Trump 2.0 Set To Gut Biden's Energy and Climate Policies

- Former officials in the Trump Administration and Republican policy consultants are already drafting blueprints of energy and climate policies for a second Trump term in office.

- All indications are that if Trump wins, he will make yet another U-turn in America's energy and environmental policies.

- The oil industry as a whole is looking at a second Trump term much more favorably than it does at the current Biden Administration.

Donald Trump, the most likely Republican presidential nominee, is set to overturn or at least try to dismantle many of President Joe Biden's energy and climate policies if the former president wins the November election.

The Biden Administration's methane rules, LNG export pause, EV mandates, federal oil and gas leasing, and even the Inflation Reduction Act will be all on the chopping block in a second Trump term in office.

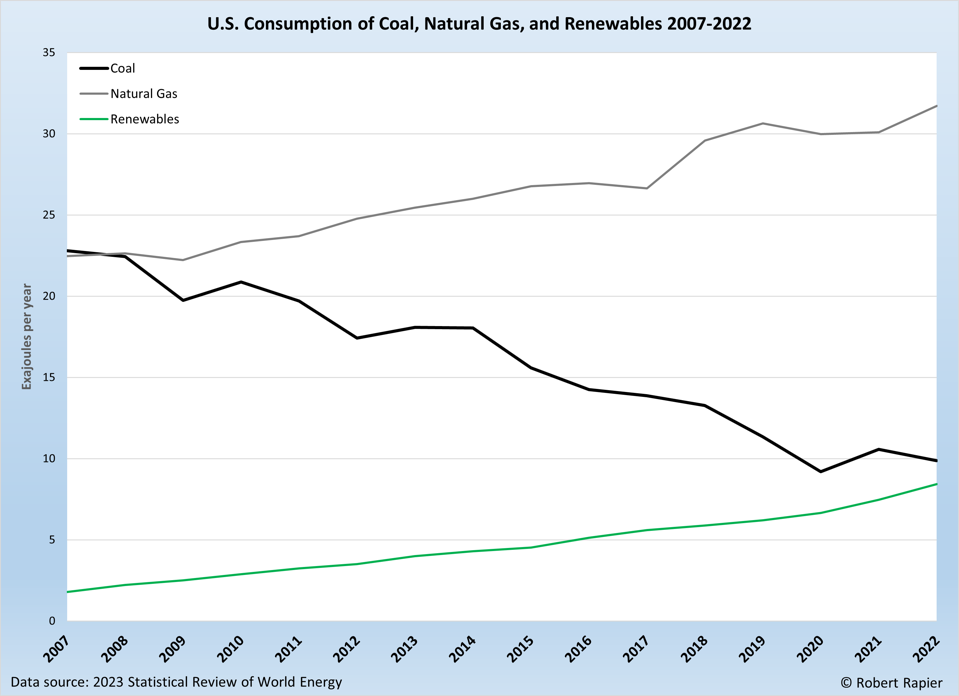

Trump would look to boost oil, natural gas, and coal development in the United States and, once again, withdraw the U.S. from the Paris Agreement, Republican policy advisers tell Reuters.

As the Biden Administration is racing to finish environmental rules so that they cannot be unwound by either a Republican Congress or the White House, Trump's campaign and advisers are preparing to dismantle many of the energy and climate policies in the first days of a second Trump presidency.

Federal Agencies Race to Finish Biden Rules

Federal agencies are expediting unfinished rules on environmental protection to make sure they can't be gutted early next year via the Congressional Review Act, or CRA, an oversight tool Congress may use to overturn final rules issued by federal agencies, Politico reports.

The first Trump Administration used that act to gut several Obama-era federal agency rules. CRA allows Congress to overturn agency rules within 60 congressional session days of when a regulation is finalized and sent to the Capitol. This means that the deadline for finalizing the Biden Administration rules to keep them out of CRA reach could be as soon as May or June.

"It's pedal to the metal time," James Goodwin, a senior policy analyst at the liberal-leaning Center for Progressive Reform, told Politico.

Advisers Line Up Trump Energy Agenda

Former officials in the Trump Administration and Republican policy consultants are already drafting blueprints of energy and climate policies for a second Trump term in office. All indications are that if Trump wins, he will make yet another U-turn in America's energy and environmental policies.Related: Gold Hydrogen Could Be A Game-Changer for Energy Markets

Shale tycoon Harold Hamm, Trump's former National Economic Council Director, Larry Kudlow, former Interior Secretary David Bernhardt, former Energy Secretary Rick Perry, and former senior adviser Kevin Hassett are some of the people with whom Trump is directly discussing energy policy issues, according to Reuters' sources.

The oil industry as a whole is looking at a second Trump term much more favorably than it does at the current Biden Administration, which, U.S. oil and gas associations say, has waged war on America's oil and gas sector and risks to undermine national security.

The American Petroleum Institute (API) and other organizations have heavily criticized the Biden Administration for reducing oil and gas lease sales on federal lands to a historical low, new methane rules, and the freeze on permitting new U.S. LNG export facilities.

Although U.S. oil and gas production has been setting records under Biden, the industry acknowledges it is doing that despite – not thanks to – the current Administration.

The sector associations have frequently criticized Biden's energy policies as "hostile" to the oil and gas industry and undermining the American economy and jobs.

In the latest Dallas Fed Energy Survey, an executive at an E&P firm said: "The administration's continued war on the petroleum industry has an effect for sure, but we're seeing that the real world needs our industry, and the public is trumping the downward pressure the administration is trying to maintain."

What Will Trump Change?

If Trump wins the presidential election, he is sure to support the oil and gas industry by introducing more lease sales – after all, "drill, baby, drill" is a frequent campaign talking point, as is Biden's EV mandate.

"On day one, I will end Crooked Joe Biden's insane electric vehicle mandate," Trump said at a rally last month.

The Inflation Reduction Act (IRA) is also under scrutiny for possible scrapping of tax breaks if Trump wins in November. However, this would first need a Republican-controlled Congress with both House and Senate. And even then, it could be difficult to scale back or scrap the incentives, as they mostly benefit projects and jobs in Republican states, analysts say.

The current pause on new permits for LNG export plants could also be undone by a Trump administration.

"A Trump administration could be expected to be more supportive of developers, allowing more export projects and ultimately boosting international sales of US gas," Ed Crooks, Vice-Chair, Americas, at Wood Mackenzie, wrote in an analysis last month.

"A more active leasing programme could potentially boost production, but only in the longer term. It would be unrealistic to expect a change of administration to make a large and rapid difference to the supply side for US oil and gas," Crooks noted.

Trump could actually influence U.S. fossil fuel demand more than supply, according to WoodMac.

A combination of scrapping the EV mandate and supporting domestic demand for fuels and natural gas "could make a material difference to US demand for oil and gas over time," WoodMac Crooks says.

By Tsvetana Paraskova for Oilprice.com

.jpg?ext=.jpg) The Bull Run Fossil Plant in Tennessee (Image: TVA)

The Bull Run Fossil Plant in Tennessee (Image: TVA).jpg.aspx?width=730&height=410) Type One Energy's concept for a stellarator fusion reactor (Image: Type One Energy)

Type One Energy's concept for a stellarator fusion reactor (Image: Type One Energy).jpg?ext=.jpg) AtkinsRéalis' vision of a Candu Monark plant (Image: AtkinsRéalis)

AtkinsRéalis' vision of a Candu Monark plant (Image: AtkinsRéalis).jpg?ext=.jpg) A concept for a nuclear-powered cargo ship (Image: Core Power)

A concept for a nuclear-powered cargo ship (Image: Core Power)