Strong Interest in NE Wind Solicitation as Ørsted, Avangrid, CIP Bid

Experts are predicting strong participation in the New England regional offshore wind energy solicitation due to close today. Announced in October 2023, the program coordinated the next phase of wind energy projects between Connecticut, Massachusetts, and Rhode Island and was designed to counter some of the pressures that slowed the industry’s progress in 2023.

Where companies including Ørsted were moving to withdraw from projects and canceling power purchase agreements in 2023, the same companies are now aggressively bidding for the next round of projects. Ørsted, Avangrid, and Copenhagen Infrastructure Partners each announced their entries citing a long list of regional benefits and planned investments.

Reuters was quoting experts saying that other companies were likely to enter bids today. Engie is expected to make a proposal according to Reuters. Both BP and EDP are also in a position to possibly submit proposals. The regional, multi-state solicitation calls for as much as 6.8 GW of wind energy capacity.

Ørsted

Ørsted publicly announced the details of its proposal launching a new project called Starboard Wind which would work with Connecticut. They are proposing a project with a capacity of 1,184 MW which they said would provide the equivalent of power for 600,000 homes in Connecticut. They are promising the project with a long list of touted benefits for the state and its economy including saying it would result in more than 800 full-time jobs.

The project would expand the use of the New London State Pier for staging and assembly. The company highlights it has already invested more than $100 million in infrastructure improvements to redevelop the New London State Pier and says it would further the efforts to support this project if it is selected.

Ørsted highlights that with its partner Eversource they are currently building Revolution Wind, Connecticut’s first offshore wind farm, and marshaling the project out of State Pier. They are saying that Starboard Wind would build on Revolution Wind’s investments and accomplishments and advance the state toward its goal of 100 percent clean energy by 2040.

Onshore construction is underway for the 704 MW Revolution Wind project, with offshore construction to begin in the coming months. Revolution Wind will deliver 304 MW of offshore wind power to Connecticut and another 400 MW to Rhode Island, powering more than 350,000 New England homes. The project is expected to be in operation in 2025.

Avangrid

Avangrid, part of the Iberdrola Group, countered by submitting multiple proposals both for the regional approach as well as in the single-state procurements in Massachusetts, Connecticut, and Rhode Island. Repositioning for the multi-state approach, the company is rechristening its Park City Wind project as New England Wind with two phases. The first project would have a capacity of 791 MW and they highlight it is advanced in the federal approval process making it shovel-ready. The second phase would have a capacity of 1,080 MW. They said the new names reflect the regional approach to the industry offering a total of 1,870 MW.

New England 1 would be 30 miles south of Barnstable, Massachusetts, and border Vineyard Wind 1 which the group already has under construction. They are highlighting the project would provide power for approximately 400,000 homes and create more than 4,400 full-time jobs. As part of the project, Avangrid reports it has entered into an agreement with the City of Boston as the first to provide 15 MW of offshore wind power to the city. New England Wind 2 is the new name for the Commonwealth Wind project.

They highlight the use of the marshaling facility in Salem, Massachusetts, and their lease with Crowley Maritime as the facility’s anchor tenant. They are also saying they would utilize the New Bedford Foss Marine Terminal for construction logistics. They would also be using a purpose-built SOV from Edison Chouest Offshore and crew transfer vessels with one built locally by Patriot Offshore Maritime Services.

Copenhagen Infrastructure Partners

Copenhagen Infrastructure Partners which manage funds that hold the leases and for which Vineyard Offshore serves as U.S. development partner reported that it is entering proposals in each of the state solicitations and an overall arching regional proposal for the multi-state approach. The group which is developing Vineyard Wind 1 reports it submitted a proposal for a 1,200 MW capacity project for the New England grid, providing enough to power more than 650,000 homes, starting in 2031.

There project would be 29 miles south of Nantucket with its export cable making landfall in New London, Connecticut. Among the benefits they highlight would also be the use of the Salem Offshore Wind Terminal for staging while O&M would be based at the New Bedford Foss Marine Terminal. The company say its proposal would support 3,800 job-years of employment across New England and source materials locally including secondary steel components for foundations from Rhode Island.

Last week, the federal Bureau of Ocean Energy Management announced it was moving forward on the review of Copenhagen Infrastructure Partners’ Vineyard North project which would be over 2 GW of wind power.

Ocean Winds, the partnership between Engie and EDP, is developing SouthCoast Wind off Massachusetts which would have a capacity of 2.4 GW and likely to also enter a bid.

Analysts are encouraged by the strong interest emerging in the New England solicitation. They said it demonstrates the industry is regaining momentum after the financial and supply chain challenges emerged in 2023.

Ørsted Green Lights Seventh US Offshore Wind Farm as it Gets BOEM Approval

The U.S. continues to push forward with its efforts to develop renewable offshore wind energy with the Biden administration highlighting that it has approved the seventh offshore wind farm. This comes as the latest in the series of rapid developments as the efforts reach the conclusion of the long permitting process and the administrations seek to add more opportunities into the pipeline.

