Thomas URBAIN

Tue, September 24, 2024

Steam rises out of the nuclear plant on Three Mile Island, with the operational plant run by Exelon Generation, in Middletown, Pennsylvania (Andrew CABALLERO-REYNOLDS) (Andrew CABALLERO-REYNOLDS/AFP/AFP)

Two American energy companies are each preparing to bring a nuclear power station back into service, an unprecedented operation which should help meet the growing need for electricity in the United States.

With demand for nuclear energy rising in the wake of Russia's invasion of Ukraine and the US government eager to transition to carbon-free resources, the calculus has changed on the shuttered nuclear plants.

On Friday, Constellation Energy unveiled plans to restart a reactor at Pennsylvania's Three Mile Island, which was closed for economic reasons in 2019. The plant was the site of the worst commercial nuclear power accident in US history in 1979.

The relaunch initiative is part of a 20-year electricity supply contract with Microsoft.

Last October, Holtec started the ball rolling by filing an application with the US Nuclear Regulatory Commission (NRC) to resume operation of the Palisades nuclear plant in Michigan, which was shut down in 2022.

According to several specialists, restarting this plant would be a world first.

"Everyone's kind of watching what we're doing with this project and seeing how viable it is," said Holtec spokesperson Patrick O'Brien. "So it's something that if we can show it's done, the international stage might start looking at the same kind of thing."

Contacted by AFP, the NRC said that only one application for restart had been submitted to it to date, that of Holtec, which is aiming for the end of 2025.

The dismantling of a power plant takes several decades, and in the case of Holtec's Palisades site it had not begun in full.

At Three Mile Island the fuel was removed from the reactor, but "major equipment removal or demolition activities have not started," a Constellation spokesperson told AFP.

"There is a lot that you can reuse at a site, even if you have to rebuild the nuclear plant," said Jacopo Buongiorno, professor of nuclear science and engineering at the Massachusetts Institute of Technology (MIT).

Holtec estimates the cost of the operation at around $2 billion, according to its spokesman, while Constellation puts the bill for the Three Mile Island restart at $1.6 billion.

By comparison, the construction of the two most recent reactors in the US, to be connected to the grid in 2023 and 2024 at the Vogtle site in Georgia, cost more than $30 billion.

- More to come? -

With the global energy balance affected by Russia's war in Ukraine and energy transition policies now incorporating nuclear fission more frequently and more widely, nuclear energy is gaining momentum.

Around 56 percent of Americans are in favor of developing nuclear energy in the US, compared with 43 percent just four years ago, according to a survey by the Pew Research Center published in August.

The future seemed reserved for the new generation of small modular reactors (SMRs), with their shorter construction times and the possibility of mass production.

But the initial design and construction of these pocket-sized power plants is proving costly because they are still prototypes.

The first Natrium from start-up TerraPower, currently positioned to be the first operational SMR in the US in 2030, is expected to cost around $4 billion.

Thus, restarting an existing power station appears to be the quickest and cheapest route, which could inspire other projects -- where possible.

"I don't think there are that many mothballed nuclear plants out there that you'll be able to restart," said Jacopo Buongiorno from MIT.

In response to a query from AFP, NextEra Energy Resources said it was "evaluating this opportunity" of restarting the Duane Arnold power station in the midwestern US state of Iowa, which closed in 2020, but that it "needed to make an informed decision about resuming operations at the facility."

As for the Indian Point nuclear site north of New York City which was shut down in 2021 under pressure from the state's then-governor, Andrew Cuomo, "nothing is impossible with time and resources," according to Holtec's Patrick O'Brien.

But, he added, it would be much more complicated to resurrect than Palisades or Three Mile Island.

Reactivating an existing facility raises the question of safety for plants that were originally intended to have a 40-year lifespan.

While people may think "it must be unsafe, it must be crumbling," that's simply not true, he said.

"Because, with the exception of the concrete containment, which is of course monitored and the reactor pressure vessel, again, heavily monitored, virtually everything else in these plants has been replaced at one point or another," he added.

And the project has the backing of the federal government, with the Biden-Harris administration earlier this year agreeing to provide a $1.5 billion loan to Holtec for the Palisades project "for our nation's historic transition to a safe and secure clean energy future," according to an Department of Energy spokesperson.

Tom Carter

Mon, September 23, 2024

Wall Street is throwing its support behind nuclear energy.

Some 14 banks, including Goldman Sachs, are backing a drive to help triple global nuclear energy supply.

Tech giants including Microsoft are also turning to nuclear energy to help power data centers.

Big Tech is getting excited about nuclear power — and now Wall Street wants a piece of the action.

14 of the world's largest financial institutions, including US giants Goldman Sachs, Morgan Stanley, and Bank of America, announced on Monday they would throw their support behind an effort to triple the world's nuclear energy capacity by 2050.

The banks, which also include Citi, Barclays and BNP Paribas have not said what steps they will take to help achieve this goal.

However, their involvement could be crucial in helping meet the emissions target laid out in last year's COP28 climate conference and revive the nuclear energy sector.

The announcement, held at the Rockefeller Center during New York's Climate Week event, saw the financial institutions express support for growing nuclear power generation and expanding the broader nuclear industry.

