[By Dirk Siebels]

The importance of maritime trade is often highlighted to justify naval spending and operations. When commercial traffic in the Red Sea started to be impacted by Houthi attacks, countless statements were subsequently issued that included the percentage of world trade or specific types of cargo that are normally moved through this area. Maritime trade did not come to a standstill despite the threat. Ships were – and still are – re-routed around Africa to avoid Red Sea passages. While a longer route is more expensive, it is important to consider that maritime transport in general is extremely efficient – and therefore cheap. Freight rates have accordingly stabilized as shipping companies settled into a ‘new normal.’

Operations of international naval forces in the Red Sea and the Gulf of Aden have been hampered by various shortcomings. On the tactical and operational level, problems have included ammunition shortages, a lack of coordination between allied nations, as well as deficient equipment. Despite the negative headlines, naval forces can also point to large numbers of intercepted missiles and drones, as well as dozens of escorts of merchant ships.

Launching a multinational operation with little time for preparation and planning to counter an unprecedented threat is no small feat. It would be unreasonable to expect neither mistakes nor problems. At the same time, it is questionable at best whether the current naval operations can become a success on the strategic level. So far, military interventions responding to Houthi attacks have been characterized by complicated coordination on the political level, virtually non-existent broader engagement with Houthi leaders, as well as a lack of clearly identified – and achievable – aims. Moreover, cooperation between naval forces and commercial shipping is limited and often confusing in execution. This aspect is particularly problematic, considering that naval operations were launched as a direct response to Houthi attacks against merchant vessels.

One important question is whether military operations have had an impact on merchant shipping through the Red Sea and what the outlook now is. Finding answers requires a detailed look at figures for maritime traffic.

