Bloomberg News | March 21, 2024 |

Stock image.

Copper resumed a rally that saw it hit an 11-month high this week, after the Federal Reserve’s signals on future rate cuts bolstered risk appetite and weakened the US dollar.

The metal has gained more than 10% over the past six weeks, boosted by supply risks, along with a generally more positive global economic outlook. Open-interest, or the number of outstanding contracts, for copper on the Shanghai Futures Exchange has soared to a record of more than 500,000 since last week as investors increased bullish bets.

The US dollar steadied following a decline on Wednesday, as Fed policymakers kept their outlook for three cuts this year and moved toward slowing the pace of reducing their bond holdings, suggesting they aren’t alarmed by a recent uptick in inflation. A weaker greenback makes commodities from copper to iron ore cheaper to other currency holders.

The copper market remains very tight, Goldman Sachs Group Inc. said in a note. “The combination of record low copper stocks, our expectation of peak mine supply next year, rapid green demand growth, and low price elasticity of both demand and supply will, in our view lead to copper scarcity pricing in 2025,” analysts led by Lina Thomas said.

Copper climbed 0.8% to $8,998.50 a ton on the London Metal Exchange by 11:35 a.m. local time, after rising as much as 1.8% earlier. Zinc rose 1.3% after Glencore Plc said it temporarily ceased operations at its McArthur River zinc and lead mine in northern Australia due to a cyclone.

Rainfall at the site this week exceeded a previous record set in 1974, according to a statement from Glencore. The company is monitoring flooding in the area and assessing impacts on its operations.

Reuters | March 22, 2024 |

Mining trucks at Glencore’s Katanga copper mine in the Democratic Republic of Congo. Credit: Glencore.