James Schaefer of Guggenheim Securities said in a press release: "New nuclear power is both clean and safe, and more importantly proven. It is essential that we accelerate the progression of planned projects into plants on the ground given the huge demand coming down the line for data centers and AI technologies. This will require nuclear companies, plant owners, data center and technology companies, together with banks and financial institutions to collaborate closely."

The 25 nations endorsing the Declaration to Triple Nuclear Energy include the US, Canada, France, Japan, Korea, Sweden, Ukraine, United Arab Emirates and the UK.

Once considered the future of clean energy, nuclear power has declined in popularity in recent decades due to governments' reluctance to back expensive infrastructure projects, concerns about its environmental impact, and other factors such as competition from cheap natural gas in the US.

Declining output

Nuclear accounted for a quarter of Germany's electricity production until 2011, but a change in government policy meant all its plants were shut down by last year.

Nuclear's share of global electricity production dropped to its lowest level since the 1980s last year, per the World Nuclear Industry Status Report.

That might soon change, and it's not just Wall Street getting more interested in nuclear power. Big Tech is also increasingly throwing its support behind the technology, as companies seek to power AI systems and data centers while cutting back their carbon emissions.

Microsoft struck a deal last week to reopen one reactor at the Three Mile Island nuclear plant, which remains best-known for a partial meltdown in 1979.

The tech giant has agreed to buy energy generated by the plant for the next two decades, having invested heavily in AI through its partnership with ChatGPT-maker OpenAI.

Oracle CEO Larry Ellison told investors earlier this month that the energy demand of advanced AI is so "crazy" that his company is building a data center powered by three small nuclear reactors.

"We've found the location and the power place, they've already got building permits for three nuclear reactors," he said on Oracle's first-quarter earnings call.

"These are the small modular nuclear reactors to power the data center. This is how crazy it's getting. This is what's going on."

Rolls-Royce is one of the leading contenders with its small modular reactor designs and has secured development funding of more than £200m from the British government.

Meanwhile, TerraPower, a company cofounded by Bill Gates, is planning a new nuclear power plant in Wyoming.

Goldman Sachs, Morgan Stanley, Bank of America, Barclays and BNP Paribas, did not immediately respond to requests for comment from Business Insider, sent outside normal working hours. Citi declined to comment.

Josh Kurtz

Mon, September 23, 2024

The Calvert Cliffs Nuclear Power Plant Units 1 and 2 are located near Lusby and licensed for at least the next decacde. Photo by the Nuclear Regulatory Commission.

As Maryland officials scramble to meet the state’s ambitious clean energy mandates, they are coalescing around a concept that seemed unthinkable a decade ago: That nuclear energy must be part of the solution.

Even environmentalists are coming to terms with the idea.

Paul Pinsky, the director of the Maryland Energy Administration, and one of the leading climate advocates in Annapolis during his long tenure in the General Assembly, recalled protesting against nuclear power plants in the 1970s. Now, he says, nuclear has “become a staple” in the state and nation’s energy portfolio, even if many Americans don’t realize it.

“If you asked 100 people on the street if their lights came on because of nuclear energy, I would guess three people would know it,” Pinsky said.

The Calvert Cliffs Nuclear Power Plant in Southern Maryland, which opened in 1975, generates about 40% of the energy produced in Maryland — all of it carbon-free. More than 80% of the clean energy generated in the state comes from the nuclear plant.

But nuclear continues to be hamstrung by a reputation, gained largely after high-profile disasters at power plants in the 1970s and 1980s, that it’s dangerous. The nuclear industry has also been struggling financially: Several nuclear power plants across the country have been decommissioned over the past few decades, in part because more natural gas power is being generated in the U.S. than ever before, which is far cheaper to produce.

Yet clean energy mandates have prompted policymakers to take another look at nuclear, knowing that whatever progress is being made developing other clean energy sources is inadequate for meeting short- and medium-term goals. In Maryland, the 2022 Climate Solutions Now legislation, which Pinsky co-sponsored, requires the state to create a 100% clean energy standard by 2035, while reaching zero carbon emissions by 2045.

For the past few years, stakeholders in Maryland’s nuclear industry have been angling for greater recognition — and possibly financial incentives — from state authorities, and they soon may get their wish.

People power vs. electric power in feud over proposed transmission project

“We appreciate the fact that we’re hearing people talk about recognizing nuclear in the state’s clean energy program,” said Mason Emnett, director of public policy at Constellation Energy, which owns and operates Calvert Cliffs.

But four months before the kick-off of the 2025 General Assembly session, it isn’t clear yet if there will be concrete legislative action to bolster nuclear.

“We’re not exactly sure what to expect from the upcoming legislative session,” Emnett said. And at this stage, the industry does not appear to have a specific ask.

The leaders of the two relevant legislative committees in Annapolis, Senate Education, Energy and Environment Chair Brian J. Feldman (D-Montgomery) and House Economic Matters Chair C.T. Wilson (D-Charles), are both supportive of nuclear in the broadest sense. But neither seems ready just yet to advance or embrace specific legislation.

