CRIMINAL CAPITALISM BANK ROBBERY

FinCEN Files: HSBC moved Ponzi scheme millions despite warning

HSBC allowed fraudsters to transfer millions of dollars around the world even after it had learned of their scam, leaked secret files show.

Britain's biggest bank moved the money through its US business to HSBC accounts in Hong Kong in 2013 and 2014.

Its role in the $80m (£62m) fraud is detailed in a leak of documents - banks' "suspicious activity reports" - that have been called the FinCEN Files.

HSBC says it has always met its legal duties on reporting such activity.

The files show the investment scam started soon after the bank was fined $1.9bn (£1.4bn) in the US over money laundering. It had promised to clamp down on these sorts of practices.

The scam was a Ponzi scheme - a notorious type of investment racket that pays existing stakeholders with money collected from new members.

Lawyers for duped investors say the bank should have acted sooner to close the fraudsters' accounts.

The documents leak includes a series of other revelations - such as the suggestion one of the biggest banks in the US may have helped a notorious mobster to move more than $1bn.

What are the FinCEN Files?

The FinCEN Files are a leak of 2,657 documents, at the heart of which are 2,100 suspicious activity reports, or SARs.

SARs are not evidence of wrongdoing - banks send them to the authorities if they suspect customers could be up to no good.

By law, they have to know who their clients are - it's not enough to file SARs and keep taking dirty money from clients while expecting enforcers to deal with the problem. If they have evidence of criminal activity, they should stop moving the cash.

The leak shows how money was laundered through some of the world's biggest banks and how criminals used anonymous British companies to hide their money.

The SARs were leaked to the Buzzfeed website and shared with the International Consortium of Investigative Journalists (ICIJ). Panorama led the research for the BBC as part of a global probe. The ICIJ led the reporting of the Panama Papers and Paradise Papers leaks - secret files detailing the offshore activities of the wealthy and the famous.

Fergus Shiel, from the consortium, said the FinCEN Files are an "insight into what banks know about the vast flows of dirty money across the globe… [The] system that is meant to regulate the flows of tainted money is broken".

The leaked SARs had been submitted to the US Financial Crimes Enforcement Network, or FinCEN between 2000 and 2017 and cover transactions worth about $2 trillion.

FinCEN said the leak could impact US national security, risk investigations, and threaten the safety of those who file the reports.

But last week it announced proposals to overhaul its anti-money laundering programmes.

The UK also unveiled plans to reform its register of company information to clamp down on fraud and money laundering.

- All you need to know about FinCEN documents leak

- HSBC shares dive to lowest since '95 after FinCEN revelations

What was the Ponzi scam?

FACEBOOK

FACEBOOKThe investment scam that HSBC was warned about was called WCM777. It was started by Chinese national Ming Xu. Little is known about how he came to be living in the US, although he claims to have studied for an MA in California.

Basing himself in the Los Angeles area, Xu - or "Dr Phil" as he styled himself - acted as a pastor at evangelical churches.

Xu said he was operating a global investment bank, World Capital Market, that would pay out 100% profit in a 100 days. In reality, he was running the WCM777 Ponzi scheme.

Through travelling seminars, Facebook and webinars on YouTube, it raised $80m selling supposed investment opportunities in cloud computing.

Thousands of people from the East Asian and Latino communities were taken in. The fraudsters used Christian imagery and targeted poor communities in the US, Colombia and Peru. There were also victims in other countries, including the UK.

But the impact were not just financial. The scheme led to the death of investor Reynaldo Pacheco, who was found under water on a wine estate in Napa, California, in April 2014. Police say he had been bludgeoned with rocks.

HANDOUT

HANDOUTHe signed up to the scheme and was expected to recruit other investors. The promise was everyone would get rich.

A woman Mr Pacheco, 44, introduced lost about $3,000. That led to the killing by men hired to kidnap him.

"He literally was trying to… make people's lives better, and he himself was scammed, and conned, and he unfortunately paid for it with his life," said Sgt Chris Pacheco (no relation), one of the officers who investigated the killing.

Reynaldo, he said, "was murdered for being a victim in a Ponzi scheme".

