Next week the cruise industry meets for its biggest conference of the year and will discuss the trends shaping cruising. In advanced, The Maritime Executive is sharing its Cruise Industry Outlook from the magazine's January/February issue. We invite you to read more about the cruise industry in the magazine including a profile of Norwegian Cruise Line Holdings CEO Harry Sommer.

Despite fears that high debt levels and steep discounting would hold back the recovery, the cruise industry surpassed all expectations in 2023 and is expected to reach new heights in 2024.

“The cruise industry's 2023 rebound was nothing short of phenomenal,” says industry observer John Udemezue. “Fueled by pent-up demand, value-driven pricing and innovative itinerary tweaks, it surpassed the most optimistic predictions.”

Beyond the pent-up demand that everyone expected would drive bookings in 2023, he points to the continued value proposition that cruising offers and the desire for new experiences as additional factors driving the rebound.

“People Ventured Out”

By the numbers, it was a strong year, but there were also key underlying trends that indicate a sustainable recovery. The trade group Cruise Lines International Association (CLIA) calculates that 31.5 million people sailed on its members’ ships, which represent about 90 percent of the industry, in 2023 – up six percent from the pre-pandemic peak in 2019.

Cruising, however, is somewhat capacity-constrained as older ships were retired during the pandemic and new deliveries slowed, but CLIA forecasts a better than 13 percent increase or a total of 35.7 million travelers sailing on member lines’ cruises in 2024.

Jared Benoff from the family-owned virtual travel agency Vacationeeze says, “People really ventured out and were looking for a way to escape in 2023.” He predicts it will “continue to be the era of trying something new, expanding horizons and thinking about travel differently.” Noting that clients want something far from the ordinary, he sees growth in multi-adventure cruising – combining the cruise with multiple experiences.

Travelers are focusing on experiences, and the good news for cruise lines is they’re willing to pay for these “achievements” and planning their trips further out, providing companies with greater certainty.

Last summer, the industry set a record for bookings with an average of 230 days before departure. Many in the industry are now reporting that there’s minimal availability, especially for cruises in the first half of 2024. Some lines are already accepting reservations for cruises scheduled for the third and fourth quarters of 2026.

Record Bookings and Pricing

“We continue to see the industry better booked at this stage of the year for the rest of the year than ever before,” observes Patrick Scholes, equity research analyst at Truist Securities. “Even with eight percent year-over-year capacity growth in 2024, we see the industry with 7 – 10 more points of occupancy on the books for the rest of the year than in any ‘normal’ (pre-COVID) year.”

The bad news for travelers and the good news for the industry is that this equates to stronger-than-anticipated pricing power and the end of discounting. The consumer website Cruise Critic reports the average price of a five-night cruise to the Caribbean, Bahamas or Bermuda was up 37 percent in 2023, ten times the current inflation rate.

UBS cruise analyst Robin Farley reported hearing that, as of December 2023 in conversations with cruise sellers, “Overall average ticket prices booked by brand are up mid-single digits to low double digits.” She notes that there remains strong demand for traditional destinations like the Caribbean and Alaska but adds that cruise lines see growth in the market as part of the “shift to experiences more than objects.”

“We observed significant strength in pricing growth,” confirms Truist’s Scholes, predicting that “2024 will likely be the strongest year ever for year-over-year pricing growth for the modern cruise industry.” Despite the price increases, analysts point out that the pricing gap between land-based resorts and cruises remains significant – at 25 to 30 percent, according to Scholes.

Debt Overhang

The restored pricing power comes as welcome news for the cruise lines, which took on astronomical amounts of debt during the pandemic to keep their operations afloat.

Initially, just getting the ships back in service was critical to cash flow. Then came discounting to increase occupancy, and now – at last – the income can be used to pare down debt. The three largest publicly traded cruise holding companies – Carnival Corporation, Royal Caribbean Group and Norwegian Cruise Line Holdings – collectively restructured and lowered debt by seven percent in 2023 but still have more than $64 billion in long-term debt outstanding. Paying it down will continue to be a focus for 2024.

The debt overhang has meant cruise lines slowed capital expenditures, delayed overhaul projects and deferred new construction. The orderbook is down to just 46 ships over the next five years, representing 4.8 million gross tons or approximately 110,000 berths in an industry that currently has over 300 ocean-going ships and more than 700,000 berths.

Having turned the corner on profits, the expectation is that larger shipbuilding orders will be coming soon. MSC Cruises, Royal Caribbean International and Norwegian Cruise Line Holdings have pre-pandemic orders in place for large ships for the contemporary segment serving the broad market.

