Cobalt’s battery-powered boom has turned to bust

Bloomberg News | February 9, 2023 |

Credit: Missouri Cobalt

A blistering rally in the cobalt market is turning into a rout, putting pressure on miners and offering tentative cost relief for carmakers after a surge in battery metal prices last year.

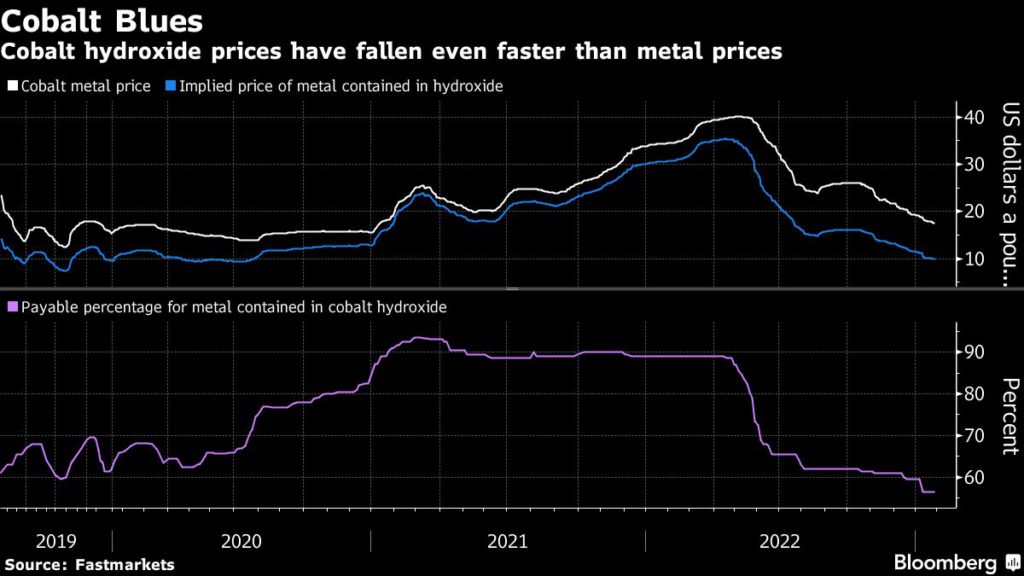

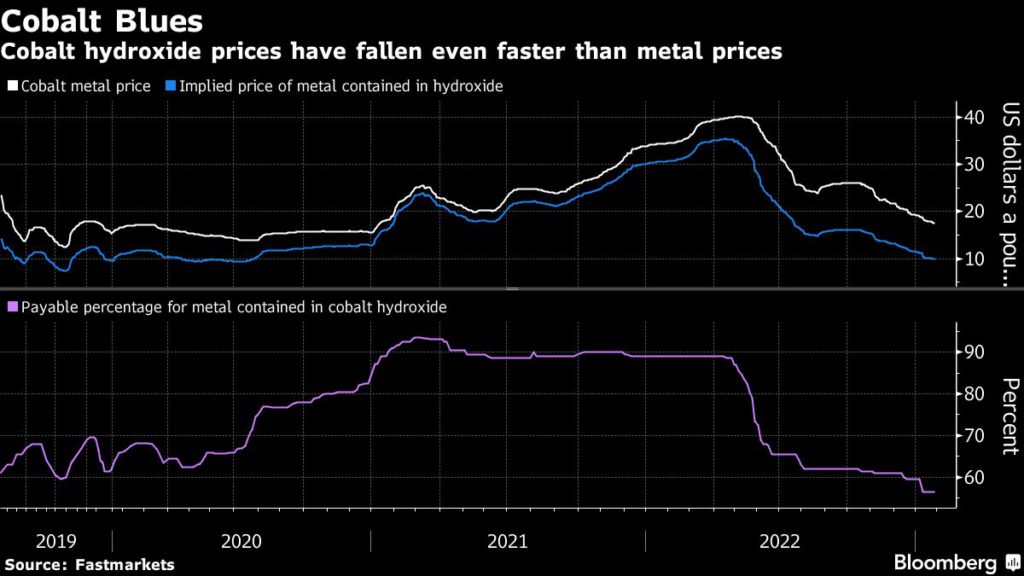

Cobalt rallied sharply early in 2022 as demand for electric vehicles surged. But while automotive usage is still rising, there’s been a sharp drop-off in buying from another key sector — Chinese electronics — and cobalt prices have crashed more than 50% since a peak in May.