“There is a lot of discussion about how do we get to 100% clean energy by 2035 without nuclear being part of the picture?” Feldman said in a recent interview. He predicted that legislation would emerge in the next session addressing how to bolster clean energy production in Maryland.

Wilson said he expects legislation to be introduced “incentivizing new nuclear deals,” similar to measures from recent sessions that have attempted to bolster solar energy installations and offshore wind production in Maryland. He added that because it takes so long to develop new nuclear facilities, the state needs to act quickly to produce results that may not be realized for several years.

“It may be a very viable opportunity, but it’s way out in the future,” Wilson said in an interview. “It would be nice to start stimulating something.”

One possible legislative solution would be to include nuclear energy in the state’s Renewable Portfolio Standard (RPS), which provides financial credits, known as RECs, for producers or suppliers of certain clean energy sources.

Every year in Annapolis, bills are introduced to tweak the RPS, usually to add a clean energy source to the standard or to eliminate one that’s considered dirty — or to change the complicated tiered system for calculating financial credits. But they rarely get very far, in part because they are complicated and cumbersome and are lobbied heavily by powerful interests that stand to gain or lose from the legislation.

For 2025, Del. Lorig Charkoudian (D-Montgomery), one of the leading environmentalists in the legislature and the top energy policy wonk, is contemplating legislation that would eliminate the RPS altogether and replace it with a system that would provide new and different types of incentives for clean energy producers. Charkoudian said the current RPS is flawed because it focuses on arcane compliance numbers without incentivizing clean energy production.

“We know we need to build energy generation in Maryland, and any generation we build in 2024 and beyond has to be clean,” she said. “That’s why we need to restructure our clean energy compliance. We need to do something that begins to address resource adequacy.”

Feds give final approval to Maryland offshore wind project

Charkoudian said any new system for incentivizing clean energy production would have to include nuclear, to ensure that Calvert Cliffs, the state’s only nuclear plant, stays open for the foreseeable future. The two reactors at the nuclear plant along the Chesapeake Bay in Lusby are licensed to operate through 2034 and 2036, respectively, and Constellation will begin the application process for renewing their licenses through the Nuclear Regulatory Commission late this decade.

Beyond Charkoudian’s proposed legislation, which is still being developed, “there’s going to be a large conversation [during the 2025 session] about our Renewable Portfolio Standard,” Feldman predicted.

Charkoudian said she expects some of her colleagues to advance nuclear bills in the upcoming session.

“I think there’s a range of thoughts about what they should be,” she said.

An economic challenge

The federal government, through the Inflation Reduction Act, currently has an incentive providing tax credits for nuclear energy production that lasts through 2032. Whether a dysfunctional Congress can extend it when it nears its expiration is very much an open question. But that credit, and any incentives for nuclear that the state can provide, will help to ensure Constellation’s robust investment in the Calvert Cliffs plant.

“The economics of nuclear continue to be a challenge,” Feldman said.

The Maryland Energy Administration is finalizing a rough draft of a report that will detail recommendations for how the state can meet is clean energy goals by 2035, and nuclear will inevitably part of the mix. A final report could be released by the end of the year.

Whether the report serves as a template for legislative action for Gov. Wes Moore’s administration remains to be seen.

“Alongside the state legislature and other stakeholders, the Moore-Miller Administration is continuing to explore all available options, including nuclear energy, to help to meet Maryland’s environmental and energy goals,” Carter Elliot IV, a spokesperson for Moore (D), said in an email. “The governor looks forward to supporting legislation and initiatives that will help Maryland secure its clean energy future.”

Late last year, between Christmas and New Year’s Day, the Maryland Department of the Environment released a meaty document outlining what the state needs to do meet its lofty climate mandates. Price tag: A minimum of $10 billion. State policymakers are still struggling to come up with ways to pay for the recommendations, at a time when the state is anticipating significant revenue shortfalls.

It’s possible that any report on clean energy strategies for Maryland could also involve robust government investment — a significant stumbling block to the state’s ambitions.

If there is expansion of nuclear energy in Maryland in the future, it won’t be of the scale of another Calvert Cliffs power plant, because that’s not feasible given the fragile economics of the nuclear industry. When two new large reactors began operating at an existing Georgia nuclear plant in 2023 and 2024, respectively, it marked the first time that a large-scale nuclear facility opened or expanded in the U.S. in almost 40 years.

But nuclear advocates are increasingly optimistic about the commercial and operational prospects of a new technology known as small modular reactors, which can be located at far smaller sites than a full-scale nuclear plant operation. The federal government is pouring billions of dollars into research for the technology, and one of the beneficiaries is X-Energy Reactor Co. LLC, a company located in Rockville, just down the road from the Nuclear Regulatory Commission headquarters.

Yet even the most optimistic proponents of small modular reactors believe it will be a minimum of seven years before any of those facilities are operational and supplying power to the electric grid. And Charkoudian believes that unlike existing technologies that haven’t been fully adopted yet in the U.S., it is especially difficult to ask taxpayers and utility ratepayers to make investments in these facilities because they aren’t visible anywhere yet.

“It’s just not commercially available,” she said. “At least you can see that offshore wind exists in Europe. There’s no question about whether they’re viable.”