Introducing the company’s premium cruise ship Vista for Oceania Cruises, Norwegian CEO Harry Sommer said in 2023 that he sees a new ship for Oceania and sister brand Regent Seven Seas Cruises every two to three years as the right pace that “we can absorb from a staffing, guest acquisition and experience perspective.” Similarly, Carnival Corporation is down to just three ships under construction, but CEO Josh Weinstein predicts it will be making an order shortly and begin introducing one or two new ships per year across its nine brands starting in 2027.

Emerging environmental regulations present another challenge that is likely to contribute to new orders. The cruise industry has adopted liquified natural gas, “as the cleanest fuel option available today,” says CLIA, with Carnival Corporation’s brands as well as MSC Cruises, Disney Cruise Line and recently Royal Caribbean Group all introducing LNG dual-fuel ships. Norwegian Cruise Line and TUI Group with Germany’s Mein Schiff are pioneering methanol-ready cruise ships.

The industry, however, needs more orders to fuel growth. Jef Henninger, a travel agent at Simple Travel Hacks, notes the contemporary brands that appeal to families and the average traveler are focused on bigger ships. He says they’re neglecting to build smaller ships to replace those that are over 25 years old and, in some cases, showing their age.

Royal Caribbean International, for example, is focusing on 250,000-gross-ton ships loaded with water parks, slides, ice skating, surfing and other attractions. However, its headline-grabbing “Ultimate World Cruise,” a 274-night journey sold as an immersive voyage to more than 60 countries, is aboard the Serenade of the Seas, a 20-year-old, 90,000-gross-ton vessel. She only has a rock-climbing wall and mini-golf as her attractions, a point that’s been noticed by the “TikTokers” in their endless social media postings from the cruise.

Where the Growth Is

Over the past few years, the development of expedition cruising to exotic destinations has driven growth in the industry, but the buildout of the segment is nearly complete. Companies are shifting their focus to luxury and premium ships, reflecting travelers’ desires for achievements and experiences.

“The luxury cruise segment is thriving with passengers looking for smaller ships, more high-end experiences, exclusive amenities and exceptional service,” says Kim Gervais, a travel specialist at Explore the World Travel.

UBS’s Farley notes that “Luxury cruising is only about five percent of the luxury travel market,” but growing rapidly. The number of berths in the segment has increased 1.5 times since the pandemic, and currently half the ships on order, and the only orders placed since 2020, are for small, luxury and niche cruise ships. UBS calculates that the luxury/upper premium segment of the industry will grow by 15 percent in 2024 after a 21 percent spurt in 2023.

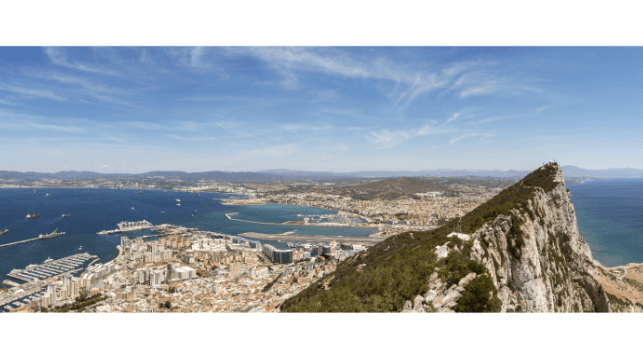

Further driving growth in luxury cruising is a blurring of the line with expedition cruising, says Grant Holmes, Vice President for Global Cruise & Superyachts at Inchcape, the world’s biggest port agency for the cruise industry. He points out that expedition cruising was “traditionally polar bears and penguins” but luxury cruising has entered the segment and the ships are looking for new destinations. He sees a trend in “warm water exploration” where luxury ships provide access to destinations and events, helping travelers complete those bucket list items. “Access is the new luxury,” says Holmes.

Bright Outlook

As cruise lines look to further build their business, Jason Eckhoff, CEO of BusinessClass.com, sees a marketing emphasis on “so-called second-time cruisers.” He says that while the “new to cruise” segment remains important, cruise lines are targeting people who previously experienced a cruise and seeking to rekindle their interest to create new bookings.

Most observers believe the industry still has lingering challenges but has at last found its way forward after several challenging years. With bookings at record levels and newfound pricing power, the outlook is very bright. – MarEx

Allan Jordan is the magazine’s Associate Editor.

The opinions expressed herein are the author's and not necessarily those of The Maritime Ex