Michael Hiltzik

Wed, November 22, 2023

UAW President Shawn Fain announces the start of a series of strikes that ultimately brought the union success in contract negotiations with the Big Three automakers. (Matthew Hatcher / AFP/Getty Images)

A funny thing happened in the wake of the United Auto Workers' recent contract settlements with major auto companies .

Toyota said it would give its workers a raise worth about 9% on its top pay rate, beginning in January.

Nissan said its 9,000 U.S. workers would get raises of about 10% and would end a two-tiered pay system.

When we return to the bargaining table in 2028, it won’t just be with a Big Three, but with a Big Five or Big Six.

UAW President Shawn Fain

Honda announced a pay raise of 11% for workers at its plants in Ohio, Indiana and Georgia, along with an accelerated schedule of bringing workers up to the top rate to three years from six.

Subaru said it would raise pay at its plant in Lafayette, Ind., though it hasn't said by how much.

What's funny about these announcements is that none of these companies is covered by a UAW contract. But they could read the handwriting on the wall from the UAW's contract settlements. If they didn't UAW President Shawn Fain made sure they wouldn't miss the message.

As some of the leading nonunion shops in the industry, they responded almost instantaneously. Before the ink had dried on the union's agreements with GM, Ford and Stellantis (the owner of Chrysler and Jeep), he announced that his next targets would be the foreign automakers that had set up their shops in anti-labor states to keep unions from their doors.

“One of our biggest goals coming out of this historic contract victory is to organize like we’ve never organized before,” Fain said. “When we return to the bargaining table in 2028, it won’t just be with a Big Three, but with a Big Five or Big Six.” (He also signaled that he would be pushing to unionize Tesla.)

There are a few ways to look at this. One is that the UAW has absorbed the lesson that the key to organizing new locations and recruiting new members is achieving victory in contract negotiations. That's what brings union membership out of the abstract and makes its benefits concrete.

Read more: Column: American unions have finally remembered how to win

Few things spell success like the contract terms reached by the UAW after its six-week strikes in September and October — including historic wage gains, the rollback of many concessions the union gave the companies to ensure their survival during the last recession, and assurances that the industry's transition to electric vehicle manufacture won't proceed without union participation. As far as that goes, the new contracts are a great advertisement for the virtues of union membership.

The improved wage scales and other workplace benefits announced by the Japanese automakers are, of course, good for those companies' employees, who become collateral beneficiaries of the UAW's efforts.

It's also true, however, that the nonunion companies' responses could successfully undermine the UAW's organizing efforts.

"When you have a half-unionized industry where the unions have real ability to make a difference, the non-union companies have to follow along or they are just inviting the unions in," labor historian Erik Loomis told me. "It becomes very easy to siphon off union support in a factory when the wages are the same plus the workers don't have to pay dues."

Indeed, the technique of fighting unionization by offering workers better pay and benefits is as old as, well, labor-management relations themselves.

In his 1993 memoir "Confessions of a Union Buster," former anti-union consultant Martin Jay Levitt related "the five key corporate failings that drive workers to seek union help," as his very first boss outlined for him: "lack of recognition, weak management, poor communication, substandard working conditions, and non-competitive wages and benefits."

If a company dealt with these issues, Levitt was instructed, "it can achieve a happy work force and never have to fear a union invasion."

None of that means that the raises announced by Toyota et al are, or should be, the equivalent of everything a union can offer workers at an organized plant or company.

There may be other benefits that aren't offered by the nonunion employers, including job security guarantees — especially in anti-union right-to-work states where many foreign automakers and some domestic manufacturers have set up shop, such as North and South Carolina, Indiana, Alabama, Tennessee, Kentucky, Kansas and Georgia.

Read more: Column: A Teamsters strike against UPS could remake the union movement for the better

Nor should it escape workers' notice that the nonunion companies had to be goaded by the UAW's success into offering raises to their own employees.