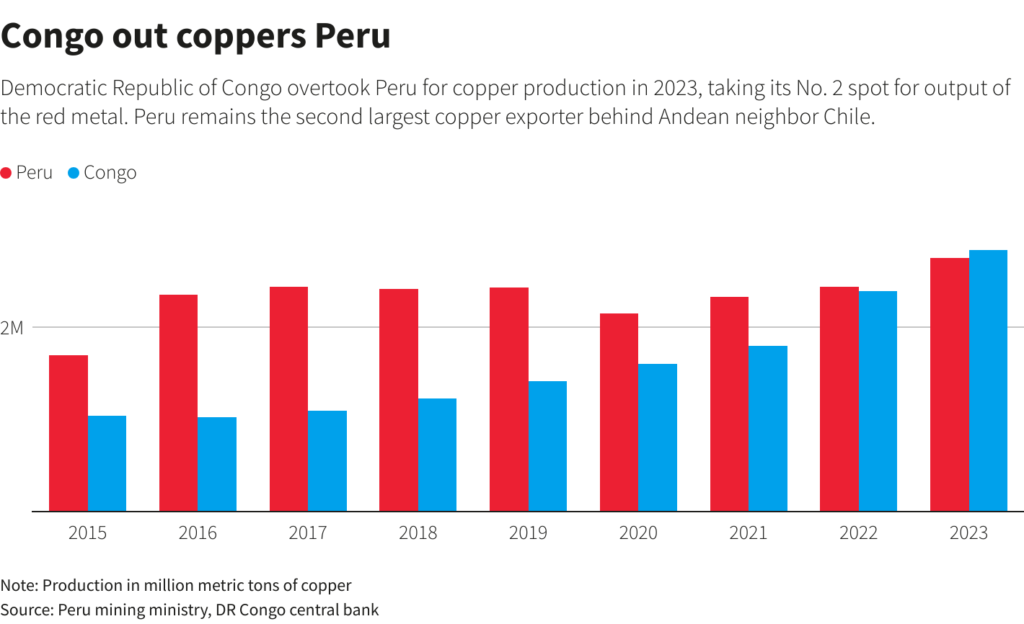

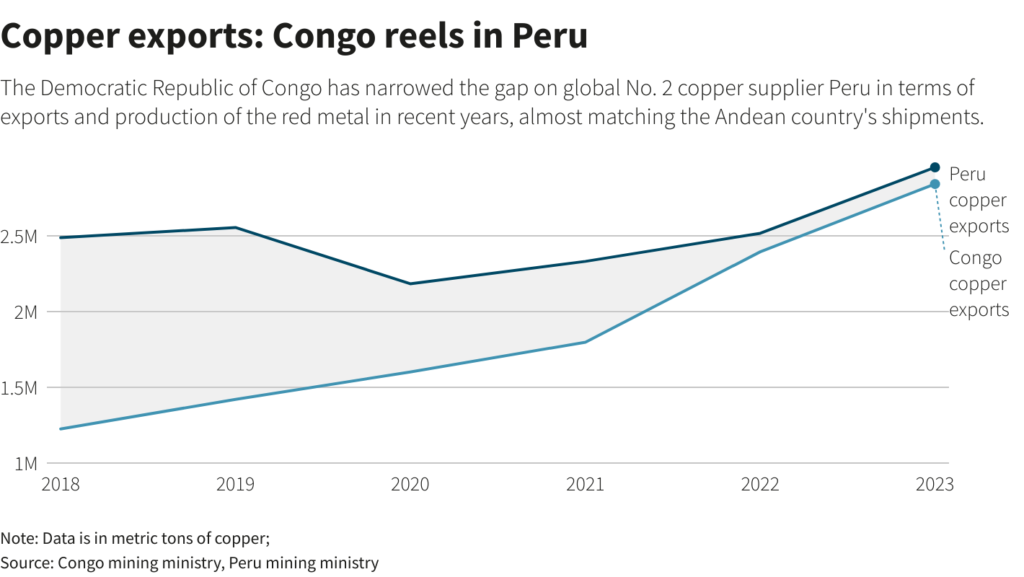

The Democratic Republic of the Congo overtook Peru as the world’s second largest copper producer in 2023, though it still lags the South American country in exports, official data from both nations show.

Congo produced about 2.84 million tons of copper last year, the country’s central bank reported. Peru’s output was 2.76 million tons, the Andean country’s mining and energy ministry said.

Congo has been reeling in Peru’s No. 2 copper spot over recent years, with flagging mining investment in Peru linked to red tape and recent political turmoil and protests. Chile remains the distant top producer of the red metal.

Peru, however, is hanging onto its lead over Congo on copper exports. Peru exported some 2.95 million tons of the metal last year, more than its annual production due to sales of stocks held over from previous years.

Rómulo Mucho, Peru’s minister of energy and mines, said in early March he expected copper production to increase to 3 million tons in 2024. The ministry did not immediately respond to a request for comment.

Peru’s Andes are home to major mining firms including Freeport-McMoRan, MMG, BHP, Glencore, Teck Resources, Japan’s Mitsubishi, and Southern Copper of Grupo México.

(By Marco Aquino and Felix Njini; Editing by Adam Jourdan and Richard Chang)

Reuters | March 21, 2024 |

Los Pelambres completed expansion will add 60,000 tonnes of copper a year to the company’s overall production once in full operation. (Image courtesy of Antofagasta plc.)

Chilean miner Antofagasta Minerals on Thursday inaugurated a more than $2 billion desalination plant for its flagship copper mine in Chile, Los Pelambres, aimed at relieving the effects of severe drought that has hit production.

The mine is the first to operate with desalinated water in an area of the country that has suffered a 15-year drought, sucking water from reservoirs and sparking concern over the fresh water supply.

Chilean President Gabriel Boric praised the project, saying the situation in the Coquimbo region, where Los Pelambres is located, is concerning.

“Especially with the climate change crisis, we must be not only a mining country, but also a country at the cutting edge of responsible, sustainable mining,” he said at the inauguration for the plant, which is at coast in Los Vilos, a city within Coquimbo.

