World Trade Month recognizes the importance of international trade each May. It highlights how trade between countries creates jobs, opens new business opportunities, and strengthens the global economy. The United States has been celebrating it since 1938, and many events and programs are held throughout the month to promote its significance.

World Trade Month wouldn't be complete without acknowledging the agricultural sector's critical role. Here's how agriculture contributes significantly to global commerce:

- Food Security: International trade allows countries to import the food they don't produce enough of, ensuring a wider variety and stable supply for consumers worldwide.

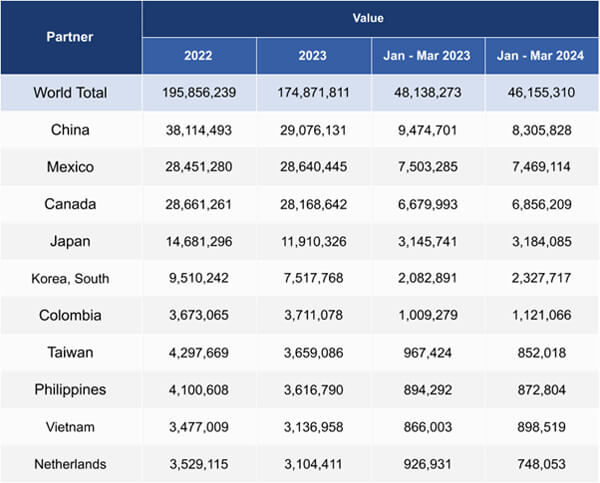

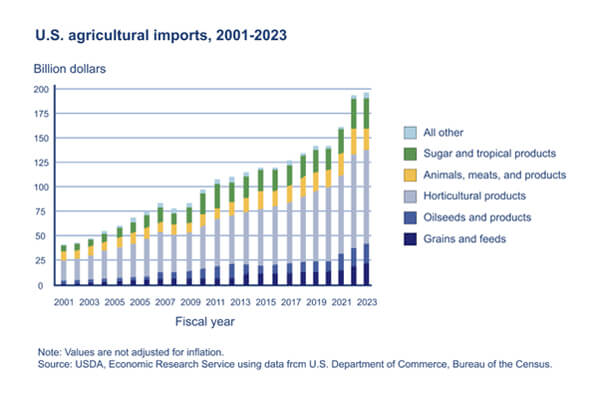

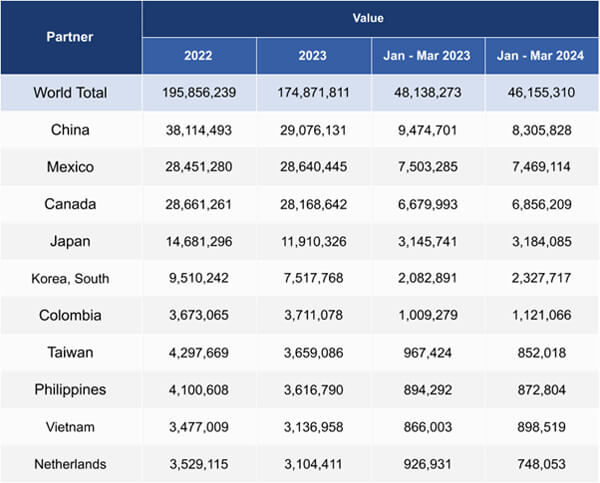

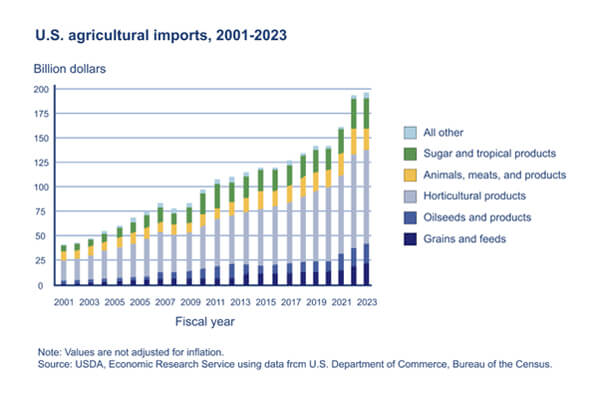

US agricultural imports

- Economic Growth: Agricultural exports are a major source of income for many countries, boosting their economies and contributing to global trade value.

- Efficiency and Innovation: Trade fosters competition, encouraging innovation and efficiency in agricultural practices to stay competitive in the global market.

While vital, agricultural trade faces hurdles. Regulations and tariffs can make exporting agricultural products expensive and complex. Countries worldwide tend to impose higher tariffs on agricultural products than non-agricultural goods. Studies show this happens in over 90 percent of countries.

Trends, Growth Areas, and Challenges for Agricultural Trade

Recent trends in agricultural trade paint a complex picture with both growth and challenges.

Growth Trends

Despite a projected slowdown, global agricultural trade continues to expand, with a significant rise in volume and value compared to overall world trade. The total value of agricultural production worldwide is expected to reach US$3.9 trillion in 2024. According to Statista, this number is projected to grow at an average annual rate of 5.66% over the next four years, reaching US$4.86 trillion by 2028.

Emerging Markets and Growth Areas

Demand for products like fruits, vegetables, and meat is rising, particularly in developing countries with growing middle classes. Consequently, these countries are projected to account for 92% of the global increase in meat imports, 92% of the increase in grain and oilseed imports, and nearly all the rise in world cotton imports (Developing Countries Dominate World Demand for Agricultural Products, Ronald Trostle and Ralph Seeley).

