Mountain Province discovers kimberlite in three target areas at Kennady North

Staff Writer | May 17, 2022 |

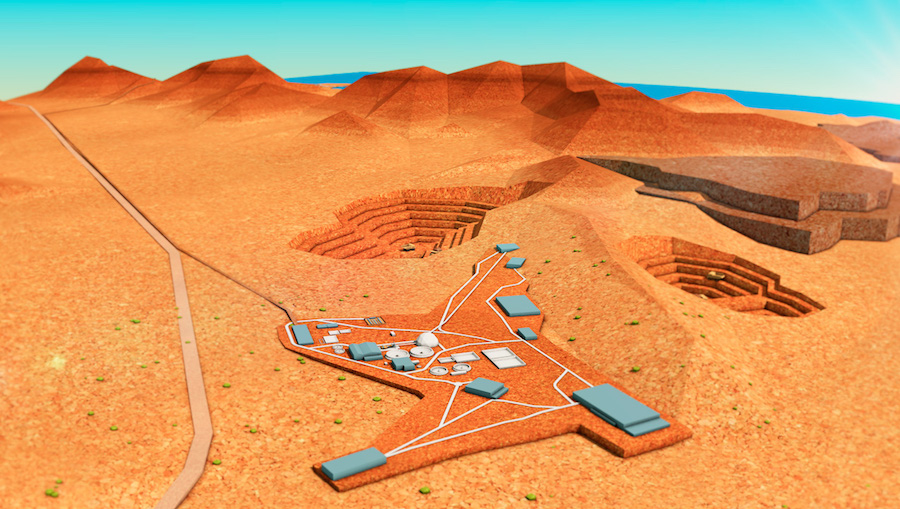

The Kennady North project is located 300 km east-northeast of Yellowknife, NWT.

Credit: Mountain Province Diamonds

Mountain Province Diamonds (TSX: MPVD) has released interim exploration results for its 100%-held Kennady North project in Northwest Territories, consisting of over 107,000 ha of claims and leases that completely surround the Gahcho Kué diamond mine.

The 2022 exploration program is focused on finding new kimberlites based on a detailed analysis of historical technical information, including ground and airborne geophysics, kimberlite indicator minerals, and geological mapping. The latest results highlight the discoveries from 3,000 metres (20 holes) of the current 6,000-metre drill program that have been completed so far.

Drilling to date has tested four of the 16 target areas identified on the property, with three of those returning kimberlite intersections: the North anomaly, north of the Faraday 1-3 kimberlite deposit; the South anomaly, south of the Faraday 2 deposit; and Kelvin South, south of the Kelvin deposit. Overall, 16 of the 20 holes intersected kimberlite.

At the North anomaly, all seven holes intersected kimberlite, including hypabyssal kimberlite (average thickness of 1.54 metres) and also volcaniclastic kimberlite (average 0.95m), which is often an indicator of kimberlite size potential.

At South Anomaly, all five holes hit hypabyssal kimberlite at an average width of 4.5 metres (3.23-metresthickness). At Kelvin South, four of six drill holes intersected hypabyssal kimberlite.

“We began 2022 with a plan to launch an aggressive winter exploration campaign over Kennady North, and we have achieved that plan” said CEO Mark Wall. “We have discovered kimberlite in three of four targets tested to date, and completed all of our scheduled airborne and ground geophysics.”

The winter drilling is expected to continue at Kennady North through the end of May, with the aim of testing as “many priority anomalies as feasible,” he added.

Summer exploration at Kennady North will start in the third quarter, with emphasis on follow-up sampling of indicator mineral results generated from the 2021 till sampling program, which are expected to be complete by the end of Q3.

A review of all winter 2022 ground geophysical data continues through the second quarter, with the intent to drill areas of interest with land-based anomalies in the summer program.

The Kennady North project has been the focus of exploration by numerous operators since 1992. Limited drilling led to the discovery of the Kelvin deposit, and later on Faraday 1, 2, and 3. Subsequent geophysics and drilling resulted in significant tonnages of kimberlite at both Kelvin (8.5 million indicated tonnes grading 1.6 carats per tonne for 13.6 million carats) and the Faradays (nearly 4 million inferred tonnes containing 7.35 million carats).

Mountain Province Diamonds (TSX: MPVD) has released interim exploration results for its 100%-held Kennady North project in Northwest Territories, consisting of over 107,000 ha of claims and leases that completely surround the Gahcho Kué diamond mine.

The 2022 exploration program is focused on finding new kimberlites based on a detailed analysis of historical technical information, including ground and airborne geophysics, kimberlite indicator minerals, and geological mapping. The latest results highlight the discoveries from 3,000 metres (20 holes) of the current 6,000-metre drill program that have been completed so far.

Drilling to date has tested four of the 16 target areas identified on the property, with three of those returning kimberlite intersections: the North anomaly, north of the Faraday 1-3 kimberlite deposit; the South anomaly, south of the Faraday 2 deposit; and Kelvin South, south of the Kelvin deposit. Overall, 16 of the 20 holes intersected kimberlite.

At the North anomaly, all seven holes intersected kimberlite, including hypabyssal kimberlite (average thickness of 1.54 metres) and also volcaniclastic kimberlite (average 0.95m), which is often an indicator of kimberlite size potential.

At South Anomaly, all five holes hit hypabyssal kimberlite at an average width of 4.5 metres (3.23-metresthickness). At Kelvin South, four of six drill holes intersected hypabyssal kimberlite.

“We began 2022 with a plan to launch an aggressive winter exploration campaign over Kennady North, and we have achieved that plan” said CEO Mark Wall. “We have discovered kimberlite in three of four targets tested to date, and completed all of our scheduled airborne and ground geophysics.”

The winter drilling is expected to continue at Kennady North through the end of May, with the aim of testing as “many priority anomalies as feasible,” he added.

Summer exploration at Kennady North will start in the third quarter, with emphasis on follow-up sampling of indicator mineral results generated from the 2021 till sampling program, which are expected to be complete by the end of Q3.

A review of all winter 2022 ground geophysical data continues through the second quarter, with the intent to drill areas of interest with land-based anomalies in the summer program.

The Kennady North project has been the focus of exploration by numerous operators since 1992. Limited drilling led to the discovery of the Kelvin deposit, and later on Faraday 1, 2, and 3. Subsequent geophysics and drilling resulted in significant tonnages of kimberlite at both Kelvin (8.5 million indicated tonnes grading 1.6 carats per tonne for 13.6 million carats) and the Faradays (nearly 4 million inferred tonnes containing 7.35 million carats).