Data points

Any conversation about the need to generate more clean energy — and more energy altogether — cannot take place without discussing the likelihood that energy-consuming data centers are coming to Maryland. Even without data centers, Maryland needs more energy generation and transmission. With them, the need expands exponentially.

“Data centers are like a huge tick that you put on our grid, and wherever you put it, they can start sucking that energy out,” said Wilson, the House Economic Matters chair.

Data center conference gets caught up in power line controversy

Already there is controversy over a proposed transmission line project that would run through three Maryland counties on its way to data centers in Northern Virginia. And while a big data center hub is in the early stages of development in Frederick County, some big technology companies are now eyeing the Calvert Cliffs nuclear property as a possible location for a data center.

During this year’s legislative session, as lawmakers debated a measure to restructure the electricity market in Maryland, the House attempted to insert an amendment that dealt with the complicated topic of onsite electricity generation and how electric suppliers interact with their largest commercial customers. It would have effectively prevented Constellation from building a data center on the Calvert Cliffs property.

The amendment was dropped on the final day of the legislative session after House-Senate negotiations, but Constellation continues to talk to tech companies about a data center at Calvert Cliffs. It isn’t a widespread practice in the industry yet, but it’s likely to become one: Talen Energy Corp., which operates the Susquehanna Steam Electric Station nuclear plant in Berwick, Pa., generates electricity for an adjacent data center, which it sold earlier this year to Amazon Web Services.

And Constellation announced Friday that it had reached an agreement with Microsoft to reopen the infamous Three Mile Island nuclear plant in Pennsylvania – site of the worst nuclear accident in U.S. history, in 1979 – to help power Microsoft’s data centers. Under the agreement, the plant, which was mothballed in 2019, could reopen as soon as 2028.

“It makes perfect sense to place a data center adjacent to your power providing center,” said Del. Mark N. Fisher (R-Calvert), whose district includes the Calvert Cliffs nuclear plant. “The closer you are to the power supply, the more secure your data center is.”

But that potential development has also sparked a debate about whether a data center next to a nuclear site would effectively be siphoning off a significant portion of power that’s meant to go on the electric grid.

“We’ve been telling our customers that [nuclear plants] are there for the grid, but now we’re taking them off the grid,” said Vincent Duane, a principal at Copper Monarch LLC, an electricity markets and cybersecurity consulting firm. He spoke at a conference on data centers last month sponsored by the Maryland Tech Council.

Nuclear advocates counter that the electricity is going to be consumed anyway, regardless of whether the data center is near a power plant or not. Setting up a data center that feeds directly off a power plant will reduce the need for expensive electric transmission updates, they argue, and income that the nuclear company takes in from a data center could prompt more investments and more efficient power generation at the nuclear plant.

“You have a question of configuration — how do you plug it in?” said Emnett, the Constellation executive. “Do you plug it in to the generator or do you plug it in to the grid?”

That’s one of many questions that Maryland policymakers and regulators will have to consider as they contemplate the possible expansion of nuclear energy in the state.

Microsoft announces plan to reopen Three Mile Island nuclear power plant to support AI

Max Hauptman, USA TODAY

Fri, September 20, 2024

A dormant nuclear power plant in Pennsylvania may soon be reactivated to help power some of the increasing energy needs of Microsoft.

On Friday, Constellation Energy and Microsoft announced the signing of a 20-year power purchasing agreement, in which one of the reactors at the Three Mile Island nuclear power plant would be brought back online to exclusively serve the energy needs of the tech giant’s massive data centers that help support artificial intelligence.

Neither Constellation Energy nor Microsoft disclosed the financial terms of the deal.

Reviving the Unit 1 reactor at Three Mile Island, which was shut down in 2019, will require approval by the U.S. Nuclear Regulatory Commission. If granted, the power plant is expected to return to operation in 2028.

A first for nuclear power

“Powering industries critical to our nation’s global economic and technological competitiveness, including data centers, requires an abundance of energy that is carbon-free and reliable every hour of every day, and nuclear plants are the only energy sources that can consistently deliver on that promise,” Joe Dominguez, president and CEO of Constellation Energy, said in a statement on Friday.

When Three Mile Island was shuttered for economic reasons in 2019, it had a generating capacity of 837 megawatts, enough to power more than 800,000 homes. Once brought back online, Constellation Energy said that it expected to once again generate more than 800 megawatts of electricity for Microsoft, as well as potentially add up $16 billion to Pennsylvania’s GDP along with 3,400 direct and indirect jobs.

No U.S. nuclear power plant has ever reopened after being decommissioned, which could make the Three Mile Island plant a first once it is brought back to operational status.

What happened at Three Mile Island

Three Mile Island, located near Harrisburg, is best known as the site of the most serious nuclear accident in U.S. history. In 1979, a mechanical failure caused the partial meltdown of the facility’s Unit 2 reactor, which has remained closed ever since. While the amount of radiation released during the accident was ultimately relatively minor, the incident was widely seen as causing public distrust of the nuclear power industry.

A statewide poll conducted by Susquehanna Polling & Research found state residents favoring restarting Three Mile Island by a more than 2-1 margin, according to Constellation Energy’s press release.