Pound for pound, the batteries used in laptops, phones and tablets contain much more cobalt than EV batteries, and demand from the industry has fallen about 30% to 40% over the past year, according to researcher Rystad Energy. At the same time, demand growth for use in EVs is moderating as more manufacturers shift to battery chemistries that don’t require cobalt.

For carmakers, cobalt’s boom-to-bust swing will have a minor impact on the cost of batteries, when compared with other materials like lithium, which is used in much greater volumes and is still trading at sky-high levels. Yet the collapse offers a stark illustration of how quickly the balance between buyers and sellers can shift in the small but rapidly expanding markets for battery metals.

“The distinction between cobalt and lithium is that carmakers are very eager to get hold of lithium, while they’re doing everything they can to get rid of cobalt,” Michael Widmer, head of metals research at Bank of America Corp., said by phone. “The individual dynamics are very different, but where we’ve seen commonality in the battery metals markets is in the fact that massive rallies can quickly be followed by massive declines.”

The pressure is particularly evident for producers of cobalt hydroxide, a semi-refined product that accounts for the bulk of global supply. It typically trades at a discount to the pure metal, but the gap has widened dramatically in recent months — in some cases, miners are only getting paid for a little more than half of the cobalt contained in the hydroxide they sell, down from about 90% a year ago.

The crash has also been amplified by changes in the way that cobalt is priced. Until 2018, top producer Glencore Plc typically priced its hydroxide at a fixed discount to metal under annual contracts, but some customers looked to back out of the deals after a wave of new supply caused discounts to widen dramatically in the spot market, according to people familiar with the deals.

Glencore has since been pricing much more of its material with a floating reference to the prevailing discounts in the spot market, in a move that’s likely to reduce the risk that buyers will look to walk away from unprofitable contracts this time around. However, it’s also amplified the miner’s exposure to the slump in prices and demand.

Under some contracts, Glencore has been selling cobalt hydroxide at its steepest-ever discount to the price of the finished metal, according to people familiar with the matter. While the slump is unlikely to be much of a concern at a time when Glencore is reaping huge profits elsewhere, the prices it’s receiving for hydroxide are now approaching a nadir seen in 2019, when its trading business took a $350 million first-half loss on cobalt that was mined, but it couldn’t sell.

The challenges that have come with cobalt’s wild swings are emblematic of broader commercial growing pains being experienced by miners, consumers and financiers in the markets for battery metals. Unlike much larger commodity markets like copper and oil, cobalt has been nearly impossible to hedge in large volumes until recently, and so the gyrations seen in the past few years have been particularly painful for carmakers on the way up, and for miners on the way down.

This time, though, buyers and sellers have been flocking to a CME Group cobalt contract to hedge their exposure, setting the stage for a potentially seismic shift in the way the industry manages its price risks.

Lithium trading has also been picking up on the exchange, and while volumes are still tiny in relation to global supply, advocates say the contracts will have an increasingly large role to play as the electric vehicle industry expands rapidly.

“It’s going to be very important to get the contracts up and running,” said Widmer at Bank of America, which has been making markets for clients who want to trade the CME contracts. “Given the price volatility we have in these markets, risk management tools like this are going to be increasingly helpful.”

(By Thomas Biesheuvel and Mark Burton)

Bloomberg News | February 9, 2023 |

Credit: Missouri Cobalt

A blistering rally in the cobalt market is turning into a rout, putting pressure on miners and offering tentative cost relief for carmakers after a surge in battery metal prices last year.

Cobalt rallied sharply early in 2022 as demand for electric vehicles surged. But while automotive usage is still rising, there’s been a sharp drop-off in buying from another key sector — Chinese electronics — and cobalt prices have crashed more than 50% since a peak in May.