By then, regulators in California had already told HSBC it was investigating WCM777 - and alerted its residents to the fraud. This happened in September 2013

And California, along with Colorado and Massachusetts, took action against WCM for selling unregistered investments.

HSBC did spot suspicious transactions going through its systems. But it was not until April 2014, after US financial regulator the Securities and Exchange Commission filed charges, that the WCM777 accounts at HSBC in Hong Kong were shut.

By that time there was nearly nothing left in them.

What do the suspicious activity reports show?

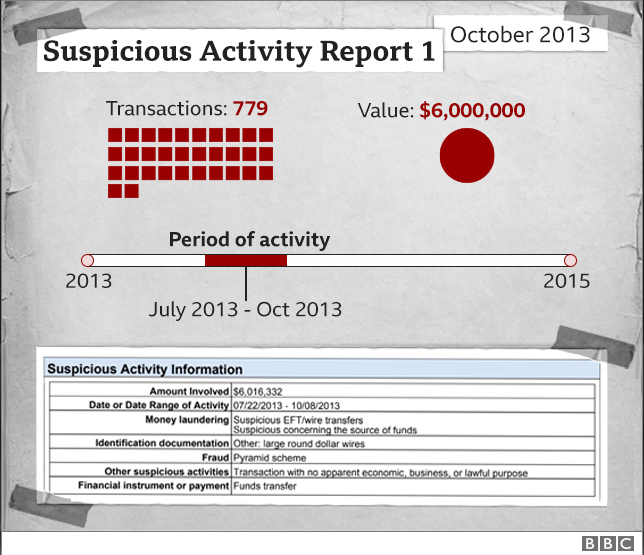

HSBC filed its first SAR about the scam on 29 October 2013 relating to more than $6m sent to the fraudsters' accounts in Hong Kong.

Bank officials said there was "no apparent economic, business, or lawful purpose" for the transactions - and noted allegations of "Ponzi scheme activities".

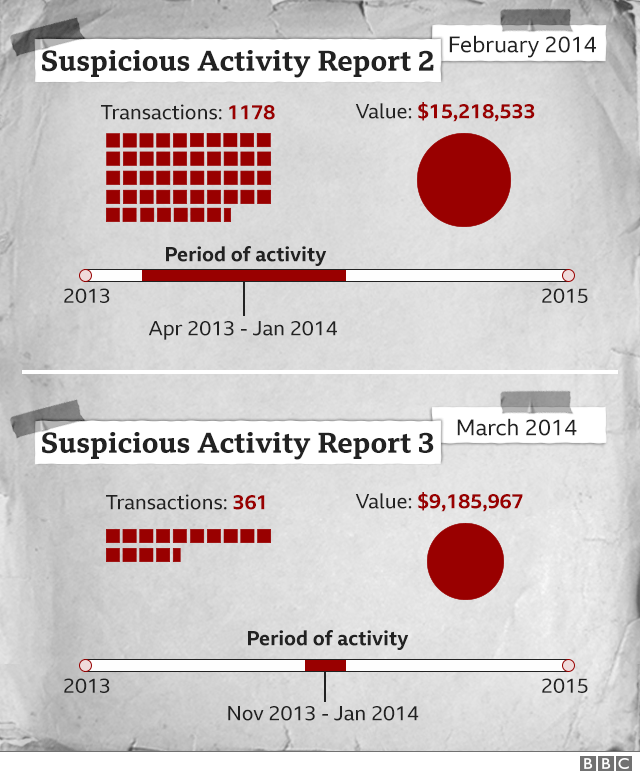

A second SAR in February 2014 identified $15.4m in suspicious transactions, and a "Potential Ponzi scheme".

A third report in March related to a company associated with WCM777 and nearly $9.2m, and noted the regulatory moves by US states and an investigation ordered by Colombia's president.

What did HSBC do?

The WCM777 scheme emerged months after HSBC avoided a US criminal prosecution over money laundering by Mexican drug barons. It did so by agreeing to improve procedures.

