The automaking giant is talking tough about worker wages.

TODD CAMPBELL

SEP 20, 2023 6:36 PM EDT

The United Auto Workers (UAW) wish list for striking workers is long, but pay is one of the stickiest points when negotiating a deal with General Motors (GM) - Get Free Report, Ford Motors (F) - Get Free Report, and Stellantis (STLA) - Get Free Report.

The UAW is on record asking for wage increases of 40%, saying record profits at the big three demand a record contract. That's a big ask that could cause the strike to continue and potentially escalate.

General Motors' President Mark Reuss on Sept. 20 penned an op-ed for the Detroit Free Press that took aim at claims its profitability gives it the financial firepower necessary to bump up wages significantly.

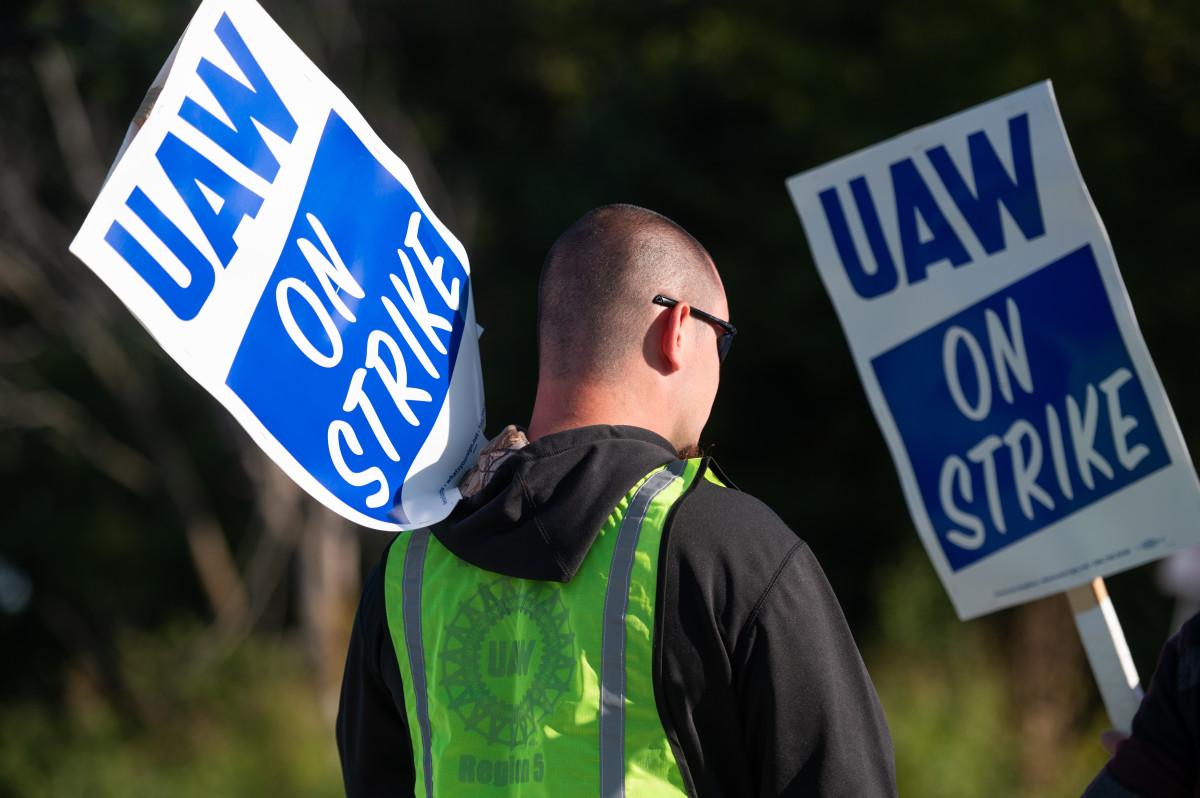

WENTZVILLE, MISSOURI - SEPTEMBER 15: GM workers with the UAW Local 2250 Union strike outside the General Motors Wentzville Assembly Plant on September 15, 2023 in Wentzville, Missouri. In the first time in its history the United Auto Workers union is on strike against all three of America’s unionized automakers, General Motors, Ford and Stellantis, at the same time. (Photo by Michael B. Thomas/Getty Images)

Michael B. Thomas/Getty Images

The stakes are high for workers and automakers

Auto workers made concessions during the Great Financial Crisis to help U.S. carmakers stay afloat. Following years of improving profitability, they're looking for GM, Ford, and Stellantis to bridge the gap between worker wages and rising inflation-related costs.

A return to pensions that were dismantled for new workers during the Great Recession, a shorter 32-hour workweek, and cost-of-living increases are included on striking auto workers' wish lists. Getting the Detroit Big Three to sign off on those demands would be hard enough without the demand for a significant bump up in pay.

