Big Tech's Got a Conflict Minerals Problem

- Big Tech companies like Amazon, Apple, Google, Meta, and Microsoft are potentially sourcing minerals from conflict-affected regions in Africa.

- Despite regulations like the Dodd-Frank Act in the US and similar EU legislation, these companies struggle to fully trace the origins of the minerals used in their products.

- Companies often cite the potential economic harm to local communities as a reason for continuing operations in conflict-affected and high-risk areas.

According to its conflict minerals report (CMR) for 2023, Amazon cannot rule out having sourced minerals from nine of ten African countries where human rights-violating militias finance themselves through mining.

These countries are the Democratic Republic of the Congo, the Republic of the Congo, the Central African Republic, South Sudan, Uganda, Rwanda, Burundi, Tanzania, Zambia and Angola.

But, as Statista's Florian Zandt shows in the chart below, the other four members of GAMAM, a group synonymous with the moniker Big Tech, also potentially source some of the raw materials processed in contracted smelters from these regions.

You will find more infographics at Statista

Both Apple and Google’s parent company Alphabet reported that smelters integrated into their supply chains potentially processed minerals from six of the ten countries on the African continent mentioned above. Meta lists five of these countries in its report, while Microsoft claims to have reason to believe that minerals from two of the ten countries listed might end up in their products. However, the country list provided by Alphabet was last updated in 2021 and has been absent from their annual CMR since 2022. Additionally, Microsoft doesn't clarify if the countries listed in its report are merely those where smelters are located or if they are the source countries for potential conflict materials.

Contractors working for GAMAM companies are also active in extracting and processing raw materials in countries defined as CAHRAs, short for Conflict-Affected and High-Risk Areas. The extended CAHRA definition, which includes the extraction of minerals as well as other conflict resources, encompasses specific regions in Afghanistan, Mexico, Myanmar, and Yemen, among others.

According to Microsoft’s conflict minerals report, the company relies on "responsible sourcing" rather than restricting or avoiding the usage of the conflict minerals tantalum, tin, tungsten, and gold, known as 3TG, from these regions. Stopping operations in Covered Countries and CAHRAs would allegedly cause significant economic harm to the affected countries.

U.S. importers of raw materials have been required to disclose their sources for potential conflict minerals under the Dodd-Frank Act since 2010. A similar regulation has been in effect in the European Union since January 1, 2021, aimed at curbing the financing of violent militias, particularly in the Democratic Republic of Congo and surrounding countries, where said groups control the mining of tin and coltan. In the 1990s, the term "blood diamonds" gained significant attention in this context, referring to gemstones mined in Sierra Leone and Angola and sold by rebel groups to finance their operations.

