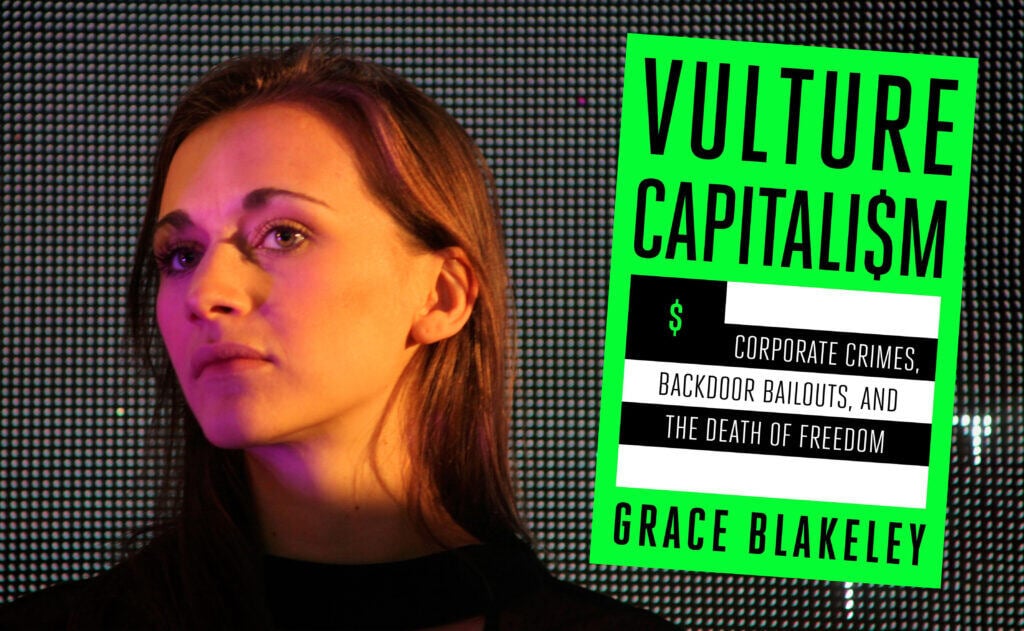

Vulture Capitalism

Corporate Crimes, Backdoor Bailouts, and the Death of Freedom

By Grace Blakeley

Hardcover

LIST PRICE $30.00

Vulture Capitalism | Book by Grace Blakeley | Official Publisher Page | Simon & Schuster

About The Book

In the vein of The Shock Doctrine and Evil Geniuses, this timely and “galvanizing” (Naomi Klein, New York Times bestselling author) manifesto illustrates how corporate and political power brokers have used capitalism to advance their own interests at the expense of the rest of us—and how we can take back our economy.

It’s easy to look at the state of the world around us and feel hopeless. We live in an era marked by war, climate crisis, political polarization, and acute inequality—and yet many of us feel powerless to do anything about these profound issues. We’ve been assured that unfettered capitalism is necessary to ensure our freedom and prosperity but why, in our age of unchecked corporate power, are most of us living paycheck to paycheck? When the economy falters, why do governments bail out corporations and shareholders but leave everyday people in the dust?

Now, acclaimed journalist and progressive star on the rise Grace Blakeley exposes the corrupt system that is failing all around us, pulling back the curtain on the free-market mythology we have been sold. She also clearly illustrates how, as corporate interests have taken hold, governments have historically been shifting away from competition and democracy towards monopoly and oligarchy.

Tracing over a century of neoliberal planning and backdoor bailouts, Blakeley takes us on a deeply reported tour of the corporate crimes, political maneuvering, and economic manipulation that elites have used to enshrine a global system of “vulture capitalism”—planned capitalist economies that benefit corporations and the uber-wealthy at the expense of the rest of us.

As “the sort of book that will help us make a better world” (Rob Delaney, New York Times bestselling author), Vulture Capitalism exposes the cracks already emerging within capitalism, lighting a path forward for how we can democratize our economy, not just our politics, to ensure true freedom for all.

