Indigenous Organizations Unite Against Controversial Amazon Copper Mining Project

SUCÚA, Ecuador, OTTAWA, ON and OAKLAND, Calif., Feb. 29, 2024 /CNW/ - Today, the Shuar Arutam People (PSHA) filed a complaint against Solaris Resources Inc. (TSX: SLS) before the British Columbia Securities Commission over its failure to continuously disclose material information to shareholders regarding its Warintza mining project which overlaps PSHA's titled territory. In spite of PSHA´s explicit and continuous rejection of the Warintza project, Vancouver-based Solaris has kept moving forward with its mining plans in the Amazon, one of the most biodiverse areas on the planet. The complaint comes just days before the biggest mining conference in the world, the annual trade show of the Prospectors and Developers Association of Canada (PDAC) to be held March 3-6 in Toronto. Solaris, in the past, has used PDAC to showcase its "Warintza model" of community engagement as industry best practice.

Source: Government Council of the Shuar Arutam People (PSHA), Amazon Watch, MiningWatch Canada, WITNESS. (CNW Group/MiningWatch Canada)

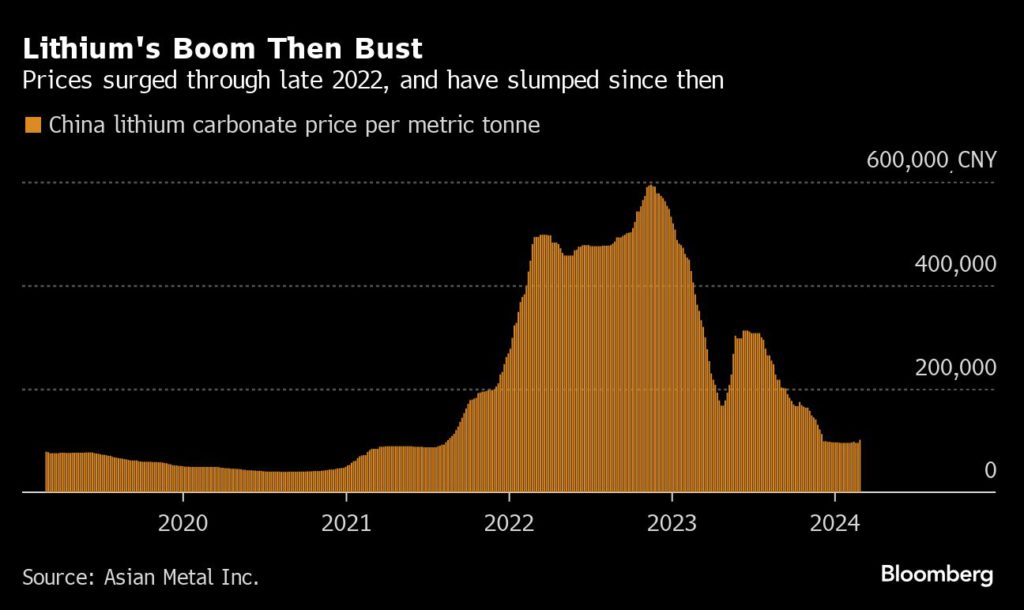

The global rush for critical minerals to meet rising demand of the energy transition away from fossil fuels has seen mining companies rebrand themselves as a sustainable 'green' industry and allies in mitigating climate change. But, much like the legacy of oil extraction, mining projects continue to violate human rights, disrespect the rule of law, contribute to climate change, and threaten important ecosystems and biodiversity, particularly in places like the Amazon basin, which is at a dangerous tipping point of collapse.

According to the complaint, the company has been disclosing partial information regarding its relationships with Indigenous communities opposing the project, and fails in its obligation to regularly disclose Ecuador's political and legal risks that may impede development of mining activities. The complaint also shows Solaris' failure to formally disclose material risks indicates a lack of compliance with its obligations, and may mislead current and prospective investors, which warrants a deeper investigation.

As recognized by the Ecuadorian government, PSHA is the legal representative body of 47 communities with collective land title and ancestral possession of 232,500 hectares of territory in the Cordillera del Condor region of Ecuador's Amazon, and site of Solaris' flagship Warintza copper-gold project. PSHA has repeatedly expressed its opposition to the project. The government has failed to consult them as required by the Ecuadorian constitution and international Indigenous Rights obligations, nor has their consent for the project been obtained.