The Department of the Interior’s Bureau of Ocean Energy Management today issued the Record of Decision for the Sunrise Wind project to provide power to New York State. It is a key hurdle for the project that was first auctioned in 2013. BOEM's issuance of the Record of Decision formally concludes its National Environmental Policy Act review process and precedes the anticipated approval of Sunrise Wind's Construction and Operations Plan, expected this summer.

The lease area is located approximately 16.4 nautical miles south of Martha’s Vineyard, Massachusetts, and approximately 26.5 nm east of Montauk, New York. The project calls for a capacity of 924 MW which they report will provide power for the equivalent of 600,000 homes in New York State.

At the same time today, Ørsted and its joint venture partner Eversource have taken a final investment decision for the project meaning that they will now advance with some initial onshore construction activities. The companies highlighted that they have already given contracts for work including the installation of the underground duct bank system for the onshore transmission line and construction and steel manufacturing work.

These developments are especially significant as the project was in doubt just a few months ago as Ørsted began reassessing its U.S. portfolio and the partners said the power purchase agreement was no longer financially viable. New York State permitted them to cancel the old contract and selected Sunrise Wind for a second time in the recent solicitation. The companies are still working to finalize a new 25-year contract with the state.

As previously announced, Ørsted has agreed to acquire Eversource’s 50 percent ownership share in Sunrise Wind, becoming the project’s sole owner, subject to the signing of an OREC contract with NYSERDA, finalization of acquisition agreements, COP approval, and other relevant regulatory approvals. Eversource will remain contracted to lead the project’s onshore construction.

In issuing the Record of Decision, BOEM highlights that it revised the plans to reflect the comments received during its review process. Among the points, the decision altered the plan calling for fewer turbines. It approved the construction of up to 84 wind turbines within the lease area.

As the seventh approved project, BOEM reports it has now cleared 8 GW of offshore wind power capacity. They estimate this will power roughly three million homes.

Today’s action follows the release of guidance last week for the tax credits available to the wind industry under the Inflation Reduction Act, as well as launching the next phase of reviews for the Vineyard Northeast and Atlantic Shores Offshore Wind. They have also approved Empire Wind’s construction plan and moved forward on projects in the Gulf of Maine, the Central Atlantic, and the Oregon Coast. The administration has conducted a total of four lease auctions including the first off California and in the Gulf of Mexico.

Hornsea 3 Offshore Wind Farm Will Achieve an Energy Output of 2.9 GW

[By: Sarens]

The new wind farm, located 120 km off the Norfolk coast and 160 km off the Yorkshire coast, will be the single largest offshore wind project in the world with a surface area of 696 km2 and up to 231 turbines.

Sarens will work together with Aibel to assemble the two HVDC converter platforms at the Maptaphut facility in Rayong (Thailand), from where they will be transported to Haugesund to be equipped with Hitachi Energy's latest generation HVDC converter valve technology prior to final completion and commissioning.

The new Hornsea 3 offshore wind farm, located 120 km off the Norfolk coast and 160 km off the Yorkshire coast, will become, once commissioned in 2027, the largest offshore wind project in the world with up to 231 turbines, 696 km2 of occupied area and a clean electricity production of 2.9 GW, which will be enough to supply more than 3.3 million homes in the UK.

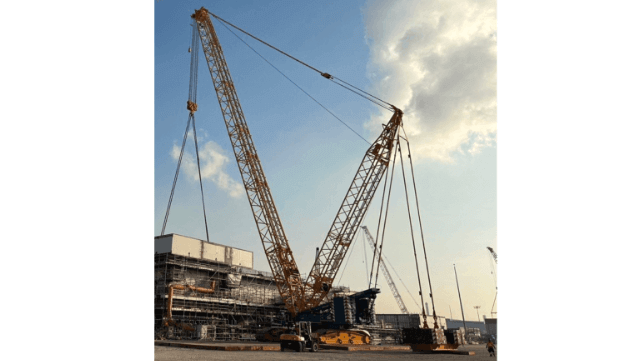

Sarens, world leader in heavy lifting, engineered transport and crane rental, is working with Aibel on the construction of the wind farm's two HVDC (high-voltage direct current) converter platforms at Aibel's facilities in Maptaphut, Rayong (Thailand). These units will be key to ensuring the performance of the wind farm, as they are the units responsible for transmitting large amounts of electricity over long distances, once the electricity produced by the wind turbines has been converted into alternating current.

This new facility, which will be operated by Ørsted, joins the two previous phases, which came on stream in 2019 and 2022 respectively. These two farms already contribute more than 2.5 GW of renewable energy to the UK grid, benefiting nearly 2.5 million homes.

For this operation, scheduled from January 2024 to the first quarter of 2025, Sarens transported two CC2800-1 crane units, each with a capacity of 600 tons, from its facility. Both cranes will collaborate in lifitng Section S210 weighing, 273 tons, and Section S220 weighing ,388.7 tons to their final positions, completing the module. As a preliminary step, the cranes were positioned on steel mats for crawl and stack the section on the surface , ensuring the operation’s security, precise crane movements, and preventing damage to both the material and operators in the vicinity.”.

