WWIII

Dutch Navy Accuses Chinese Jets of "Unsafe" Close Approach

Chinese fighters made an "unsafe" close approach to the Dutch frigate Zr.Ms. Tromp off the coast of China last week, according to the Netherlands' ministry of defense.

The Tromp was deployed to the East China Sea to join in the international monitoring mission for enforcement of UN sanctions on North Korea. While the Tromp was under way in international waters, two Chinese fighters made a close approach to the frigate. "This created a potentially unsafe situation," the ministry warned.

After this incident, the Tromp's helicopter was approached by a Chinese helicopter and two fighter jets.

The encounter concluded without mishap and Tromp continued onwards to her journey, headed for Japan. She will be crossing the Pacific to join in the U.S. Navy's RIMPAC 2024 exercise off Hawaii, which begins June 26 and runs until early August.

A Chinese helicopter also approached a Dutch naval helicopter (Dutch Ministry of Defense)

The run-in was the latest in a long series of tense interactions between the Chinese military and the Western warships tasked with enforcing UN sanctions on North Korea. Though it is a signatory to the sanctions measures, China is widely believed to allow banned maritime trade with Pyongyang.

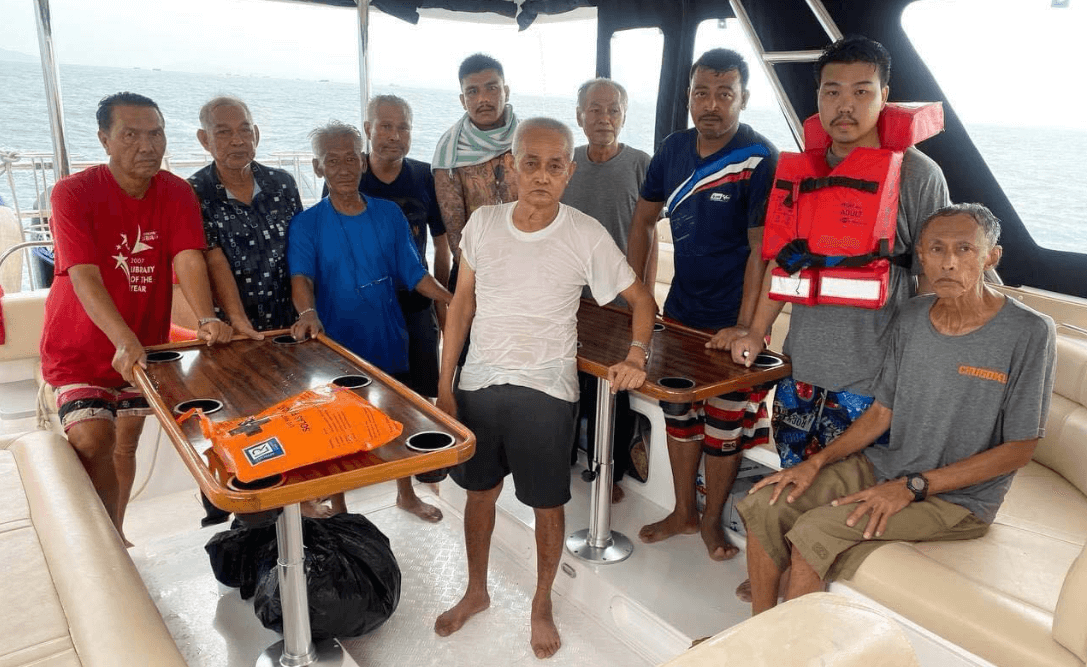

Tensions between China and Western-allied neighbors are also running high. Last week, the Philippines accused Chinese forces of stealing a food drop near the Philippine base at Second Thomas Shoal. The China Coast Guard intercepted one out of the four parcels that were parachute-dropped to the outpost during an airborne supply run in mid-May. During that altercation, the China Coast Guard boats moved to within five meters of the base, prompting Philippine marines to draw firearms as a precautionary measure. China routinely blockades the outpost using its coast guard and maritime militia vessels, often with aggressive and hazardous tactics.

The Armed Forces of the Philippines has also accused the China Coast Guard of attempting to forcibly block a medical evacuation at Second Thomas Shoal last month. Philippine Coast Guard spokesman Cmdre. Jay Tarriela said that Chinese vessels intentionally rammed a rigid hull inflatable and made multiple attempts to cut off the medevac vessels.

Image courtesy National Committee on Maritime Security

Image courtesy National Committee on Maritime Security