Antofagasta began construction in 2019 for the plant, and plans to pump 400 liters of water per second for use at Los Pelambres, located about 55 km inland.

The company plans to supply another 400 liters of water per second in a second phase slated for completion in 2027, which it says would relieve pressure on the nearby Choapa river.

Chile’s historic drought has impacted nearly ever aspect of life in the nation that is the world’s top copper producer. Mining companies outside Coquimbo are already using seawater, particularly in Antofagasta, a northern desert region home to most of Chile’s mining activity.

(By Natalia Ramos and Alexander Villegas; Editing by Daina Beth Solomon and David Evans)

Reuters | March 22, 2024 |

Lubambe mine, Zambia – Image courtesy of ZCCM – IH

A unit of International Holding Company, Abu Dhabi’s most valuable company, is interested in acquiring Zambia’s Lubambe copper mine, an asset that China’s JCHX Mining has already agreed to buy, three sources familiar with the details told Reuters.

International Resources Holding recently told EMR Capital that it is interested in bidding for the private equity manager’s 80% stake in the Lubambe copper project, which is up for sale, a development that may complicate a sale process that’s already underway, two of the sources said.

The IHC unit’s interest in Lubambe, with potential to be among Zambia’s largest copper mines, comes after Shanghai-listed JCHX, a mine servicing and contracting firm, entered into a deal to buy EMR’s 80% stake in Lubambe in January.

The sale process requires approval from the Zambian government, which is pending and unclear at the moment, one of the sources said.

The Zambian government owns a 20% stake in Lubambe through state-firm ZCCM-IH.

The IHC unit’s interest is spurred by an aggressive push by cash-rich oil majors United Arab Emirates and Saudi Arabia to secure critical metal supply in Africa, as they bid to diversify their economies and engage with energy transition.

Middle East investors are pitted against Chinese companies in Africa, including state backed firms, also aggressively pursuing deals in Africa to strengthen China’s grip on minerals required to power a rapidly expanding domestic electric vehicle manufacturing sector.

EMR Capital’s binding deal agreed directly with JCHX technically precludes it from entertaining any new offers, one of the sources said. Still, EMR is aware that IRH is interested in buying the assets and that the UAE firm has officially informed the Zambian government and ZCCM-IH of its interest, two sources said.

While its interest is now widely known within the Zambian government circles, the UAE firm hasn’t presented a formal offer to EMR on the Lubambe stake, one source said.

EMR declined to comment. IRH and IHC didn’t immediately respond to emailed questions.

IRH has gatecrashed once before. It staged a last minute buyout of a 51% stake in Zambia’s Mopani Copper Mines last month, its first mining deal in Africa’s second-largest producer of the metal that is key to products from power lines and industrial machinery to electric vehicles.

The Abu Dhabi firm became the Zambian government’s preferred investor for Mopani mines ahead of Sibanye Stillwater and China’s Zijin Mining Group, which had been short listed for the assets after a protracted selection process.

Cashing out

EMR, which has owned the Lubambe mine since 2017, wants to exit the project as its funds mature, after Covid delayed its development, the sources said. It also sold a 51% stake in adjacent Mingomba copper project for a sizeable amount to California-based start up KoBold Metals.

EMR still holds a 28% stake Mingomba, alongside Zambia’s ZCCM.

Lubambe, previously owned by African Rainbow Minerals and Vale SA, produced about 15,000 tons of copper last year but needs to raise output to about 2,500 tons a month to become sustainable, it says on its website.

JCHX in January said it proposed to pay $1 for EMR’s 80% stake, and another $1 to take over the project’s $857 million debt.

JCHX did not respond to emailed questions.

Zambia’s ministry of mines did not immediately respond to emailed questions.

(By Felix Njini, Julian Luk, Clara Denina, Melanie Burton, Chris Mfula and Hadeel Al Sayegh; Editing by Veronica Brown and David Evans)