Bloomberg News | February 8, 2024 |

Artisanal miners in DRC. (Image by Enough Project, Flickr)

The state-owned company created to buy all of Democratic Republic of Congo’s hand-dug cobalt could start operating within three months after years of delays, according to its chief executive officer.

Entreprise Generale du Cobalt will soon launch pilot sites around the town of Kolwezi on parts of five mining permits belonging to its main shareholder, state-miner Gecamines, Eric Kalala said.

“The problem before was that we didn’t have any land, but that problem has been solved,” Kalala told Bloomberg News on the sidelines of the Mining Indaba conference in Cape Town on Wednesday. The company doesn’t yet have an offtake agreement for the electric-vehicle battery metal, which will be dug by small-scale, artisanal miners working with EGC-approved cooperatives.

Congo founded EGC in 2019 to formalize artisanal cobalt mining, which employs hundreds of thousands of people but is infamous for dangerous working conditions and child labor. The company has struggled to get off the ground amid disagreements about its structure and weak cobalt prices due to oversupply.

The low prices offer an “opportunity” to set up the company with less competition on the ground from other buyers, with the aim of being ready to capitalize when the market turns, Kalala said.

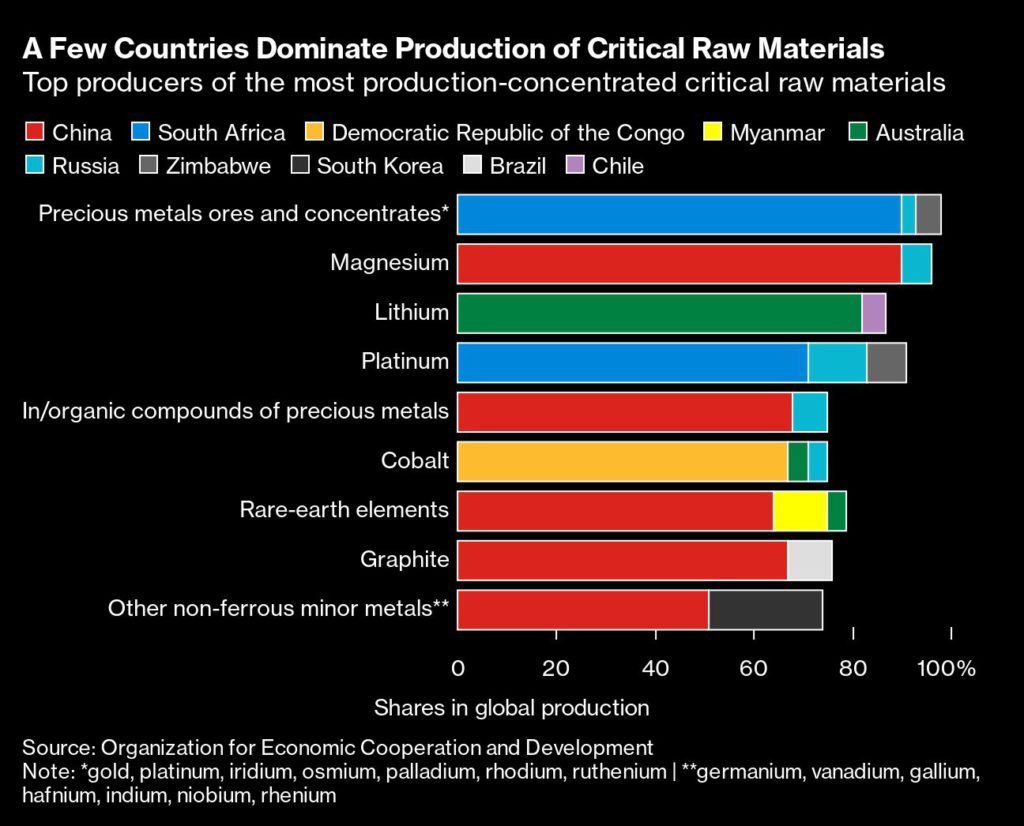

In theory, EGC could be a major player in global cobalt, 70% of which comes from Congo. The country’s artisanal miners can account for as much as 20% of national output, according to the company.