Recent power demands from tech companies, much of it driven by the vast energy resources required by data centers supporting artificial intelligence, has led them to seek out nuclear power options.

Earlier this year, Amazon Web Services announced plans to purchase energy for one of it’s data centers from Talen Energy’s Susquehanna nuclear power plant, also located in Pennsylvania.

"This agreement is a major milestone in Microsoft's efforts to help decarbonize the grid in support of our commitment to become carbon negative,” Microsoft VP of Energy Bobby Hollis said on Friday. “Microsoft continues to collaborate with energy providers to develop carbon-free energy sources to help meet the grids' capacity and reliability needs,"

Max Hauptman is a Trending Reporter for USA TODAY. He can be reached at MHauptman@gannett.com

This article originally appeared on USA TODAY: Three Mile Island nuclear plant to reopen, sell power to Microsoft

Theara Coleman, The Week US

Tue, September 24, 2024

The lights will be back on at the Pennsylvania power plant in the next few years. | Credit: Matthew Hatcher / Stringer / Getty Images

With artificial intelligence putting a damper on its clean energy goals, Microsoft is turning to nuclear power in a first-of-its-kind exclusive deal with a nuclear plant. The massive amount of energy needed to power artificial intelligence has contributed to a resurgence of interest in nuclear power, a turn for an industry on its way out over the last decade. But with Big Tech closing in on nuclear plants, some wonder what will be left for everyone else.

The symbolism of the deal

Three Mile Island, the dormant Pennsylvania nuclear plant at the center of the Microsoft deal, became "shorthand for the risks posed by nuclear energy after one of the plant's two reactors partly melted down in 1979," said The New York Times. The other reactor operated safely for years before ultimately closing down for economic reasons five years ago. With the Microsoft deal, a "revival is at hand." Because of artificial intelligence, the tech giant needs massive amounts of electricity for its growing number of data centers, and the company has agreed to use as much power as possible from the plant over the next 20 years. The plant's owner, Constellation Energy, promises to spend $1.6 billion refurbishing the reactor, hoping to restart it by 2028 with regulatory approval. The deal marks the first time "Microsoft has secured a dedicated, 100% nuclear facility for its use," the Times said.

"The symbolism is enormous," Joseph Dominguez, the chief executive of Constellation, said to the Times. Even though Three Mile Island "was the site of the industry's greatest failure," it can now be a "place of rebirth."

To fulfill its energy needs, Microsoft is also pursuing power from nuclear fusion, a "potentially abundant, cheap and clean form of electricity that scientists have been trying to develop for decades," said The Washington Post, although "most say [it] is still a decade or more away from generating electricity." Microsoft is ahead of the game, having signed a contract to buy fusion energy "from a start-up that claims it can deliver it by 2028."

Microsoft's new deal will help move it closer to its goals of running its global network on clean energy in 2025, said Bobby Hollis, Microsoft's Vice President of Energy, per Bloomberg. Integrating its entire product line around AI has increased cloud computing demand, "imperiling Microsoft's plans to be carbon negative by 2030," Bloomberg said. The agreement is a "major milestone in Microsoft's efforts to help decarbonize the grid," Hollis added.

AI pushes the resurgence of nuclear power

The unprecedented deal is the "latest sign of surging interest in the nuclear industry as power demand for AI soars," Bloomberg said. Over the past decade, over a dozen nuclear reactors have gone dark "in the face of increasing competition from cheaper natural gas and renewable energy." But now, the growing demand for electricity, "especially from data centers," has led many to turn to nuclear plants that can "provide carbon-free power around the clock."

"Policymakers and the market have received a huge wake-up call," Dominguez said. With the way technology moves, there is "no version of the future of this country that doesn't rely on these nuclear assets."

Unfortunately, tech's bullish approach to securing nuclear power has some experts worried there will not be enough to go around. The owners of nearly a third of the country's nuclear power plants were in talks with tech companies to meet the demands of the AI boom, The Wall Street Journal said. These deliberations could potentially "remove stable power generation from the grid while reliability concerns are rising across much of the U.S," and the electricity demand is driven up by new tech like AI, the outlet said. Instead of helping to add new green energy solutions to meet their "soaring power needs," tech companies would be "effectively diverting existing electricity resources." That could raise prices for other customers and "hold back emission-cutting goals," said the Journal.

Amazon Web Services closed a similar deal earlier this year, acquiring a data center campus connected to Talen Energy Corp.'s nuclear power plant on the Susquehanna River in Pennsylvania for $650 million. The arrangement raised concerns among clean energy advocates and regulators, specifically the the state's consumer advocate, Patrick Cicero, who said he was worried about cost and reliability if big companies snatch up all the plants. "Never before could anyone say to a nuclear-power plant, we'll take all the energy you can give us," Cicero said to the Journal.

Analysis-US nuclear plants won't power up Big Tech's AI ambitions right away

FILE PHOTO: The front entrance of the Three Mile Island Nuclear power plant is pictured in Dauphin County

By Laila Kearney and Timothy Gardner

NEW YORK/WASHINGTON (Reuters) - A plan by Microsoft to use the restart of a Three Mile Island nuclear reactor to help power its expanding data centers reflects the tech industry's hopes nuclear energy can be a quick and climate-friendly answer to its massive electricity needs.

