Tokyo gets helpful shove from unhelpful

war

HONG KONG, March 21 (Reuters Breakingviews) - The Japanese economy is feeling the fallout from the Russian invasion of Ukraine. But although rising import costs will sting, Prime Minister Fumio Kishida is making good use of the crisis so far.

Japan, the world’s fifth-largest energy consumer in 2019, relies heavily on fossil fuels, a condition exacerbated by its decision to turn off most of its nuclear reactors after a tsunami caused a meltdown in 2011. That forced a pivot to natural gas, which together with coal and oil comprise nearly 90% of energy consumption. With supply constricted, Japanese buyers are now on the receiving end of skyrocketing import prices just when their economy was starting to turn a corner, a vulnerability exacerbated by sharp currency depreciation. The yen is now trading around 119 per dollar, a level not seen since 2016.

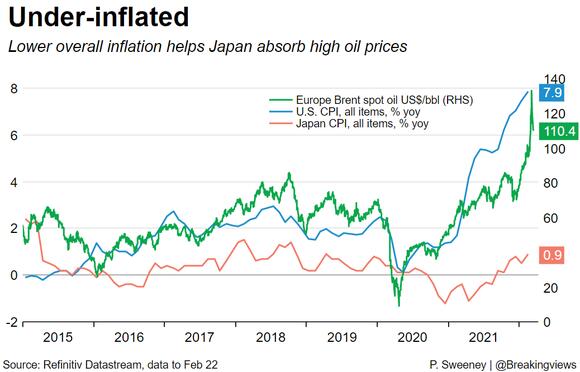

Yet while official data showed energy prices popped 20.5% in February, overall consumer price inflation was a tepid 0.9% year-on-year. In fact Japan, by dint of its aging society and investments in efficiency, has become less energy-intense when it comes to driving growth, which is forecast to hit nearly 3% in the current fiscal year. It won’t feel a serious pinch from oil until prices exceed $150 per barrel, according to an analysis by HSBC. Equity investors aren’t panicking; the Topix index is down only 4% in 2022.

As for the loss of the Russian market, the hit to roughly $8 billion worth of annual exports is manageable. Those consumers are a nice-to-have for brands like Uniqlo, but currency sanctions have made it a liability. Japanese bank exposure to Russia is less than $10 billion, per an analysis by CLSA.

The natural gas crunch will accelerate Kishida’s push to re-open the country’s mothballed nuclear plants. That will alleviate the country’s dependence on imports and help it hit its carbon neutral target by 2050.

This crisis has also given the government cover to start easing Covid-19 lockdown measures

and reopen borders to tourism, which could ease the impact if foreign demand for Japanese exports plummets. Next might come more moves to upgrade the country’s defense industry’s innovation and export competitiveness.

No matter how the war turns out, Japan still faces serious challenges: economic, demographic and now, military. The tragedy in Ukraine can prod Tokyo to focus on solving them.

Follow @petesweeneypro on Twitter

CONTEXT NEWS

- Japan's core consumer prices, which exclude energy and fresh food, rose 0.6% in February, the fastest annual pace in two years, the government reported March 18. The reading would follow a 0.2% increase in January and mark the highest since February 2020.

- The crisis in Ukraine could hurt Japan's economy by driving up the price households and companies pay for fuel and commodities, Bank of Japan board member Junko Nakagawa said on March 3. "While energy and food prices may rise, such moves could weigh on Japan's economy if they hurt corporate profits and household income," he said. The country will not adjust its monetary policy or stimulus plans despite expectations of rising inflation.

- Japan said on March 16 that it will lift Covid-19 restrictions imposed on Tokyo and 17 other prefectures as a wave of infections caused by the Omicron variant ebbs.

Editing by Robyn Mak and Katrina Hamlin

No comments:

Post a Comment