Pound for pound, the batteries used in laptops, phones and tablets contain much more cobalt than EV batteries, and demand from the industry has fallen about 30% to 40% over the past year, according to researcher Rystad Energy. At the same time, demand growth for use in EVs is moderating as more manufacturers shift to battery chemistries that don’t require cobalt.

For carmakers, cobalt’s boom-to-bust swing will have a minor impact on the cost of batteries, when compared with other materials like lithium, which is used in much greater volumes and is still trading at sky-high levels. Yet the collapse offers a stark illustration of how quickly the balance between buyers and sellers can shift in the small but rapidly expanding markets for battery metals.

“The distinction between cobalt and lithium is that carmakers are very eager to get hold of lithium, while they’re doing everything they can to get rid of cobalt,” Michael Widmer, head of metals research at Bank of America Corp., said by phone. “The individual dynamics are very different, but where we’ve seen commonality in the battery metals markets is in the fact that massive rallies can quickly be followed by massive declines.”

The pressure is particularly evident for producers of cobalt hydroxide, a semi-refined product that accounts for the bulk of global supply. It typically trades at a discount to the pure metal, but the gap has widened dramatically in recent months — in some cases, miners are only getting paid for a little more than half of the cobalt contained in the hydroxide they sell, down from about 90% a year ago.

The crash has also been amplified by changes in the way that cobalt is priced. Until 2018, top producer Glencore Plc typically priced its hydroxide at a fixed discount to metal under annual contracts, but some customers looked to back out of the deals after a wave of new supply caused discounts to widen dramatically in the spot market, according to people familiar with the deals.

Glencore has since been pricing much more of its material with a floating reference to the prevailing discounts in the spot market, in a move that’s likely to reduce the risk that buyers will look to walk away from unprofitable contracts this time around. However, it’s also amplified the miner’s exposure to the slump in prices and demand.

Under some contracts, Glencore has been selling cobalt hydroxide at its steepest-ever discount to the price of the finished metal, according to people familiar with the matter. While the slump is unlikely to be much of a concern at a time when Glencore is reaping huge profits elsewhere, the prices it’s receiving for hydroxide are now approaching a nadir seen in 2019, when its trading business took a $350 million first-half loss on cobalt that was mined, but it couldn’t sell.

The challenges that have come with cobalt’s wild swings are emblematic of broader commercial growing pains being experienced by miners, consumers and financiers in the markets for battery metals. Unlike much larger commodity markets like copper and oil, cobalt has been nearly impossible to hedge in large volumes until recently, and so the gyrations seen in the past few years have been particularly painful for carmakers on the way up, and for miners on the way down.

This time, though, buyers and sellers have been flocking to a CME Group cobalt contract to hedge their exposure, setting the stage for a potentially seismic shift in the way the industry manages its price risks.

Lithium trading has also been picking up on the exchange, and while volumes are still tiny in relation to global supply, advocates say the contracts will have an increasingly large role to play as the electric vehicle industry expands rapidly.

“It’s going to be very important to get the contracts up and running,” said Widmer at Bank of America, which has been making markets for clients who want to trade the CME contracts. “Given the price volatility we have in these markets, risk management tools like this are going to be increasingly helpful.”

(By Thomas Biesheuvel and Mark Burton)

Bloomberg News | February 8, 2023

Cobalt mining in the Democratic Republic of the Congo. (Image by Fairphone, Flickr).

Cobalt buyers must push for changes to formalize operations of unregulated artisanal mines in the Democratic Republic of Congo as they are indispensable in meeting rising demand for the battery metal used electric vehicles and consumer electronics, according to a new report.

Companies that buy cobalt engage in a “futile” exercise when they try to distinguish flows from industrial mines and the significant production from artisanal small-scale mining, or ASM, said a paper published Wednesday by the Geneva Center for Business and Human Rights and the NYU Stern Center for Business and Human Rights.

“Without ASM cobalt, buyers will not be able to meet a global demand that is projected to increase fourfold by 2030,” said Dorothee Baumann-Pauly, director of the Geneva Center and author of the paper.

