Reuters | June 20, 2024

Lynas’ C & L plant in Malaysia. Credit: Lynas Rare Earths Ltd.

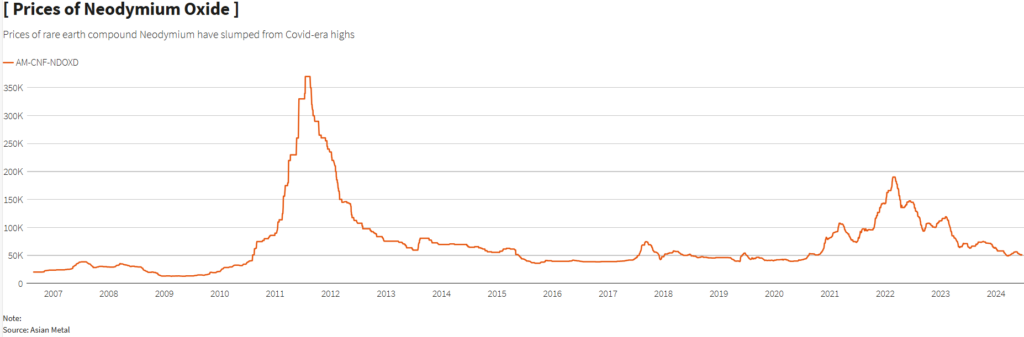

Lynas Rare Earths, the world’s largest producer outside of China, said on Thursday that demand for responsibly produced rare earths was increasing but had not resulted in higher prices.

Rare earths are a group of 17 metals, some of which are used in permanent magnets for applications including motors for wind turbines, electric vehicles and drones. Western nations are building a supply chain separate to dominant producer China, but some have been struggling to find funding due to low prices.

Key quotes

“Governments are starting to take action on supply chain resilience and customer demand for responsibly produced rare earths is increasing but it’s not translating to price,” Lynas CEO Amanda Lacaze said at a rare earths conference in Tokyo.

“Demand growth has not been matched by price growth,” she said. “The idea that we will suddenly have a functioning market is I think unlikely.”

Why it’s important

Some miners of metals needed for the energy transition are calling for a green premium to be applied to responsibly produced metals, however others increasingly say that consumers are interested in the product, but not with a premium attached.

China also supplies most of the world’s rare earth magnets and supply from the country has grown, weighing on prices.

Context

Nickel miner Wyloo Metals, owned by Australian mining magnate Andrew Forrest, said in March that if the London Metal Exchange (LME) wouldn’t launch a green nickel contract, the industry would have to look for another trading venue.

The London Metal Exchange (LME) does not plan to launch a separate “green” nickel contract because the market is not large enough, but said its partner was developing an index price that will reflect demand for low carbon nickel.

Lithium miners have been publishing prices they have agreed for supply amid a push to increase price transparency.

Indonesia’s Nickel Industries says that consumers don’t want to pay a green premium, but rather want its nickel at a discount.

(By Melanie Burton and Yuka Obayashi; Editing by Stephen Coates)

Spitbank Fort, with Portsmouth in the background (Clarenco)

Spitbank Fort, with Portsmouth in the background (Clarenco)