"Why not the raise before the UAW's?" asks veteran union lawyer Thomas Geoghegan. "It should tell auto workers at Toyota, Honda, and Subaru, who had nowhere else to go anyway, that they were being paid less than they were worth."

The companies' motivation may be to keep the UAW from storming their gates, Geoghegan says, "but it may backfire by making the workers wonder why a raise now, and not before. We don't have truly competitive labor markets, paying people what they are worth — if we did, then that raise would have occurred without the UAW."

In other words, the UAW, along with other heavy industry unions such as the Teamsters, have a ways to go to reinforce their recent victories by carrying their fight to new plants in parts of the country — such as the Deep South — where they have long struggled to make headway.

They have a lot to show for their efforts thus far, and for at least the next year, an administration in Washington that has supported Americans' collective bargaining rights like no other administration in 90 years. At the moment, they appear to have the advantage over recalcitrant managements. Let's see what they do with it.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

This story originally appeared in Los Angeles Times.

UAW chief, having won concessions from strikes, aims to expand membership to nonunion automakers

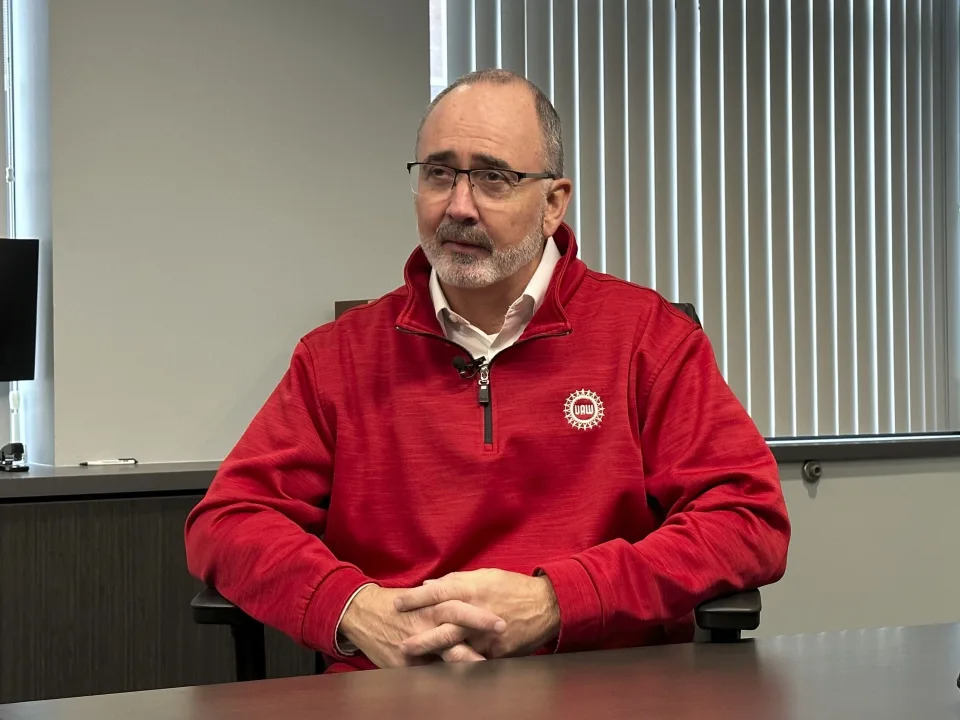

UAW President-Interview

United Auto Workers President Shawn Fain speaks to a reporter from The Associated Press during an interview at the union's headquarters Monday, Nov. 20, 2023, in Detroit.

(AP Photo/Mike Householder)

TOM KRISHER and MIKE HOUSEHOLDER

Mon, November 20, 2023

DETROIT (AP) — Entering contract talks with Detroit's three automakers, Shawn Fain set lofty expectations for what he could gain for his union members — and delivered on many of them. He secured significant pay raises, improved benefits, the right to strike over plant closures and a raft of other concessions.