Vulture Capitalism

- Grace Blakeley & Jeremy Corbyn In Conversation

Purpose Made Podcast

May 13, 2024

We Live In The Age of “Vulture Capitalism”

Leading economics writer Grace Blakeley explains why the way people talk about free markets is completely wrong.

Current Affairs

filed 26 April 2024 in Economics

Grace Blakeley is one of the left’s leading economic thinkers. In her new book, Vulture Capitalism, Blakeley explains how capitalism really works and gives a crucial primer on the modern economy. She joins today to explain why conceiving of “free markets” and “government planning” as opposites is highly misleading, because our neoliberal “market-based” economy involves many deep ties between the state and corporations. Instead of thinking of “capitalism” and “socialism” as a spectrum that runs from markets to government, Blakeley says we should focus our analysis on who owns and controls production, and who gets the benefits.

This conversation originally appeared on the Current Affairs podcast.

Nathan J. Robinson

When I describe you to people, Grace Blakeley, I describe you as “scary smart.” You know everything about the global economy, and you’ve read everything. This new book Vulture Capitalism contains mountains of research, explains the way the entire global economy works, and also provides a compelling alternate vision of how the entire economy could be structured. That’s what you’ll get when you pick up Vulture Capitalism by Grace Blakeley!

Grace Blakeley

What an intro. What a description of the book. I’m so glad that you enjoyed it.

Robinson

Yes, it’s phenomenal. I really do mean that. There’s so much in the book, and so I was trying to think of what I can start with that is simple and goes to the core of it. So, we have this popular conception that is everywhere: there’s something called the “state,” and there’s something called the “market.” “Capitalism” is when the market makes decisions. People choose what to buy in the market, and that’s what determines what happens in the economy. The “state” is this other thing. “Socialism” is when the state owns everything and does the planning. This binary—state/market, capitalism/central planning—is very common, and I think one of the core things you’re trying to do is blow this apart.

Blakeley

Yes, just completely blow it up. It’s just wrong. The reason that I started thinking that this was something that I needed to write at the beginning of the pandemic. In 2019, there had been the recent loss of the general election by the Labour Party. I was doing a bunch of interviews on TV during the pandemic, and all the kinds of newsreaders and interviewers were saying, “Jeremy Corbyn lost the election, but ultimately, you got what you wanted because we have the state spending loads of money, and that’s socialism. We didn’t even need Jeremy Corbyn to win the election, because you’ve got socialism, and it’s being delivered by Conservative party.”

I just found it so staggering every time I was confronted with this argument, and it led me to realize that the vast majority of people, even educated people who were asking these questions, just don’t know the difference between capitalism and socialism and have this flawed understanding of what capitalism actually is.

It comes from this divide that we’ve had in our politics, between social democracy and neoliberalism, between Friedrich von Hayek—who was the darling of the neoliberals—and John Maynard Keynes. The two heroes or villains, depending on which side you’re on, of our economic and political debate for most of the 20th century. Keynes said “we need a state to tame the irrationalities of the market, we need government intervention, and we need to the public sector to invest.” Even if in the middle of a crisis and there’s nothing to invest in, we should just pay people to dig holes just to give them jobs to create incomes and kind of boost economic growth.

And then Hayek comes in and says this kind of planning by the state is the source of all tyranny and creates inefficiencies that undermine the functioning of the market. We need less state—a different kind of state that does less stuff, basically. That is the kind of argument that won in the 1980s, and we saw neoliberals like Thatcher, Reagan, and Pinochet in Chile, come to power everywhere. We’re told that they shrunk the state, but they didn’t.

Robinson

Even leftists say they did.

Blakeley

Exactly. We get called out here because we’ve also signed up to this kind of dichotomy. We often say things like they “deregulated” and reduced public spending, and all that sort of stuff. And while in some cases that is true, it’s very misleading because with the type of regulation that we have, there wasn’t less regulation after the neoliberal shift, there was actually often more. It required a huge amount of regulation to create markets where no markets existed before, for example, in healthcare in areas of the public sector.