Instead of addressing the full scope of its legal Free, Prior, and Informed Consent (FPIC) obligations, Solaris Resources has chosen to emphasize a "Strategic Alliance" with just two communities in the area, Yawi and Warintz, causing division and internal conflicts. However, it's important to note that neither of these communities can enter into a process of consultation or provide consent for land that is part of the collective PSHA territory. This has led to misleading implications for investors, suggesting that the company has secured the necessary "social license" to operate. This lack of FPIC puts the viability of the project at risk and opens the door to future litigation, similar to legal injunctions that have paralyzed neighboring mining projects.

The complaint arises as Chinese mining company Zijin Mining Group Co Ltd., along with its wholly-owned indirect subsidiary, Jinlong (Singapore) Mining Pte. Ltd. awaits approval from the TSX and Canadian securities regulators over its private placement of approximately 15% of Solaris' shares. According to financial analysts, this sale will trigger the Investment Canada Act, and could contradict Ottawa's policy of preventing Chinese companies from investing in Canadian-owned critical minerals projects.

Solaris also intends to list on the New York Stock Exchange (NYSE) in 2024, where it could face a similar complaint as the one presented to the British Columbia Securities Commission.

The complaint also shows that Solaris' positive country outlook is unsupported. The company does not disclose growing anti-extraction sentiment throughout Ecuador, where twelve mining projects are paralyzed due to opposition and legal actions. Recent plebiscites have restricted mining in several provinces, as well as one Ecuador's largest oil reserves under Yasuni National Park. Indigenous and anti-mining civil society organizations have also threatened new protests.

A growing coalition of Indigenous organizations and civil society groups including the regional confederation of Amazonian indigenous peoples of Ecuador's Amazon - CONFENIAE, Amazon Watch, Mining Watch, Witness, and Nia Tero are joining PSHA in their demand that Solaris Resources cancel the Warintza project and the Ecuadorian government revoke all mining concessions on its territory.

This story reflects a pervasive trend of conflict between Canadian mining companies and Indigenous communities, exacerbated by a history of environmental and social harm documented in the recent report Unmasking Canada: Rights Violations Across Latin America. The complaint against Solaris Resources Inc. by the PSHA exemplifies the ongoing struggle for Indigenous rights and environmental justice, amidst a backdrop of increasing resistance to mining projects in Ecuador and beyond. As Indigenous groups mobilize against extractive industries, supported by civil society organizations, it underscores the urgent need to hold mining companies accountable for their actions and prioritize Indigenous rights and environmental protection over corporate interests.

Jaime Palomino, President of PSHA, elaborates: "The Shuar Arutam people have rejected the Warintza project for many years. Despite this, the company insists on promoting the project by dividing the communities and trying to reach agreements with other Indigenous organizations. Both the company and the Ecuadorian government should respect our own government structure and our autonomy. Therefore, we are unaware of and reject any agreement that is or has been signed on our behalf."

"Solaris is misleading existing and future investors about the Warintza project. The reality on the ground is far different than the rosy outlook the company paints in its disclosures and CSR presentations. No legally binding consultation for the project has been conducted. Solaris has merely deployed a divide and conquer strategy in an attempt to manufacture consent. Solaris continues to keep its shareholders in the dark that there is steadfast opposition to this project that puts its viability at risk" said Mary Mijares, Fossil Finance Campaigner at Amazon Watch.

"The Shuar have repeatedly asserted there exists no social license for Solaris Resources' flagship Warintza project, even as the Canadian company downplays strong and consistent opposition. Today's complaint filed with the BC Securities Commission by the Shuar Arutam People and allied organizations is one more avenue to have their voices heard, as Ecuadorian communities increasingly succeed in stopping projects they see as socially and environmentally harmful" says Viviana Herrera, the Latin America Coordinator for MiningWatch Canada.

BACKGROUND:

For over two decades, the Shuar Arutam People (PSHA), Southwest Ecuador, in the Amazonian province of Morona Santiago, in the Cordillera del Cóndor, have firmly expressed their opposition to extractive megaprojects, including mining in their territory. In 2019, they declared their lands "a territory of life (TICCA)" and launched an international campaign "The Shuar Have Already Decided: No Mining!" In January 2021, PSHA's Governing Council, together with Public Services International (PSI), filed a complaint with the ILO against the Ecuadorian government for violation of ILO Convention 169 and for violating their collective rights and not consulting them on projects being carried out on our territory.

In 2019, Solaris Resources acquired Lowell Mineral Exploration and the controversial Warintza Project, which has remained dormant since 2006 after PSHA evicted Lowell Mineral Exploration.

SOURCE MiningWatch Canada

Thu, February 29, 2024