But it will be tough to swiftly meet soaring power demand from the data centers behind artificial intelligence with new or resurrected nuclear reactors, as companies will face high regulatory hurdles, potential fuel supply obstacles, and sometimes stiff local and environmental opposition.

Microsoft and Constellation Energy announced a deal to restart a unit at the plant in Pennsylvania on Friday, in what would be the first-ever restart for a data center.

At the announcement, Constellation’s CEO Joe Dominguez called nuclear power the only energy source available that is both climate-friendly and reliable enough to support Big Tech’s needs, implying weather-dependent wind and solar energy may not be up to the task.

The announcement follows a similar agreement in March in which Amazon.com purchased a nuclear-powered datacenter from Talen Energy , and other nuclear contracts for data centers are in the works, power industry sources say.

The needs these deals aim to fill are huge.

U.S. data center power use is expected to roughly triple between 2023 and 2030 and will require about 47 gigawatts of new generation capacity, according to Goldman Sachs estimates, which assumed natural gas, wind and solar would fill the gap.

Climate conscious investors and regulators are keen to ensure this spike does not trigger a huge rise in greenhouse gas emissions.

For Microsoft and Constellation, at least, the deal is likely to be challenging to bring to fruition.

"Nobody has done this before," said Kate Fowler, global nuclear energy leader for Marsh, an energy insurance broker and risk advisor, about Three Mile Island's attempted restart. "There's going to be challenges that pop up."

The Three Mile Island plant made global headlines in 1979 with a partial meltdown at its Unit 2 reactor, the worst nuclear incident in US history.

The reopening plan covers the Unit 1 reactor at the Pennsylvania plant, which operated safely for decades before being closed five years ago. The $1.6-billion plan would restart Unit 1 by 2028 to offset Microsoft's data-center power consumption in the region.

But key permits for the plant's new life have not yet been filed, regulators say.

Getting them could be hard, especially against local opponents who remember the 1979 partial meltdown.

Resuming the use of equipment and infrastructure that has been dormant for five years could also be tricky, said Edwin Lyman, a nuclear safety expert at the Union of Concerned Scientists.

"Constellation should expect to encounter problems that will be costly and time-consuming to fix," Lyman said.

Three Mile Island also will require modified surface and groundwater permits, said Stacey Hanrahan, a spokesperson for the Susquehanna River Basin Commission.

"Any modification request will be thoroughly reviewed, and the project's expected water demands will be evaluated for sustainability and potential adverse impacts to the environment and other users," Hanrahan said.

OTHER HURDLES

There are broader issues that could affect any number of other attempted tech-nuclear link ups in the U.S.

For instance, Washington slapped restrictions on enriched uranium imports following Russia's 2022 full-scale invasion of Ukraine.

Securing licenses from the U.S. Nuclear Regulatory Commission could also be tricky for any nuclear project.

"The NRC currently really has a full plate," said Sola Talabi, a nuclear engineer and president of energy risk consultancy Pittsburgh Technical, noting license applications for different types of reactors the agency has never considered before, including high-tech modular plants and the restart of another decommissioned reactor.

Even though President Joe Biden recently signed legislation to streamline the NRC's licensing process, consideration of the queue of new projects by the timelines laid out by companies will challenge NRC personnel and technical resources, Talabi said.

For the Talen project, pocketbook issues have become a problem. Even though the plant is operating, Amazon's data center there faces challenges on the federal level from two regulated utilities who predict it could increase transmission costs that would raise power bills.

Talen disputes the prediction that the public would face higher power bills or reliability problems from the data center, which could consume enough electricity to power all the homes in New Mexico.

In general, simply purchasing power from nuclear plants to run data centers just means diverting it away from other consumers, creating competition for supplies on the grid that could potentially drive up power bills.

In the meantime, the Three Mile Island project is posing a major test of public appetite for expanded nuclear power.

Talabi said four years is likely enough for Constellation to address any technical issues at Three Mile Island, which could be substantial when sensitive components such as steam generators and reactor vessels have been closed for years. But he emphasized the importance of handling environmental and community concerns that may arise around the site.

"Probably more than anywhere else in the country, the need for community engagement to ensure that we have societal acceptance is going to be critical for restart," Talabi said.

(Reporting by Laila Kearney and Timothy Gardner; Editing by David Gregorio and Sonali Paul)

White House reacts to Three Mile Island Power reopening plan

Brady Doran

Tue, September 24, 2024 at 11:04 AM MDT·1 min read

(WHTM) — A senior advisor at the White House has issued a statement regarding Constellation Energy Corporation and Microsoft’s Three Mile Island purchase agreement.

Constellation Energy Corporation announced its plan to restart the Unit 1 nuclear reactor at Three Mile Island as part of a purchase agreement with Microsoft on Friday, Sept. 20, exactly five years after TMI shut down Unit 1.

“This week’s announcement of an agreement between Constellation and Microsoft shows that we can create good-paying and union jobs and power our nation’s industries of the future with clean, safe, affordable energy. We’re proud that clean energy tax credits in President Biden and Vice President Harris’s Inflation Reduction Act will help support this project and create good-paying and union jobs in nuclear power in Pennsylvania.”