Congo accounts for nearly 70% of global cobalt supply, which is mainly produced at industrial projects controlled by multinational companies including Glencore Plc and CMOC Group Ltd. But ASM material can make up nearly 20% of Congo’s output when prices are high, according to Darton Commodities. Formalization of ASM practices would help address the root causes of human rights abuses, alleviate extreme poverty in workers’ communities and improve site-safety standards, the paper said.

“It is imperative that companies recognize this opportunity to encourage formalization and the responsible extraction of cobalt to contribute to a global energy transition that is not only green but also just,” Baumann-Pauly said.

The report looked at the results of a pilot project working with artisanal diggers at Mutoshi mine in southeastern Congo from 2018-2020. The initiative was run by Trafigura Group, Congolese miner Chemaf Sarl, the NGO Pact, and a local mining cooperative.

Mutoshi demonstrated how formalization can improve miner safety, encourage female participation and diminish child labor, according to the report, which also said that many practices put in place are no longer being observed and conditions have worsened.

Trafigura and Chemaf shut down the project amid fallout from Covid-19 and Congo’s decision to create a state-owned artisanal cobalt monopoly, though they continue working together through Chemaf’s industrial mining operations in Congo. Chemaf didn’t respond to an emailed request for comment. Trafigura helped fund Congo’s proposed monopoly, known as Entreprise Generale du Cobalt. The project is on hold as the government decides how to structure the company.

“We remain a strong advocate for the formalization of the ASM cobalt sector in the DRC and look forward supporting the government and other committed stakeholders such as major downstream brands in taking formalization to scale,” James Nicholson, Trafigura’s head of social responsibility, said in an email.

(By Richard Annerquaye Abbey, with assistance from Michael J. Kavanagh)

Microsoft calls for ‘coalition’ to improve Congo’s informal cobalt mines

Reuters | February 8, 2023 |

Congo accounts for three-quarters of the world’s mined cobalt supply. (Stock Image)

Microsoft visited an artisanal cobalt mine in Democratic Republic of Congo in December as part of attempts to jump-start formalization of the little-regulated and dangerous industry that experts say is key to meeting global demand for the battery material.

Congo accounts for three-quarters of the world’s mined cobalt supply. Industrial mines produce most of Congo’s cobalt, but “artisanal” miners, who dig by hand and often die when tunnels cave in, account for up to 30% of production, though that fluctuates depending on price.

In the first known visit by a Microsoft executive to an artisanal cobalt site in Congo, chief of staff for tech and corporate responsibility Michele Burlington met miners at Mutoshi, where commodities trader Trafigura had helped run a formalization scheme that ended in 2020.

Companies that use cobalt in products from electric cars to smartphones should work to improve conditions at artisanal mines instead of seeking to cut artisanal cobalt out of their supply chains, an independent report on the visit argued on Wednesday.

“Electric vehicle manufacturers and electronics companies are operating with one eye open and one eye closed,” said Dorothee Baumann Pauly, director of the Geneva Center for Business and Human Rights, who wrote the report.

“In practice it is virtually impossible for them to completely exclude artisanal cobalt, especially when it is sent to smelters and refiners in DRC and China.”

Microsoft declined to reply to Reuters‘ questions about the visit or about its strategy on artisanal cobalt. In the report, Microsoft said that it is “committed to responsible and ethical sourcing”.

“We are continuing to work on this problem. It’s an issue that will take a coalition to solve,” the $1.9 trillion computer manufacturer and software company said.

As consumers become more concerned that the products they buy are tainted by poor working conditions or child labour, global tech firms and carmakers have been using less mined cobalt in their batteries by increasing recycling and switching to lower-cobalt chemistries. Read full story

Apple, for example, aims to massively reduce its use of all materials sourced directly from mines, and has said that 13% of the cobalt shipped in its products in 2021 came from recycling.

The issues around artisanal mining are an existential threat to the cobalt industry, according to Marina Demidova, head of communications at the Cobalt Institute. “If we get this wrong, cobalt probably will cease to be in batteries in 20 years’ time.”

So far, attempts to formalize the industry have fallen flat.

