Vessel Condition, Human Error Blamed for Loss of Thai Navy Frigate

The Royal Thai Navy has completed its investigation into the sinking of the frigate Sukhothai in 2022, blaming a combination of bad weather, vessel condition and human error for the casualty.

On the night of December 18, 2022, the 36-year-old frigate Sukhothai encountered heavy weather while operating about 20 miles off Bang Saphan, Thailand. Instead of continuing onward to Bang Saphan, where there would be no assist tugs, the commanding officer opted to reverse course and return to the naval base at Chon Buri, on the other side of the Gulf of Thailand.

Conditions continued to worsen, and wave heights reached about 20 feet. The vessel lost power and began to flood, and her pumps were unable to keep up. Response vessels could not transfer over salvage pumps because the surface conditions were too rough. The vessel suffered progressive flooding, and at 0012 hours, the Sukhothai capsized and sank.

76 survivors were rescued, including 18 who were hospitalized. 24 deceased crewmembers' bodies were recovered, and five remain missing at sea.

After the casualty, divers from the Royal Thai Navy and the U.S. Navy inspected the ship and found evidence of physical damage. The wave breaker just forward of the main cannon had torn off, leaving a one-inch hole in the deck where water could enter. The gun turret also showed signs of impact damage from an unknown object, and there were two substantial penetrations on the port side above the waterline, about one foot long each - also from impact with an unidentified object. In addition, the hatch for a line locker was unsecured, and the hatch for the cannon's gun bay compartment was not possible to close, according to The Nation Thailand. All of these factors could potentially contribute to flooding in heavy seas.

In addition, the investigation found fault with the commanding officer's decision to turn back and head for Chon Buri. Bang Saphan was closer, and the decision "was made hastily and without thorough consideration," the investigators concluded.

The former CO, Capt. Pichitchai Tuannadee, acknowledged that the decision had been his, though he said that he and his crew had acted with the best intentions to save their ship. Tuannadee resigned from the Navy at the same press conference, and said that his departure would preserve the honor of the post he held. Before leaving, he will serve out a 15-day punitive detention.

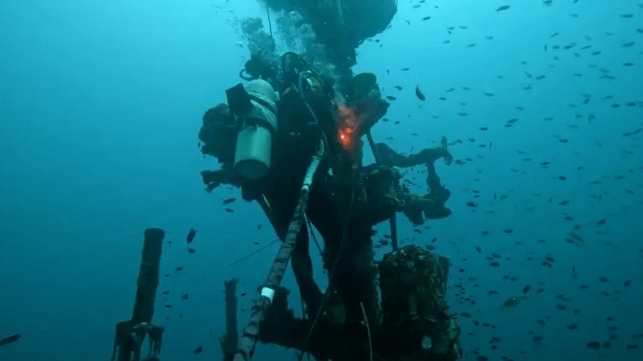

The Thai government initially pledged to raise the wreck of the Sukhothai, but the project proved to be too expensive and risky. Instead, it opted to work with the U.S. Navy's salvage specialists to remove or decommission the ship's weapons, munitions and sensitive materials.