Maritime Traffic Patterns

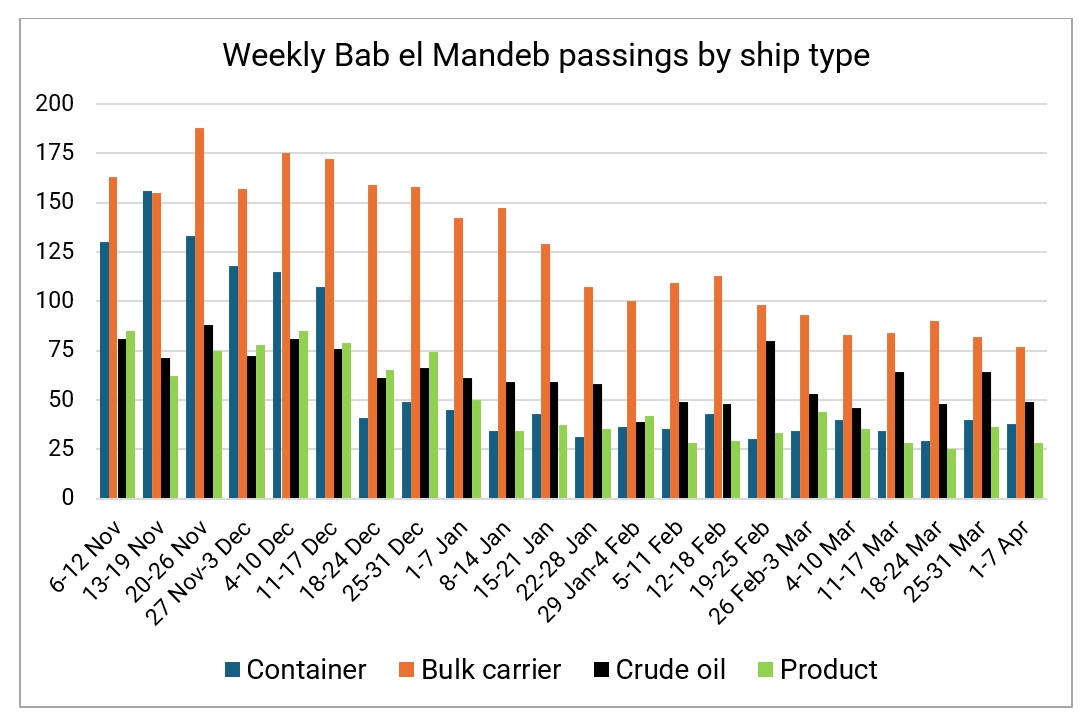

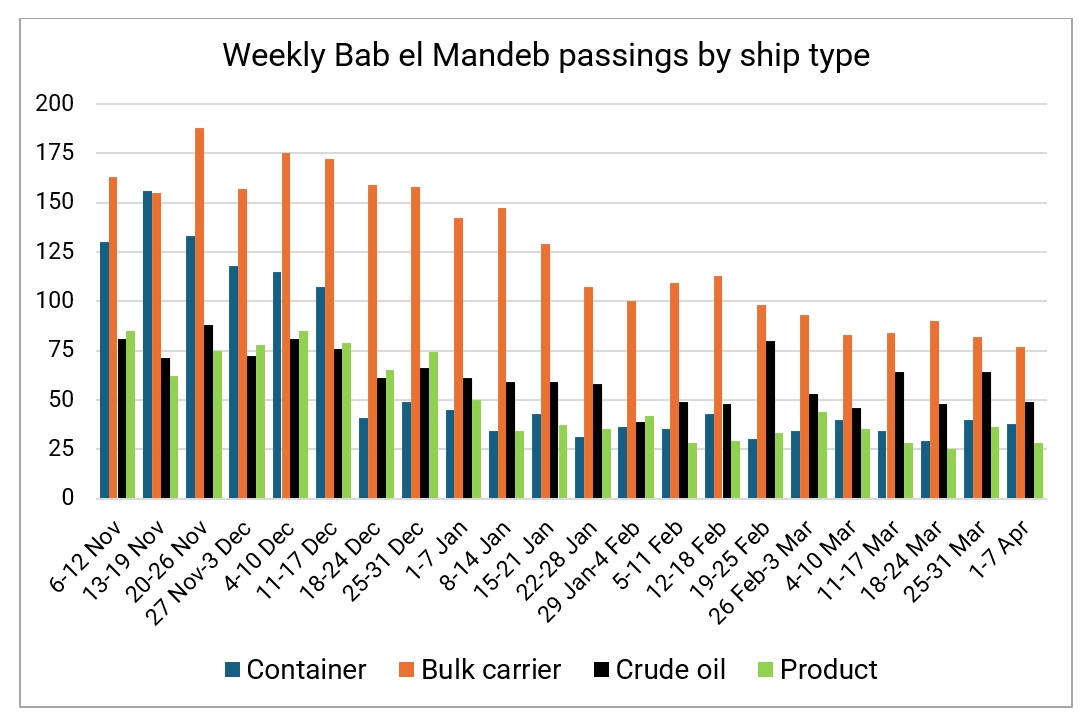

The number of merchant ship transits through the Bab el Mandeb has declined considerably due to Houthi attacks. By mid-December, many container lines declared that most or all of their ships would be re-routed around the Cape of Good Hope. Figure 1 shows that the announcement was followed by an immediate drop in container ships passing the Bab el Mandeb. While that does not mean that all container traffic in the Red Sea and the Gulf of Aden has stopped, most vessels which are still transiting the Bab el Mandeb are relatively small and mostly trading within the region.

Figure 1: Weekly Bab el Mandeb passings by ship type, including merchant vessels >10,000 dwt. (Author graphic, based on data from Lloyd’s List Intelligence/Seasearcher)

Figure 1: Weekly Bab el Mandeb passings by ship type, including merchant vessels >10,000 dwt. (Author graphic, based on data from Lloyd’s List Intelligence/Seasearcher)

The decline for other ship types has been more gradual, likely due to the fact that the container market is heavily concentrated. In this sector of the shipping industry, the five largest companies control almost two-thirds of the entire market. In other sectors, notably in the bulk carrier and tanker markets, concentration is much less significant. Many companies of all sizes therefore have to consider the risk levels to their vessels before deciding whether or not to transit through the Red Sea.