Trafigura and Congo mining firm Chemaf’s formalization scheme at Mutoshi, launched in 2018, ended abruptly in March 2020 with the coronavirus pandemic. Now diggers work in deep tunnels with no personal protective equipment, and women miners said they make less money than before, according to the report.

Entreprise Generale du Cobalt, a unit of state mining company Gecamines, was granted a monopoly on artisanal cobalt by government decree. EGC signed a supply deal with Trafigura in November 2020 and published a sourcing standard, but has yet to start buying cobalt due to political wrangling.

“Greater stakeholder engagement, including from global buyers, will help to overcome this impasse,” Baumann-Pauly said.

(By Helen Reid and Clara Denina; Editing by Stephen Coates)

Reuters | February 8, 2023 |

Congo accounts for three-quarters of the world’s mined cobalt supply. (Stock Image)

Microsoft visited an artisanal cobalt mine in Democratic Republic of Congo in December as part of attempts to jump-start formalization of the little-regulated and dangerous industry that experts say is key to meeting global demand for the battery material.

Congo accounts for three-quarters of the world’s mined cobalt supply. Industrial mines produce most of Congo’s cobalt, but “artisanal” miners, who dig by hand and often die when tunnels cave in, account for up to 30% of production, though that fluctuates depending on price.

In the first known visit by a Microsoft executive to an artisanal cobalt site in Congo, chief of staff for tech and corporate responsibility Michele Burlington met miners at Mutoshi, where commodities trader Trafigura had helped run a formalization scheme that ended in 2020.

Companies that use cobalt in products from electric cars to smartphones should work to improve conditions at artisanal mines instead of seeking to cut artisanal cobalt out of their supply chains, an independent report on the visit argued on Wednesday.

“Electric vehicle manufacturers and electronics companies are operating with one eye open and one eye closed,” said Dorothee Baumann Pauly, director of the Geneva Center for Business and Human Rights, who wrote the report.

“In practice it is virtually impossible for them to completely exclude artisanal cobalt, especially when it is sent to smelters and refiners in DRC and China.”

Microsoft declined to reply to Reuters‘ questions about the visit or about its strategy on artisanal cobalt. In the report, Microsoft said that it is “committed to responsible and ethical sourcing”.

“We are continuing to work on this problem. It’s an issue that will take a coalition to solve,” the $1.9 trillion computer manufacturer and software company said.

As consumers become more concerned that the products they buy are tainted by poor working conditions or child labour, global tech firms and carmakers have been using less mined cobalt in their batteries by increasing recycling and switching to lower-cobalt chemistries. Read full story

Apple, for example, aims to massively reduce its use of all materials sourced directly from mines, and has said that 13% of the cobalt shipped in its products in 2021 came from recycling.

The issues around artisanal mining are an existential threat to the cobalt industry, according to Marina Demidova, head of communications at the Cobalt Institute. “If we get this wrong, cobalt probably will cease to be in batteries in 20 years’ time.”

So far, attempts to formalize the industry have fallen flat.

Trafigura and Congo mining firm Chemaf’s formalization scheme at Mutoshi, launched in 2018, ended abruptly in March 2020 with the coronavirus pandemic. Now diggers work in deep tunnels with no personal protective equipment, and women miners said they make less money than before, according to the report.

Entreprise Generale du Cobalt, a unit of state mining company Gecamines, was granted a monopoly on artisanal cobalt by government decree. EGC signed a supply deal with Trafigura in November 2020 and published a sourcing standard, but has yet to start buying cobalt due to political wrangling.

“Greater stakeholder engagement, including from global buyers, will help to overcome this impasse,” Baumann-Pauly said.

(By Helen Reid and Clara Denina; Editing by Stephen Coates)

Congo’s president wants new exploration for green energy metals

Bloomberg News | February 7, 2023 |

Felix Tshisekedi became DRC’s president in January 2019. Image courtesy of Wikimedia Commons.

Democratic Republic of Congo wants to position itself as a key source of metals in the green energy transition, and that will mean new exploration for nickel and chrome, according to President Felix Tshisekedi.

