Levitation: Classic Magic Trick May Enable Quantum Computing

A new project will use the electric field in an accelerator cavity to try to levitate a tiny metallic particle, allowing it to store quantum information.

Quantum computing could solve problems that are difficult for traditional computer systems. It may seem like magic. One step toward achieving quantum computing even resembles a magician’s trick: levitation. A new project at the U.S. Department of Energy’s Thomas Jefferson National Accelerator Facility will attempt this trick by levitating a microscopic particle in a superconducting radiofrequency (SRF) cavity to observe quantum phenomena.

Typically at Jefferson Lab and other particle accelerator facilities, SRF cavities enable studies of the atom’s nucleus. They do this by accelerating subatomic particles, such as electrons. This project will use the same type of cavity to instead levitate a microscopic particle of metal, between 1 and 100 micrometers in diameter, with the cavity’s electric field.

“No one has ever intentionally suspended a particle in an electric field in a vacuum using SRF cavities,” said Drew Weisenberger, a principal investigator on this project, as well as Chief Technology Officer and head of the Radiation Detector and Imaging Group in the Experimental Nuclear Physics Division at Jefferson Lab.

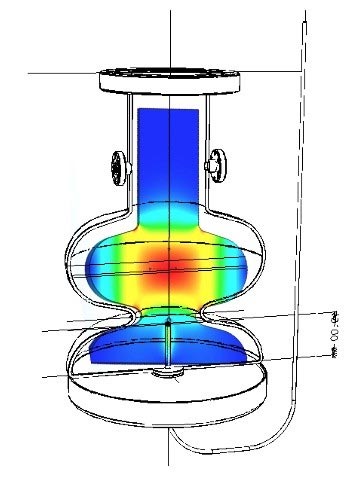

This is a line drawing of an accelerator cavity that will be used in a proof of principle project that aims to levitate a tiny metallic particle, allowing it to store quantum information. Credit: Jefferson Lab

If the project team is able to levitate a particle, they might be able to then impart a quantum state on it by cooling the trapped particle to its lowest possible energy level (because that’s when quantum properties occur).

“Storing quantum information on a levitated nanoparticle is our ultimate goal, but for now, it is a proof of principle experiment,” said Pashupati Dhakal, another principal investigator on the project and a staff scientist at Jefferson Lab in the Accelerator Operations, Research and Development Division. “We want to know if we can trap and levitate particles inside the cavity using the electric field.”

Exploring the Quantum with Accelerator Cavities

The idea for this project came from observations of accelerator experts. They think they have already unintentionally levitated unwanted and rare nanoparticles of metal, such as niobium and iron, inside SRF cavities during particle accelerator operations. They suspect that this unintentional levitation has impacted the performance of SRF cavity components.

Researchers are attempting to use a several-decades-old technique called “laser trapping”, as a step toward reliably imparting a quantum state on a particle suspended in a laser beam. But, the Jefferson Lab project team thinks that SRF cavities may provide a better tool for those researchers.

“An electric field could go potentially beyond the capabilities of laser trapping,” Weisenberger said.

Intrinsic characteristics of SRF cavities will overcome some limits of laser trapping. A levitated particle in an SRF cavity that is under vacuum and chilled to super cold temperatures will only interact with the cavity’s electric field and not lose information to the outside, which is important for maintaining a quantum state.

“Like storing information on a computer chip, the quantum state will stay and not dissipate,” Weisenberger said. “And that could eventually lead to applications in quantum computing and quantum communications.”

This project, titled “SRF Levitation and Trapping of Nanoparticles Experiment,” is funded by the Laboratory Directed Research & Development program, which provides resources for Jefferson Lab personnel to make rapid and significant contributions to critical science and technology problems relevant to the mission of Jefferson Lab and the DOE.

A Multidisciplinary Approach

The project was conceived and launched by Rongli Geng in October 2021 before he transitioned to Oak Ridge National Laboratory. It has now shifted to a larger and more multi-disciplinary team led by Weisenberger and Dhakal, the current co-principal investigators.

Weisenberger’s team researches detector technology for nuclear physics research, whereas Dhakal’s work focuses on developing SRF cavities to accelerate electrons at high speeds. Weisenberger says that the multidisciplinary approach will bring together their expertise as they branch out together into the less familiar territory of this LDRD project.

Both principal investigators remark that the project is moving forward well, thanks to the diligence and expertise supplied by every member of the team. Team members include John Musson, Frank Marhauser, Haipeng Wang, Wenze Xi, Brian Kross and Jack McKisson.

“It’s an interesting step outside of the usual things that we do,” Weisenberger said. “The LDRD program lets loose Jefferson Lab scientists and engineers on a research question that isn’t directly related to what we’re actually hired to do, but is making use of all the expertise that we bring and it’s a great resource to tap to try to stretch. That’s what we’re doing with this project, stretching.”

Building and Testing

Before turning the project over the Weisenberger and Dhakal, Geng and his colleagues had determined the required parameters of the cavity and electric field with simulations and calculations.

“We have everything on paper but we have to make it into a reality,” Dhakal said.

The team is currently setting up the experiment in real life.

“We have to see if what was simulated can actually happen,” Weisenberger said.

First, they’ll assemble a mock-up of the experiment at room temperature. Then, they’ll circulate liquid helium around the outer surfaces of the cavity to cool it to superconducting temperatures approaching absolute zero.

Next comes the most difficult part. They must get a single microscopic particle in the correct region of the cavity while the cavity is locked up inside a containment vessel at superconducting temperatures, under vacuum, and with the electric field on.

“We’ve come up with a way to remotely launch a particle in the cavity under experimental conditions, we just have to test it now,” Weisenberger said. “In the research and development world, you often can’t do what you thought you could do. We try and test and run into problems, try to solve the problems, and keep going.”

This is a year-long project with the possibility of another year of funding, depending on how things go. It is also an early stage, proof of principle project. If it is ultimately successful, there would still be a long road of R&D before the concepts could be applied toward building quantum computers. Such computers would require levitating and imparting quantum states on tens to hundreds to thousands of much smaller particles predictably and reliably.

Still, the researchers are looking forward to the discoveries they hope this study will enable regarding microscopic particle levitation and potential observation of a quantum state.

“I’m optimistic,” Dhakal said. “Either way, we’ll discover something. Failure is just as much a part of R&D as success. You learn from both. Basically, whether the particle levitates or not, or whether we can impart the quantum state to it or not, it’s something that’s never been done before. It’s very challenging and exciting.”

The team already has a research paper in the works for this project, but only time will tell whether they can realize this bit of magic in the laboratory.