Congo exported 139,800 tons of cobalt last year, a 21% increase from 2022. Total world production was about 190,000 tons in 2022, according to US Geological Survey estimates.

Commodity trader Trafigura Group is still EGC’s “main partner” in the project, but “bilateral discussions” continue with other parties, Kalala said.

“Trafigura remains committed to its commercial agreement with EGC and delivering on the pressing need to kick-start the large-scale formalization” of the artisanal and small-scale cobalt sector, Trafigura said by email.

“At present Trafigura is the only company permitted to buy from EGC – we encourage others to follow our approach and contribute towards meaningful change,” the Singapore-based company said.

Incursions by artisanal miners pose risks for private miners across Congo, and EGC is “designing a legal solution” that could allow it to operate on parts of permits owned by companies like Glencore and Eurasian Resources Group, Kalala said.

ERG didn’t immediately respond to a request for comment. Glencore declined to comment.

(By William Clowes and Michael J. Kavanagh)

Reuters | February 7, 2024 |t

State mining company Gecamines headquarters. (Image courtesy of Gecamines).

Congo’s state mining company Gecamines and its subsidiary Entreprise Generale du Cobalt (EGC) have signed an agreement granting EGC exclusive mining rights to five mining areas, the firms said on Wednesday.

Created by government decree in December 2019, EGC was granted a monopoly on artisanal cobalt produced in the central African country, the world’s top producer of a critical metal key to the global energy transition.

“The provision of these 5 mining areas from Gécamines to EGC will mark the beginning of the standardization of artisanal cobalt mining and the structuring of local entrepreneurship,” Gino Buhendwa Ntale, EGC chairman, said in a statement.

Artisanal miners, who dig cobalt using rudimentary means, are the second largest source of cobalt worldwide after the Congo’s industrial mines.

Late on Tuesday, the Mineral Security Partnership (MSP), a multinational collaboration of more than a dozen countries and the European Union to invest in a global supply chain, also announced a deal with Gecamines and Japan’s JOGMEC.

“This is a MOU (memorandum of understanding) that will expedite European and Japanese investment in the mining sector in the DRC (Democratic Republic of Congo), and it’s also a powerful demonstration of the MSP’s efforts to secure and diversify critical mineral supply chains,” US Under Secretary of State for Energy Jose W. Fernandez told a media briefing.

(By Anait Miridzhanian and Wendell Roelf; Editing by Eileen Soreng and Mark Potter)

US to commit more funds to African rail link for metal exports

Reuters | February 8, 2024 |

The railway runs from Lobito, on Angola’s Atlantic coast, 1300km westwards to Kolwezi in the Democratic Republic of Congo, with a connection to Zambia.

The United States will provide more funds for the construction of the Lobito Corridor, a rail link to export metals from Central Africa’s Copperbelt, including a link for Zambia, US energy envoy Amos Hochstein said.

Washington has been supporting the project linking mineral-rich Democratic Republic of Congo (DRC) and Zambia to Lobito port in Angola. The link seeks to bypass logistics bottlenecks in South Africa that have held up copper and cobalt exports – metals vital to the energy transition away from fossil fuels.

In 2022, a consortium led by global commodities giant Trafigura, Portugal’s Mota-Engil and Vecturis SA of Belgium was awarded a 30-year concession for railway services and support logistics on the Lobito Corridor. The consortium plans to spend $455 million in Angola and $100 million in the DRC on equipment, operations and infrastructure maintenance.

Ivanhoe, Trafigura to be first users of Lobito Atlantic Railway Corridor

Additional funding is required to extend the 1,700 km (1,060 miles) line into Zambia in the second phase.