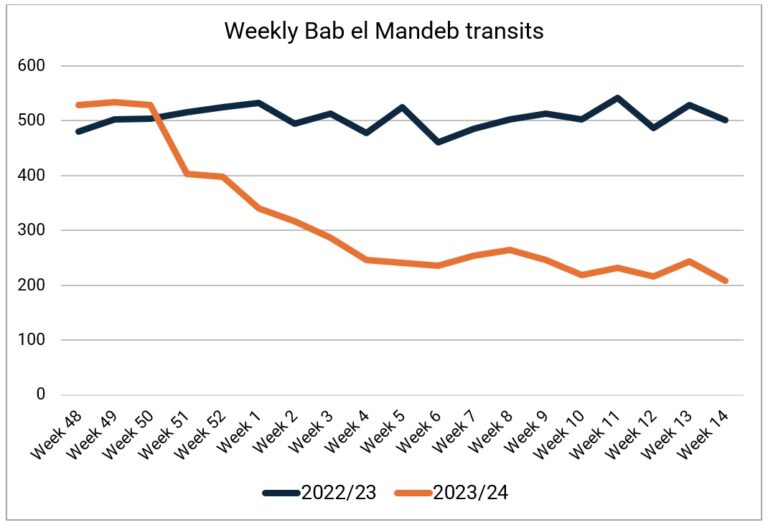

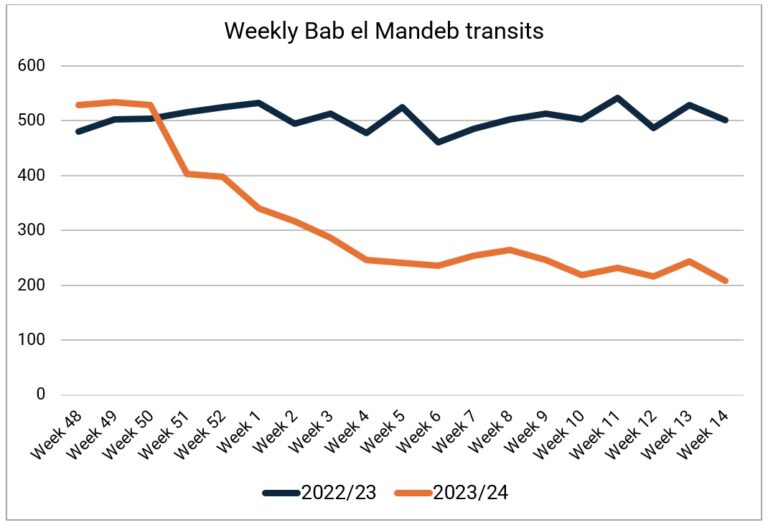

So far, military operations have not led to a recovery in maritime traffic levels. Instead, traffic figures have been relatively stable since mid-January at between 40 to 50 percent of Bab el Mandeb transits compared to the same period during the previous year (Figure 2).

Figure 2: Weekly Bab el Mandeb transits by merchant ships >10,000 dwt. (Author graphic, based on data from Lloyd’s List Intelligence/Seasearcher)

The fact that there have been very little changes to current traffic levels between January and April highlights how operators of commercial vessels remain hesitant about a full return to the Red Sea. Whether that is due to the current level of military operations or the apparent lack of additional efforts to negotiate with Houthi leaders is open for debate.

In this context, it is interesting that the EU-led Operation Aspides has been hailed as a major success. On April 8, EU representatives stated that 68 merchant vessels had been escorted since the beginning of the operation. However, that amounts to less than two ships per day, compared with the 30 to 40 ships transiting the Bab el Mandeb per day even at the current level of traffic. No similar statistics have been provided for Operation Prosperity Guardian, but the numbers are very unlikely to be significantly higher.