But to the United Auto Workers president, the agreements that emerged from talks that were marked by six weeks of strikes were merely the start of a victory streak and a renaissance for the 88-year-old union. Now, Fain has set his latest ambitious goal: To gain UAW membership in nonunion companies across the industry — from foreign automakers with U.S. operations like Toyota to electric vehicle makers like Tesla to EV battery plants that will likely represent a sizable share of auto jobs in the decades ahead.

Already, Fain asserted in an interview with The Associated Press, the contracts have benefited workers in nonunion auto companies: Soon after the UAW won major pay raises for its workers, Toyota, Honda, Hyundai and Nissan — all nonunion operations — raised their own workers' pay in what Fain characterized as an obvious bid to stop the UAW from unionizing those workforces.

Last week, workers at General Motors, Ford and Stellantis collectively voted 64% to ratify the new settlement deals, which are among the richest contracts in the UAW 88-year history. The agreements ended many wage tiers, gave temporary hires better pay and a path to full-time work and boosted from around 6% to 10% the annual 401(k) contributions for those without pension plans.

According to Fain, workers at some nonunion plants, including the electric vehicle sales leader, Tesla, have contacted the UAW about joining the union, which hasn't even begun its organizing efforts. Fain noted that the nonunion companies didn't raise pay for their workers until after the UAW won general and cost-of-living raises, which should reach 33% by the time the contacts expire in 2028.

“Companies play their workers as fools sometimes,” he said in the interview. “They care about keeping more for themselves and leaving the employees to fend for themselves.”

Fain, who took office just eight months ago in the first direct election of UAW leaders in its history, said the time is right for labor unions to grow as they did in the 1930s and 40s, before they began a steady decline beginning in the 1950s. American workers, he said, are fed up with stagnant wages while corporate executives earn ever-growing multiples of median worker pay.

Companies, Fain said, will spend “limitless amounts” to try to stop the UAW, but the union can point to its Detroit contracts to show workers they will have a voice. In that way, he said, the union is a “great equalizer."

Fain declined to say which nonunion companies the UAW would target first. But high on the list is Tesla, whose biggest shareholder is CEO Elon Musk, the world's wealthiest man and an outspoken opponent of the union.

“The world's richest man is the richest man for a reason,” Fain said. “They get this kind of wealth by exploiting other people.”

Musk, who also runs the rocket company SpaceX, is talking about shipping Tesla production to Mexico and other low-cost countries.

A message was left seeking comment from Tesla.

The union leader said he expects Toyota, Honda and others to fight the UAW's organizing effort by threatening to close factories or eliminate benefits. Musk has threated to end stock awards that go to production workers if they vote to join the union. Fain said the UAW, if given the opportunity, would negotiate to retain and increase those stock awards.

The union, Fain says, also will have to organize Detroit automakers' EV battery plants, which are joint ventures with South Korean companies. GM and Stellantis, the maker of Jeep and Ram vehicles, have agreed to bring their joint venture plants under the union's national contract, making it easier for the UAW to sign them up. Ford has not.

That, he said, could become a problem if Ford fights the UAW's efforts to organize at the plants in Kentucky and Tennessee.

“Unless they change their tune, it's going to be an all-out war,” Fain said.

Ford did agree to put a wholly owned battery plant being planned for Michigan and a planned electric pickup plant in Tennessee into the UAW contract. But in the interview, Fain accused CEO Jim Farley of agreeing to work with the union on the joint-venture plants — only to renege later.

“At that point, things didn't go well,” Fain said. “We had to make progress where we could, and we did.”

In response, Ford said in a statement that it negotiated in good faith with the UAW and agreed to work with it on a fair deal to address the issue of union representation of the battery plants.

“These are multi-billion dollar investments, and the future of our industry is in the balance, so any deal must make sustainable business sense,” the company said.

Fain declined to say what his fight would look like or if it could mean a strike against Ford in 2025, when the joint-venture plants are set to open.

“It just means we're going to do what we have to do to get it,” he said. “Those workers deserve their fair share of economic and social justice."

