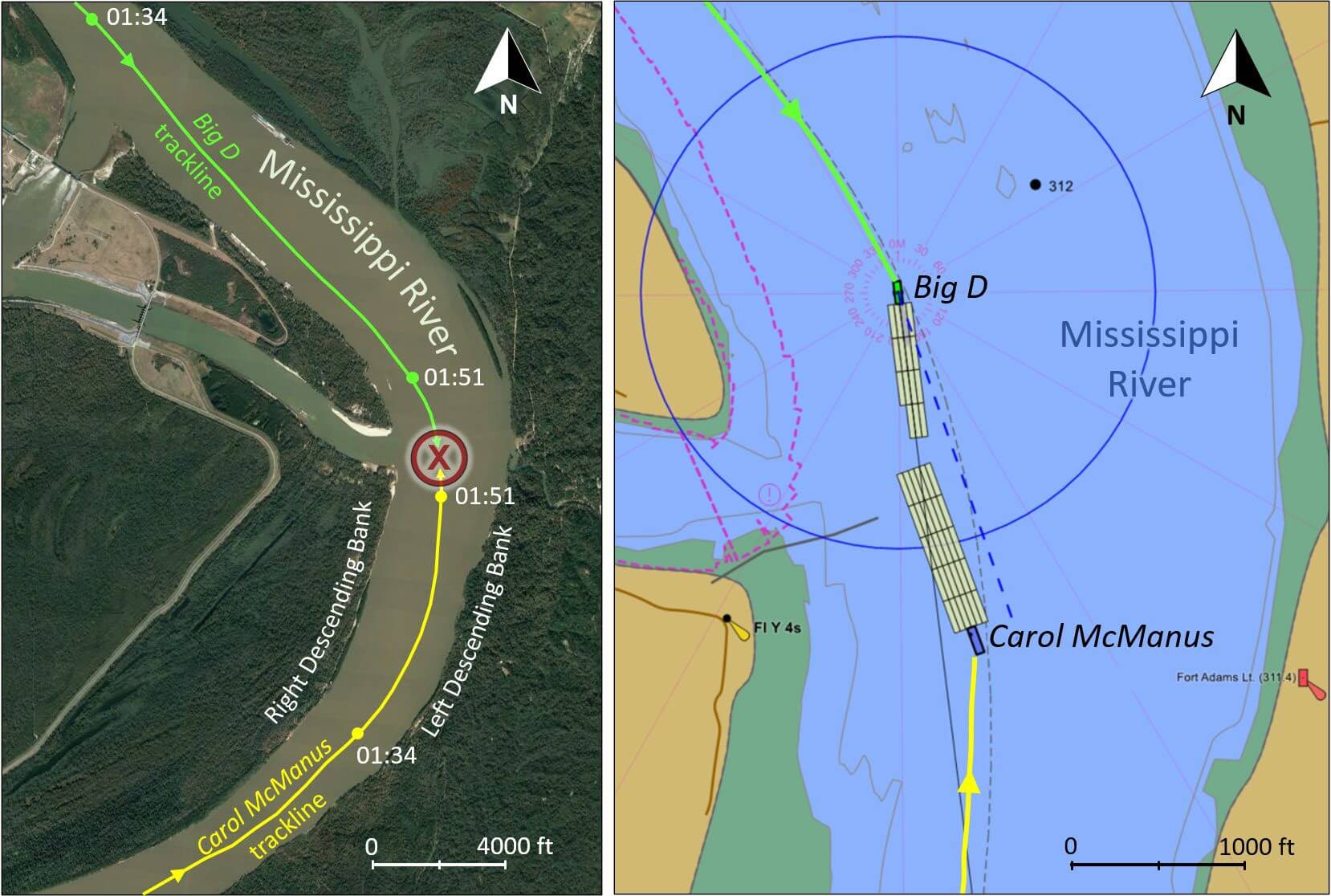

Courtesy NTSB

Courtesy NTSB