Exploration for the two minerals will begin “in the next few days” in Congo’s southern, diamond-rich Kasai region, Tshisekedi said Tuesday at the Investing in African Mining Indaba conference in Cape Town, South Africa. The country is also looking for partners to invest in cobalt, tantalum, tin and lithium processing

The transition to clean-energy technologies is a huge driving force for metals used in batteries, solar components, wind turbines and EVs. Meanwhile, mine output has been limited, helping to send prices for the commodities higher. Copper on the London Metal Exchange is up more than 40% since the end of 2019, while nickel surged more than 90%.

Congo provides more than two-thirds of the key battery mineral cobalt and is tied with Peru as the world’s second-biggest copper producer, according to the US Geological Survey. It also has significant deposits of other minerals including lithium, graphite and manganese. But only 19% of the country — Africa’s second-biggest by landmass — has been properly explored, Tshisekedi said.

‘New deposits’

“The goal is to discover new deposits that can be the subject of calls for bids, with a view to concluding mutually profitable public-private partnerships,” Tshisekedi said according to an emailed transcript of his remarks. The country’s recently created national geologic service will oversee the exploration, he said.

The president is hoping to attract new investment by improving the regulatory environment and through the creation of incentives like a special economic zone around lithium deposits in southeastern Congo, he said.

“Financiers, mining operators, equipment manufacturers, subcontractors, recyclers — everyone can find their part,” he said.

Despite its mineral riches, Congo remains one of the poorest countries in the world, and miners will be expected to ensure Congolese people also benefit, he said. This will include buying insurance from companies registered in Congo and negotiating development projects with local communities during exploration, he said.

(By Michael J. Kavanagh)

Bloomberg News | February 7, 2023 |

Felix Tshisekedi became DRC’s president in January 2019. Image courtesy of Wikimedia Commons.

Democratic Republic of Congo wants to position itself as a key source of metals in the green energy transition, and that will mean new exploration for nickel and chrome, according to President Felix Tshisekedi.

Exploration for the two minerals will begin “in the next few days” in Congo’s southern, diamond-rich Kasai region, Tshisekedi said Tuesday at the Investing in African Mining Indaba conference in Cape Town, South Africa. The country is also looking for partners to invest in cobalt, tantalum, tin and lithium processing

The transition to clean-energy technologies is a huge driving force for metals used in batteries, solar components, wind turbines and EVs. Meanwhile, mine output has been limited, helping to send prices for the commodities higher. Copper on the London Metal Exchange is up more than 40% since the end of 2019, while nickel surged more than 90%.

Congo provides more than two-thirds of the key battery mineral cobalt and is tied with Peru as the world’s second-biggest copper producer, according to the US Geological Survey. It also has significant deposits of other minerals including lithium, graphite and manganese. But only 19% of the country — Africa’s second-biggest by landmass — has been properly explored, Tshisekedi said.

‘New deposits’

“The goal is to discover new deposits that can be the subject of calls for bids, with a view to concluding mutually profitable public-private partnerships,” Tshisekedi said according to an emailed transcript of his remarks. The country’s recently created national geologic service will oversee the exploration, he said.

The president is hoping to attract new investment by improving the regulatory environment and through the creation of incentives like a special economic zone around lithium deposits in southeastern Congo, he said.

“Financiers, mining operators, equipment manufacturers, subcontractors, recyclers — everyone can find their part,” he said.

Despite its mineral riches, Congo remains one of the poorest countries in the world, and miners will be expected to ensure Congolese people also benefit, he said. This will include buying insurance from companies registered in Congo and negotiating development projects with local communities during exploration, he said.

(By Michael J. Kavanagh)

The biggest source of cobalt outside Africa is now Indonesia

Bloomberg News | February 8, 2023 |

Reference photo. Battery Pack for BMW-i3 Electric Vehicle.

Indonesia’s expansion is “somewhat reshaping the global supply chain,” Harry Fisher and Greg Miller, analysts at Benchmark Mineral Intelligence, said in an email. An array of projects have been “on schedule to date and are ramping up successfully” despite initial concerns around over-runs on budget and costs.