Ford has said it couldn't pledge to unionize the battery plants because its joint venture partner would have to agree and the plants aren't exclusively under its control. In addition, Ford has said, the plants haven't been built, and it can't agree to the unionization of workers who haven't been hired yet.

In the contract talks, Fain said, he would have liked to gain stronger pension increases for longtime workers with defined benefit plans. He'd also like steady pension checks for newer hires rather than 401(k) plans. The union plans to seek law changes requiring “retirement security” for all workers, and will push for the benefits in 2028 contract talks.

In the interview, Fain said he doesn't expect the higher costs that the automakers will absorb from the new contracts to lead them to build new factories in Mexico or Canada. The union, he said, can strike if a U.S. plant is closed and could take action if companies build new factories elsewhere.

The UAW, he said, will try to work with the companies. But he noted that partnering with the automakers in the past to address costs has typically benefited them to the exclusion of workers. He noted the concessions the UAW agreed to in 2008 to help the automakers survive dire financial problems.

This time, he said, union members negotiated for themselves but also won raises for nonunion workers in the South who would have received nothing without the UAW.

"That’s something to be proud of,” he said.

TOM KRISHER and MIKE HOUSEHOLDER

Mon, November 20, 2023

DETROIT (AP) — Entering contract talks with Detroit's three automakers, Shawn Fain set lofty expectations for what he could gain for his union members — and delivered on many of them. He secured significant pay raises, improved benefits, the right to strike over plant closures and a raft of other concessions.

But to the United Auto Workers president, the agreements that emerged from talks that were marked by six weeks of strikes were merely the start of a victory streak and a renaissance for the 88-year-old union. Now, Fain has set his latest ambitious goal: To gain UAW membership in nonunion companies across the industry — from foreign automakers with U.S. operations like Toyota to electric vehicle makers like Tesla to EV battery plants that will likely represent a sizable share of auto jobs in the decades ahead.

Already, Fain asserted in an interview with The Associated Press, the contracts have benefited workers in nonunion auto companies: Soon after the UAW won major pay raises for its workers, Toyota, Honda, Hyundai and Nissan — all nonunion operations — raised their own workers' pay in what Fain characterized as an obvious bid to stop the UAW from unionizing those workforces.

Last week, workers at General Motors, Ford and Stellantis collectively voted 64% to ratify the new settlement deals, which are among the richest contracts in the UAW 88-year history. The agreements ended many wage tiers, gave temporary hires better pay and a path to full-time work and boosted from around 6% to 10% the annual 401(k) contributions for those without pension plans.

According to Fain, workers at some nonunion plants, including the electric vehicle sales leader, Tesla, have contacted the UAW about joining the union, which hasn't even begun its organizing efforts. Fain noted that the nonunion companies didn't raise pay for their workers until after the UAW won general and cost-of-living raises, which should reach 33% by the time the contacts expire in 2028.

“Companies play their workers as fools sometimes,” he said in the interview. “They care about keeping more for themselves and leaving the employees to fend for themselves.”

Fain, who took office just eight months ago in the first direct election of UAW leaders in its history, said the time is right for labor unions to grow as they did in the 1930s and 40s, before they began a steady decline beginning in the 1950s. American workers, he said, are fed up with stagnant wages while corporate executives earn ever-growing multiples of median worker pay.

Companies, Fain said, will spend “limitless amounts” to try to stop the UAW, but the union can point to its Detroit contracts to show workers they will have a voice. In that way, he said, the union is a “great equalizer."

Fain declined to say which nonunion companies the UAW would target first. But high on the list is Tesla, whose biggest shareholder is CEO Elon Musk, the world's wealthiest man and an outspoken opponent of the union.

“The world's richest man is the richest man for a reason,” Fain said. “They get this kind of wealth by exploiting other people.”

Musk, who also runs the rocket company SpaceX, is talking about shipping Tesla production to Mexico and other low-cost countries.

A message was left seeking comment from Tesla.

