Galit Altstein

Mon, 26 Aug 2024,

(Bloomberg) -- With domestic and international attention focused on Israel’s war in Gaza and escalating tensions with Hezbollah, Prime Minister Benjamin Netanyahu’s administration has stalled discussions on next year’s budget — set to be the most challenging and crucial in decades.

Netanyahu and Finance Minister Bezalel Smotrich insist there will be a fiscal framework in place for 2025 but haven’t explained delays in its formulation, leaving markets and investors guessing on how it will be put together at a time that the conflict is causing the budget deficit and debt issuance to soar. Budgeting is usually well underway by this time of year.

Top central bank and finance ministry technocrats have joined credit-rating agencies and business leaders in warning that a hiatus will cloud Israel’s economic prospects and elevate the already-high risk premium on its assets.

Tensions over the budgetary process were evident in a letter Bank of Israel Governor Amir Yaron wrote to Netanyahu this month. He urged the prime minister to follow up on a meeting they held weeks ago to discuss ways to steady the nation’s finances — including trimming spending and raising taxes.

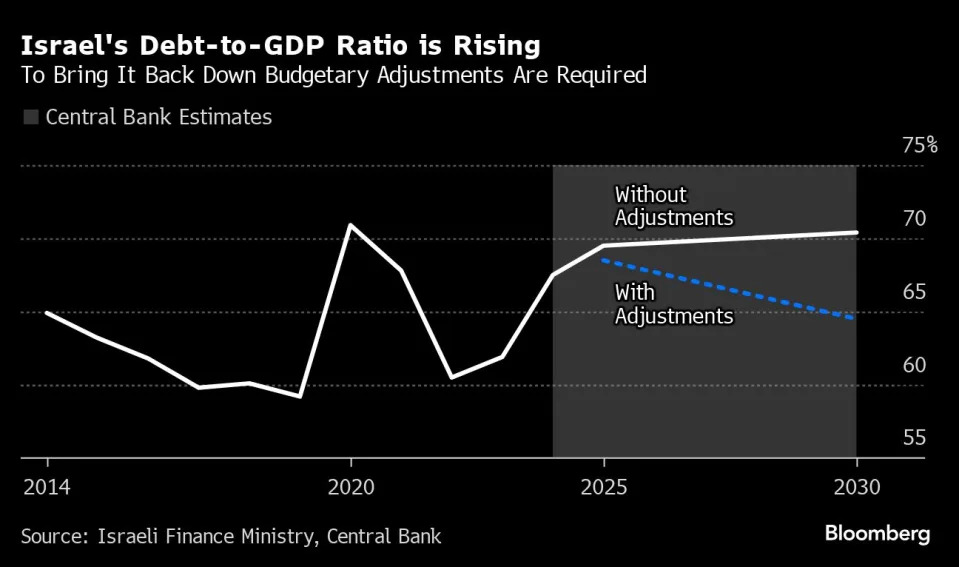

Yaron, who under Israeli law is the government’s top economic adviser, argues that permanent budgetary adjustments totaling some 30 billion shekels ($8 billion) are needed next year to sustain increased defense and other war-related expenditure. They are also necessary, he said, to steady Israel’s debt-to-gross domestic product ratio — which the central bank sees at 67.5% this year, up from around 59% in 2022.

“Maintaining the budget framework for 2024 and promoting the orderly process of structuring the budget for 2025 are critical,” the governor wrote.

GDP grew just 2% last year, almost half the rate the finance ministry expected prior to the outbreak of the war, and JPMorgan Chase & Co. sees an expansion of just 1.4% this year after cutting its forecast twice over the past two weeks.

Disquiet over Israel’s economy, the government’s handling of its finances and the risk of intensified fighting is becoming evident in the financial markets. Yields on the government’s 10-year shekel bonds have risen almost 90 basis points this year.

Fitch Ratings cut Israel’s rating by one notch to A, the third-highest level, on Aug. 13. That followed a similar move by Moody’s Investors Service in February.

“The conflict in Gaza could last well into 2025 and there are risks of it broadening to other fronts,” Fitch said.