The cobalt expansion is largely thanks to billions of dollars of investment by Chinese firms on refineries that dish out a chemical cocktail containing cobalt as well as nickel. The biggest global nickel producer Tsingshan Holding Group Co., cobalt refining giant Zhejiang Huayou Cobalt and the top battery manufacturer known as CATL are among investors.

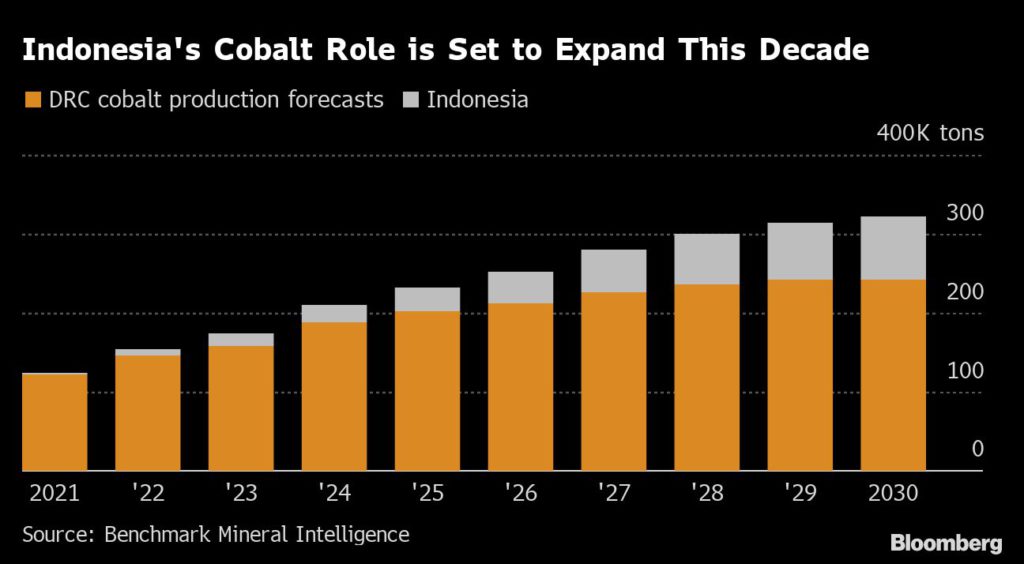

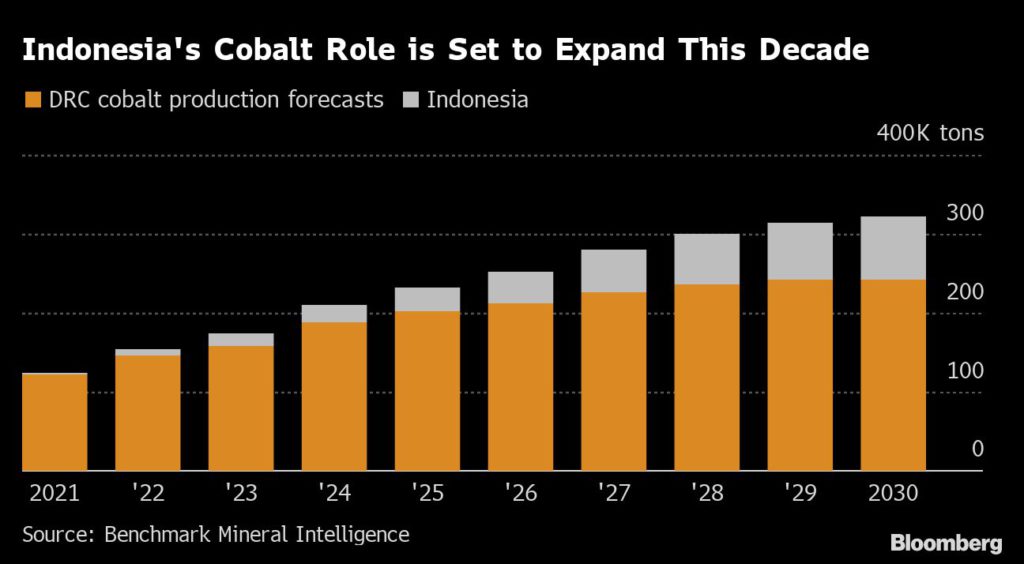

Cobalt output from the country will more than double again this year, according to Benchmark Mineral Intelligence.

