Cecilia Jamasmie | March 20, 2024 |

Glencore currently operates 26 mines in 21 thermal and coking coal mining complexes across Australia, Colombia and South Africa. (Image courtesy of Glencore.)

Mining and commodities trader Glencore (LON: GLEN) said on Wednesday it is on track to reduce carbon dioxide equivalent emissions for its industrial assets by 25% by the end of 2030.

In its 2024-2026 Climate Action Transition Plan (CATP), the Swiss company outlined the work it is doing to achieve emissions reduction targets of 15% and 50% by the end of 2026 and 2035, respectively.

The company’s revised climate plan is much like a previous plan it released — but this time includes the interim 2030 target.

“[The new plan] reflects a wide range of inputs, including analysis of the evolving market landscape, new regulatory requirements, mining and energy peer approaches, the IEA’s latest modelling, stakeholder inputs, and emerging insights from the most recent United Nations Framework Convention on Climate Change (UNFCCC) dialogue,” chief executive officer Gary Nagle said in a statement.

“We have also undertaken extensive engagement with our shareholders and appreciate their time and support as we have developed this CATP,” Nagle noted.

Glencore, like most of the world’s biggest listed companies, published its first climate action plans in 2020 in a bid to help with reaching the 2015 Paris Agreement goal of capping temperatures within 1.5 degrees Celsius.

The Baar, Switzerland-based firm, one of the top global thermal coal exporters, has faced backlash for being one of the few top miners still involved in the extraction of the fossil fuel used to generate electricity.

After facing pressure from major investors and shareholders, Glencore committed to run down its coal mines by the mid-2040s, closing at least 12 by 2035.

“We recognize the different roles of thermal coal and steelmaking coal – and the different transition pathways for both,” Nagle said while presenting the new strategy.

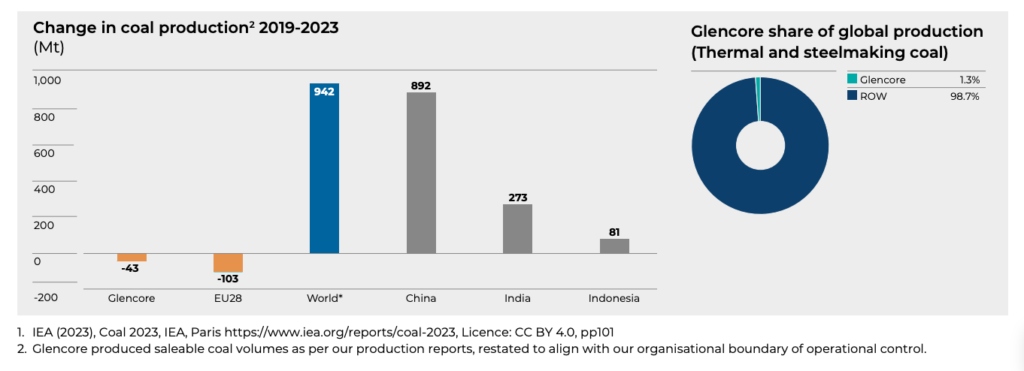

Source: Glencore’s 2024-2026 Climate Action Transition Plan. (Click to see full size)

The executive noted the company “remains committed” to the responsible phase-down of its coal portfolio and is not progressing any greenfield thermal coal investments.

The company continues to produce and recycle commodities considered key for today’s cleaner transition technologies. Nagle said the speed and direction of Glencore’s decarbonization efforts are significantly shaped by geopolitics, policy decisions, and technological advancements.

Tackling Scope 3 emissions

Glencore plans to cut “Scope 3” emissions — those produced when customers burn or process a company’s raw materials — by 30% by 2035 and achieving net zero Scope 3 emissions by 2050.

The company did not include its marketing activities in the these goals. It justified the decision by saying that, by trading in the third party volumes, its activities do not generate additional Scope 3 emissions, “which in the ordinary course are associated with the transformation or use of the product by third parties”.

Glencore recently acquired a 77% interest in Teck’s (TSX: TECK.A, TECK.B)(NYSE: TECK) steelmaking coal business, Elk Valley Resources (EVR). The transaction remains subject to mandatory regulatory approvals and is expected to close by no later than Q3 2024.

The executive noted the company “remains committed” to the responsible phase-down of its coal portfolio and is not progressing any greenfield thermal coal investments.

The company continues to produce and recycle commodities considered key for today’s cleaner transition technologies. Nagle said the speed and direction of Glencore’s decarbonization efforts are significantly shaped by geopolitics, policy decisions, and technological advancements.

Tackling Scope 3 emissions

Glencore plans to cut “Scope 3” emissions — those produced when customers burn or process a company’s raw materials — by 30% by 2035 and achieving net zero Scope 3 emissions by 2050.

The company did not include its marketing activities in the these goals. It justified the decision by saying that, by trading in the third party volumes, its activities do not generate additional Scope 3 emissions, “which in the ordinary course are associated with the transformation or use of the product by third parties”.

Glencore recently acquired a 77% interest in Teck’s (TSX: TECK.A, TECK.B)(NYSE: TECK) steelmaking coal business, Elk Valley Resources (EVR). The transaction remains subject to mandatory regulatory approvals and is expected to close by no later than Q3 2024.

Glencore-backed Peru zinc miner Volcan halts three mines over permits

Reuters | March 19, 2024 |

San Cristobal mine is ranked among the world’s biggest producers of zinc, lead and silver. (Image courtesy of Minera San Cristobal)

Peruvian zinc, lead and silver miner Volcan, backed by global commodities giant Glencore Plc, will halt activity at three of its mines in the country from Tuesday as it works on updating an operating permit for its Rumichaca tailings dam.

The Peruvian firm said in a statement, posted to the local regulator, that it would suspend its operations in the San Cristobal, Carahuacra and Ticlio mines in the center of the country for up to 30 days.

Peru is the world’s second largest producer of copper, silver and zinc, which are key to its economy. Sales of the metals are equivalent to 60% of all the country’s exports.

The mines are part of the Yauli mining unit, located in the department of Junin, 170 kilometers (105.63 miles) from capital Lima, which produces zinc, lead, silver and copper. The Rumichaca tailings dam is in the same area.

The company did not specify what impact the suspension of activities would have on production, but said that during the shutdown period “all the necessary care and maintenance work will be carried out to restart operations as soon as possible.”

(By Juana Casas; Editing by Deepa Babington)

Reuters | March 19, 2024 |

San Cristobal mine is ranked among the world’s biggest producers of zinc, lead and silver. (Image courtesy of Minera San Cristobal)

Peruvian zinc, lead and silver miner Volcan, backed by global commodities giant Glencore Plc, will halt activity at three of its mines in the country from Tuesday as it works on updating an operating permit for its Rumichaca tailings dam.

The Peruvian firm said in a statement, posted to the local regulator, that it would suspend its operations in the San Cristobal, Carahuacra and Ticlio mines in the center of the country for up to 30 days.

Peru is the world’s second largest producer of copper, silver and zinc, which are key to its economy. Sales of the metals are equivalent to 60% of all the country’s exports.

The mines are part of the Yauli mining unit, located in the department of Junin, 170 kilometers (105.63 miles) from capital Lima, which produces zinc, lead, silver and copper. The Rumichaca tailings dam is in the same area.

The company did not specify what impact the suspension of activities would have on production, but said that during the shutdown period “all the necessary care and maintenance work will be carried out to restart operations as soon as possible.”

(By Juana Casas; Editing by Deepa Babington)

No comments:

Post a Comment