John Podesta, Senior Advisor to the President on Clean Energy Innovation and Implementation

The 20-year power purchase agreement will not only restart the Unit 1 nuclear reactor but also pave the way for the launch of the Crane Clean Energy Center (CCEC).

Constellation Energy unveils plan to restart Three Mile Island nuclear reactor

AI May Breathe New Life Into Three Mile Island to Supply Power to Microsoft’s Data Centers

Microsoft’s investment into TMI is designed to contribute to its commitment to becoming carbon-negative by 2030 and power the company’s massive data centers.

The plan needs to undergo government approval before the reactor reopens.

Copyright 2024 Nexstar Media, Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Energy firm moves forward with first phase of nuclear power station in bid to meet clean energy demands: 'To pave the way for the incorporation of nuclear power

Mike Taylor

Mon, September 23, 2024

A Finnish company is exploring nuclear power as part of its goal to reach net-zero energy production.

Helen has partnered with Steady Energy, a small modular reactor developer, to produce heat for Helsinki by the early 2030s, World Nuclear News reported. Helen is one of the largest energy companies in the country and already provides electricity, heating, and cooling throughout Finland.

The first phase of the project, to evaluate plant sites, suppliers, and partners, will be completed in 2026. The coalition was established in October 2023, and it could lead to 10 reactors that produce 50 megawatts of clean, renewable energy — a sector in which worldwide investments skyrocketed last year.

To produce carbon-neutral energy, Helen needs a "steady, reliable, and electricity-independent heat source that can be located near the district heating network," the company stated, per WNN.

"We have never had any doubt about the need to mitigate climate change. In practice, this means including all clean forms of production in our energy palette," CEO Olli Sirkka said. "It is good to acknowledge, however, that everything is not in our own hands and that the transition requires accomplishments also from decision-makers and technology developers. I am expecting the ongoing reforms of the Nuclear Energy Act and official regulations to pave the way for the incorporation of nuclear power into Helsinki's heat production."

Steady Energy's part is to create the first district heating plant in the world with its LDR-50 small modular reactor, per the report. In August, it asked the Radiation and Nuclear Safety Authority to review the safety of the SMR.

Watch now: What's the true environmental impact of renewable energy?

It will feature "two nested pressure vessels with their intermediate space partially filled with water," WNN reported. When the water boils, heat is moved passively into the reactor pool. There is no need for electricity or mechanical parts, reducing the chance of failure.

Steady Energy is a spinoff of VTT Technical Research Centre, which has been developing the technology since 2020. It has inked deals with two other energy companies to construct five district heating reactors and a small nuclear power plant in the same early-2030s timeline as the Helen partnership.

Helen also has an agreement with utility Fortum for possible collaboration, as WNN reported.

Join our free newsletter for weekly updates on the latest innovations improving our lives and shaping our future, and don't miss this cool list of easy ways to help yourself while helping the planet.

Constellation Energy's Microsoft Deal Sparks Long-Term Growth: Analysts Raise Price Forecasts Amid Nuclear Revival

Lekha Gupta

Mon, September 23, 2024

Constellation Energy's Microsoft Deal Sparks Long-Term Growth: Analysts Raise Price Forecasts Amid Nuclear Revival

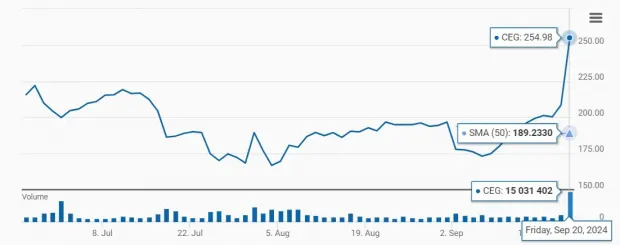

Constellation Energy Corporation (NASDAQ:CEG) shares are trading relatively flat today after jumping more than 22% after the company signed a 20-year power purchase agreement with Microsoft on Friday.

The deal entails the launch of the Crane Clean Energy Center (CCEC) and the restart of Three Mile Island Unit 1, which was closed five years ago.

Following the announcement, several analysts raised the price target on the stock.

KeyBanc analyst Sophie Karp maintained an Overweight rating and raised the price target from $230 to $265.

The analyst writes that the deal allows for reevaluating other parts of CEG’s portfolio, and they expect continued positive momentum for the shares.

Nuclear generation has unique scarcity characteristics that are difficult to replicate at scale, positioning CEG to leverage its asset base and expertise as the country’s largest nuclear operator, says the analyst.

Although the company did not disclose the offtake price, Karp estimates that it needs to be around $120/MWh to achieve a projected increase in “base” EPS CAGR from 10% to 13% between 2024 and 2030.

The analyst writes that the price is a significant premium over current PJM power curves and exceeds the estimated ~$60/MWh gross receipts from CEG’s PJM fleet based on recent capacity pricing.

The analyst updated the estimates based on the second-quarter results, revised power and capacity prices, and operating assumptions.