Game changer

The expansion from Indonesia has also helped soften fears of tight supplies for cobalt, which is used in diverse applications from aerospace materials to magnets as well as batteries. Global benchmark cobalt prices have more than halved since May last year, and are down 13% so far this year.

While softer cobalt prices have provided costs relief to manufacturers and automakers, some are already trying to phase out cobalt from their batteries because of ethical concerns about DRC production, and after bouts of price volatility in recent years. The surge in Indonesian supply could help assuage both concerns.

The global cobalt market will be in surplus this year and prices will remain “bogged down” in the near term as supply expands, Susan Zou, analyst at Rystad Energy said by email.

“Every 3-4 months there is a new announcement about an upcoming project” in Indonesia, she said. “It’s a game changer.”

(By Annie Lee and Mark Burton)

Bloomberg News | February 8, 2023 |

Reference photo. Battery Pack for BMW-i3 Electric Vehicle.

(Image by RudolfSimon, Wikimedia Commons)

Indonesia has become the world’s second-largest cobalt producer, bolstering its bid to be a big player in the electric-vehicle supply chain.

Production of the battery material in the Southeast Asian country surged past others including Russia and Australia to grab the No. 2 spot last year, according to US government data. The expansion will continue this decade, easing the world’s reliance on Democratic Republic of Congo for more than two thirds of supplies and staving off potential shortages, analysts say.

Indonesian President Joko Widodo has spearheaded the country’s push to build battery and EV industries on the back of the country’s rich mineral resources. It already produces about half of the world’s nickel, and its share of global cobalt output will rise to almost 20% by 2030, from about 1% in 2021, according to Benchmark Mineral Intelligence.

Indonesia has become the world’s second-largest cobalt producer, bolstering its bid to be a big player in the electric-vehicle supply chain.

Production of the battery material in the Southeast Asian country surged past others including Russia and Australia to grab the No. 2 spot last year, according to US government data. The expansion will continue this decade, easing the world’s reliance on Democratic Republic of Congo for more than two thirds of supplies and staving off potential shortages, analysts say.

Indonesian President Joko Widodo has spearheaded the country’s push to build battery and EV industries on the back of the country’s rich mineral resources. It already produces about half of the world’s nickel, and its share of global cobalt output will rise to almost 20% by 2030, from about 1% in 2021, according to Benchmark Mineral Intelligence.

Indonesia’s expansion is “somewhat reshaping the global supply chain,” Harry Fisher and Greg Miller, analysts at Benchmark Mineral Intelligence, said in an email. An array of projects have been “on schedule to date and are ramping up successfully” despite initial concerns around over-runs on budget and costs.

The cobalt expansion is largely thanks to billions of dollars of investment by Chinese firms on refineries that dish out a chemical cocktail containing cobalt as well as nickel. The biggest global nickel producer Tsingshan Holding Group Co., cobalt refining giant Zhejiang Huayou Cobalt and the top battery manufacturer known as CATL are among investors.

Cobalt output from the country will more than double again this year, according to Benchmark Mineral Intelligence.

Game changer

The expansion from Indonesia has also helped soften fears of tight supplies for cobalt, which is used in diverse applications from aerospace materials to magnets as well as batteries. Global benchmark cobalt prices have more than halved since May last year, and are down 13% so far this year.

While softer cobalt prices have provided costs relief to manufacturers and automakers, some are already trying to phase out cobalt from their batteries because of ethical concerns about DRC production, and after bouts of price volatility in recent years. The surge in Indonesian supply could help assuage both concerns.

The global cobalt market will be in surplus this year and prices will remain “bogged down” in the near term as supply expands, Susan Zou, analyst at Rystad Energy said by email.

“Every 3-4 months there is a new announcement about an upcoming project” in Indonesia, she said. “It’s a game changer.”

(By Annie Lee and Mark Burton)

No comments:

Post a Comment