Traders Betting on Hawkish Shift by Colombia Face Reality Check

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Colombia’s central bank is stymieing derivative traders betting on faster-than-anticipated interest-rate hikes and creating obstacles for those bullish on the peso.

The unanimity of the central bank’s decision this week to keep rates unchanged spurred an unwinding of bets that Colombia would join Brazil, Mexico and other nations that are pulling back stimulus to curb inflation as their economies begin rebounding from the pandemic.

While the market was far from pricing in a rate increase at the Monday meeting, the peso rallied ahead of it on speculation Colombia could follow in the footsteps of Mexico’s surprise hike last week.

But the resounding decision to instead stand pat has given investors a strong incentive to shift cash elsewhere to seize on higher rates, adding another potential headwind to a currency that has been weighed down this year by political protests and economic uncertainty. Rate futures now show roughly even odds that the bank will hold steady again at the next meeting on July 30, and the peso has slid some 1.6% against the U.S. dollar since the decision.

“A more hawkish central bank of Colombia was an important driver for short-term tactical bullishness” for the peso, said Jens Nystedt, a fund manager in New York at Emso Asset Management, whose firm oversees $6.8 billion. But what this week’s meeting “signals quite clearly here is that they’re not going to be hiking anytime soon. That catalyst is not going to be there.”

Nystedt said the peso may strengthen on the back of oil prices in the medium term. But he said the bank’s stance means that any near-term advance in the currency will hinge on credit-rating moves and whether President Ivan Duque Marquez has success in reviving fiscal reforms to shore up the government’s finances.

Speculation that the bank would start lifting its key benchmark from a record low of 1.75% was spurred in part by figures showing that inflation accelerated, even though that was partly attributed to supply-chain issues caused by nationwide demonstrations and unrest set off by Duque’s ill-fated attempt to raise taxes. On June 25, the day after Mexico’s hike, part of the Colombian swap-rate curve saw its biggest daily swing in more than a year, only to reverse that after the bank held steady.

Futures markets are now pricing in an approximately 50% chance of a 25 basis-point-hike in July and that the bank’s key rate will be at 2.29% in three months, less than the 2.41% predicted ahead of Monday’s meeting.

As in other countries, Colombia policymakers see some of the uptick in inflation as the result of temporary factors caused by the emergence from the Covid-19 lockdowns. And while inflation went from 1.5% year-over-year in December to 3.3% in May, it’s still well within the bank’s target range.

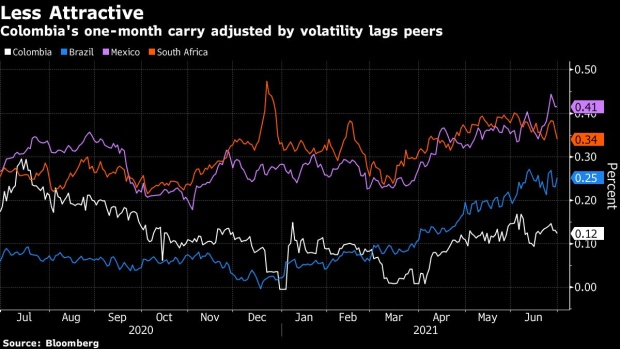

Even if investors agree that the central bank has time to tighten monetary policy, the country’s currency could still underperform those from counties such as as Brazil, Mexico and South Africa where similar recoveries are underway and interest rates are higher. The annual yield an investor receives to carry a long Colombian peso position for one month adjusted by currency volatility is only 0.12%, half what traders get in the Brazilian real and less than a third of the cushion offered by the Mexican peso, which drastically impacts the attractiveness of the Andean currency.

There’s also the risk of more downgrades to Colombia’s foreign-currency bonds, which were cut to junk by S&P Global Ratings in May. Late Thursday, Fitch Ratings followed suit, dropping the debt to one step below investment grade.

“The central bank of Colombia is facing a less challenging inflation outlook in the near term so they have more room to wait than the other countries, like Brazil and Mexico,” said Mauro Roca, managing director of emerging markets at TCW Group Inc. in Los Angeles.

“Colombian rates don’t look the most attractive in a relative basis in the moment,” he said. “There’s still important political noise and that may affect the prospect of tax reform, which may also impact local assets.”

©2021 Bloomberg L.P.

No comments:

Post a Comment