And at the same time, we didn’t see a fall in public spending, and we haven’t seen that over the last several decades. But we’ve seen massive increases in subsidies for the rich and tax cuts that benefit the rich. We’ve seen bank bailouts; we’ve seen pandemic bailouts that have channeled billions of dollars of public funds into the hands of private corporations.

So, what’s happened isn’t that the state has become “smaller” and left more space for the market—less socialism and more capitalism. What’s actually shifted from the social democratic post-war era to the neoliberal era, from the 1940s to the 1980s up to today, is the nature of state policy and whose interests it serves. So, there’s been a shift in the balance of class power, such that the state is now used by capital, by the wealthy elites, to serve their own interests.

Robinson

I want to break this down, because the idea is really ingrained that there’s some kind of spectrum between how much “the government” produces the economy and how much the market makes economic decisions. You brought up the economists Hayek and Keynes in the 20th century. Hayek wrote this book, The Road to Serfdom, where he says with welfare programs and healthcare and all that, soon, you’ll have Nazism in Britain, or whatever—it’s incredible that this argument was taken so seriously because it’s insane. But then you have, as you say, on the opposite pole of that Keynes, this idea that, in fact, the economy will be a disaster unless there are decisions made in government about how to allocate resources. You say that’s not the spectrum of possible ideas. Break us out of the spectrum.

Is there, perhaps, a third economist that we can bring in here who might have some other ideas?

Blakeley

There’s Karl Marx. I come from a Marxist perspective, basically. And so, what that means, when you’re thinking about how to analyze capitalism, or to really to analyze a society in general, is that you start—you don’t end, but you start—by looking at the way that society produces things. So, feudalism was a system of aristocrats and peasants, and land was a very important asset that was used to produce basic agricultural commodities. The way that political system worked was that there were lords who owned the land, and peasants who worked the land. The whole nature of that social system was organized around land and how that was governed, and the political system flowed from that.

Moving into capitalism, this is a system oriented around the production of commodities, and the production of commodities within corporations, in which there is a divide between the people who own everything and need to produce commodities, and those who are forced to sell their labor power for a living. So, you have this insight from the very beginning: capitalism is a class-based system where there’s a clear social division of labor between the people who own all the stuff and those who have to work for a living.

The most important thing that really kind of shapes how capitalist societies work is the balance of class power in that society. It’s not the balance between the “market” and the “state.” Those things are important in determining how certain actors can make their voices known. So, for example, during the post-war period when there was a larger state, it was easier for the labor movement to organize within the state and make certain demands that were ultimately realized, but that power that they held didn’t come because the state was bigger. It came because they were organized enough to have built up these powerful institutions that were capable of organizing, both within the state and within corporations as well. The whole of society had higher wages and more public services and all these different sorts of things. Basically, that society was structured in such a way that it operated more in the interests of workers than the society that we have today.

The neoliberal assault wasn’t about shrinking the state. Again, this was a powerful narrative that seized on the kind of liberatory narratives that had been put forward around 1968 around personal freedom and autonomy. The idea was that there was this crushing repressive state apparatus that was keeping everyone under its control—which, of course, was in a way kind of true. The neoliberals seized upon that and said, we are going to shrink the state and create space for personal freedom within the market and there’ll be many small producers creating all the things that you need—there will be entrepreneurship—and you’ll be able to work on these amazing ideas and bring those ideas to market, and you’ll be able to invest however you want in stock markets, etc.

So, it was all really oriented around the idea of personal freedom. Now, that was very deceptive and very powerful because what we ended up with was not an economy that prioritized personal freedom. It was an economy dominated, not by small individual producers and small investors that are operating in the market, but these massive corporate behemoths and financial institutions that have insane amounts of power, increasingly operating within the state in the same way that organized labor once did to get their demands met.

And again, that comes down to not necessarily the size of the state or the market or whatever. It’s about the balance of class power. There are many reasons that we can go into as to why that shifted so much, but it was partly because of this outright battle that was being fought on both a kind of ideological and material level that the neoliberals won—ultimately capital got its way. There are some examples of this that I lay out in the book that I think might be helpful and explain what this means. Readers and listeners might remember the Boeing 727 Max disaster.

