Staff Writer | April 21, 2024

Tailings pond. (Reference image by Ramjheetun Elodie, Flickr.)

Chemists at the US Department of Energy’s Oak Ridge National Laboratory demonstrated that aluminum hydroxide, a mineral that is abundant in the earth’s crust, can adsorb at least five times more lithium than can be collected using previously explored adsorbent materials.

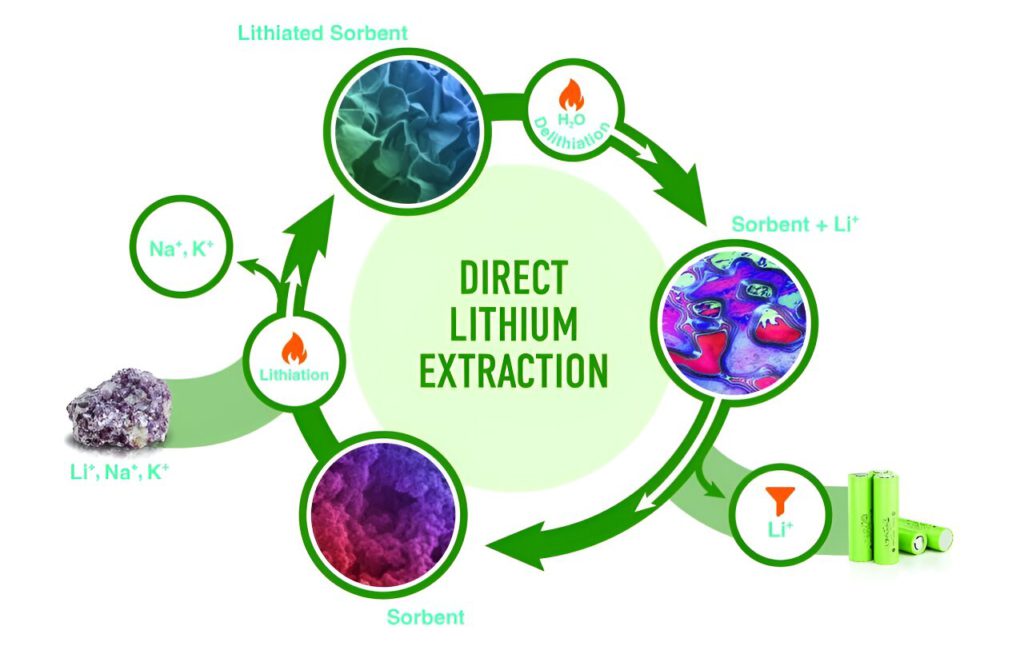

Using a newly developed process to extract lithium from waste liquids leached from mining sites, oil fields, and used batteries, the researchers proved that aluminum hydroxide can act as a sorbent of lithium sulphate and hold it.

“The key advantage is that it works in a wider pH range of 5 to 11 compared to other direct lithium extraction methods,” Parans Paranthaman, ORNL Corporate Fellow and co-author of the papers that present these findings, said in a media statement.

The patent-pending acid-free extraction process takes place at 140 degrees Celsius, compared to traditional methods that roast mined minerals at 250 degrees Celsius with acid or 800 to 1000 degrees Celsius without acid.

The technique works based on lithiation, during which an aluminum hydroxide powder extracts lithium ions from a solvent to form a stable layered double h

“This is the basis for a circular economy,” Paranthaman said.

Quick reactions

Aluminum hydroxide exists in four highly ordered crystalline polymorphs and one amorphous, or disordered, form.

Form turns out to play a big role in the sorbent’s function.

“Based on calorimetric measurements, we learned that amorphous aluminum hydroxide is the least stable form among aluminum hydroxides and thus is highly reactive,” Jayanthi Kumar, co-author of the research, said. “That was a key to this method resulting in greater lithium extraction capacity.”

Because amorphous aluminum hydroxide is the least stable among the mineral’s forms, it spontaneously reacts with lithium from brine leached from waste clays.

“Only when we did the measurements did we realize that the amorphous form is way, way, way less stable. That is why it is more reactive,” Kumar said. “To gain stability, it reacts very quickly compared to other forms.”

Two steps to recover lithium

Kumar is optimizing the process by which the sorbent selectively adsorbs lithium from liquids containing lithium, sodium and potassium and goes on to form LDH sulphate.

The researchers used scanning electron microscopy to characterize the morphology of aluminum hydroxide during lithiation. It is a charged neutral layer that contains atomic vacancies, or tiny holes. Lithium is absorbed at these sites. The size of these vacancies is the key to aluminum hydroxide’s selectivity for lithium, which is a positively charged ion, or cation.

“That vacant site is so small that it can fit only cations the size of lithium,” Kumar said. “Sodium and potassium are cations with larger radii. The bigger cations don’t fit into the vacant site. However, it’s a perfect match for lithium.”

The selectivity of amorphous aluminum hydroxide for lithium results in near-perfect efficiency. In a single step, the process captured 37 milligrams of lithium per gram of recoverable sorbent—approximately five times more than a crystalline form of aluminum hydroxide called gibbsite, which was previously employed for lithium extraction.

The first step of lithiation extracts 86% of the lithium in the leachate, or brine, from mining sites or oil fields. Running the leachate through the amorphous aluminum hydroxide sorbent a second time picks up the rest of the lithium. “In two steps, you can fully recover the lithium,” Paranthaman said.

Greener process

Venkat Roy and Fu Zhao at Purdue University analyzed the life cycle benefits of a circular economy from direct lithium extraction. They compared the ORNL process to a standard method using sodium carbonate. They found the ORNL technology used one-third of the material and one-third of the energy and subsequently generated fewer greenhouse gas emissions.

Next, the researchers want to extend the process to extract more lithium and regenerate the sorbent in a specific form. Now, when the amorphous aluminum hydroxide sorbent reacts with the lithium and is later treated with hot water to remove the lithium and regenerate the sorbent, the result is a structural change in the aluminum hydroxide polymorph from amorphous to a crystalline form called bayerite.

“The bayerite form is less reactive,” Kumar said. “It requires either more time—18 hours—or more concentrated lithium for it to react, as opposed to the amorphous form, which reacts within 3 hours to pick all the lithium from the leachate solution. We need to find a route to get back to the amorphous phase, which we know is highly reactive.”

The scientists believe that success in optimizing the new process for extraction speed and efficiency could be a game-changer for the domestic lithium supply. More than half of the world’s land-based lithium reserves are in places where the concentration of dissolved minerals is high, such as California’s Salton Sea or oil fields in Texas and Pennsylvania.

“Domestically, we don’t really have lithium manufacturing,” Paranthaman said. “Less than 2% of lithium for manufacturing is from North America. If we can use the new ORNL process, we have various lithium sources all over the United States. The sorbent is so good you can use it for any brines or even solutions from recycled lithium-ion batteries.”