Fighting erupted after Hamas militants swarmed into southern Israel on Oct. 7, killing about 1,200 people and taking 240 hostage. Israel responded with an air and ground assault that have reduced large tracts of the Gaza Strip to rubble. More than 40,000 people have been killed, according to health officials in Hamas-run Gaza.

Israel and Hezbollah have also been engaged in tit-for-tat strikes since the war began. Those escalated on Sunday, when 100 Israeli warplanes swooped over southern Lebanon, taking out thousands of Hezbollah missile launchers in what it termed a pre-preemptive strike, and the group responded by firing more than 200 projectiles across the border. Hamas and Hezbollah are both backed by Iran and are designated as terrorist organizations by the US.

Israel has spent 88 billion shekels on the war so far — almost 5% of GDP — and has raised more than 190 billion shekels through July to help fund the military and plug the fiscal deficit. If sustained, this year’s borrowing will break the record set during the Covid-19 pandemic in 2020.

The deficit rose to 8.1% of GDP in the 12 months through July. The finance ministry and central bank expect it be around 6.6% for this year as a whole, but that’s presuming the conflict with Hezbollah doesn’t worsen.

“Fiscal policy is the elephant in the room” as far as markets are concerned, Yaron said last month. “If you wait for the last minute, you make bad decisions.”

Budget proposals are typically drafted early in the Israeli summer, brought to the cabinet for approval by August and passed by parliament by year-end. Under Israeli law, the process can be extended until as late as the end of March. The government automatically collapses if it isn’t concluded.

Netanyahu and Smotrich met last week to discuss the budget, but they’ve yet to agree on a basic framework and finance ministry officials say almost no substantive discussions have taken place so far.

An official at the prime minister’s office, who spoke on condition of anonymity, said spending and financing plans can be comfortably approved even if they are placed before the cabinet as late as October — a time line technocrats say isn’t feasible.

The politics surrounding the budget are fraught, with some money directed toward entities headed by ultra-religious and nationalist politicians who form part of Netanyahu’s coalition and are key to him retaining power. Those discretionary budgets alone totaled 6 billion shekels this year, including funding for Jewish settlements in the West Bank and religious causes that have stirred controversy.

“The government stalls because the unveiling of a budget involves public scrutiny, and if controversial expenses aren’t cut it will be slammed domestically and may precipitate another downgrade in Israel’s credit rating,” Avigdor Lieberman, an opposition leader who preceded Smotrich as finance minister, said in an interview. “It’s likely that the government will choose to increase the deficit and its external debt.”

The stalling is vintage Netanyahu and he is likely to dismiss any criticism as politically motivated, according to Mazal Mualem, a political analyst who recently published a biography on the Israeli leader.

“For the prime minister, procrastination is a management strategy,” she said.

--With assistance from Srinivasan Sivabalan and Julius Domoney.

Most Read from Bloomberg Businessweek

Gaza war economic consequences for Israel

TEHRAN, Aug. 27 (MNA) – With growing concern, Zionist economists are warning officials in Tel Aviv that if the Gaza war does not end by 2025, the regime's economic situation will worsen.

According to the US media, the current state of the Israeli regime is the result of the high costs that this regime has incurred during the ongoing war in Gaza.

Israeli premier Benjamin Netanyahu tried to allay the fears of Zionist experts by saying that the economic damage is short-term and temporary, but contrary to his claims, the war in Gaza has harmed thousands of small businesses and international trust in Israel's economy.

Yacov Sheinin, an Israeli economist, said the total cost of the war could amount to $120 billion, or 20% of the country’s gross domestic product, a broad measure of economic activity.

The Israeli regime's Finance Ministry this month said the country’s deficit over the last 12 months has risen to over 8% of GDP, far exceeding the 6.6% deficit-to-GDP ratio the ministry projected for 2024. In 2023, Israel’s budget deficit was roughly 4% of its GDP.

The Israeli ports also saw a 16% percent drop in shipping in the first half of the year, compared with the same period in 2023.

Israeli business information company CofaceBDI reports that some 46,000 businesses have closed since the start of the war — 75% of them small businesses.