Frik Els | February 20, 2024 |

A new report from Griffith Asia Institute, a unit of Australia’s Griffith University, shows 10 years after the launch of China’s Belt & Road Initiative (BRI) cumulative engagement tops $1 trillion with about $634 billion in construction contracts and $419 billion in non-financial investments.

The authors point out that 2023 was the first time that more than 50% of BRI engagement was through investments where Chinese investors take equity stakes as opposed to construction contracts, which are typically financed through loans provided by Chinese financial institutions or contractors, often accompanied by guarantees from the host country.

Last year Africa overtook the Middle East as the no. 1 target of BRI projects after a 114% jump in investments and a 47% jump in construction projects on the continent. Investments in Latin America and the Caribbean also doubled last year.

Source: Griffith Asia Institute

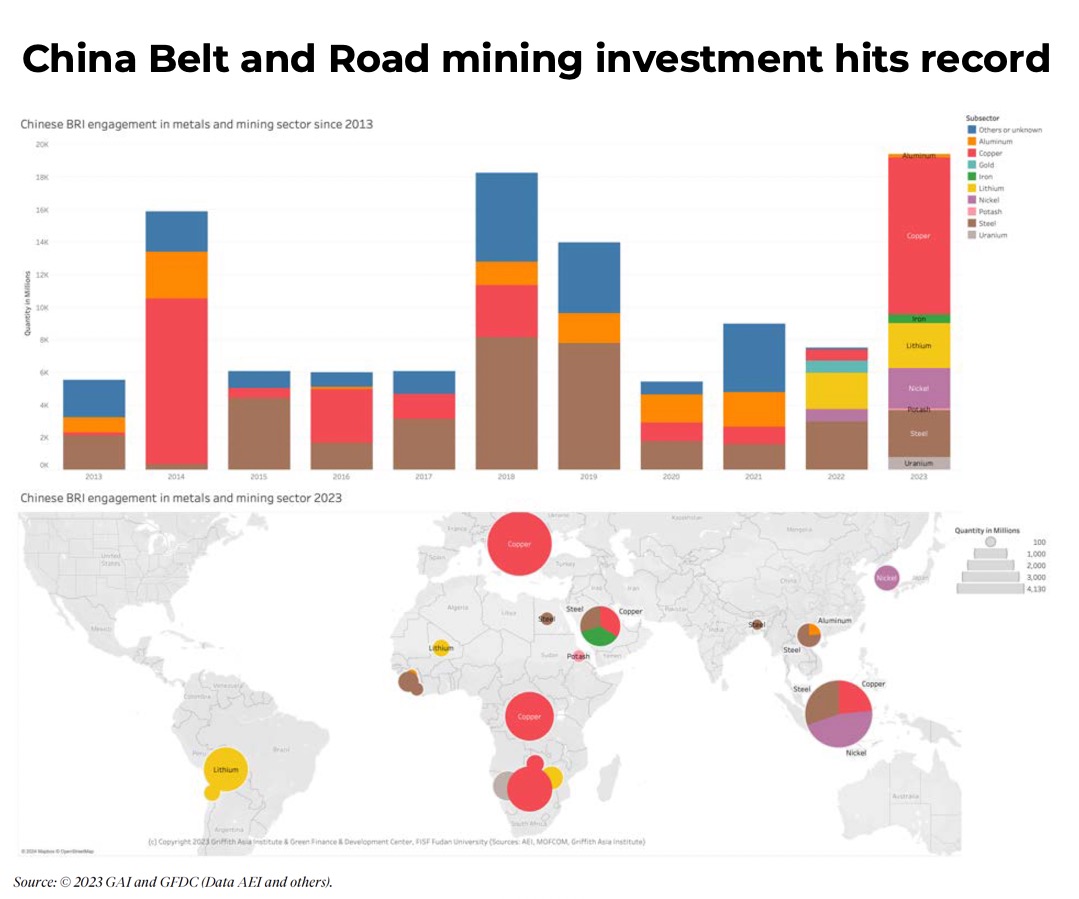

China’s BRI-related investment in metals and mining reached $19.4 billion in 2023 according to the study, a 158% jump compared to 2022 and the highest on record.

Minerals and metals investment focused on the green energy transition with copper making up the lion’s share of new project announcements last year, followed by sizable lithium, nickel and uranium spending under the BRI.

Apart from a giant new copper processing facility in Saudi Arabia, mining investments were focused in Indonesia and various countries in Africa and South America.

Examples include vertical integration investments by the world’s largest battery manufacturer CATL, which bought shares for a nickel mining concession in Indonesia from PT Aneka Tambang (Antam).

Lithium projects in Mali attracted investment from Chinese firms Jiangxi, Ganfeng and Hainan Mining (through the acquisition of Kodal Minerals) while Zhejiang Huayou Cobalt commissioned a lithium processing plant in Zimbabwe.

Downstream investment in battery and electric vehicle manufacturing also soared, reaching nearly $10 billion, according to the report. The largest investors under the BRI last year were CATL, accounting for more than 15% of overall spending, followed by Zijin Mining at 11%.

Zhejiang Huayou Cobalt contributed nearly 9% of the total while CMOC (formerly China Molybdenum) and Minmetals each had a 5%-plus share of the $92.4 billion total investments in 2023.

For 2024, the Griffith Asia Institute sees further growth of Chinese BRI engagement with a strong focus on country partnerships in renewable energy, resource-backed mining and related technologies including EV batteries.

China’s BRI-related investment in metals and mining reached $19.4 billion in 2023 according to the study, a 158% jump compared to 2022 and the highest on record.

Minerals and metals investment focused on the green energy transition with copper making up the lion’s share of new project announcements last year, followed by sizable lithium, nickel and uranium spending under the BRI.

Apart from a giant new copper processing facility in Saudi Arabia, mining investments were focused in Indonesia and various countries in Africa and South America.

Examples include vertical integration investments by the world’s largest battery manufacturer CATL, which bought shares for a nickel mining concession in Indonesia from PT Aneka Tambang (Antam).

Lithium projects in Mali attracted investment from Chinese firms Jiangxi, Ganfeng and Hainan Mining (through the acquisition of Kodal Minerals) while Zhejiang Huayou Cobalt commissioned a lithium processing plant in Zimbabwe.

Downstream investment in battery and electric vehicle manufacturing also soared, reaching nearly $10 billion, according to the report. The largest investors under the BRI last year were CATL, accounting for more than 15% of overall spending, followed by Zijin Mining at 11%.

Zhejiang Huayou Cobalt contributed nearly 9% of the total while CMOC (formerly China Molybdenum) and Minmetals each had a 5%-plus share of the $92.4 billion total investments in 2023.

For 2024, the Griffith Asia Institute sees further growth of Chinese BRI engagement with a strong focus on country partnerships in renewable energy, resource-backed mining and related technologies including EV batteries.

No comments:

Post a Comment