Challenges

Geopolitical disputes can lead to trade wars and tariffs, disrupting established trade flows and raising food prices. Caldara and Iacoviello in their work “Measuring geopolitical risk” identify several ways geopolitical risks disrupt agricultural exports. These risks can lead to:

- Higher export costs. The cost of shipping agricultural goods can increase due to factors like disruptions in transportation routes or higher fuel prices.

- Increased security spending. Exporters may need to invest more in security measures to protect their products during transport, especially in high-risk regions.

- Reduced insurance coverage. Insurance companies may be less willing to cover shipments in areas with heightened geopolitical tensions, making it more expensive or impossible for exporters to obtain adequate coverage.

Opportunities for Agricultural Trade

The current economic climate presents both challenges and opportunities for agricultural trade.

Technological Advancements in Agriculture

The global agricultural sector is experiencing a surge in demand for advanced equipment. Maryana Serafinas – CEO of Atlantic Project Cargo highlighted three main factors:

- Feeding a world population projected to reach 9.1 billion by 2050 necessitates significant increases in food production.

- As incomes rise in developing countries, the demand for meat, dairy, and processed foods increases, putting pressure on agricultural output.

- In many regions, the agricultural industry faces a shrinking workforce. Precision agriculture equipment helps address this by automating tasks and improving efficiency.

This rising demand translates into a need for efficient and reliable transportation of agricultural equipment. Atlantic Project Cargo handles large and complex agricultural machinery, including tractors, combines, planters, and sophisticated harvester attachments. Additionally, Atlantic Project Cargo's global network allows them to facilitate the transport of this equipment from manufacturers to farms worldwide.

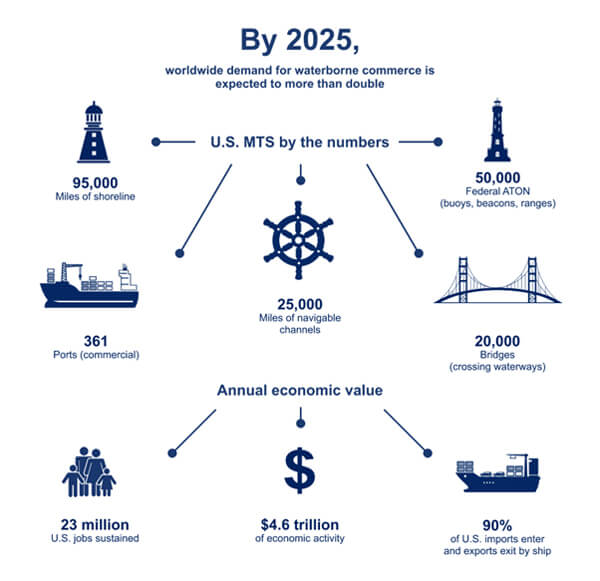

How Shipping and Logistics Drive American Prosperity

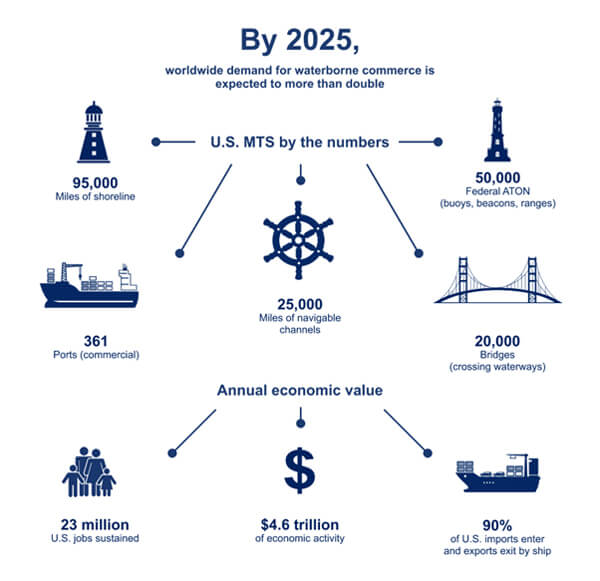

USCG MARITIME COMMERCE'S STRATEGIC OUTLOOK

The United States prospers from global trade, and behind every imported good and exported product lies a complex web of shipping and logistics. These services ensure the smooth flow of goods across vast distances, playing a vital role in the US economy, especially in the agricultural sector.

Why Shipping and Logistics Matter for US Agriculture

The agricultural sector is a major contributor to the US economy, and efficient shipping and logistics are crucial for its success:

US farmers can export their products to a wider audience, increasing their income and fostering economic growth. Countries like China and Japan rely heavily on US agricultural imports. According to data from fiscal year 2023, the top five export destinations for US agricultural products accounted for a substantial 64% of the total value of US agricultural exports. China ranked as the leading importer, with a value of $33.7 billion in US agricultural goods. Mexico and Canada followed closely behind, importing $28.2 billion and $27.9 billion worth of US agricultural products, respectively. (Economic Research Service, U.S. DEPARTMENT OF AGRICULTURE)

Efficient logistics reduce costs and delivery times, giving US agricultural products a competitive edge in the global market. Fresh produce can reach distant markets while still maintaining quality.

The US imports certain food products it doesn't produce enough of. Efficient logistics ensure a wider variety and stable supply of food for American consumers.

Conclusion

World Trade Month serves as a timely reminder of the critical role agriculture plays in international commerce. From ensuring global food security to fostering economic growth, agricultural trade is a complex and dynamic system.

Companies like Atlantic Project Cargo play a crucial role in this ecosystem by facilitating the movement of oversized and specialized agricultural equipment. Their expertise in customized solutions, navigating regulations, and utilizing alternative transport methods ensures this vital equipment reaches farms around the world.

This article is sponsored by Atlantic Project Cargo. Visit them online at www.atlanticprojectcargo.com

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.