Reuters | April 18, 2024 |

Demonstrations against the contract have turned into an anti-government, end-to-all-mining movement. (Image: Screenshot of stock video.)

Prospects are poor for First Quantum Minerals to recover its canceled concession for a lucrative copper mine after presidential elections in May, a Reuters review of the campaigns’ proposals and interviews with protest leaders show.

Protests against First Quantum’s concession demanding greater environmental guarantees and transparency in negotiations made authorities not only annul its contract to operate one of the world’s largest and newest copper mines but ban all new metal mining permits last year.

Metal traders and investors are closely watching the election outcome to see if a new president could help revive mining in Panama.

Eight candidates are set to appear on the May 5 ballot, with polls showing a tight race. Among the five frontrunners, three have vowed to continue with the plans to close the Cobre Panama mine, one has pledged a referendum on the matter and another has not formally indicated his intentions.

The Canadian miner lost nearly half of its market value after it was stripped of its contract and in March global rating agency Fitch downgraded Panama’s sovereign bonds to speculative grade, citing fiscal and governance challenges aggravated by the mine’s closure.

Asked about its expectations for the mine after the vote, a spokesperson for First Quantum said only: “As in any jurisdiction we operate in, we look forward to seeing the process of democracy deliver the candidate of Panama’s choice in a fair, transparent and peaceful election.”

Reuters spoke to leaders from five different protesters’ groups. Three groups, including the country’s main workers’ union SUNTRACS, said there was no scenario under which they would let authorities seal a new partnership with First Quantum.

“People already showed on the streets they don’t want metal mining,” Saul Mendez, head of SUNTRACS, said.

Two groups said they would support a referendum on the matter, and predicted the result would be against mining. A survey published by local newspaper La Prensa in February showed 90% of Panamanians oppose mining.

All five groups expressed their distrust towards candidates, even the ones who have outright opposed mining, saying that politicians do not tend to fulfill their promises.

“If the incoming president opens that mine without authorization from the whole country, of course we’re going back to the streets and to the sea,” Sabino Ayarza, a representative of the fishing flotilla that halted First Quantum’s operations by blocking its main port, told Reuters.

“And we’re going with other thoughts. We are no longer going passively as before, but aggressively to close that.”

Reuters also spoke to six legal experts in Panama who said that while local laws could technically allow First Quantum’s prospects to change in a matter of months, a referendum or another type of consultation to ensure public support would be the only way to achieve that politically.

First Quantum said in February it was seeking $20 billion through international arbitration over Panama’s order to close the mine. The miner has filed for two arbitration proceedings, one under the Canada-Panama Free Trade Agreement, and another linked to the arbitration clause on the canceled contract. The clause provides for proceedings in Miami, according to the company.

Panama’s deputy finance minister told Reuters days after the announcement that the country is ready to defend its interests in the legal battle against First Quantum, adding the state will prove to courts it respects foreign investment.

Renzo Merino from Moody’s sovereign team said Panama’s economy was already doing well before the mine began to extract copper. “Panama hasn’t lost that. It still has the potential,” he said, while warning a recovery could be slow if investor concerns spread to other sectors and the country is forced to pay compensation in arbitration.

Presidential frontrunners

Mining has not been a big campaign issue.

Among the five frontrunners, Jose Raul Mulino, who is leading the latest polls, does not mention mining in his government plan and he has not attended any presidential debates.

Former President and candidate Martin Torrijos, who has been among the top three candidates in many polls, does not mention intentions for mining in his government plan, though he told Reuters at a campaign event that the closure of the mine is a decision Panamanians already took and he plans to follow.

Romulo Roux vowed in his plan to press ahead with closing the mine, but did not mention anything about the future of mining. He was not available for an interview but his running mate, Jose Blandon, told Reuters at an event that his team has no plans to overturn the mining ban.

Current vice president and presidential candidate Jose Gabriel Carrizo’s proposal for the country calls for a public vote for Panamanians to decide on the future of mining.

The campaigns of candidates Mulino, Roux, and Carrizo did not make them available for interview for this story.