Robinson

You talk a lot about Boeing.

Blakeley

Yes. That obviously happened a couple of years ago, and is now in the news again because there’s more engineering failure.

Robinson

It came back just in time for the publication of the book.

Blakeley

I know, it’s very convenient. People can read the story in the book, so I won’t go into it in too much detail. But suffice to say, the corporate culture became just unbelievably financialized. The whole purpose of the corporation shifted from producing planes to just maximizing value for shareholders.

Robinson

You could make planes or money.

Blakeley

Yes, literally. So, there was this whole new cast of managers that was created to cut costs and extract value from the firm. Unions were attacked—even engineers were attacked. The whole idea was to make these planes as cheaply and as quickly as possible. It emerged later, after the disasters, that senior management at Boeing knew that there were these massive flaws in this airplane that led it to potentially nosedive out of the sky, and they did nothing about it. The FAA [Federal Aviation Administration] did nothing about it because they had effectively become captured by the very institutions that were supposed to be regulating. And the state, of course, which is supposed to be this counterweight to what’s going on in the market, actually aided and abetted Boeing by channeling billions of dollars worth of corporate welfare into the company at the same time.

So, this idea that we have states and markets fighting each other for influence is just completely, utterly false. Most of the time, public and private interests are working not just alongside each other, but through each other. Private corporations work through the state, and the state often works through private corporations. So, we just need to take this idea of this big separation between the state and market and just throw it out.

Robinson

As you mentioned, even socialists fall into this. There was this famous economic debate, the “Socialist calculation debate,” about, as I understand it, whether the economy could function without prices and markets, as if that’s a debate over socialism. That’s kind of a separate debate. The debate over whether central planning can work, without prices and markets is often seen as a debate about “socialism,” because socialism was associated with central planning and a lack of markets and prices. But as you point out in the book, under the system that we call capitalism, there is a ton of central planning without markets and prices in these giant entities called corporations.

Blakeley

Yes. I start with the book by saying, okay, so Hayek says an economy is far too complex to be centrally planned—there are so many variables, feedback loops, and different actors interacting with one another that it will be impossible for one institution to take control of this whole thing and tell everyone what to do—which you say, right, fair enough, because you know that from history that seems to be the case. But if we look at the way that capitalism actually works, that is how it works: it’s a small number of very powerful people basically making decisions on behalf of everyone else.

We can talk about the corporation. I look at how corporations, financial institutions, states, and empires plan. Now, the state side of things is kind of more accepted; it’s more accepted that states can plan. I actually look at how state power functions and show that it tends to favor the interests of capital. But even within the corporation, you have this immense amount of power concentrated in decision makers at the top of the corporation, precisely because these corporations do not really operate in a market. So, within the corporation, we know that the way decisions are made is based on authority—senior managers decide how the firm is going to operate, and then everyone else simply has to follow.

Robinson

You have to do what you’re told if you’re at the bottom.

Blakeley

Exactly. But the idea is supposed to be that those decisions are dictated by the market. So, the market says to produce X amount of Y commodity and managers consult that, make a decision, and maybe they get it a bit wrong, so they adjust it, and that’s all reflected in profits. But that feedback mechanism doesn’t work at all when you have consolidated corporate power, which we do across the whole economy, particularly in the US, but also to an increasing extent in Europe, where a lot of the most significant productive sectors are characterized by these massive international monopolies that do have some competition in the sense that there are a few other firms, but generally collude with one another and don’t really compete over price. And more than that, they have the power to kind of operate within and through state institutions to make sure that they get their way regardless.

Another theorist of capitalism is Joseph Schumpeter, who had this idea of “creative destruction,” and this was what kept the kind of entrepreneurial spirit alive—if you didn’t compete and come up with amazing new ideas, then you would die. But that isn’t the case anymore. These firms survive, no matter what—even Boeing. It’s gone through all of these incredibly horrendous disasters, basically killed tons of people, and it still exists. And it’s probably never gonna not exist because the American state won’t allow it to collapse.