When the wind farm comes online, Ørsted’s Hornsea trio – comprising Hornsea 1, 2, and 3 – will have a total capacity of in excess of 5 GW, making it the world’s largest operating offshore wind zone. The Hornsea zone will also include Ørsted’s Hornsea 4 project, which could have a capacity of up to 2.6 GW. Hornsea 4 received its development consent order from the UK government earlier in 2023 and is now eligible for forthcoming CfD allocation rounds.

Sarens has extensive international experience in the assembly and maintenance of wind farms. It has participated in various installations in France such as Fécamp, Saint Nazaire, Provence Grand Large in the lifting and transport work for the foundation bases of the new offshore wind farm in Saint Brieuc, located off the Brittany coast. During this project, Sarens successfully transported loads weighing over 1,150 tons. More recently, Sarens has worked in the receiving and loading out the monopiles and transition pieces for 176 turbines for the Coastal Virginia Offshore Windfarm.

US Research to Improve Aerodynamic Performance of Offshore Wind Turbines

The U.S. Department of Energy's Wind Energies Technologies Office plans to invest $5.1 million from the Bipartisan Infrastructure Law to support research and technology development to advance modeling and analysis for next-generation offshore wind turbine blades. According to the announcement, these efforts aim to facilitate the accelerated development and deployment of cost-effective offshore wind energy technology focusing on larger turbines with a capacity above 10 MW.

Wind turbine blades experience high loads when in operation, when stationary for installation or maintenance, and with the passage of extreme weather events. As wind turbines become larger, gathering data becomes challenging due to the large scale of the modern turbines.

To effectively design new offshore wind turbine blades, engineers however need to gather aerodynamic data that will help assess how a wind turbine blade responds in all weather conditions. The new project looks to help fill that gap.

They note in announcing this project that while simulation tools for large blades needed for offshore wind turbines can represent unsteady behavior when the turbine is in operation, they sometimes make inaccurate assumptions for conditions where the rotor is idling or stationary, leading to overly conservative designs or a risk of damage in certain wind conditions. Additionally, extreme weather events affect turbines in operation because the wind may come from any direction, and the loads generated on the blade and the resulting blade motion may be highly unsteady depending upon when and where the wind is blowing.

The goal of this research is to develop and validate improved modeling and simulation tools for the behavior of idling or stationary blades for large-scale wind turbines. They also look to enhance the methods for collecting and disseminating benchmark aerodynamic data to inform the design of large next-generation wind turbine airfoils and blades.

They look to provide the wind industry with accurate models to minimize the risks of developing and deploying large offshore wind turbines.

China and companies in Europe are working on these new generations of turbines which will increase the field and reduce the number of installations required for each project. Vestas Wind Systems previously announced a 15 MW turbine and China’s MingYang has demonstrated a 16 MW turbine including the longest blades yet built. Last year, the Chinese surprised the industry with an announcement that they were already working on a 22 MW turbine which they expect to complete between 2024 and 2025.

Italy Approves First Floating Offshore Wind Project

To help demonstrate the potential for floating wind and to jumpstart Italy’s efforts, the Italian authorities last week approved the country’s first floating wind farm. While Italy has several projects in the planning stage for offshore wind energy generation, the country has only commissioned one offshore wind farm in 2022.

Italian Ministry for Environment and Energy Security granted approval for a project known as 7SeasMed Floating Offshore Wind last week. They completed the environmental impact assessment approving the project which is being led by Copenhagen Offshore Partners and is owned by a consortium that includes GreenIT, the Italian renewable energy joint venture between Plenitude (Eni) and CDP Equity (CDP Group), and Copenhagen Infrastructure Partners.

The plan for 7SeasMed calls for a 250MW floating offshore wind project located just over 20 miles off the coast of Sicily. It will be positioned on the western side of the island near Marsala. The estimates are that it will provide around five percent of Sicily’s total electricity consumption, powering more than 70,000 homes.

Consortium's map of proposed offshore wind farms for Italy (CIP)

Approval of the EIA paves the way for the construction and operation of the offshore wind farm, which the partners said will use cutting-edge technologies. By utilizing floating platforms anchored to the seabed, 7SeasMed aims to unlock new opportunities for sustainable energy generation while minimizing environmental impact. By deploying state-of-the-art floating platform technology, the project aims to showcase advancements in offshore wind technology, driving innovation, and expertise in the renewable energy sector.

The investment consortium last announced a year ago reporting it had agreements to develop floating offshore wind projects in the Latium region and near Sardinia. They have grown their total portfolio to approximately 3 GW, making it one of the largest floating portfolios in Italy. In addition to 7SeasMed, they look to develop the Ichnusa (504MW, Sardinia) Tyrrhenian (500MW, Latium), Nurax (500MW, Sardinia), and Poseidon (1000MW, Sardinia) projects. Their goal is to start commercial operation between 2028-2031.