World’s top aluminum producer sees raw material supply risk in Guinea

Bloomberg News | March 28, 2024

Image by Aluminum Corp of China Ltd.

Aluminum Corp. of China Ltd. said it sees “relatively high” risks to supplies of bauxite from Guinea, highlighting its growing dependence on a single country for the raw material.

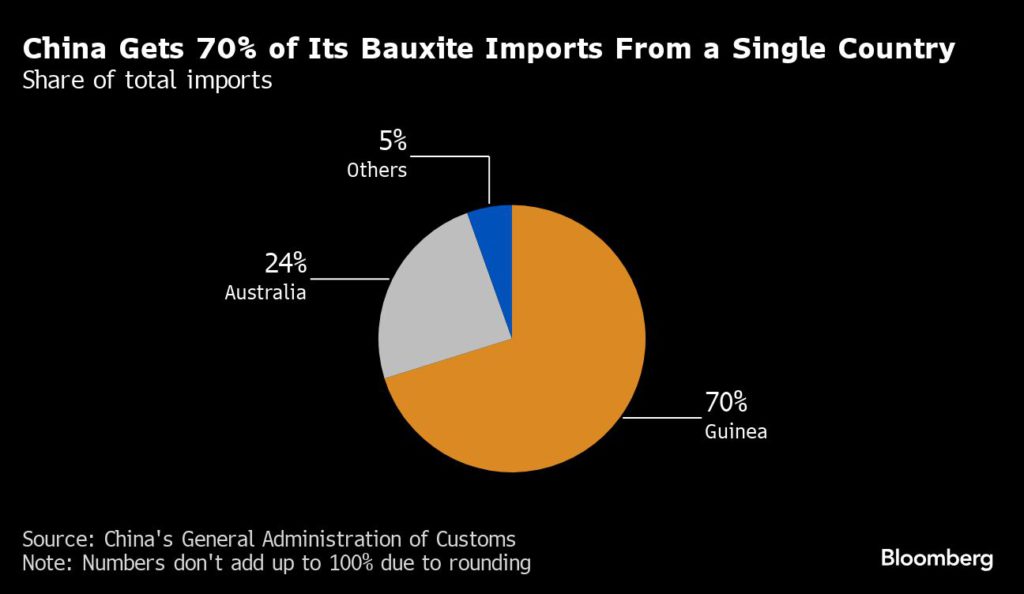

The West African nation last year provided 70% of China’s imports of bauxite, which is used to produce aluminum. That’s left Chalco, as the company is known, highly exposed to disruptions there.

“The company’s bauxite mine in Guinea may experience fluctuations in supply due to local policy changes and frequent strikes,” the world’s biggest aluminum producer said in its annual results statement.

Chalco said it will try to ensure supply continuity from its single mine in Guinea, and will seek to develop more mines in the country’s north. It will also look to cooperate on bauxite projects in other places, and to develop more supplies domestically.

Guinea blew past Australia and Indonesia in the 2010s to become the biggest bauxite exporter. Most of it goes to China, where it’s processed into alumina and then aluminum metal. China’s own bauxite production has faded, while Indonesia halted exports in its push to process more minerals at home.

China might eventually have to rely on Guinea for 90% of its bauxite imports, Bloomberg Intelligence analyst Michelle Leung said in a note this month. It’s possible Guinea could emulate Indonesia by requiring foreign companies to build refineries locally, she said.

Chalco’s net income rose 60% to 6.72 billion yuan last year. The company warned that sluggish global economic growth and expanding geopolitical risks were creating a highly uncertain outlook for commodities. “The domestic market still

Reuters | March 29, 2024 |

Credit: Century Aluminum

The US is going to build its first primary aluminum smelter in 45 years.

The Biden-Harris administration has awarded $500 million to Century Aluminum towards the construction of a new “green” low-carbon smelter.

The aim is to halt what US consumers such as Ford Motor and PepsiCo have described as a crisis in a sector that has shrunk from 19 to just four operating domestic plants over the last two decades.

With aluminum usage expected to grow strongly thanks to its use in energy transition applications such as solar power and wind turbines, the ambition is also to reduce the country’s import dependency.

However, translating ambition into actuality will depend on whether Century can find enough green power to run its new green smelter.

Sector reboot

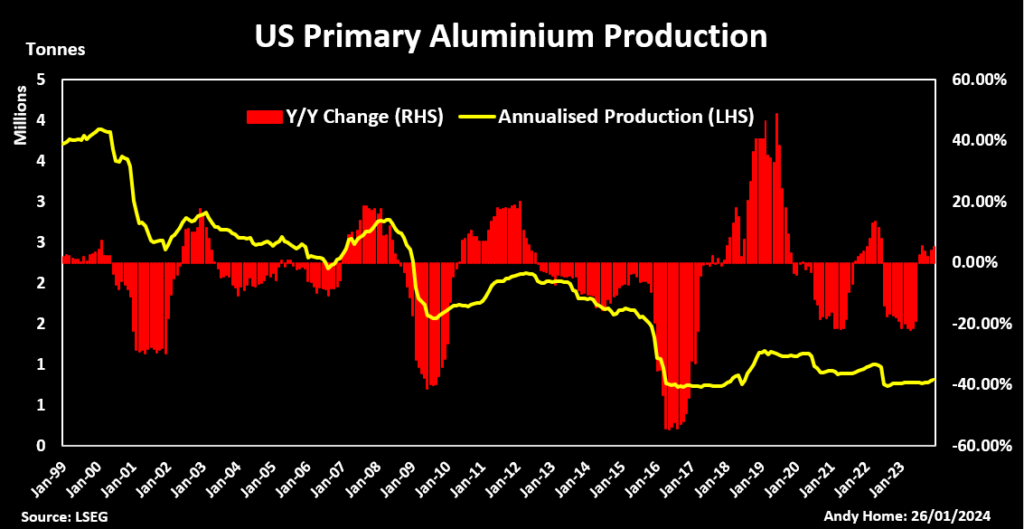

US production of primary aluminum fell from 3.8 million metric tons in 1999 to 785,000 tons last year.