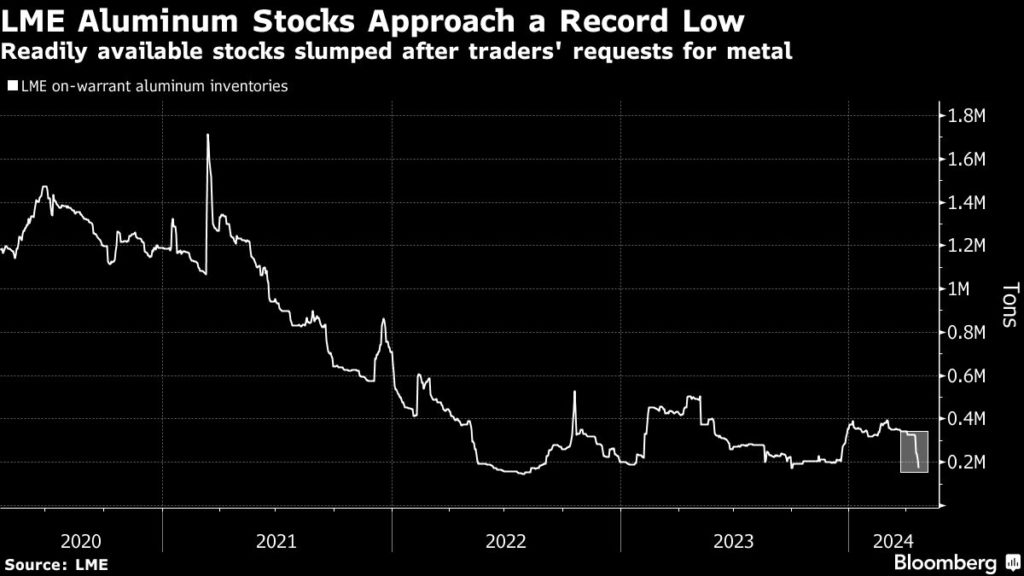

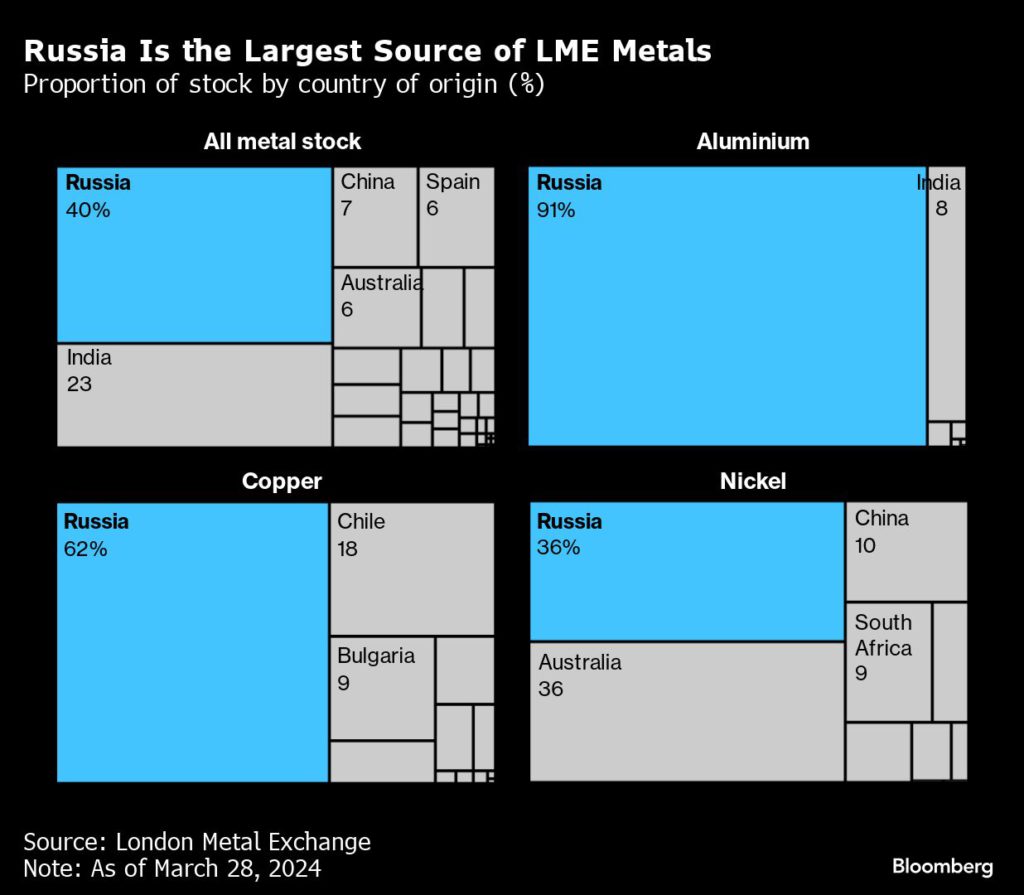

Panama’s ban on new metal mining concessions pushed up copper prices due to fears about supply. Any hint of a shift in Panama could again move markets.

Candidate Ricardo Lombana, who has been moving between second and fourth place in the latest polls, went further in his government plan by proposing to change the constitution to ban mining outright.

“No economic impact is above the constitutional mandate and the sovereign will. The whole country knows that the concession contract is illegal and that its closure must be consummated,” Lombana told Reuters.

(By Valentine Hilaire, Elida Moreno and Divya Rajagopal; Editing by Denny Thomas and Claudia Parsons)

Rio Tinto, Saudi Arabia vying for First Quantum mines stake

Bloomberg News | April 18, 2024 |

First Quantum’s 80%-owned Kansanshi mine in Zambia is Africa’s largest copper operation. (Image courtesy of Liam Richer | YouTube)

Rio Tinto Group and Saudi Arabia’s state-backed Manara Minerals Investment Co. are among suitors considering bids for a stake in First Quantum Minerals Ltd.’s Zambian copper mines, according to people familiar with the matter.

Japanese trading houses Mitsui & Co. and Sumitomo Corp. have also been studying the assets, the people said, asking not to be identified as the talks are private. First Quantum is open to selling as much as 30% in its mines in Zambia, depending on the offers it receives, and is seeking first-round bids in the coming weeks, they said.

The Sentinel and Kansanshi mines could also attract interest from Chinese companies such as Zijin Mining Group Co. and Jiangxi Copper Co., which is First Quantum’s second-biggest shareholder, the people said. The process is in the early stages and there’s no certainty the parties will proceed with bids.

Shares of First Quantum rose as much as 6.9% to C$15.80 in Toronto after Bloomberg reported interest in the Zambian mines stake.

Zambia accounted for about half of First Quantum’s copper output and revenue last year, and delivered more than $450 million in operating profit.

