BHP stands down 25% of nickel project workforce

Bloomberg News | March 17, 2024 |

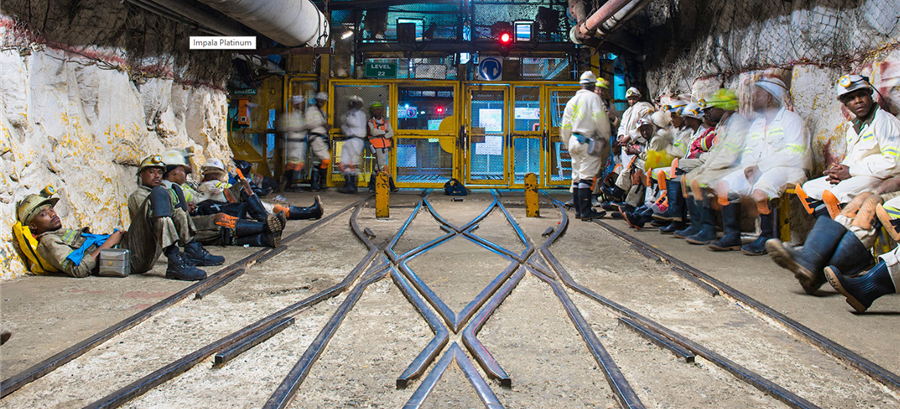

West Musgrave project area. (Image by BHP).

BHP Group Ltd., the world’s largest miner, has stood down around a quarter of the workers constructing its West Musgrave nickel and copper project in Western Australia, according to a report from the Australian Financial Review.

The workforce at the A$1.7 billion project has been cut from about 400 to 300 people, the AFR reported, without saying where it got the information. A company spokesman said the exit of some workers didn’t mean the entire project – acquired from OZ Minerals Ltd. last year – has been canceled, the AFR said.

In February, BHP took a $2.5 billion impairment on the value of its Australian nickel assets after a surge in supply of the battery metal dragged down prices. The miner also said it would shutter its Kambalda concentrator, which processes ore, and could mothball its other Australian nickel assets after a review.

The price of nickel — a metal traditionally used to strengthen steel that’s become key to the energy transition due to its use in electrification and batteries — has dropped 40% since the start of 2023 on the London Metal Exchange.

(By Georgina McKay)

Implats’ Zimbabwe unit plans voluntary job cuts to contain costs

Bloomberg News | March 18, 2024 |

Bloomberg News | March 18, 2024 |

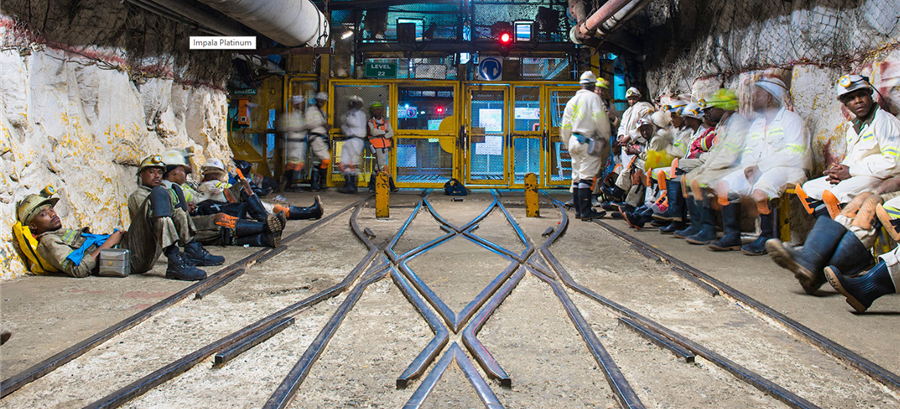

Impala Platinum’s Rustenburg operations.

Image courtesy of Implats Distinctly Platinum

Impala Platinum Holdings Ltd.’s Zimbabwean unit is offering staff voluntary redundancy packages to cut costs because of anemic metal prices.

Weak platinum group metal prices are projected to last for the next 12 to 18 months, Zimplats Holdings Ltd. chief executive officer Alex Mhembere said in a staff circular dated March 18 that was confirmed by the company. The producer is beginning “a voluntary retrenchment exercise for all employees wishing to be considered,” which may “mitigate the need for a compulsory retrenchment,” the circular said.

Impala Platinum Holdings Ltd.’s Zimbabwean unit is offering staff voluntary redundancy packages to cut costs because of anemic metal prices.

Weak platinum group metal prices are projected to last for the next 12 to 18 months, Zimplats Holdings Ltd. chief executive officer Alex Mhembere said in a staff circular dated March 18 that was confirmed by the company. The producer is beginning “a voluntary retrenchment exercise for all employees wishing to be considered,” which may “mitigate the need for a compulsory retrenchment,” the circular said.

Impala, known as Implats, and its PGM mining peers have already cut thousands of jobs in neighboring South Africa – which accounts for about 70% of global platinum output. The four largest producers have all recently released sobering earnings reports, with profits battered by a sharp slump in metals prices since the start of last year.

Employees at Zimplats – Zimbabwe’s biggest producer of PGMs – are being offered a minimum of three months’ pay and must submit their application forms by March 22, according to the circular.

“We have been working with all teams across the board in implementing various cost containment and cash preservation programs,” Mhembere said. “I am confident that as a team we will successfully navigate through the headwinds.”

(By Godfrey Marawanyika)

Employees at Zimplats – Zimbabwe’s biggest producer of PGMs – are being offered a minimum of three months’ pay and must submit their application forms by March 22, according to the circular.

“We have been working with all teams across the board in implementing various cost containment and cash preservation programs,” Mhembere said. “I am confident that as a team we will successfully navigate through the headwinds.”

(By Godfrey Marawanyika)

No comments:

Post a Comment