The West’s Nuclear Power Revival Could Be Slower Than Hoped

- At the COP28 climate summit at the end of last year, the United States and 21 other countries pledged to triple nuclear energy capacities by 2050.

- Most Western governments – with the notable exception of Germany – are now betting on nuclear power to help them with the carbon emission targets.

- The West has seen in recent years several cautionary tales of huge delays and cost overruns in looking to boost nuclear capacity.

Western nations may be getting ahead of themselves in their ambition to swiftly roll out new nuclear power capacity in the current push to reduce dependence on Russian uranium and meet net-zero targets with more nuclear-generated electricity.

At the COP28 climate summit at the end of last year, the United States and 21 other countries pledged to triple nuclear energy capacities by 2050, saying that incorporating more nuclear power in their energy mix is critical for achieving their net zero goals in the coming decades.

The United States, alongside Britain, France, Canada, Sweden, South Korea, Ghana, and the United Arab Emirates (UAE), among others, signed the declaration at the COP28 climate summit in Dubai.

“The Declaration recognizes the key role of nuclear energy in achieving global net-zero greenhouse gas emissions by 2050 and keeping the 1.5-degree Celsius goal within reach,” the U.S. Department of State said

John Kerry, President Joe Biden’s climate envoy, says there are “trillions of dollars” available that could be used for investment in nuclear energy.

“We are not making the argument to anybody that this is absolutely going to be the sweeping alternative to every other energy source — no, that’s not what brings us here. But you can’t get to net-zero 2050 without some nuclear power,” he told reporters at the time.

“Too Optimistic”

Most Western governments – with the notable exception of Germany – are now betting on nuclear power to help them with the carbon emission targets.

But many may have become too optimistic they would see a fast rollout of nuclear reactors and capacities in an industry notoriously known for years of delays and huge cost overruns.

“Clients, governments and ourselves as the industry players . . . we all become too optimistic,” Ian Edwards, chief executive of Canada’s engineering giant AtkinsRéalis, told the Financial Times.

“We have this optimism bias towards being able to deliver faster.

The stakeholders need to plan better and get the execution phase done right, according to the executive of the company, which manufactures the CANDU reactor, the only nuclear reactor that doesn’t need enriched uranium.

The CANDU technology stands for Canada deuterium uranium because it uses deuterium oxide, or heavy water, as a moderator and coolant and uses natural – not enriched – uranium as a fuel.

The West has seen in recent years several cautionary tales of huge delays and cost overruns in looking to boost nuclear capacity. Two of the glaring examples are the UK’s Hinkley Point C project by French energy giant EDF and the Vogtle nuclear power plant in the U.S. state of Georgia.

Early this year, EDF pushed back – again – the probable operational start at Hinkley Point C to 2029-2031, depending on various scenarios, compared to the original intention to have the first unit at the plan running in 2025. The costs have gone through the roof – to an estimated $43.5 billion (£34 billion), from $23 billion (£18 billion) budgeted initially.

In Georgia, a new reactor at the Vogtle nuclear power plant began commercial operation last summer in what was the first new nuclear reactor to start up in the United States since 2016. Construction at the two new reactor sites at Vogtle began in 2009. Originally expected to cost $14 billion and begin commercial operation in 2016 (Vogtle 3) and 2017 (Vogtle 4), the project ran into significant construction delays and cost overruns. The total cost of the project is now estimated at more than $30 billion.

New Technology Promises Revival of Nuclear Power

AtkinsRéalis, whose natural-uranium reactor design differentiates it from the competition, has a sales pitch advantage because of the Russian dominance in enriched uranium supply, Edwards told FT.

But he warned that demand for AtkinsRéalis’s technology is likely to exceed the company’s capacity to meet it.

Last year, AtkinsRéalis’s revenues from its nuclear division rose by 16.5% compared to 2022, thanks to higher sales volumes from Europe, Asia, and the United States.

Despite the West’s attempts to reduce its reliance on Russian uranium, the EU doubled its imports of Russian nuclear fuel last year, mostly due to former Soviet bloc countries such as the Czech Republic and Slovakia importing Russian fuel for their Soviet-era nuclear plants, NGO Bellona said in an analysis last week, citing data from Eurostat and the UN’s international trade service Comtrade.

The United States is doubling down on its own supply of nuclear fuel and technology, including innovative reactor designs

Soaring uranium prices and a supply squeeze on the global uranium market have prompted U.S. uranium producers to revive abandoned mines that haven’t been operational in more than a decade.

Early this year, Uranium Energy Corp said it would restart uranium production at its fully permitted site in Wyoming as the resurgence in nuclear power has led to a new bull market in uranium.

“Uranium market fundamentals are the best the industry has witnessed,” Uranium Energy president and CEO Amir Adnani said in January.

