America's Ammunition Production May Soon Be Controlled By A Foreign Buyer – Analysis

By James Durso

In October 2023, the Czechoslovak Group (CSG), of Prague, Czech Republic, entered into a definitive agreement to buy the ammunition brands of Vista Outdoor Inc. for $1.9 billion. Vista is an outdoor sports company that specializes in outdoor products, i.e., camp equipment, and shooting sports, i.e., ammunition.

The deal would give CSG control 70% of the manufacturing capacity for ammunition primers, ownership of ammunition brands Federal, Remington, Speer, CCI, Hevi-Shot, and Alliant Powder, and management of the U.S. Army’s Lake City Army Ammunition Plant. The transaction was criticized by U.S. Senators J.D. Vance and John Kennedy, Representatives Mike Waltz and Clay Higgins, and the National Sheriffs Association. (CSG currently has a 70% stake in Italian munition maker Fiocchi Munizioni which is widely available in the U.S.)

In February, U.S.-based MNC Capital Partners and a private equity partner made their first offer to buy Vista for $35.00 per share in cash for both the outdoor products and ammunition pieces. The offer was rejected by the Vista board in March.)

The senators claim the deal will put a foreign company that has ties to Russia and China in control of primer production, and at the helm of the Lake City Army Ammunition Plant, a government-owned, contractor-operated producer of small arms ammunition for the U.S. government and civilian buyers.

The acquisition must be approved by the Committee on Foreign Investment in the United States (CFIUS) and Senator Kennedy asked Janet Yellen, the Secretary of the Treasury to ensure that CFIUS will “carefully examine national security concerns of the proposed acquisition.”

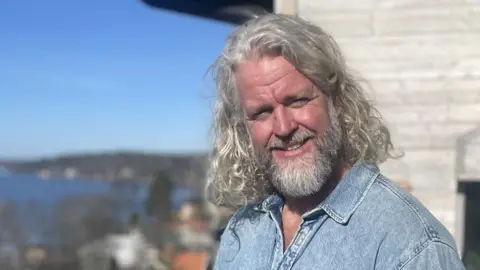

In response to the legislators, Michal Strnad the CEO of CSG, claimed CSG was a significant supplier to NATO countries, “has never had any ties to Putin’s regime,” only ever exported civilian products to Russia, never broke any embargoes, and has never been sanctioned. Strnad then invited Senator Vance to “visit SG member companies in the U.S. and Europe to experience first-hand who we really are.”

CSG’s American ammunition division CEO David Stepan announced that CSG had “publicly stated our pledge to maintain Vista’s manufacturing operations in the United States, led by the same topflight American management team that runs its operation today.”

“We have no plans,” Stepan added, “to move any employment or production overseas.”

On the other hand, Czech media reports a CSG subsidiary supplied surveillance radars to a Chinese airfield, and, when Michal Strnad’s father, Jaroslav, ran Excalibur Army, a CSG predecessor, the company breached an arms embargo on Azerbaijan, according to Forbes, so CFIUS and its security service partners have some digging to do.

Assuming everyone is being high-minded here, what are next steps?

First, CRIUS must decide on CSG’s fitness as a buyer of Vista, which will mean plumbing the senators’ concerns about Russia and China connections.

The Pentagon has a vote in CFIUS and it has recently revived concerns about lack of competition in the defense sector. In a 2022 report, “State of Competition within the Defense Industrial Base,” the Pentagon identified munitions are one of five “Priority Industrial Base Sectors” and declared “Each M&A [mergers and acquisitions] case should be reviewed carefully for negative effects on competition.”

The Pentagon also reviewed the surety of its supply chains and in another recent report, “Securing Defense-Critical Supply Chains,” the department recommended action to “Mitigate Foreign Ownership, Control, or Influence (FOCI).” Looking at potential conflicts in Europe and Asia, and the ongoing resupply of Israel and Ukraine, the Defense Department may want to ensure as much ammunition production as possible is controlled by American entities.

Then, the shareholders of Vista will vote and, as many of the shareholders, such as Blackrock, are playing with someone else’s money, they won’t rush if they can get a better, all-cash offer that is likely to be approved by the feds. In any case, Vista management understands its duty and told MNC it must improve its revised offer of $37.50 a share in cash for the ammunition and outdoor products brands.

According to Reuters, “While CSG’s proposal pays off Vista’s debt, gives shareholders $750 million in cash, and leaves perhaps $150 million for a special dividend, according to Roth analysts, that only totals up to about $15.50 per share, and investors are left owning a sub-scale outdoor business. MNC’s offer gets them $37.50 per share, cash, and a way out.”

What are some options?

CFIUS can green-light the CSG offer with no conditions, or the U.S. may allow the acquisition to proceed if CSG divests itself of enough of its new holdings that satisfies the government that marketplace competition is preserved. Or, the U.S. may require naming a proxy board to head the new companies, or a Special Security Arrangement to ensure U.S. interests in the Lake City plant are safeguarded.

The U.S. has no beef with foreign buyers. In 2021, Colt’s Manufacturing Company of Hartford, Connecticut, the maker of the military’s M-16 and M-4 rifles, was bought by Prague-based Česká zbrojovka Group (CZ). FN Firearms USA, a supplier to the Pentagon, is owned by Belgian FN Herstal SA. And PMC Ammunition Inc., a supplier to many police agencies, is owned by Korea’s Poongsan Corporation. This deal is foundering on elevated Pentagon and congressional concerns about competition and supply chain integrity, and ongoing resupply commitments to foreign partners.

What is the best deal for the U.S.?

The best deal for the U.S. is a higher offer from MNC so Vista’s American shareholders get more cash, and an invitation to GSG to invest that $1.9 billion in greenfield ammunition plants in the U.S. which, as new facilities, will compete with existing manufacturers and ensure government and private buyers in the U.S. get the best deal. Also investing in the U.S. may turn CSG’s challengers on the Hill into champions if the firm can create jobs in the U.S. while contributing to the robustness of America’s defense industrial base.

- This article was published at Real Clear World

James Durso (@james_durso) is a regular commentator on foreign policy and national security matters. Mr. Durso served in the U.S. Navy for 20 years and has worked in Kuwait, Saudi Arabia, Iraq, and Central Asia.