Bloomberg News | November 27, 2024 |

Credit: Envy Motors

A Singapore businessman who convinced investors to put a total of S$1.5 billion ($1.1 billion) into a nickel trading scheme channeled a third of that into his own accounts, prosecutors said at the start of his trial.

Ng Yu Zhi, a former accountant, faces 42 charges including fraud, forgery and money laundering. He’s accused of leading investors in his Envy Group to believe they could profit from physical nickel trades, thanks to his purchases of discounted metal from an Australian mine. In reality, the scheme was “pure fiction,” the prosecution said in an opening statement

In fact, no cheap nickel was purchased, so there was none to sell. There was no agreement with the mine, and no forward contracts for the sale of the metal, prosecutors said.

“The Envy companies paid earlier investors not with returns generated from physical nickel trading, but with the moneys invested by other investors,” they said.

Over a period of six years, Ng’s companies received money from a total of 947 investors, including many high-profile figures in the city state, misappropriating nearly S$482 million to fund his lavish lifestyle and extravagant purchases from art and jewelry to high-end cars.

Ng faces 108 charges, but only 42 will proceed, and he pleaded not guilty to those on Tuesday. The prosecution plans to call on evidence from 58 witnesses.

The nickel scam is the latest in a series of scandals in the financial and commodities-trading hub, now working to restore a reputation for good governance.

Earlier this month, former oil tycoon Lim Oon Kuin, 82, was handed a 17-and-half year jail sentence for cheating HSBC Holdings Plc and instigating forgery. In October, S. Iswaran became the first ex-cabinet minister to be jailed in almost half a century, after pleading guilty to charges including obstruction of justice.

(By Yihui Xie)

Reuters | November 28, 2024

The Syama gold complex in Mali. (Photo by Philip Mostert | Resolute Mining.)

Australia’s Resolute Mining said on Friday it paid a further $50 million to Mali as part of negotiations to settle a tax dispute for the release of its CEO and two other executives who were detained by the government earlier this month.

Shares of the miner rose as much as 7.2% before paring some gains to trade at 5.4% higher, as of 0002 GMT.

The miner’s top boss Terence Holohan and two other employees were released by Mali government, the company had said in a statement on Nov. 21.

The executives had gone to the capital city of Bamako to hold discussions with the mining and tax authorities regarding general activities related to the company’s business practices in Mali.

After negotiating with the West African nation’s government, Resolute had agreed to pay $160 million to resolve the tax dispute, with $80 million being already paid, the company said in a statement on Nov. 18.

The Perth-headquartered company expects to pay the remaining $30 million by the end of this year, it said.

Resolute also said that operations at its Syama mine had not incurred any problems and continued as usual.

Syama gold mine – one of the company’s two operational mines – contributed nearly two-thirds of its annual sales of 329,061 ounces (9.33 metric tons) in 2023.

Resolute owns an 80% stake in the project, while Mali’s government holds the rest.

(By Rajasik Mukherjee; Editing by Rashmi Aich)

Barrick Confirms Arrest of Four Malian Employees, Reaffirms Commitment to Resolution of Disputes

Toronto – Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX) today confirmed that four employees of its Loulo-Gounkoto mining complex had been charged and detained pending trial. While Barrick refutes these charges, it said it would continue to engage with the Malian government to find an amicable dispute settlement that would ensure the long-term sustainability of the complex.

President and chief executive Mark Bristow said that since September 30, the company had been actively seeking to finalize a Memorandum of Agreement that would guide Barrick’s partnership with the government in future, including the state’s share of the economic benefits generated by the complex and the legal framework under which this would be managed.

“Our attempts to find a mutually acceptable resolution have so far been unsuccessful, but we remain committed to engage with the government in order to resolve all the claims levied against the company and its employees and secure the early release of our unjustly imprisoned colleagues,” he said.