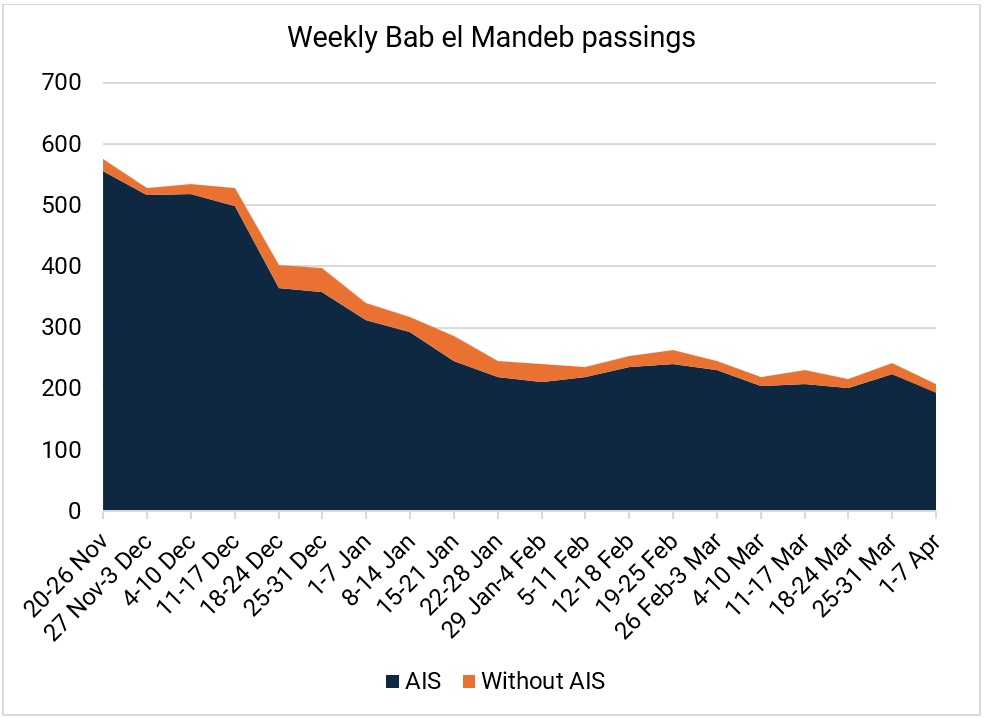

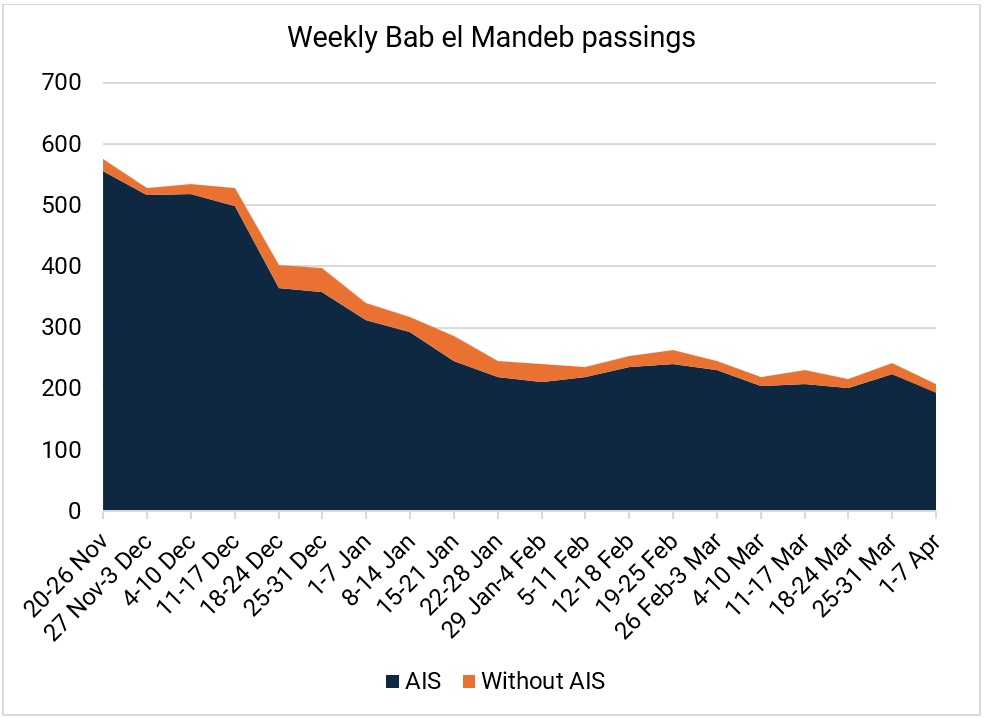

Moreover, naval forces have recommended that ship operators should consider Red Sea transits with AIS switched off. EU naval forces have tried to underline this recommendation with an alarming statistic: “Around 80% of vessels that have been hit had AIS .”

Whether this is really useful advice is at least questionable. Despite naval recommendations to the contrary, more than 90 percent of merchant ships are transiting the Bab el Mandeb with AIS switched on. The situation has not changed significantly over time either, shown in Figure 3.

Figure 3: Bab el Mandeb passings by merchant ships >10,000 dwt with and without AIS. (Author graphic, based on data from Lloyd’s List Intelligence/Seasearcher)

Political Considerations

In combination with the broader regional context, political decision-makers are left with a complicated dilemma. Should there be a military response against the Houthi attacks? Should military operations be purely defensive? Would strikes against Houthi targets lead to another escalation in the Middle East?