By Zerohedge.com

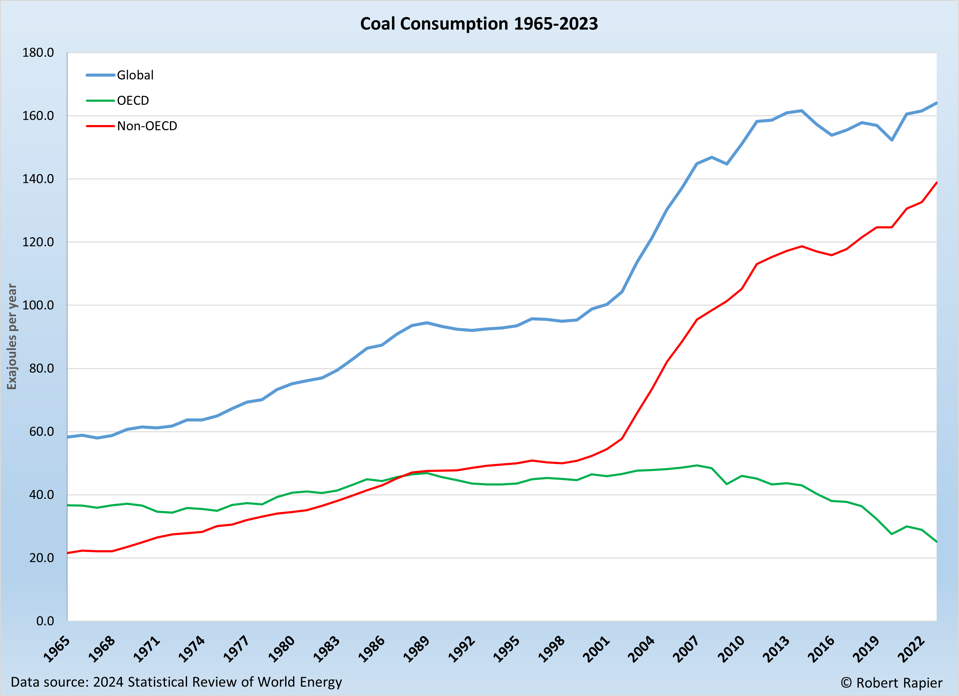

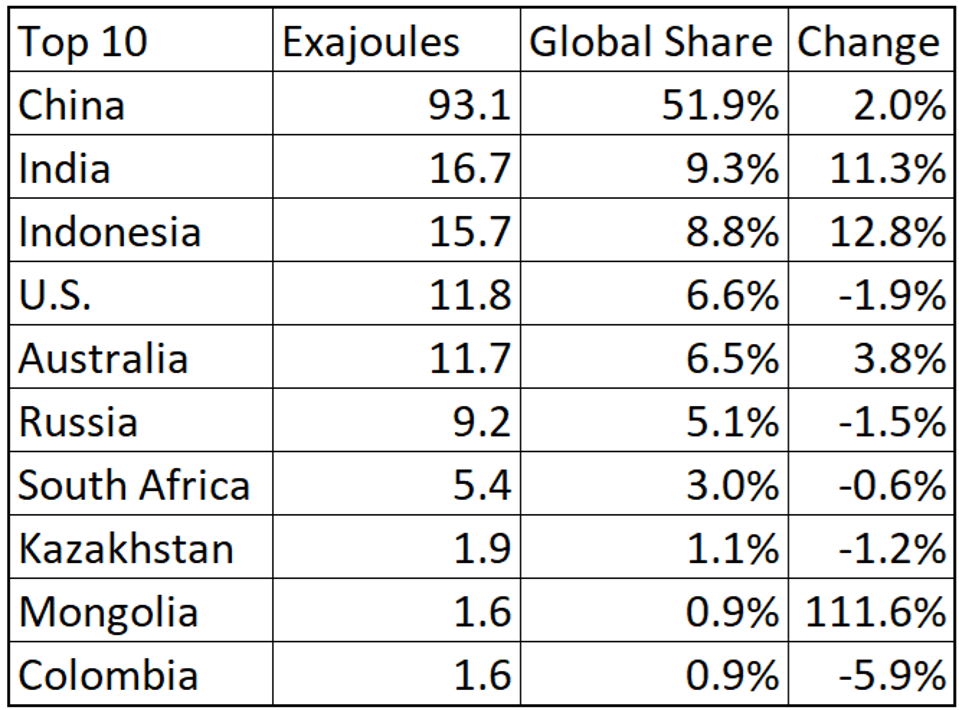

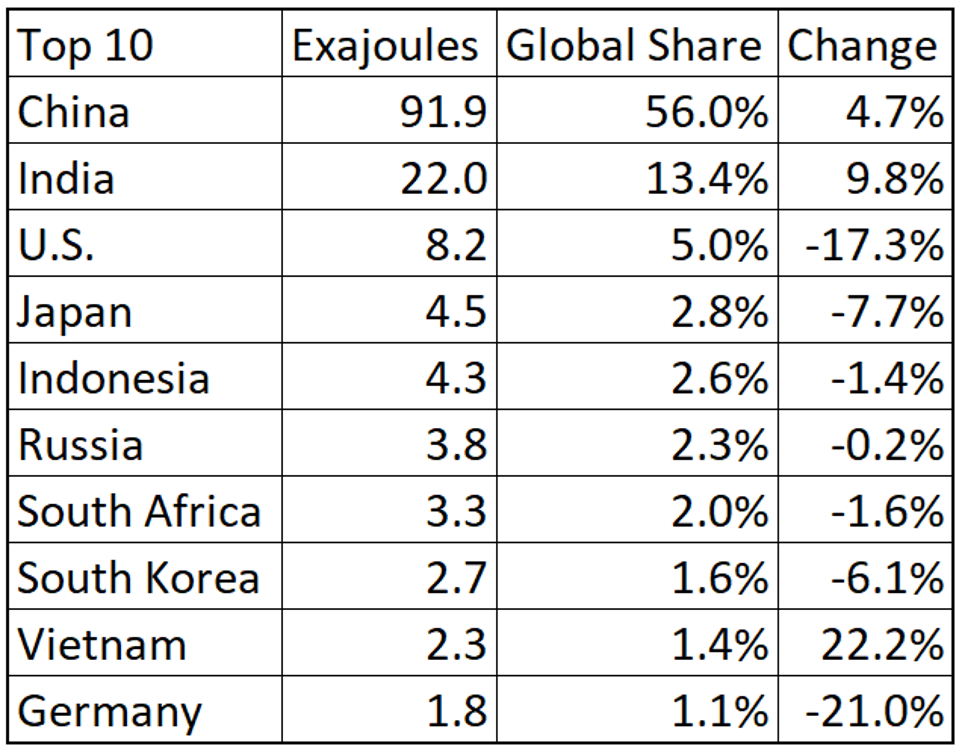

Is China’s Dominance in Critical Minerals Production Fading?

- China currently accounts for two-thirds of the world's critical minerals processing capacity, but its dominance is waning.

- The demand for critical minerals like cobalt, graphite, and lithium is expected to increase six-fold by 2050 due to the adoption of green technologies.

- Countries like the United States, Australia, Myanmar, and Thailand are emerging as significant players in critical minerals production, challenging China's monopoly.

Demand for critical minerals such as copper, cobalt, lithium and nickel is soaring. These raw materials are used in a range of new technologies, from electric cars to wind turbines, which are becoming ever more important as the world moves towards a green transition. Experts forecast that this trend is set to accelerate, with global production of cobalt, graphite, and lithium set to increase nearly six-fold between now and 2050 (World Bank).

As Statista's Anna Fleck shows in the chart below, data recently published by the United Nations Conference on Trade and Development (UNCTAD) shows that China accounts for around two-thirds of the world's processing/refining capacity for critical minerals.

You will find more infographics at Statista

While the extraction of these materials takes place all around the globe, China currently accounts for more than half of the world's refining of aluminum, lithium and cobalt, around 90 percent of that of rare earth metals and manganese and 100 percent of that of natural graphite. In addition, more than a third of the world's copper and nickel processing is carried out in China.

While China is in the lead for critical minerals production, the nation is losing its dominance. For example, the United States and Australia have increased their production of rare earths from 2010 onwards and most recently, Myanmar and Thailand have started to mine far more than before.

By Zerohedge.com

.jpg?ext=.jpg) The Nuclear Frontier bus arrived in Knoxville, Tennessee on 30 July (Image: The Nuclear Company/X)

The Nuclear Frontier bus arrived in Knoxville, Tennessee on 30 July (Image: The Nuclear Company/X)