The U.S. is also backing advanced nuclear technology and small-scale reactors, hyped to be the future of nuclear energy.

This week, TerraPower, a company working on small-scale nuclear reactor development backed by Bill Gates, said it would begin construction on its next-generation nuclear reactor in the United States as soon as June.

TerraPower has been developing the Natrium technology for advanced reactors, which features a sodium-cooled fast reactor with a molten salt-based energy storage system. The Natrium demonstration plant will be built near a retiring coal facility in Kemmerer, Wyoming.

By Tsvetana Paraskova for Oilprice.com

Bloomberg News | March 21, 2024 |

Uranium yellowcake. (Image: Energy Fuels Inc.)

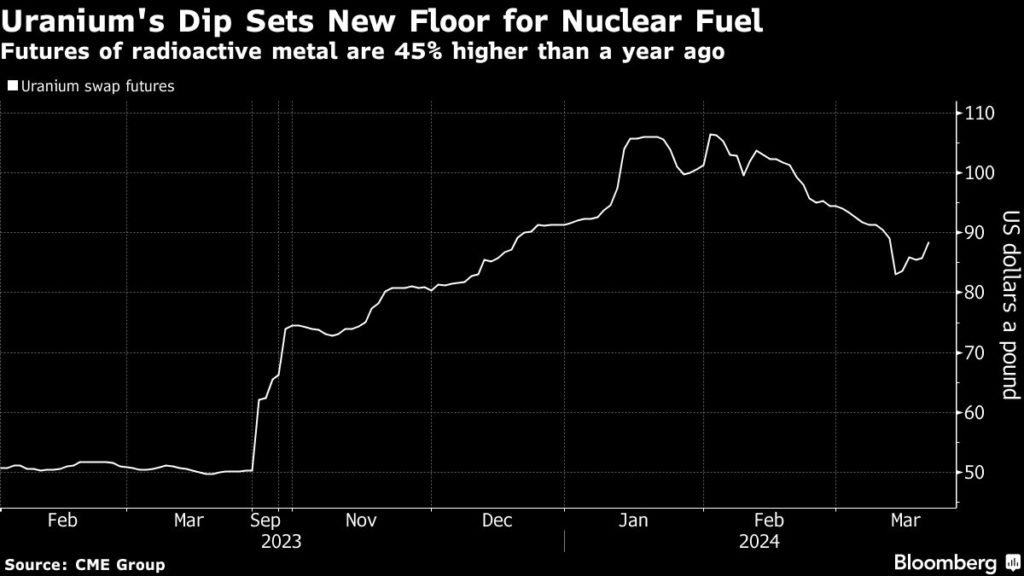

Uranium may have lost some sizzle after an electrifying 10-month rally, but analysts and investors aren’t losing faith in the long-term prospects of the nuclear fuel.

After a 22% decline over six weeks, industry experts and analysts say that the uranium market has likely set a new floor thanks to a strong demand outlook.

“We have reached a bottom,” said Jonathan Hinze, president of UxC, a nuclear industry research firm. “The fundamentals are still strong, with increased demand and supply that hasn’t fully responded.”

Uranium futures are trading at $88.50 a pound in New York — down from the 16-year high reached in February, but still well above last year’s average price of $66.60 a pound.

There are indicators uranium’s new floor is at around current levels, Cantor Fitzgerald analyst Mike Kozak said in an interview, predicting that fundamental buyers will come back into the market and drive up prices again.

Bullish investors are betting on the long-term prospects of the radioactive metal due to a growing supply gap and increased demand as governments worldwide turn to nuclear power to counter climate change. Such demand comes as Canada’s Cameco Corp. and Kazakhstan’s Kazatomprom, which together account for half of global supply, warned of supply setbacks in the coming years.

Kazatomprom, the No. 1 producer, said during its March 15 earnings call that it is projecting a 21 million pound supply deficit in 2030 — a shortfall that would multiply to 147 million pounds by 2040.

Geopolitics may also affect the supply outlook. The US introduced a bill in December that would ban imports of enriched Russian uranium — the kind used to fuel nuclear reactors and weapons. The bill needs to be passed by the US Senate and signed by President Joe Biden to be enacted.

Still, with other uranium miners looking to dust off mothballed operations in response to higher prices, there are risks a rally could fizzle out quickly, much in the same way that a boom in battery metals markets turned to bust over the past couple years.

Treva Klingbiel, president of uranium price provider TradeTech, said she doesn’t see demand for nuclear fuel easing any time soon.

“We have a number of geopolitical factors that have a really significant influence on buyer behavior, even though fundamentally nothing has changed” she said. “Buyers can use the spot to tell them the sentiment of the day, but must look at the long-term market to see that it is marching steadily up, it hasn’t taken a hiccup at all.”

(By Maria Clara Cobo)