Robinson

So, help us understand in a little more detail what it means for a company not to be subject to market discipline. Is it that Boeing can fuck up a million times and there’s no change in what the market does, because another plane manufacturer isn’t going to spring up in the United States?

Blakeley

It’s a lot of different factors. So firstly, the argument that Marx made as to why what he called centralization would increase over time under capitalism is that production becomes a lot more complex. You need a lot more stuff to start a business in something like aerospace. It’s so complicated and so complex that you need a lot of capital, expertise, connections, and contracts with other large corporations.

So basically, it’s kind of impossible to really start an aerospace company on the scale of something like Boeing from the ground up. You have two or three established firms in that sector. At the main, we’ve got Airbus and Boeing, and they just exist—they have all the capital, knowledge, and expertise. The barriers to entry are just huge, and that’s just a function of the nature of capitalist development. But a second and arguably more important factor, and something that’s overlooked by plenty of pure economists, is that inevitably when you get these big corporate benefits, they have very close links with states, particularly with the state in which they’re headquartered.

So, Boeing has really deep links with the American state with the Department of Defense with various administrations. It can lobby for tax cuts and has a huge influence over state governments, let alone the federal government because often it’s a massive employer. We’ve seen it was able to influence regulation, lobby, and extract value out of the American state at all levels. And it’s actually the same with Airbus in the EU. There have been all sorts of scandals surrounding Airbus and throughout the aerospace industry—issues around corruption and fraud and those sorts of things—precisely because of these relationships between senior executives and members of a particular state or international institutions or whatever, which are so important to ensuring the survival of this firm, and this is something that investors pay attention to.

So, when there’s a scandal, nobody seriously thinks that Boeing is going to collapse because the American state isn’t going to allow it. The capital doesn’t flee; the money just keeps flooding in. We’ve seen that Boeing’s share price, until recently, wasn’t dramatically affected by the events that took place several years ago with the Max disasters. We saw that it got tons of support from the state over the course of the pandemic.

The markets don’t operate the way that they are theorized to operate according to your average mainstream economist. And basically, this comes down to the fact that our worldview is based on this idea that there’s this big separation between politics and economics. There’s economics, which is numbers and companies and finance, and then there’s politics, which is messy arguments and not numbers, and these two worlds are kind of incompatible, but actually, they are part of one system, which is capitalism. The relationships between allegedly separate institutions within a capitalist economy have massive implications for the way that system works.

Robinson

Now, I want to know what you say when you meet someone who describes themselves as a free market libertarian. You lay out what you’ve just laid out for me, and they reply that what you’re describing isn’t capitalism, but “crony capitalism.” This is a libertarian buzzword term. And they say, “of course I don’t believe that the state should be doing special favors for corporations and I believe the things you’re describing are very bad, but that’s not real pure capitalism.”

Blakeley

Those people have no theory of the state. They have no working or functional, or even comprehensible, theory of power, really. The state isn’t just a thing that exists out there, that you get into government, pick it up and do things with it. It is a very complex set of institutions that exists outside what we would usually refer to as the institutions of government. Governments can change, but the wider state apparatus, in many ways, remains the same, and the way that those institutions function reflects the balance of power and society as a whole.

Now, that sounds complicated, but it’s actually very simple. The companies and individuals that can wield power within state institutions, or over particular politicians, are the ones that can get their way and have those policies that they want to see enacted get enacted. It kind of goes back to what I was talking to you before. Back in the post-war period, there was a more equal balance of power in both the US and the UK, and most of the developed world, between corporations and workers. Workers had their institutions that would lobby within the state for their interests, and private corporations had their institutions that would lobby within the state for their interests. What happened after the 1980s was that the workers basically were crushed. The scales began to tilt just extremely unevenly in favor of capital.