The union leader said he expects Toyota, Honda and others to fight the UAW's organizing effort by threatening to close factories or eliminate benefits. Musk has threated to end stock awards that go to production workers if they vote to join the union. Fain said the UAW, if given the opportunity, would negotiate to retain and increase those stock awards.

The union, Fain says, also will have to organize Detroit automakers' EV battery plants, which are joint ventures with South Korean companies. GM and Stellantis, the maker of Jeep and Ram vehicles, have agreed to bring their joint venture plants under the union's national contract, making it easier for the UAW to sign them up. Ford has not.

That, he said, could become a problem if Ford fights the UAW's efforts to organize at the plants in Kentucky and Tennessee.

“Unless they change their tune, it's going to be an all-out war,” Fain said.

Ford did agree to put a wholly owned battery plant being planned for Michigan and a planned electric pickup plant in Tennessee into the UAW contract. But in the interview, Fain accused CEO Jim Farley of agreeing to work with the union on the joint-venture plants — only to renege later.

“At that point, things didn't go well,” Fain said. “We had to make progress where we could, and we did.”

In response, Ford said in a statement that it negotiated in good faith with the UAW and agreed to work with it on a fair deal to address the issue of union representation of the battery plants.

“These are multi-billion dollar investments, and the future of our industry is in the balance, so any deal must make sustainable business sense,” the company said.

Fain declined to say what his fight would look like or if it could mean a strike against Ford in 2025, when the joint-venture plants are set to open.

“It just means we're going to do what we have to do to get it,” he said. “Those workers deserve their fair share of economic and social justice."

Ford has said it couldn't pledge to unionize the battery plants because its joint venture partner would have to agree and the plants aren't exclusively under its control. In addition, Ford has said, the plants haven't been built, and it can't agree to the unionization of workers who haven't been hired yet.

In the contract talks, Fain said, he would have liked to gain stronger pension increases for longtime workers with defined benefit plans. He'd also like steady pension checks for newer hires rather than 401(k) plans. The union plans to seek law changes requiring “retirement security” for all workers, and will push for the benefits in 2028 contract talks.

In the interview, Fain said he doesn't expect the higher costs that the automakers will absorb from the new contracts to lead them to build new factories in Mexico or Canada. The union, he said, can strike if a U.S. plant is closed and could take action if companies build new factories elsewhere.

The UAW, he said, will try to work with the companies. But he noted that partnering with the automakers in the past to address costs has typically benefited them to the exclusion of workers. He noted the concessions the UAW agreed to in 2008 to help the automakers survive dire financial problems.

This time, he said, union members negotiated for themselves but also won raises for nonunion workers in the South who would have received nothing without the UAW.

"That’s something to be proud of,” he said.

Why Nissan, Toyota workers can 'thank' the UAW for pay hikes

Foreign automakers are using a ‘union substitution' strategy in order to deter unionization, which means matching UAW contracts.

Pras Subramanian

·Senior Reporter

Tue, November 21, 2023

United Auto Workers (UAW) president Shawn Fain calls it the “UAW bump,” in which non-union auto workers are seemingly getting pay hikes thanks to the UAW’s contracts with the Big Three. Whatever workers are calling the phenomenon, they are likely very grateful for the extra pay this Thanksgiving holiday.

Nissan became the latest non-union automaker to hike pay for its US workers, with the Japanese company increasing top wages by 10% starting this January. Workers not at the top wage scale will also receive hikes, with 9,000 US workers in total receiving these wage gains. Nissan also said it is eliminating wage tiers across its workforce.

If some of the wage gains and changes sound familiar, it is because they echo some of the gains reached by UAW workers in their bargaining process. The pattern agreements the UAW struck with GM, Ford, and Stellantis include a 25% hike in base wages through 2028, including an immediate 11% bump as well as ratification bonuses among other benefits.

Nissan’s pay hikes follow similar moves made by Hyundai, Toyota, and Honda in recent weeks for their US workers, none of whom are unionized.