“We have committed to finance $250 million for the Angola phase one. I expect that we will commit additional resources in the same range for the second phase,” Hochstein said late Wednesday in an interview ahead of an investment forum on the project in Zambia.

The first phase involved upgrading the rail line on the Angolan side, and the second phase will involve building a new multibillion-dollar rail through Zambia and beyond, he said.

“I expect that we will start seeing some significant volumes using the rail by June-July,” he said, without giving figures.

The US and its partners have also mobilized close to $1 billion to expand the Lobito Corridor by developing a new 800 km (500 mile) rail line to further connect Zambia to the network, he said during the opening of the investment forum on Thursday.

“With the Africa Finance Corporation (AFC) as the private-sector lead developing the project, we aim to break ground in 2026 and have an operational rail between eastern Angola across northwestern Zambia by 2028,” he said.

The AFC had financing commitments from the US, the European Union and African Development Bank (AfDB), which would bring in extra private sector financing, he said.

Hochstein welcomed the announcement on Wednesday by mining firm Ivanhoe Mines that it had signed up to use the rail line for its copper exports from the DRC.

“That’s critically important because it shows commitment by the private sector to this project. It will also make financing cheaper,” Hochstein said.

He also said the US was contemplating other similar projects in Africa and elsewhere.

“Within Africa, I expect to have at least one more in the next year,” Hochstein said, without specifying where.

(By Chris Mfula; Editing by Nelson Banya and Mark Potter)

Reuters | February 7, 2024 |

The Tenke Fungurume mine in DRC. Credit: CMOC

Chinese mining firm CMOC Group could buy more assets in copper and cobalt-rich Democratic Republic of Congo, and sees further potential for growth in South America and Indonesia, an executive told Reuters on Wednesday.

“If there are opportunities, if there are assets that meet our criteria, of course we do consider increasing our presence in the DRC. Why not? We already have investments,” Julie Liang, CMOC vice president for ESG, said in an interview on the sidelines of the Africa Mining Indaba.

Copper and cobalt are among the metals that are expected to see strong demand in the years to come due to their use in green technologies, such as electric vehicles, that are key to helping governments globally meet climate targets.

CMOC last year became the world’s No. 1 cobalt mining company with production of some 55,000 tons, and could further outpace rivals including Glencore after raising its output forecast this year to 60,000 tons-70,000 tons.

The group’s copper production is projected at 520,000 tons-570,000 tons from about 420,000 tons last year. In the long run there is potential to further increase production beyond 600,00 tonnes, Liang said.

“We do have ambitions to become one of the biggest copper producers in the world,” she said. CMOC’s current 2024 forecasts would put it seventh or eighth in the world this year.

Like other copper producers in DRC, CMOC is struggling with electricity shortages and issues shipping the metal to ports.

But Chinese cobalt producers have seemed unconcerned by oversupply that has knocked down cobalt prices, with some said to benefit from state support for a sector seen as vital to China’s electric vehicle industry.

The copper deposits held by CMOC’s Congolese business are lower cost than some, Liang said, which allows it to ramp up cobalt production as a by-product even as rivals are scaling down due to a price slump.

CMOC is likely to churn out even more cobalt as it ramps up copper output, she added.

Silvery-blue cobalt was once seen as an indispensable element of EV lithium-ion batteries, with prices soaring in May 2022 to four-year highs, but they have since slipped back nearly 70%.

EV sales have been slowing as inflation hits consumers and governments cut subsidies, while batteries without the mineral have been rising in popularity.

While the company sees lower cobalt prices remaining for longer, its production is aligned to longer-term demand fundamentals that could benefit from the future outlook for the energy transition sectors globally, Liang said.

Short-term weakness in cobalt prices does not represent a threat to its operations, she said, as it mines the metal as a by-product and can afford to keep producing at lower prices.

(By Felix Njini and Veronica Brown; Editing by Jan Harvey)