In the book, I use the example of the fossil fuel companies. You get a president like Biden who was elected, and a big part of his platform is saying he’s going to cut emissions and really do something about climate breakdown. Even assuming that he was even vaguely sincere about wanting to do something about that, which I know is debatable, what ultimately ends up happening is that he puts through some legislation that is designed to curb climate breakdown, and at the same time, different parts of the state continue to expand offshore drilling or provide massive subsidies to fossil fuel companies.

On the surface, what you see are these really contradictory sets of policies, with the American state on the one hand saying that we’re going to help decarbonize, and on the other is giving loads of money to fossil fuel companies, and you think, “what’s going on?” But actually, when you understand the state, not as a kind of coherent entity that does things as an individual, but as this complex set of different institutions, all of which are influenced by social relations, lobbyists, and corporations, it becomes more comprehensible because many of these powerful institutions can get their way often through the backdoor.

Robinson

So, it’s a fantasy that you could still have the giant powerful corporations but somehow with no influence over state policy.

Blakeley

When they think of the state, I think they are imagining this idea of a nice institution that’s very simple, that just everyone in the institution does exactly as they’re told by the people at the top. No organization works that way. All organizations are complicated. They rely on these difficult institutional hierarchies and weird ways of getting things done. Anyone who’s worked in an organization knows that. The idea that the state is just this neutral tool that you can just kind of pick up and get to do stuff with is just absurd.

Robinson

Let me put to you one more counterargument. Someone might say in response to you that yes, there are giant, entrenched corporations—for example, in the United States, we have the major car companies, like Ford and GM, but recently, the market has worked its magic because an upstart competitor, Tesla under Elon Musk, disrupted the industry. The car industry was precisely the sort of industry that nobody would have thought that could be done in. And because of those very barriers to entry you describe, it’s extremely costly and difficult to open a new car factory. But it was done, which shows that the power of creative destruction under capitalism is not dead, as you say it is. How do you reply to that?

Blakeley

Well, it’s an interesting question, and I think it requires us to look at the development of the auto sector in the U.S. over a slightly longer period of time. The auto manufacturers are just, again, these massive corporations that also have a significant amount of market power. Ford was one of the original monopolies, really. In the book, I look at the example of the Ford Motor Company, and how the Ford family really tried to dominate and control their workers and succeeded in doing that from the very inception of the company. Obviously, that begins to change as you start seeing much more competition from abroad. And so, the only way that most of the auto manufacturers, particularly Ford, actually managed to survive is through getting most of their profits not from selling cars, but from basically becoming little mini banks. So, the Ford Motor Credit company became substantially more profitable than the actual car manufacturing side of Ford in the run-up to the financial crisis. Of course, that required it to take on loads of debt, of course, and that eventually meant that it became kind of financially unstable, and that meant that it went to the government for a bailout through the backdoor. So, Ford got a bailout, and it’s not often included in the companies that are listed as having received bailouts, but it got money through this loan scheme provided by a different government department, not through TARP [Troubled Asset Relief Program]. Obviously, the other car manufacturers did get tons of money through TARP.

The entire U.S/ automobile sector was saved through a massive bailout from the state. It’s not particularly healthy, it’s not particularly competitive, but it continues to exist, despite market forces saying that it likely shouldn’t. Then, of course, you do get this kind of upstart company that is allegedly going to revolutionize the production of cars in the U.S., and does, to an extent, begin to compete with those entrenched giants. But again, with support from the state. All of these companies rely on support that has been put in place by the state, whether that’s tax incentives, R&D incentives, and all these different sorts of things. Ultimately, we have an auto market in the U.S. that does look pretty irrational, and has looked pretty irrational for a while now, but basically limps off because of the massive support that is continued to be provided by the U.S. state.

Now, I’m not saying that is necessarily the worst thing in the world because there are, obviously, plenty of workers in those sectors. If they didn’t have jobs, they would just be put out on the streets because there’s no functioning plan to transition the U.S. economy away from sectors like auto manufacturing. But it also just demonstrates the mythology of this idea that capitalism is a free market system. The U.S. is the center of global capitalism, and there are huge swathes of that economy that are entirely or significantly dependent upon market power—corporate power—over the market and also the relationship between corporations and the state.