UAW members hold picket signs near a GM assembly plant in Delta Township, Mich., Sept. 29, 2023. (Paul Sancya/AP Photo, File) (ASSOCIATED PRESS)

“Non-union workers can thank the UAW for their recent pay raises,” said automotive manufacturing expert Sam Fiorani of AutoForecast Solutions to Yahoo Finance. “It was entirely expected that wages would go up in the face of recent labor changes. There’s no reason for Toyota, Honda, Nissan, and the rest to raise their workers’ pay except for the pressure put on them from the union.”

Labor expert Marick Masters of Wayne State University calls what these foreign automakers are doing the “union substitution” strategy.

“Clearly, such actions by nonunion companies can be viewed as part and parcel of a ‘union substitution’ strategy, which seeks to deter unionization in specific companies by paying workers sufficiently comparable wages,” Masters said to Yahoo Finance.

Masters noted the non-union foreign automakers have “skillfully navigated” union avoidance in their US operations thus far. It also helps that these automakers have placed factories in states that are not generally union friendly, like Alabama (Honda), Georgia (Hyundai), Tennessee (Nissan), and Texas (Toyota).

United Auto Workers president Shawn Fain speaks to a reporter from The Associated Press during an interview at the union's headquarters Monday, Nov. 20, 2023, in Detroit. (Mike Householder/AP Photo) (ASSOCIATED PRESS)

While AutoForecast Solutions’ Fiorani said the foreign automakers needed to “narrow the gap” between the Big Three’s contracts with the UAW and their own workers in order to compete, there’s also the possibility that raising pay at these non-union companies helps them attract new labor from other industries as well.

“Raising their wages also enables them to recruit better for hourly workers, who compare wage offering not only to the unionized Big Three, but also other non-auto employers in their localities who may offer competitive compensation,” Wayne State’s Masters added. “This latter point is particularly important as wage rates have increased generally in the economy of the past couple of years after a long period of relative stagnation.”

For a union leader like Fain, moves by the Nissans and Toyotas of the world are music to his ears, in which the UAW hears a growing chorus of pro-union voices and new members.

"Even though you're not yet members of our union, that pay raise Toyota's giving you is the UAW bump," Fain said to Toyota workers. "UAW. That stands for, 'You are welcome.'"

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Nissan Motor hiking wages at US auto plants after UAW deal

Volkswagen becomes the latest automaker to hike wages for U.S. factory workers

Reuters

Wed, November 22, 2023

FILE PHOTO: The New York International Auto Show, in Manhattan, New York City

Foreign automakers are using a ‘union substitution' strategy in order to deter unionization, which means matching UAW contracts.

Pras Subramanian

·Senior Reporter

Tue, November 21, 2023

United Auto Workers (UAW) president Shawn Fain calls it the “UAW bump,” in which non-union auto workers are seemingly getting pay hikes thanks to the UAW’s contracts with the Big Three. Whatever workers are calling the phenomenon, they are likely very grateful for the extra pay this Thanksgiving holiday.

Nissan became the latest non-union automaker to hike pay for its US workers, with the Japanese company increasing top wages by 10% starting this January. Workers not at the top wage scale will also receive hikes, with 9,000 US workers in total receiving these wage gains. Nissan also said it is eliminating wage tiers across its workforce.

If some of the wage gains and changes sound familiar, it is because they echo some of the gains reached by UAW workers in their bargaining process. The pattern agreements the UAW struck with GM, Ford, and Stellantis include a 25% hike in base wages through 2028, including an immediate 11% bump as well as ratification bonuses among other benefits.

Nissan’s pay hikes follow similar moves made by Hyundai, Toyota, and Honda in recent weeks for their US workers, none of whom are unionized.

UAW members hold picket signs near a GM assembly plant in Delta Township, Mich., Sept. 29, 2023. (Paul Sancya/AP Photo, File) (ASSOCIATED PRESS)

“Non-union workers can thank the UAW for their recent pay raises,” said automotive manufacturing expert Sam Fiorani of AutoForecast Solutions to Yahoo Finance. “It was entirely expected that wages would go up in the face of recent labor changes. There’s no reason for Toyota, Honda, Nissan, and the rest to raise their workers’ pay except for the pressure put on them from the union.”

