In March 1951, Andrew Ivy — at the time, one of the most renowned scientists and medical ethicists in the U.S. — held a press conference in Chicago to announce Krebiozen, a recently discovered wonder drug that Ivy said could dramatically help cancer patients. The announcement created a frenzy among cancer patients, who deluged the University of Illinois’ Chicago campus, where Ivy was vice president in charge of the professional schools at the time, with telephone calls trying to obtain it.

But within a few months, Krebiozen was denounced by the American Medical Association and, a few years later, Ivy, the drug’s creator Stevan Durovic and some of their supporters were prosecuted for fraud.

The dramatic Krebiozen saga culminated in Durovic fleeing the U.S., Ivy’s reputation in ruins and two of his U. of I. colleagues — President George Stoddard and Provost Coleman Griffith — ousted from their positions, in part because of their association with the scandal.

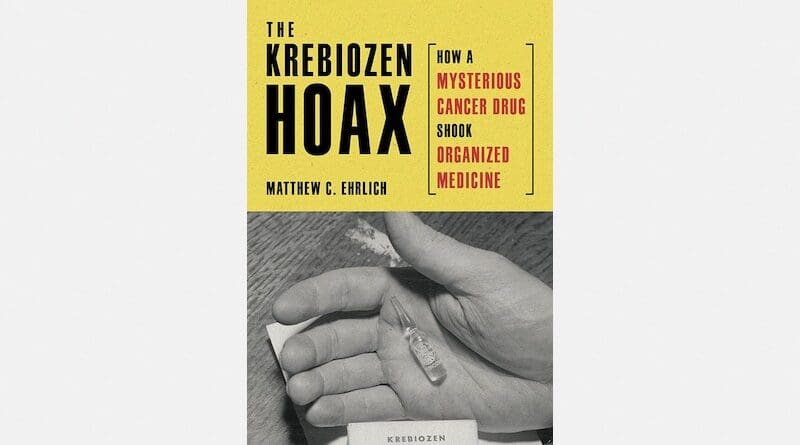

“The Krebiozen Hoax: How a Mysterious Cancer Drug Shook Organized Medicine,” a new book by Matthew C. Ehrlich, a professor emeritus of journalism at the U. of I., examines the controversial drug’s dramatic rise and fall.

Although the sensational story of Krebiozen has since faded into obscurity, Ehrlich said that its lessons are relevant today, offering potent reminders about the dangers of medical misinformation, misplaced trust and the unquestioning adoption of unproven treatments. “The Krebiozen Hoax” is also a cautionary tale about the pitfalls of hubris and how the political climate can undermine public trust in established institutions and mainstream medicine.

According to the author, Krebiozen was “a quintessential example of medical quackery” that “foreshadowed today’s bitter debates over health misinformation, medical freedom and scientific and educational expertise.”

Krebiozen also marked a “key historical moment for the Food and Drug Administration,” which was then flexing new regulatory powers, and its stance on that drug triggered backlash from cancer patients and accusations of medical overreach when the agency reported the drug was worthless as a cancer treatment, refused to license it and blocked its interstate shipment.

“It was a big episode, not just in the history of the U. of I. but also in the history of the whole state of Illinois, since the legislature and the governor got involved,” Ehrlich said. “And then, of course, it became a national deal with the involvement of the FDA and the National Cancer Institute. Illinois Senator Paul Douglas and even President Lyndon Johnson at one point got sucked into this whole thing.”

The book details how Durovic, an unknown doctor who had never published peer-reviewed research on the drug’s performance, duped a world-renowned clinician and scores of vulnerable patients who were desperate to find a cure for a frightening disease.

Ever evasive about the medicine’s formula and origins, Durovic indicated that it was derived by stimulating horses’ immune systems and extracting their blood, a potential form of immunotherapy that piqued Ivy’s research interests in the body’s defenses against cancer and may have clouded his professional judgment.

“Where I think Ivy went wrong is when he dug in his heels and refused to listen when first his close friends, then his scientific associates and prominent groups and organizations told him Krebiozen was worthless,” Ehrlich said. “He really seemed to have a natural stubbornness and a strong ambition to make a lasting contribution to science that may have gotten the best of him. And he never renounced Krebiozen, despite all the personal and professional travails that befell him.”

Ehrlich’s book examines how public excitement over the drug elevated Ivy’s Sisyphean pursuit of clinical trials and federal approval for the drug to a nationwide cause, attracting A-list supporters such as movie star Gloria Swanson and environmentalist Rachel Carson, a cancer patient who briefly and unsuccessfully treated herself with it.

The battle to obtain “fair trials” of Krebiozen that advocates believed would demonstrate its efficacy once and for all pitted them against federal regulators, mainstream medicine and the AMA. Ivy and Durovic accused the AMA of conspiring with powerful corporate interests to keep Krebiozen off the market after failing to seize control of it.

When the FDA refused to license the drug, angry demonstrators besieged the White House, with cancer patients waving picket signs declaring, “I need Krebiozen to live!”

“Krebiozen is one episode in a long, sorry series of such episodes, and that’s one of the reasons I wanted to write about it,” Ehrlich said. “It just had colorful characters involved, including Ivy, Stoddard and Douglas.”

Ivy was a distinguished physiologist and medical ethicist who testified as a representative of the AMA at the Nuremberg trials and was once dubbed “the conscience of U.S. science” by Time magazine. His friend Douglas was a firebrand Democrat legislator and decorated war hero who became one of Krebiozen’s biggest supporters and foremost legislative sponsors.

“And, like Ivy, once Douglas committed to it, he dug in and would not be dissuaded from it,” Ehrlich said.

Were it not for Ivy’s star power, political connections, rapport with the press and federal agencies’ confusion over which of them was responsible for regulating it, the Krebiozen controversy likely would have fizzled more quickly, according to the author.

Ehrlich examines the historical conditions that existed when Krebiozen came to prominence and how they likely heightened the controversy surrounding the drug.

In Ehrlich’s exploration of Krebiozen’s tumultuous history, he notes that it was among nearly150 miracle cures for cancer that were touted at one time or another. The Krebiozen controversy copied the pattern of many such brouhahas that preceded it — and foreshadowed many of those that came after it, including controversial treatments for COVID-19 such as hydroxychloroquine, Ehrlich said.

“People should be aware that these things happen from time to time,” Ehrlich said. “The story of Krebiozen is a poignant reminder that these travails are nothing new, but instead have ample historical precedent. It is also a reminder of the damage that can be inflicted when quackery and all the untruths that accompany it go unchecked for too long.”

The book was published by 3 Fields Books.