The Neocon Rot in the GOP Empowered the Warfare State

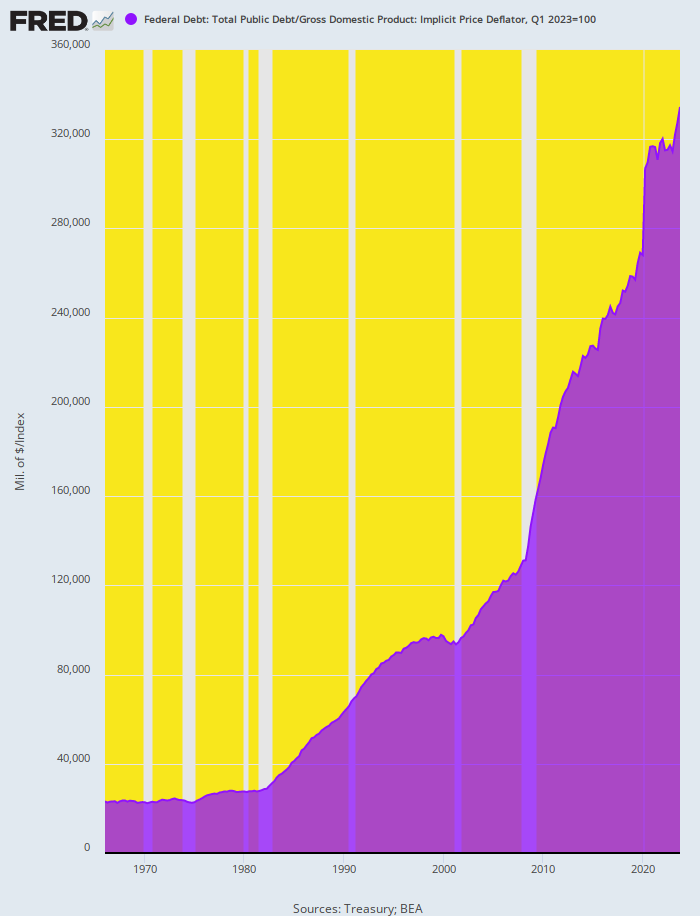

The graph below embodies a shit-ton of modern political, policy and financial history, even if on the surface its seems prosaic enough. Literally, it tracks in 2023 dollars of purchasing power the rise of the public debt since 1966.

To be sure, 1966 did have some claim to being an inflection point in modern fiscal history. That was the year in which LBJ’s “guns and butter” policies went into high gear, fueled by a spending surge for both the Great Society and the dramatic escalation of Johnson’s genocidal war on the peasants of Vietnam. And it was also the year in which LBJ famously manhandled the Chairman of the Federal Reserve down on his ranch in Texas, demanding that the Fed print the money to support his boys “bleeding and dying in the jungles of Southeast Asia”, as he put it.

But an inspection of the graph makes clear that the actual inflection point in terms of the explosion of the nation’s public debt incepted 15 years later after 1980. Thus, in 2023 dollars of purchasing power the public debt went from $2.36 trillion in 1966 to $2.76 trillion in 1980, representing a pretty modest 1.4% annual growth in real terms.

So even with a moderately more accommodative Fed after William McChesney Martin got the LBJ “treatment” and surging bills for the domestic Welfare State that Nixon and Ford did little to reverse, there was simply no sign circa 1980 that America’s politicians were about to uncork a runaway public debt.

Alas, the next 43-years proved otherwise, as what had been the flat part of the chart below virtually went vertical.

Again, in today’s dollars of purchasing power the theretofore contained public debt rose 14-fold, from $2.7 trillion in 1980 to nearly $33 trillion today. That surge embodied a dramatically higher 6.0% per annum rate of growth.

Needless to say, over any considerable period of time, the law of compound arithmetic is a monster. Had the public debt stayed on the 1966 to 1980 path of 1.4% growth, instead, the public debt today would be $5.0 trillion, not $33 trillion, And annual interest expense on the Federal debt at a standardized 4% rate would be $200 billion, not $1.3 trillion.

