Australia has rejected a US request for a warship to help protect international shipping lanes in the Red Sea.

NEWSROOM

DECEMBER 24, 2023

Canberra will instead send six additional ADF personnel. US bringing together allies to protect against Houthi strikes, Bloomberg informs.

Australia has rejected a US request for a warship to help protect international shipping lanes in the Red Sea, with Defense Minister Richard Marles saying the nation’s strategic focus had to remain on the Indo-Pacific.

Marles, who is also deputy prime minister, told Sky News on Thursday that Australia wouldn’t be sending a “ship or a plane” to the Middle East, but would instead almost triple its troop contribution to the US-led maritime force.

“We need to be really clear around our strategic focus and our strategic focus is our region,” Marles said.

The Australian Government continues to work with the United States and other partners in support of the international rules-based order in the Middle East and surrounding region. — Richard Marles (@RichardMarlesMP) December 21, 2023

The US this week announced Operation Prosperity Guardian, an international maritime task force intended to protect trading vessels sailing through the Red Sea from attacks by Houthi militants based in Yemen. Participating countries include the US, UK, France and Canada.

In a post to social media site X on Thursday, Marles said Australia would contribute an additional six Australian Defence Force personnel.

The US is Australia’s closest defense partner, a relationship even further strengthened in 2021 by the Aukus security agreement that will deliver Canberra a fleet of nuclear-powered submarines.

Spain’s Defense Ministry denied Washington’s claims that it will participate in a multinational force to patrol the Red Sea.

In a statement released to Spanish media outlets including the ABC and La Vanguardia, the ministry said Spain cannot make the decision unilaterally, and is subject to decisions made by the EU and NATO.

US Defense Secretary Lloyd Austin said Spain would be among the countries joining the 10-nation security initiative to protect trade in the Red Sea from Houthi attacks.

The Yemeni rebel group has ramped up attacks in recent days, targeting ships alleged to have links with Israel.

Energy company BP announced it was suspending shipping in the region, following in the steps of big shipping firms such as Evergreen and Maersk, which have suspended shipping operations off the coast of Yemen. The companies are instead opting to divert the routes.

The interruption of “the critical waterway… threatens the free flow of commerce, endangers innocent mariners, and violates international law,” according to the US defense secretary.

He announced launching Operation Prosperity Guardian to bolster the security of shipping in the southern Red Sea and the Gulf of Aden.

According to the US announcement, the UK, Bahrain, Canada, France, Italy, Netherlands, Norway, Seychelles and Spain are taking part.

However, if Spain’s justification for why it cannot participate is true, countries such Italy, Netherlands and France would also have to answer to the EU and NATO before committing.

Unraveling the Red Sea Conundrum: Houthi Conflict and its Global Economic Ramifications

The Red Sea, a critical maritime route connecting Europe, Asia, and Africa, holds immense strategic importance in the global economy.

BY S.M. SAYEM

DECEMBER 24, 2023

The Red Sea, a critical maritime route connecting Europe, Asia, and Africa, holds immense strategic importance in the global economy. Its waters facilitate the movement of goods and energy resources, making it a linchpin for international trade. Situated at the crossroads of major shipping routes, the Red Sea serves as a gateway for a significant portion of the world’s trade. Its geostrategic location has positioned it as a key maritime corridor, linking the Mediterranean Sea to the Indian Ocean. This has made it a focal point for major global powers seeking to secure their economic interests and exert influence in the region.

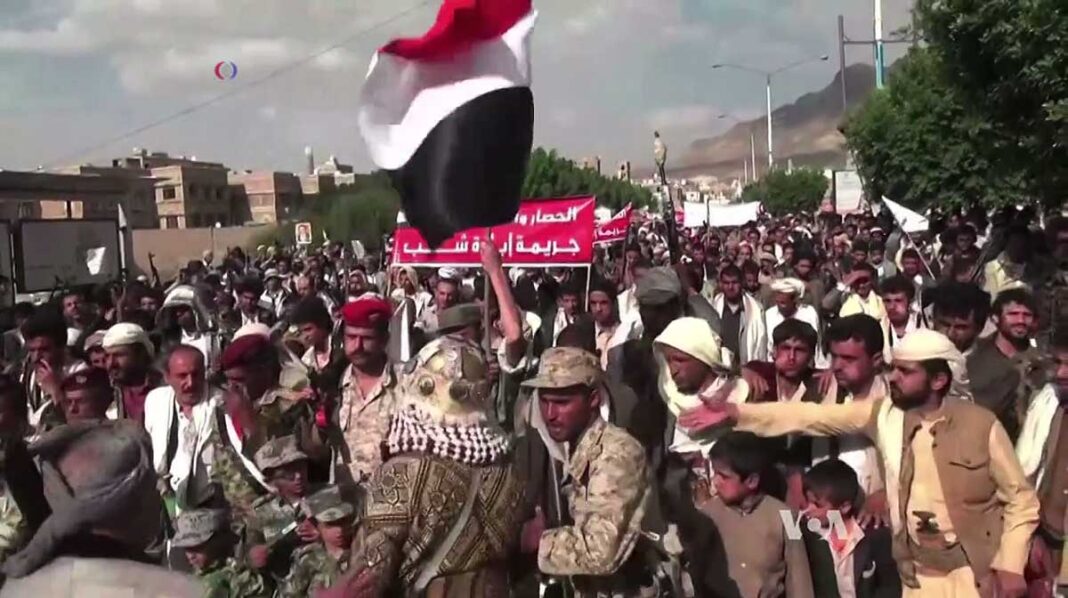

However, the stability of this crucial waterway and its possible effects on international trade have come under scrutiny due to the Houthi rebels, a Yemeni insurgent group, and recent events involving their fighters and their attacks on ships in the Red Sea. With numerous parties fighting for dominance and influence, the geopolitical dynamics around the Red Sea become more complicated. The motives behind these acts are complex, entwining power battles with regional disputes.