Analysis by the ICIJ shows that between 2011 and 2017 HSBC identified suspicious transactions moving through accounts in Hong Kong of more than $1.5bn - about $900m linked to overall criminal activity.

But the reports failed to include key facts about customers, including the ultimate beneficial owners of accounts and where the money came from.

Banks are not allowed to talk about suspicious activity reports.

HSBC said: "Starting in 2012, HSBC embarked on a multi-year journey to overhaul its ability to combat financial crime across more than 60 jurisdictions… HSBC is a much safer institution than it was in 2012."

The bank added the US authorities had determined that it "met all of its obligations under the [agreement struck with US prosecutors]".

Xu was eventually arrested by the Chinese authorities in 2017 and jailed for three years over the scam.

Speaking to the ICIJ from China, Xu said HSBC had not contacted him about his business. He denied WCM777 was a Ponzi scheme, saying it was wrongly targeted by the SEC and his aim had been to build a religious community in California on more than 400 acres of land.

What is a Ponzi scheme?

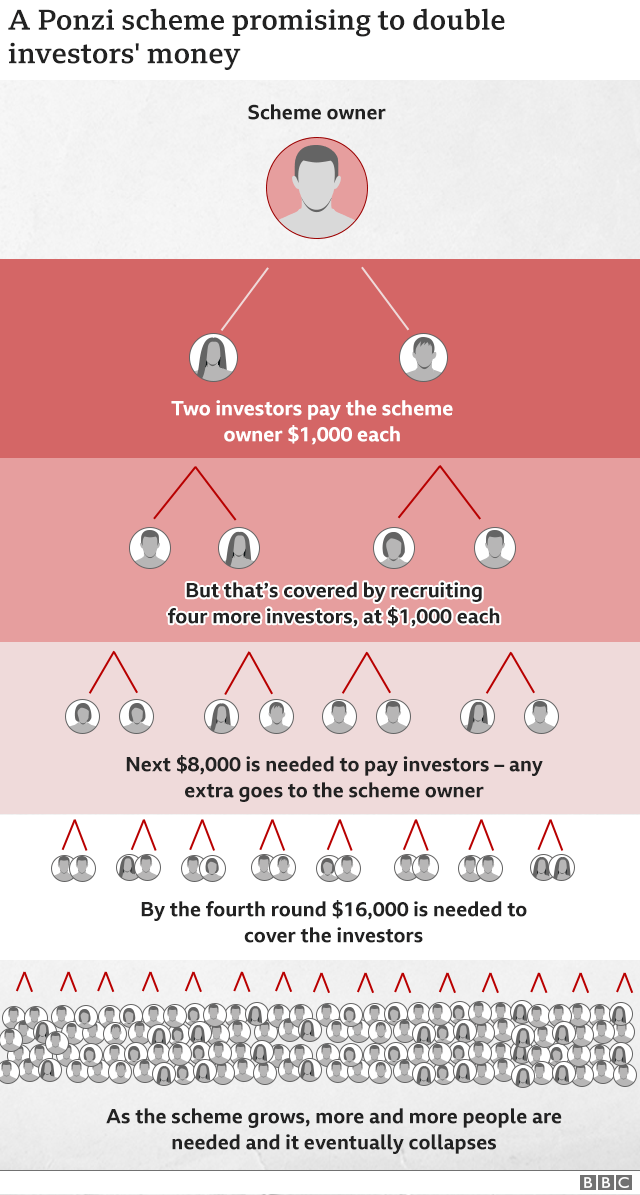

A Ponzi scheme - named after early 20th Century conman Charles Ponzi - does not generate profits from the cash it raises. Instead investors are paid a return from money coming in from other new investors.

More and more investors are needed to cover these payments. Meanwhile, the owners of the scheme move money into their own accounts.

A Ponzi scheme will collapse if it cannot find enough new investors.

What else did the leak find?