It will decline again this year due to the idling of the New Madrid smelter in Missouri in January.

There are now just four operating plants, two owned by Alcoa and two by Century, with combined annual capacity of around 650,000 tons.

The Trump’s administration introduction of a 10% aluminum import tariff in 2018 marked only a brief pause in the long-term decline.

US import dependency is already large at just over four million tons every year and is set to grow further as the 2022 Inflation Reduction Act (IRA) stimulates investment in energy transition sectors such as electric vehicles and renewable energy.

They all need aluminum. In 2020, the World Bank identified the metal as a “high-impact” and “cross-cutting” metal in all existing and potential green energy technologies.

Global usage is forecast by the International Aluminium Institute to rise from 108 million tons in 2022 to 176 million by 2050.

President Joe Biden’s administration has channelled an estimated $1.25 trillion of funds into new green energy sectors, but the money available to aluminum’s supply side stacks up at just $126 billion, according to US think tank SAFE. (“Legislative Analysis for the US Aluminum Industry”, May 2023)

Most of those funds have come in the form of IRA tax credits for advanced manufacturing rather than direct investment in more capacity.

The combination of a shrinking domestic production base and fast-rising demand is a major challenge for a government looking to re-shore critical mineral supply chains.

The inclusion of Century’s aluminum project in a broader $6 billion package of industrial decarbonization grants shows the Biden administration is only too aware of the need for a reboot.

US production of primary aluminum fell from 3.8 million metric tons in 1999 to 785,000 tons last year.

It will decline again this year due to the idling of the New Madrid smelter in Missouri in January.

There are now just four operating plants, two owned by Alcoa and two by Century, with combined annual capacity of around 650,000 tons.

The Trump’s administration introduction of a 10% aluminum import tariff in 2018 marked only a brief pause in the long-term decline.

US import dependency is already large at just over four million tons every year and is set to grow further as the 2022 Inflation Reduction Act (IRA) stimulates investment in energy transition sectors such as electric vehicles and renewable energy.

They all need aluminum. In 2020, the World Bank identified the metal as a “high-impact” and “cross-cutting” metal in all existing and potential green energy technologies.

Global usage is forecast by the International Aluminium Institute to rise from 108 million tons in 2022 to 176 million by 2050.

President Joe Biden’s administration has channelled an estimated $1.25 trillion of funds into new green energy sectors, but the money available to aluminum’s supply side stacks up at just $126 billion, according to US think tank SAFE. (“Legislative Analysis for the US Aluminum Industry”, May 2023)

Most of those funds have come in the form of IRA tax credits for advanced manufacturing rather than direct investment in more capacity.

The combination of a shrinking domestic production base and fast-rising demand is a major challenge for a government looking to re-shore critical mineral supply chains.

The inclusion of Century’s aluminum project in a broader $6 billion package of industrial decarbonization grants shows the Biden administration is only too aware of the need for a reboot.

Power challenge

Once completed, the new smelter “would double the size of the current US primary aluminum industry,” Century said.

That implies it’s going to be a sizeable smelter. It will also generate just 25% of the emissions of a traditional smelter thanks to what the Department of Energy (DOE) described as “state-of-the-art, energy-efficient design and use of carbon-free energy.”

Aluminum is produced from alumina by electrolysis, meaning smelters are massive and continuous power users.

The decline and fall of the US smelter sector has been as much about the lack of cheap power as anything else. Moreover, the remaining plants draw their power from fossil-fuel generators, meaning their metal comes with a relatively high carbon footprint.

A new smelter drawing on carbon-free energy is the most obvious way to reconcile industrial revival and net-zero commitments.

Century is looking at sites in the Ohio-Mississippi River Basin area, suggesting the company is eyeing the region’s hydro power capacity.

However, it remains to be seen whether there is sufficient spare capacity to guarantee power to a smelter of the size being proposed.

It will also obviously take time to build and bring into production.

Secondary reboot

A shorter-term solution is offered by the secondary aluminum sector, which is intrinsically greener than the primary one because re-melting only uses around 5% of the energy needed to make virgin metal.

Five metals projects were chosen for funds under the Industrial Demonstrations Program, which is managed by DOE’s Office of Clean Energy Demonstrations.

One of those is Century’s new smelter. Constellium will receive $75 million towards a first-of-its-kind zero-carbon aluminum casting plant in Virginia.

The other three go to the secondary metals sector.

Wieland will get up to $270 million for an advanced copper recycling project in Kentucky.

Real Alloy Recycling is allocated up to $67.3 million for its plans to construct the first zero-waste salt slag recycling facility in the US.

It’s not quite as headline-grabbing as a new primary smelter, but recycling what currently goes to landfill would be a major enhancement of aluminum’s circularity.

So too would be Golden Aluminum’s Next Generation Mini Mill project, which is getting $22.3 million of federal funding. The aim is to reduce natural gas consumption, improve process efficiency, and recycle 15% more mixed-grade aluminum scrap.

“This project would be highly replicable among other US aluminum producers and can help solidify the US as a world leader in decarbonized secondary aluminum production,” the DOE said.

Advanced materials recycling is an area where Western metal operators still have a technical edge on Chinese competitors and it makes sense to invest in maintaining this green advantage.

It also offers a short-term way of moderating US import dependency while Century goes in search of power.

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

(Editing by Paul Simao)

No comments:

Post a Comment