US Public Debt In Constant 2023 Dollars, 1966 to 2023

As we said, there is a shit-ton of significance in the upward climb of the chart after the 1981 bend-point. Something epochal happened to cause an extra $28 trillion of debt to be loaded upon the main street economy and to squeeze the daylights out of a federal budget that a decade or two down the road will be groaning under the entitlement costs owed to 100 million retired Americans.

So let us cut to the chase. The epochal turn of events we are referencing involves the defenestration of the old-time GOP and the consequent nullification of its dedication to the verities of fiscal rectitude, sound money, free market liberty and prosperity at home and peaceful commerce abroad.

In their stead came first and foremost the neocon enterprise of global empire and Washington hegemony – supplemented by the anti-abortion culture warriors, free-lunch tax-cutters, anti-immigrant border warriors and Greenspanian easy money brigade. Together, all of these digressions left the GOP compromised, distracted and ultimately impotent when it came to its essential mission in the struggle of American politics. That is, to function as the watchdog of the Treasury and the sturdy guardian of the nation’s taxpayers and producers.

Sometimes great historical developments can be book-ended, and the unfolding fiscal bankruptcy of the nation is one such case. It started when a cadre of neocon fanatics took over Ronald Reagan’s transition team and committed him needlessly to 7% real growth of the defense budget and it has now reached its apogee as the GOP desperately turns to Nikki Haley as it’s 11th hour alternative to the return of Donald Trump to the top of the ticket.

Quite simply, with the possible exception of the demented and bloody-thirsty Lindsay Graham, Nikki Haley is the most interventionist, pro-war Republican on today’s political scene. Yet a GOP that would even consider Haley as its presidential candidate under current circumstances has surely passed its “sell by” date when it comes to claiming the mantle of the conservative party in the two-party tango of democratic governance in America.

The first bookend that illuminates this baleful state needs only brief elaboration. The Reagan Administration inherited a $400 billion national defense budget from Jimmy Carter, when measured in current (2023) dollars of purchasing power. That was all America’s national security needed in the face of a rapidly decaying Soviet Empire and was only a tad less than the great Dwight Eisenhower had said was sufficient in 1961 when he warned against the military-industrial complex in his farewell address.

But owing to the capture of policy in the Reagan Administration by neocon hawks peddling the false claim that the Soviet Union was on the verge of a nuclear first strike capability, the mantra of “7% real growth” for the defense topline became the dominating force driving fiscal policy inside the GOP on both ends of Pennsylvania Avenue.

In Part 2 we will amplify the spillover effect of this defense spending obsession on efforts to shrink the Welfare State but suffice it here to note that by the time the Gipper left office, the Warfare State had taken on massive new girth. By 1988, the national security budget in 2023 dollars had reached $650 billion, representing a utterly needless 65% expansion of an already bloated defense establishment.

Worse still, this mushrooming level of defense spending killed whatever residual willingness to tackle domestic spending that remained among the increasingly defense-spending obsessed GOP rank-and-file on Capitol Hill. So when Reagan left office, the domestic budget stood at 15.4% of GDP, virtually the same claim on GDP that the “Carter big spenders” had left on Ronald Reagan’s doorstep.

So with no domestic spending cuts of material proportion, the soaring defense budgets and the deep 1981 tax cuts, it was off to the races in terms of annual deficits and a ballooning public debt. And it left Ronald Reagan sputtering that if deficits were due to defense spending, it was no matter: “you don’t budget for defense, you spend what you need”.

In a future column, we will elaborate on that fateful error and demonstrate that the dreadfully unfortunate potential choice of Nikki Haley to lead the GOP ticket is its lamentable end game.

David Stockman was a two-term Congressman from Michigan. He was also the Director of the Office of Management and Budget under President Ronald Reagan. After leaving the White House, Stockman had a 20-year career on Wall Street. He’s the author of three books, The Triumph of Politics: Why the Reagan Revolution Failed, The Great Deformation: The Corruption of Capitalism in America, TRUMPED! A Nation on the Brink of Ruin… And How to Bring It Back, and the recently released Great Money Bubble: Protect Yourself From The Coming Inflation Storm. He also is founder of David Stockman’s Contra Corner and David Stockman’s Bubble Finance Trader.

No comments:

Post a Comment