Labor expert Marick Masters of Wayne State University calls what these foreign automakers are doing the “union substitution” strategy.

“Clearly, such actions by nonunion companies can be viewed as part and parcel of a ‘union substitution’ strategy, which seeks to deter unionization in specific companies by paying workers sufficiently comparable wages,” Masters said to Yahoo Finance.

Masters noted the non-union foreign automakers have “skillfully navigated” union avoidance in their US operations thus far. It also helps that these automakers have placed factories in states that are not generally union friendly, like Alabama (Honda), Georgia (Hyundai), Tennessee (Nissan), and Texas (Toyota).

United Auto Workers president Shawn Fain speaks to a reporter from The Associated Press during an interview at the union's headquarters Monday, Nov. 20, 2023, in Detroit. (Mike Householder/AP Photo) (ASSOCIATED PRESS)

While AutoForecast Solutions’ Fiorani said the foreign automakers needed to “narrow the gap” between the Big Three’s contracts with the UAW and their own workers in order to compete, there’s also the possibility that raising pay at these non-union companies helps them attract new labor from other industries as well.

“Raising their wages also enables them to recruit better for hourly workers, who compare wage offering not only to the unionized Big Three, but also other non-auto employers in their localities who may offer competitive compensation,” Wayne State’s Masters added. “This latter point is particularly important as wage rates have increased generally in the economy of the past couple of years after a long period of relative stagnation.”

For a union leader like Fain, moves by the Nissans and Toyotas of the world are music to his ears, in which the UAW hears a growing chorus of pro-union voices and new members.

"Even though you're not yet members of our union, that pay raise Toyota's giving you is the UAW bump," Fain said to Toyota workers. "UAW. That stands for, 'You are welcome.'"

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Nissan Motor hiking wages at US auto plants after UAW deal

David Shepardson

Mon, November 20, 2023

A visitor is seen at Nissan Motor Corp.'s showroom in Tokyo

(Reuters) -Nissan Motor will hike top wages for workers at U.S. manufacturing plants by 10% in January after the United Auto Workers union reached new contracts with the Detroit Three automakers, a company spokesperson said on Monday.

The Japanese automaker said the wage hike takes effect Jan. 8 for production technicians, maintenance, and tool & die technicians. Workers not yet at top scale will also receive increases in wages. About 9,000 U.S. workers in total will get pay hikes.

Nissan said it is also eliminating wage tiers for U.S. production workers. In recent weeks, Hyundai Motor, Toyota Motor and Honda Motor have all announced they would hike U.S. factory wages after the UAW contract and as the union says it will work to organize nonunion plants operated by foreign automakers and Tesla.

Nissan said the pay hikes reflect its commitment to its employees in the United States "and enhancing our competitiveness."

The UAW labor deals with General Motors, Ford Motor and Stellantis include a 25% increase in base wages through 2028, including an immediate 11% hike, and will cumulatively raise the top wage by 33%, compounded with estimated cost-of-living adjustments to over $42 an hour.

It also cut the number of years needed to get to top pay from eight years to three years, will boost the pay of temporary workers by 150% and make them permanent employees. The deal also includes significant retirement improvements.

The UAW for decades has unsuccessfully sought to organize auto factories operated by foreign automakers. UAW President Shawn Fain was in Washington last week for meetings on the union's organizing strategy.

President Joe Biden has backed the UAW in its quest to unionize other carmakers.

Nissan said over the last three years it has increased wages at its three manufacturing sites by 12-18.5% in total; previously cut time needed to reach top pay from eight to four years; added two paid holidays and increased paid parental leave for production workers.