There is still no definitive agreement about the answers to these and related questions. The U.S. government launched Operation Prosperity Guardian already in December with a defensive mandate. Despite its multinational character, countries like Egypt or Saudi Arabia were unwilling to contribute. Several European countries also decided against participating in the U.S.-led operation and ultimately agreed on the EU-led Operation Aspides, launched in February with a stricter defensive focus. Meanwhile, U.S. forces launched military strikes against Houthi forces. In some cases, these were supported by other nations, yet offensive actions are part of a separate operation (Poseidon Archer). This separation is purely political as offensive actions are not supported by all countries participating in Prosperity Guardian.

Houthi attacks are a challenge to freedom of navigation. The actual extent of this challenge, however, is open for debate. Since the beginning of the Houthi campaign in November, the U.S. and several other governments have frequently stated that the attacks against merchant ships have been “indiscriminate.” Houthi forces have publicly stated their targeting parameters and initially wanted to target ships which are directly owned by Israeli companies. Such vessels quickly stopped Red Sea transits, leading the Houthis in early December to expand their potential targets to ships trading with Israel. Military strikes by American and British forces in January then led to another expansion of the potential targets to merchant ships owned by U.S. and UK companies. Some attacks were very likely carried out based on outdated commercial information about individual ships. Overall, this has resulted in a situation where the threat level for merchant vessels is closely linked to individual characteristics while all ship operators have to take the potential for collateral damage into account.

It should be noted that the reassuring presence of warships must be better coordinated. With MSCHOA and UKMTO, there are two reporting centers responsible for broadly the same region. Neither center has a full picture which includes all attacks or attempted attacks by Houthi forces since November. In addition, neither center even acknowledges the presence of another reporting center in their frequent updates to the shipping industry. The question of cooperation between MSCHOA and UKMTO has been a more or less theoretical question for many years. In the current situation, it deserves concrete resolution.

Conclusion

Naval missions to counter the threat posed by Houthi attacks may be worthwhile operations, particularly from the perspective of seafarers who rarely have a choice whether they want to transit the Red Sea. However, many of the military operations so far have been tactically focused on day-to-day operations, and much less focused on affecting the longer-term outlook. The number of ships which have been escorted has been highlighted as a success, yet many of these ships arguably would have transited anyway. More importantly, Houthi forces have firmly established the threat of drone and missile attacks, and shipping traffic is still about half of what it was before the Houthis began their attacks.

It is very likely that a longer-term mission would be necessary to meaningfully reduce the threat posed by the Houthis. But would it be possible to verify that the threat for merchant ships has been reduced enough – and how much of a reduction is enough to begin with?

Navies have been able to show their capabilities in an operational context and identify valuable lessons learned. Success on the tactical level, however, is very different from the strategic level which would include a return to normal levels of commercial traffic in the Red Sea. As it stands, it is impossible to predict when a sustainable increase in maritime traffic will take place. Such an increase, however, will very likely be based on commercial considerations rather than on the presence of warships. Frigates and destroyers may be reassuring to seafarers, yet they are unable to intercept every incoming missile or drone. More importantly, the current level of naval operations is not sustainable in the long term. Other solutions to address the threat are needed.

Dr. Dirk Siebels is a Senior Analyst for Risk Intelligence, a Denmark-based security intelligence company. The views expressed here are presented in a personal capacity.

This article appears courtesy of CIMSEC and may be found in its original form here.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

Figure 1: Weekly Bab el Mandeb passings by ship type, including merchant vessels >10,000 dwt. (Author graphic, based on data from Lloyd’s List Intelligence/Seasearcher)

Figure 1: Weekly Bab el Mandeb passings by ship type, including merchant vessels >10,000 dwt. (Author graphic, based on data from Lloyd’s List Intelligence/Seasearcher)

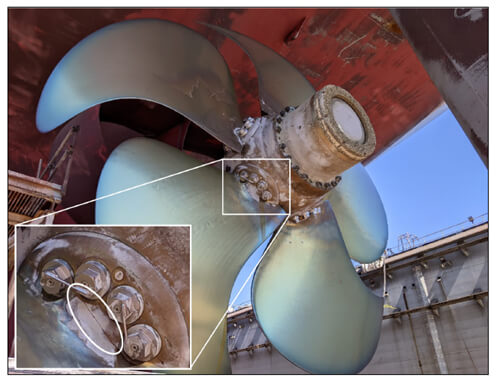

Courtesy SSU

Courtesy SSU