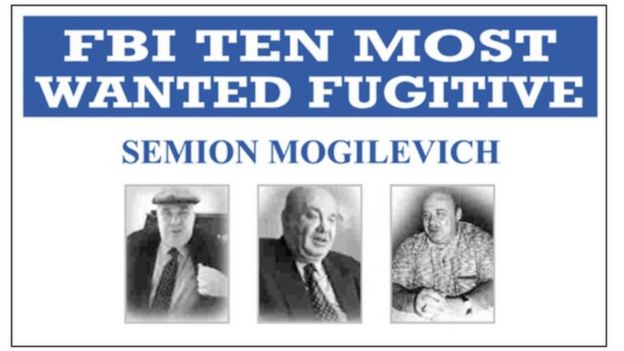

The FinCEN Files also show how multinational bank JP Morgan may have helped a man known as the Russian mafia's boss of bosses to move more than a $1bn through the financial system.

Semion Mogilevich has been accused of crimes including gun running, drug trafficking and murder.

FBI

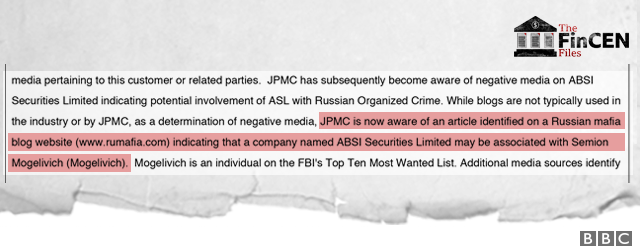

FBIBanks have measures in place to stop profits from crime going through the financial system but a SAR filed by JP Morgan in 2015 after the account was closed, reveals how its London office may have moved some of the cash.

It details how JP Morgan, provided banking services to a secretive offshore company called ABSI Enterprises between 2002 and 2013, even though the firm's ownership was not clear from the bank's records.

Over one five-year period, JP Morgan sent and received wire transfers totalling $1.02bn, the bank said.

The SAR noted ABSI's parent company "might be associated with Semion Mogilevich - an individual who was on the FBI's top 10 most wanted list".

In a statement, JP Morgan said: "We follow all laws and regulations in support of the government's work to combat financial crimes. We devote thousands of people and hundreds of millions of dollars to this important work."

The FinCEN Files is a leak of secret documents which reveal how major banks have allowed criminals to move dirty money around the world. They also show how the UK is often the weak link in the financial system and how London is awash with Russian cash.

The files were obtained by BuzzFeed News which shared them with the International Consortium of Investigative Journalists (ICIJ) and 400 journalists around the world. Panorama has led research for the BBC.

FinCEN Files: full coverage; follow reaction on Twitter using #FinCENFiles; in the BBC News app, follow the tag "FinCEN Files; Watch Panorama on the BBC iPlayer (UK viewers only).

The 11 most important things in the leaked FinCEN files, which exposed $2 trillion in suspicious transactions and are roiling the world of finance

Leaked documents from the Financial Crimes Enforcement Network were shared with news outlets.

They showed that big banks had for years engaged with dirty money with little oversight.

Banks named in the documents included JPMorgan Chase, HSBC, Barclays, and Deutsche Bank.

Here are some of the biggest takeaways from the scandal.

Visit Business Insider's homepage for more stories.

Thousands of leaked documents shared with journalists have shown how some of the world's biggest banks for years facilitated the movement of dirty money.

The documents, part of a collection of files belonging to the Financial Crimes Enforcement Network, were published on Sunday by BuzzFeed News and the International Consortium of Investigative Journalists.

FinCEN is in charge of compiling "suspicious-activity reports" sent to it by banks that suspect financial wrongdoing by their clients. SARs do not constitute evidence of wrongdoing but are a way to alert regulators and law enforcement.

The documents are shared with law-enforcement and financial-intelligence groups around the world. The agency does not require banks to stop dealing with clients who prompted SARs.

The BuzzFeed News and ICIJ said the documents showed that banks including JPMorgan Chase, HSBC, and Deutsche Bank engaged with and facilitated the movement of criminal money even after raising suspicions.

The files detailed movements and transactions over almost two decades, from 1999 into 2017.

Many of the banks named in the report have responded in statements to BuzzFeed News.

Here are some of the biggest revelations to come out of the bombshell report:

5 banks processed more suspicious money than anyone else in the leak

The names of five big banks came up more than any others in the documents.