The recent years have seen an increase in the threat to local maritime security, which has been made exacerbated by the Israel-Hamas conflict. The Houthis had previously attacked ships associated with nations fighting alongside the Saudi-led coalition in Yemen. For example, in 2018, they launched an attack against crude oil tankers that were owned by Saudi Arabia’s state shipping company, Bahri, when they were traveling through the Bab al-Mandab Strait to or from the Red Sea and Suez Canal. The Saudi Energy Ministry responded by stopping oil shipments via the chokepoint for about a week (though this seems to have been insufficient time to force shippers to look for other routes; if the interruption persisted, they may have).

But according to current discourse, the Houthis have attacked Israeli oil tankers with drones and rockets following the Israeli raid on Gaza on October 7 with the support of the Palestinians. Twelve international oil companies and large ships have forbade the transit of cargo over the Red Sea in response to their attack. A ship traveling from Asia to Europe or from Europe to Asia needs an additional two weeks to traverse through the Red Sea and Suez Canal. As a result, additional costs for manpower, fuel and insurance will ultimately be passed on to the consumer. Consequently, the announcement came a couple of days ago from the world’s largest shipping company, Mediterranean Shipping Company (MSC. They said the ship left the Red Sea. In announcing their decision, the MSC said the situation in the Red Sea area had become critical. On Friday, the company’s ship, MSC Platinum Three, was attacked in the Red Sea. Though the ship’s crew was unharmed, the ship is no longer operational. Since then, the company’s ships have been plying the southern tip of Africa.

A similar action was taken earlier this week by the French operator CMA CGM. In addition, German shipping giant Hapag-Lloyd and Danish company Maersk made the decision to cease operations in the Red Sea prior to the CMA. The majority of the ships in the ocean are operated by these corporations. And OOCL, an enterprise located in Hong Kong, has finally declared that it will no longer be carrying cargo in the Red Sea.

Experts predict that if this pattern persists, there would be a significant rise in the cost of items on the global market. The cost of the ship’s oil would increase by a million dollars if the route from Shanghai to Rotterdam took them beyond the Cape of Good Hope. Global energy security and the dry cargo trade would take a further hit if Houthi strikes intensify and the Red Sea marine traffic is severely disrupted as a result—especially in Europe, which is still recuperating from the devastating effects of the war in Ukraine. As demand rebounded in Europe and the US after the COVID-19 pandemic, the U.S. Energy Information Administration (EIA) reports that northbound crude oil transfers through two important routes to the Mediterranean—the Suez Canal and the Sumed pipeline in Egypt—increased by more than 60 percent during the first half of this year compared to 2020. Europe has been importing more oil from some Middle Eastern suppliers as a result of Western sanctions against Russia’s energy sector, according to the EIA. For instance, Iraq has shipped 743,000 barrels per day on average to Europe through the Suez Canal this year, up from 629,000 barrels during the same period last year, according to data from Kpler.

There’s more trouble over on the other side. Europe’s ports have a fixed number of workers for fixed jobs. Assume that every week, 50,000 containers are unloaded from a port. One week, amidst the abrupt absence of all containers, the subsequent week witnessed the arrival of twice as many containers, leading to the consequential loss of equilibrium in the workload. Today, as ships avoid the Suez Canal, that is precisely what is taking place. The ports are under a great deal of strain and it is growing harder to manage. Specifically, during COVID, the Suez Canal had to be halted for a few days. The price of goods increased sharply and quickly on a global scale during that time. Experts respond there’s a possibility something similar will occur again.

Freightos, an online shipping marketplace, reports that shipment costs have already climbed. Prices for cargo travel between Asia and the US East Coast increased by 5% to $2,497 per 40-foot container following the escalation of the Israel-Hamas conflict. It might cost extra. since large corporations are staying away from the Suez Canal. The Indian Ocean must be reached by traveling across Africa. To avoid this path, it needs to factor in an additional 14 days. High fuel usage must be added at the same time. Ships take a lot longer to get to their destinations as a result.

There are no Houthi vessels that are capable of blocking the waterways, according to experts. Though they have only once used a helicopter to attack a ship, they do occasionally attempt surprise strikes. To address such a situation, US Defense Secretary Lloyd Austin hurried to the Middle East nations. He then proceeded to Bahrain and declared that ten nations—including Bahrain, Canada, the United Kingdom, France, and Italy—would join forces to build a new force to combat the Houthis. In essence, it will facilitate smooth sailing and guarantee the security of the Red Sea. It will be based on Task Force 153, which is presently in operation in Bahrain. It is unclear at this time, nevertheless, if additional nations will be open to cooperating on this agreement’s model.

But how seriously the Houthis perceive this US threat is still up in the air. The Houthis are not letting any Israeli ships enter the Red Sea because they did not only assault the Israeli ship in response to the massacre occurring in Gaza. So long as there is a conflict in Gaza, the Red Sea will serve as another theater of operations for the Houthis, according to analysts.

The conflict involving Houthi rebels in the Red Sea underscores the delicate balance between geopolitics and global trade. The impact is felt not only economically but also in terms of energy security and the stability of maritime trade. As nations collaborate to counter the Houthi threat, the situation remains volatile, and the Red Sea continues to be a hotspot for geopolitical tensions. The ongoing conflict serves as a stark reminder of the intricate connections between regional conflicts and the broader global economy, underscoring the need for diplomatic solutions to safeguard vital international waterways.

S.M. Sayem is a Dhaka-based foreign policy analyst. He is studying Economics at the University of Chittagong. Contact: smsayem[at]049gmail.com

No comments:

Post a Comment