Robinson

It strikes me that one major takeaway of your book is that simple fables about the economy overlook how incredibly complicated the world is, and if you start to conceive of it in “lemonade stand” terms, you’re not really going to understand how the world works.

Just to conclude here, in terms of where we can begin to have a better conception of how the world works, it does strike me that one of the things that you draw our attention to over and over here is that while we should think a lot about the questions of planning, prices, markets, and institutions and how they work, if we want to understand what kind of economy we live in, it’s ultimately a question of power: who has it, and who doesn’t? And if you want a socialist system, don’t look at what the size of the state is. Instead, begin with the question: who is in control of what? Where are our decisions made, and how are they made? So, tell us a more about how we can begin with an analysis of power to illuminate many things about the world.

Blakeley

Yes, exactly. You said it was complicated, and it is complicated. But in some ways, it is kind of simple. It’s who gets to make the rules—who gets to determine who gets what—and at the moment, that is basically just corporate executives, politicians that are in the pockets of corporate executives, and unelected technocrats at high levels of the states.

That system of capitalist oligarchy, which is basically what we have, is this fusion of public and private power with a small number of very influential people at the top who get to decide how the whole system runs. The opposite to that isn’t a bigger state because then you just get a different constellation of interests that are making decisions that serve to reinforce the status quo and continue to give power and wealth to those at the top, or indeed, more market because, again, you get the same sort of thing.

The question is, how do we create a real democracy? How do we make sure that the decisions that are being made about people’s lives aren’t being taken by corporate executives, technocrats, or politicians, to the extent that it’s possible to be being taken by them? And so, that really requires a thorough democratization of the economy, and a thorough democratization of society. So yes, it means things like having collective ownership of the most important resources in our society. Workers should own the firms that they work in.

People say, that’s impossible, it wouldn’t work. Well, I highlight in the book plenty of times throughout history where it has worked, where workers have actually come together and shown that they have the expertise to be able to govern the firms in which they work and actually often do so better than the managers who came before them, in the sense of running the firm more efficiently and more effectively.

That requires, as I said, a kind of shift in ownership. But it also requires a real transformation in how we think about decision-making. If you take politics, for example: the idea that we’re just going to change the way that the political system works by voting for a different set of politicians, all of whom are basically still in the pockets of big businesses and financial institutions, and who are going to go into a state that is already substantially weighted in favor of the interests of one class, it’s just kind of crazy to think we could just change everything just by voting.

What is really required is to think about how we organize in our workplaces and communities on the streets, to try and create a kind of counter power from below that is capable of resisting the power that is exercised over people, whether that’s in the state or in corporations, and to start to build some alternatives.

The alternatives, I think, are the most exciting part of this. Because I think the big challenge that the left faces isn’t the people who think the system doesn’t work. Everyone knows the system doesn’t work. The challenge is that people can’t imagine a different world, and I think the reason they can’t imagine a different world is because we’re so focused on individualism. It’s always, what can I do? How can I change the world? You alone cannot go up against all these forces that are immensely powerful. But you, as part of the collective, can start to shift things. And in the book, there are all these examples that I look at of literally just communities who came together and said, we’re going to do things differently, and created massive change in their local area.

Robinson

Yes, you go from London to India, Australia, and Chile, and you look at and explain various experiments and how they have worked. And so, I think that one of the best parts of the book is part three. It’s possible to read this and think, “well, I am up against massive institutions that I can’t possibly fight.” You show that is not, in fact, true. That’s inspiring. And I think that people will come away from the book feeling a sense of determination.

Blakeley

I hope so. If they managed to make it to the end.

Robinson

I do encourage everyone who picks it up to stay through to part three if you feel yourself losing hope.

Blakeley

Start with part three, if you want.

Robinson

Nothing stops you from reading part three before you read part two.

Blakeley

Exactly.

Transcript edited by Patrick Farnsworth.