The impacts of the MSFT deal will be outside the forecast horizon, as the plant is expected to restart in 2028, adds the analyst.

Apart from this, Evercore ISI maintained an Outperform rating, with an increased price target to $254 from $212.

Maintaining an Overweight rating, Wells Fargo increased the price target to $300 from $250 and Morgan Stanley to $313 from $233.

Investors can gain exposure to the stock via Strive Natural Resources and Security ETF (NYSE:FTWO) and Virtus Reaves Utilities ETF (NYSE:UTES).

Price Action: CEG shares are down 0.12% at $254.69 at the last check Monday.

Photo by metamorworks via Shutterstock

Mon, September 23, 2024

Constellation Energy CEG recently announced that it has signed a long-term power supply agreement with Microsoft Corporation MSFT. To meet the clean energy supply obligation, The company will launch the Crane Clean Energy Center (“CCEC”) and restart Three Mile Island Unit 1.

To meet the 20-year clean energy requirements of Microsoft, Constellation Energy will restart the nuclear-powered Three Mile Island Unit 1, which remained idle for five years for economic reasons.

This market accepted this news well with Constellation Energy’s shares gaining 22.3% in the intra-day trading. CEG has outperformed its industry in the year-to-date period.

Constellation Outperforms Industry YTD

Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Investment Research

Image Source: Zacks Investment Research

The chart above indicates that the CEG stock is riding above the 50-day simple moving average (SMA), signaling a bullish trend.

How CEG Gains From Long-term Power Supply Agreement

Clean electricity demand is rising across industries, and Constellation Energy’s ability to produce a high volume of emission-free electricity from its nuclear plants is well-equipped to meet demand from the data centers.

Courtesy of this new power purchase agreement, Constellation Energy will restart its dormant nuclear power plant and supply 835 megawatts (MW) of clean energy to the grid. Microsoft to reduce its carbon footprints, will power its data centers in PJM by utilizing carbon-free energy generated from the nuclear power plant.

Data centers operate 24/7, 365 days a year, and electricity demand from these centers is destined to increase, as AI-based queries need substantially higher power than traditional Internet usage. The big tech operators will need reliable, clean power to operate data centers. Constellation’s long-term agreement with Microsoft shows its ability to efficiently serve the data centers.

This deal can create an opportunity for Constellation Energy to enter into more power supply agreements with other tech companies. Some big tech companies are in discussion with Constellation Energy’s management to shift their AI centers next to its nuclear plants for uninterrupted clean power supply.

Data Centers Growth to Create Opportunity for Constellation

Per a release from Statista, revenues from data centers are expected to witness a CAGR of 11.48% through 2029, resulting in a market volume of $212.1 billion by 2029. The PJM utilities have identified at least 50 GWs of data center load growth. The size of the data centers is also expanding, which is also creating more demand for clean electricity.

Constellation Energy expects to generate an additional $875 million net income in 2024-2025 through organic means like wind repowering, nuclear uprates, nuclear license renewals and clean hydrogen production. The restart of Three Mile Island Unit 1 due to the Microsoft deal will boost the earnings of the company.

Operating nuclear-powered generating units provides an additional advantage to Constellation Energy, as nuclear plants can reliably produce carbon-free energy 24/7 in all weather conditions and run for up to two years without needing to be refueled. These plants are a perfect fit to provide 24/7 electricity to the rising clean power demand from AI-driven data centers.

Constellation Boosts Shareholder Valu

Constellation Energy continues to increase the value of its shareholders through share buybacks and payment of dividends. The company pays a quarterly dividend to its shareholders. The company aims to increase its dividend by 10% annually, subject to its board's approval. Check CEG’s dividend history here.

Constellation Energy has utilized $2 billion to repurchase nearly 16.1 million shares through Aug. 6, 2024. The company still has $1 billion remaining of the total authorized $3.0 billion share repurchase program, which, when utilized, will further increase shareholder value.

CEG Returns Higher Than the Industry

Return on invested capital (ROIC) has outperformed the industry average in the trailing 12 months. ROIC of CEG was 4.08% compared with the industry average of 1.92%. The company has been investing effectively in profitable projects, which is evident from its ROIC.

Zacks Investment Research

Image Source: Zacks Investment Research

Constellation’s Earnings Estimates Moving North

Courtesy of its strong year-to-date performance, Constellation Energy has raised its 2024 earnings per share guidance to $7.60-$8.40 from the prior mentioned $7.23-$8.03. The Zacks Consensus Estimate for CEG’s 2024 earnings per share moved to $8 per share, up 4.6% over the last 60 days. The upward revisions in earnings estimates indicate analysts’ increasing confidence in the stock.

Zacks Investment Research

Image Source: Zacks Investment Research

CEG Stock Trades at a Premium

Constellation Energy is currently trading at a premium compared with its industry on a forward 12-month P/E basis.

Zacks Investment Research

Image Source: Zacks Investment Research

To Sum Up

Constellation Energy is benefiting from the increasing demand for clean energy in its service territories, and a new power supply agreement with Microsoft will further strengthen the performance of the company.

The company is trading at a premium. It is better to remain invested in this Zacks Rank #3 (Hold) stock and enjoy the benefits of dividends and share buybacks.