(Reporting by David Shepardson, Editing by Franklin Paul and Grant McCool)

Mon, November 20, 2023

A visitor is seen at Nissan Motor Corp.'s showroom in Tokyo

(Reuters) -Nissan Motor will hike top wages for workers at U.S. manufacturing plants by 10% in January after the United Auto Workers union reached new contracts with the Detroit Three automakers, a company spokesperson said on Monday.

The Japanese automaker said the wage hike takes effect Jan. 8 for production technicians, maintenance, and tool & die technicians. Workers not yet at top scale will also receive increases in wages. About 9,000 U.S. workers in total will get pay hikes.

Nissan said it is also eliminating wage tiers for U.S. production workers. In recent weeks, Hyundai Motor, Toyota Motor and Honda Motor have all announced they would hike U.S. factory wages after the UAW contract and as the union says it will work to organize nonunion plants operated by foreign automakers and Tesla.

Nissan said the pay hikes reflect its commitment to its employees in the United States "and enhancing our competitiveness."

The UAW labor deals with General Motors, Ford Motor and Stellantis include a 25% increase in base wages through 2028, including an immediate 11% hike, and will cumulatively raise the top wage by 33%, compounded with estimated cost-of-living adjustments to over $42 an hour.

It also cut the number of years needed to get to top pay from eight years to three years, will boost the pay of temporary workers by 150% and make them permanent employees. The deal also includes significant retirement improvements.

The UAW for decades has unsuccessfully sought to organize auto factories operated by foreign automakers. UAW President Shawn Fain was in Washington last week for meetings on the union's organizing strategy.

President Joe Biden has backed the UAW in its quest to unionize other carmakers.

Nissan said over the last three years it has increased wages at its three manufacturing sites by 12-18.5% in total; previously cut time needed to reach top pay from eight to four years; added two paid holidays and increased paid parental leave for production workers.

(Reporting by David Shepardson, Editing by Franklin Paul and Grant McCool)

Reuters

Wed, November 22, 2023

FILE PHOTO: The New York International Auto Show, in Manhattan, New York City

(Reuters) - Volkswagen said on Wednesday that it would hike salaries for production workers at its Tennessee-based Chattanooga assembly plant by 11%, weeks after the United Auto Workers union won significant pay and benefit hikes from the Detroit Three automakers.

The German company and other non-union automakers in the U.S. have come under increased pressure to improve pay and benefits following the record contracts achieved by the UAW in late October after thousands of its members went on a six-week targeted strike.

Japanese automakers Honda Motor and Toyota have raised wages for non-union U.S. factory workers in recent weeks amid signs that the union is turning its attention to organizing the workforce at foreign-owned and Tesla auto plants.

Hyundai Motor has also announced a 25% increase over the next four years for non-union production workers in Alabama and Georgia.

UAW President Shawn Fain told Reuters last week that the union was getting expressions of interest in organizing from many Tesla workers.

The Elon Musk-led company, which enjoys an operating profit advantage over other automakers, has not announced any salary hikes in the U.S.

Volkswagen's pay increase is effective from December, with a compressed wage progression timeline beginning in February.

(Reporting by Mehr Bedi in Bengaluru; Editing by Tasim Zahid)

The German company and other non-union automakers in the U.S. have come under increased pressure to improve pay and benefits following the record contracts achieved by the UAW in late October after thousands of its members went on a six-week targeted strike.

Japanese automakers Honda Motor and Toyota have raised wages for non-union U.S. factory workers in recent weeks amid signs that the union is turning its attention to organizing the workforce at foreign-owned and Tesla auto plants.

Hyundai Motor has also announced a 25% increase over the next four years for non-union production workers in Alabama and Georgia.

UAW President Shawn Fain told Reuters last week that the union was getting expressions of interest in organizing from many Tesla workers.

The Elon Musk-led company, which enjoys an operating profit advantage over other automakers, has not announced any salary hikes in the U.S.

Volkswagen's pay increase is effective from December, with a compressed wage progression timeline beginning in February.

(Reporting by Mehr Bedi in Bengaluru; Editing by Tasim Zahid)

No comments:

Post a Comment