Of the $2 trillion in suspicious transactions, $1.2 trillion moved through Deutsche Bank.

Nearly all the rest was processed by JPMorgan, Standard Chartered, Bank of New York Mellon, and Barclays.

Several other banks, including Société Générale, HSBC, State Street Corporation, Commerzbank AG, and China Investment Corporation, also processed billions.

European bank shares — already under pressure from a resurgence of the coronavirus — have tumbled since the report was published.

Barclays shares were last down 5.4% on London's FTSE 100 index, at their lowest since late April, while Deutsche Bank shares were down nearly 9% in Frankfurt, at their weakest since late May.

The leaked documents represented 0.02% of total SARs

Reporters saw more than 2,100 leaked SARs — but this is just the tip of the iceberg.

According to the ICIJ, more than 12 million SARs were filed with FinCEN from 2011 to 2017, meaning those in the leak represented about 0.02% of the total.

HSBC moved money for the WCM777 Ponzi scheme that victimized thousands

The files show that HSBC allowed fraudsters involved with WCM777, an $80 million Ponzi scheme, to move money around the world, the BBC reported.

In 2013 and 2014, the bank moved fraudsters' money from the US to Hong Kong, despite having promised to clamp down on money laundering, the outlet reported.

In 2012, after a US Senate investigation, the bank was fined a record $1.9 billion for its role in channeling cash for what the investigators called "drug kingpins and rogue nations," the BBC reported at the time.

But the following year, fraudsters working with WCM777 were able to move more than $15 million through HSBC, despite warnings that it was a scam, the leaked documents show.

At the time of the notice, WCM777 was barred from conducting business in three states.

The Ponzi scheme targeted poor communities in various nations and victimized thousands of Asian and Latino immigrants, according to the BBC and BuzzFeed News.

HSBC told the BBC it has always followed its legal duty in reporting such activities.

Read the full report from the BBC here.

Banks processed millions for the family of a Kazakh politician wanted by Interpol

The documents showed that JPMorgan Chase, along with Bank of America, Citibank, American Express, and others processed millions in transactions linked to a Kazakh politician wanted by Interpol, BuzzFeed News reported.

The family of Viktor Khrapunov, a former mayor of Almaty, Kazakhstan, used JPMorgan Chase to handle millions of dollars in transactions, even after Interpol issued a so-called red notice, the outlet said.

At the time of the transactions, Khrapunov and his wife stood accused of money laundering, fraud, and the creation of an organized crime group, according to Newsweek.

They were convicted in absentia, having fled to Switzerland. They described the charges as politically motivated, BuzzFeed News reported.

Arkady Rotenberg, a Putin associate, may have used Barclays to launder money and evade sanctions

The documents suggested that a close associate of Russian President Vladimir Putin's may have used the UK-based Barclays Bank to avoid sanctions and launder money, the BBC reported.

Arkady Rotenberg, a childhood friend of Putin's, is among several associates who were put under European Union and US sanctions following Russia's annexation of Crimea in 2014, the BBC reported. The sanctions were meant to restrict Rotenberg from conducting business with Western banks.

But companies controlled by Rotenberg appeared in numerous SARs in the leak, according to the BBC.

From 2012 to 2016, a company named Advantage Alliance moved about $77 million through HSBC; the US Senate has said there is strong evidence that the company is owned by Rotenberg. A Senate investigation found that the company was making secretive art purchases using its Barclays account to evade the sanctions, the BBC reported.

Barclays closed Advantage Alliance's account in 2016, but leaked SARs showed that the bank continued to deal with numerous other companies thought to be owned by Rotenberg until 2017, the BBC reported.

Barclays denied any wrongdoing.

Read the full report from the BBC here.

$142 million of suspected Iranian money was processed via the UAE

US prosecutors have alleged that Gunes General Trading, based in Dubai, was used to funnel Iranian state money via the United Arab Emirates and evade international sanctions, according to the BBC.

In 2011 and 2012, the documents showed, the UAE's central banking system processed $142 million in transactions for the company, despite them being labeled as suspicious, the BBC said.