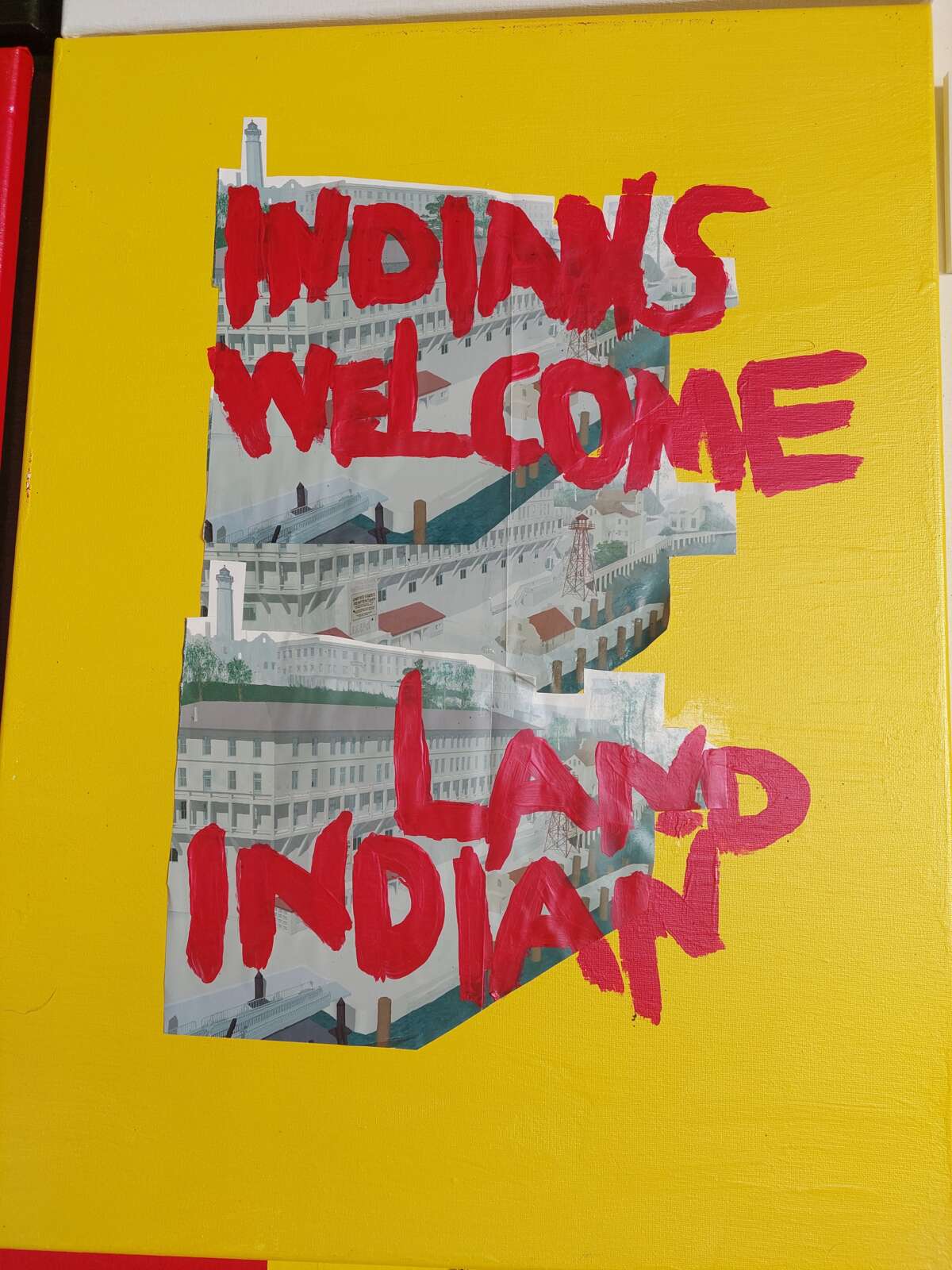

A collage featured in the Red Power on Alcatraz Perspectives 50 years Later exhibit.Johnnie Jae.

A collage featured in the Red Power on Alcatraz Perspectives 50 years Later exhibit.Johnnie Jae.