UAW's President Shawn Fain argues that automakers' profits over the past few years put them in a position to pay higher wages and still make money. However, GM's Reuss argues that paying for wages would come at the expense of investments that allow General Motors to compete in a market experiencing significant change because of the shift from traditional internal combustion engine (ICE) vehicles to electric vehicles (EV).

"If we don’t continue to invest, we will lose ground — quickly. Our competitors across the country and around the world, most of whom are non-union, will waste no time seizing the opportunity we would be handing them," wrote Reuss.

Those competitors include Tesla (TSLA) - Get Free Report, the largest U.S. EV company, with a market share of 62%. GM's EV market share totals below 5%. EVs currently represent about 7% of the total vehicles sold in the U.S. However, they're expected to increase to over one-quarter of all vehicles by 2026.

If GM hopes to capture its fair share of that market opportunity, it will need to spend a lot of money developing, manufacturing, and selling new models over the next few years.

"Those record profits are reinvested in our company and our people. In 2022, GM had net income profits of $9.9 billion. In 2023, our capital spending will be $11-$12 billion. That’s not an aberration ― over the past ten years, our net income totaled $65 billion, and the amount we invested in that same period? $77 billion," says Reuss.

General Motors is offering striking workers a 20% pay increase to continue making those investments. It believes that's a very competitive offer, particularly given the company's existing pay.

"About 85% of current represented employees would earn a base wage of approximately $82,000 a year. In contrast, the average median household income in nine areas where GM has major assembly plants is $51,821. And total compensation for the 85% of the workforce, with overtime and benefits, would be more than $150,000 a year," says Reuss.

Reuss suggests that GM's offer balances rewarding employees and maintaining the financial flexibility necessary to avoid losing market share to Tesla, Toyota (TM) - Get Free Report, Honda (HMC,) - Get Free Report and others.

The sooner a deal is struck with workers, the less likely it is that General Motors will need to delay its initiatives, potentially paving the way for others to outmaneuver it.

"As the past has clearly shown, nobody wins in a strike. We have delivered a record offer. That is a fact. It rightly rewards our team members, while positioning the company for success in the future," says Reuss.

Auto workers made concessions during the Great Financial Crisis to help U.S. carmakers stay afloat. Following years of improving profitability, they're looking for GM, Ford, and Stellantis to bridge the gap between worker wages and rising inflation-related costs.

A return to pensions that were dismantled for new workers during the Great Recession, a shorter 32-hour workweek, and cost-of-living increases are included on striking auto workers' wish lists. Getting the Detroit Big Three to sign off on those demands would be hard enough without the demand for a significant bump up in pay.

UAW's President Shawn Fain argues that automakers' profits over the past few years put them in a position to pay higher wages and still make money. However, GM's Reuss argues that paying for wages would come at the expense of investments that allow General Motors to compete in a market experiencing significant change because of the shift from traditional internal combustion engine (ICE) vehicles to electric vehicles (EV).

"If we don’t continue to invest, we will lose ground — quickly. Our competitors across the country and around the world, most of whom are non-union, will waste no time seizing the opportunity we would be handing them," wrote Reuss.

Those competitors include Tesla (TSLA) - Get Free Report, the largest U.S. EV company, with a market share of 62%. GM's EV market share totals below 5%. EVs currently represent about 7% of the total vehicles sold in the U.S. However, they're expected to increase to over one-quarter of all vehicles by 2026.

If GM hopes to capture its fair share of that market opportunity, it will need to spend a lot of money developing, manufacturing, and selling new models over the next few years.

"Those record profits are reinvested in our company and our people. In 2022, GM had net income profits of $9.9 billion. In 2023, our capital spending will be $11-$12 billion. That’s not an aberration ― over the past ten years, our net income totaled $65 billion, and the amount we invested in that same period? $77 billion," says Reuss.

General Motors is offering striking workers a 20% pay increase to continue making those investments. It believes that's a very competitive offer, particularly given the company's existing pay.

"About 85% of current represented employees would earn a base wage of approximately $82,000 a year. In contrast, the average median household income in nine areas where GM has major assembly plants is $51,821. And total compensation for the 85% of the workforce, with overtime and benefits, would be more than $150,000 a year," says Reuss.

Reuss suggests that GM's offer balances rewarding employees and maintaining the financial flexibility necessary to avoid losing market share to Tesla, Toyota (TM) - Get Free Report, Honda (HMC,) - Get Free Report and others.

The sooner a deal is struck with workers, the less likely it is that General Motors will need to delay its initiatives, potentially paving the way for others to outmaneuver it.

"As the past has clearly shown, nobody wins in a strike. We have delivered a record offer. That is a fact. It rightly rewards our team members, while positioning the company for success in the future," says Reuss.

No comments:

Post a Comment