A New York branch of Standard Chartered Bank noted hundreds of suspicious transactions from the company and flagged them to the UAE's central bank but did not mention an Iran connection, the BBC reported.

While the UAE's central bank said it alerted law enforcement and closed the accounts, Gunes General Trading used other state-owned banks to funnel another $108 million in transactions until September 2012, the BBC reported.

In 2016, the US said the company was involved in a major sanctions-evasion scheme. It has wound up within the past two years, the BBC reported.

The Central Bank of the UAE did not respond to the BBC's request for comment.

Read the full report here.

A major donor to the UK's ruling Conservative Party was linked to the Kremlin

The husband of a major donor to UK Prime Minister Boris Johnson's Conservative Party has received money from a Putin-linked millionaire who is under US sanctions, the leaked documents showed.

The files showed that Vladimir Chernukhin, the husband of Lubov Chernukhin — who has given almost $2.2 million to the Conservative Party — was given $7.8 million by an offshore company that could be traced back to a Russian politician and oligarch named Suleyman Kerimov.

Kerimov was one of several oligarchs named in a 2018 report by the US Treasury Department discussing "malign" Russian activity. The Treasury report said he was accused of laundering money and leaving taxes unpaid in Europe.

Lubov Chernukhin has spent time in the company of three prime ministers — and she once paid $205,000 to play tennis with Johnson, according to the BBC.

North Korea laundered money using a string of shell companies and US banks

The leaked documents suggested that despite international sanctions blocking North Korea's access to the global financial system, it has laundered more than $174.8 million, NBC News reported.

The documents show that transactions flagged as suspicious from about 2008 to 2017 were cleared through US banks including JPMorgan Chase and Bank of New York Mellon, NBC News said.

North Korean wire transfers flagged in the SARs were often facilitated by Chinese and shell companies, NBC News reported.

Experts told NBC News that the transactions showed all the hallmarks of money laundering.

Read the full report here.

Banks flagged Paul Manafort's activity as suspicious years before he was arrested

Bank transactions linked to Paul Manafort, President Donald Trump's former strategist who was convicted of fraud in 2018, were flagged as suspicious six years earlier, in 2012, the ICIJ reported.

More than $50 million in payments to Manafort processed by JPMorgan Chase over 10 years attracted SARs, according to the ICIJ.

The report said the bank processed $6.9 million in transactions after Manafort resigned from Trump's campaign.

Manafort is serving a seven-year sentence for tax fraud, bank fraud, and failure to report foreign bank accounts.

Deutsche Bank managers knew more than they claimed about an infamous trading scandal

2017's mirror-trading scandal — a $10 billion money-laundering scheme involving crime bosses, drug cartels, and terrorist networks — saw Deutsche Bank pay a fine and blame middle managers in its Moscow offices.

But the leaked SARs showed that awareness of the issues at the heart of the scandal went far higher in the company, BuzzFeed News reported.

According to BuzzFeed News, warnings of serious failings at the company were sent to the bank's chair and its supervisory board.

Bank of America was so concerned that it submitted a SAR about Deutsche Bank's dealings — and then its managers were asked to leave Deutsche Bank's building when they attempted to discuss the matter in London, BuzzFeed News reported.

Christian Sewing, now Deutsche Bank's CEO, ran the audit office overseeing the bank's Moscow dealings, but he gave the office the all-clear, BuzzFeed News reported.

Deutsche Bank told BuzzFeed News that Sewing was not personally involved in the Moscow audit.

Read the full story here.

Financial regulators catch only a small fraction of the activity behind dirty money

The FinCEN leak includes 2,100 SARs, but they're a fraction of what's out there.

Banks often don't know or don't follow up on their inquiries about the ultimate owners of the accounts they process, the ICIJ reported.

David Lewis, executive secretary of an anti-money-laundering group called the Financial Action Task Force, told the ICIJ that compliance was more often about going through the motions than taking real action.

"Everybody is doing badly," Lewis said.

A 2011 report by the United Nations Office on Drugs and Crime estimated that less than 1% of global illicit financial flows were seized and frozen.

Read the full story here.

No comments:

Post a Comment