First Quantum is selling a stake in its Zambian assets after it was ordered to close its flagship copper mine in Panama last year following public protests. That left the company scrambling to refinance the debt it took on to build the mine. The firm sold about $1 billion in stock and raised $1.6 billion from a notes offering this year and has said it may look at divesting smaller mining assets.

A spokesperson for Sumitomo said that the company continues to explore opportunities to acquire stakes in copper operations, declining to comment on specific deals. Spokespeople for First Quantum, Rio, Mitsui and Jiangxi Copper declined to comment. Representatives for Manara and Zijin Mining couldn’t immediately be reached.

The copper mines are attracting interest from a range of investors because demand for the metal is expected to soar in coming years. Copper is crucial for the production of electric vehicles and renewable energy infrastructure, while there is a lack of new mines being built.

And there are also relatively few good assets to buy. Some of the mines available in the central African copper belt, which stretches through Zambia and the Democratic Republic of Congo, aren’t appealing to buyers, and major firms are unwilling to sell stakes in their most important developments.

That means companies that have previously avoided taking stakes in mines in Africa — such as Japanese trading houses — have started to become more open to the possibility.

Rio, the world’s second-largest mining company, is generally reluctant to be a non-operator and has also avoided the central Africa region. The company’s copper head said at a recent conference that he sees much more value in building mines rather than buying existing assets. Still, the company has some ties with First Quantum and sold it a majority stake in a development project in Peru last year.

For Saudi Arabia, the deal would be another major coup following its purchase of a stake in Vale SA’s base metals unit for $2.6 billion. The kingdom is looking to secure supplies of metals for its industrial ambitions as it attempts to diversify its economy away from oil.

(By Dinesh Nair, Vinicy Chan and Thomas Biesheuvel)