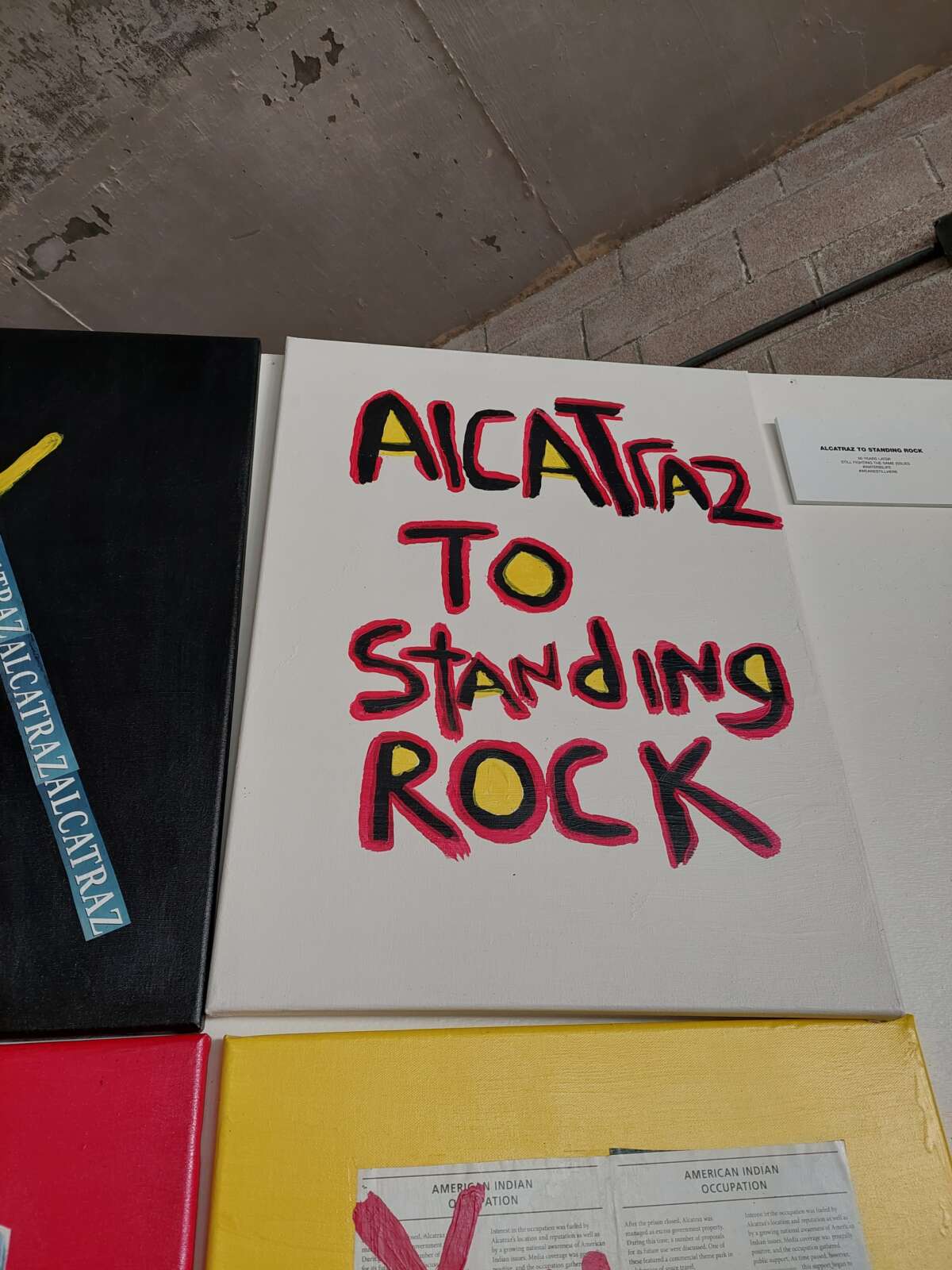

A sign reading From Alcatraz to Standing Rock is featured in the Red Power on Alcatraz Perspectives 50 years

A sign reading From Alcatraz to Standing Rock is featured in the Red Power on Alcatraz Perspectives 50 years