Bloomberg News | October 9, 2024 |

Canadian Finance Minister Chrystia Freeland, along with Bank of Canada Governor Tiff Macklem. Credit: Wikimedia Commons

Canada has provided more clarity on what it considers to be “green” investments — with new natural gas projects unlikely to make the cut.

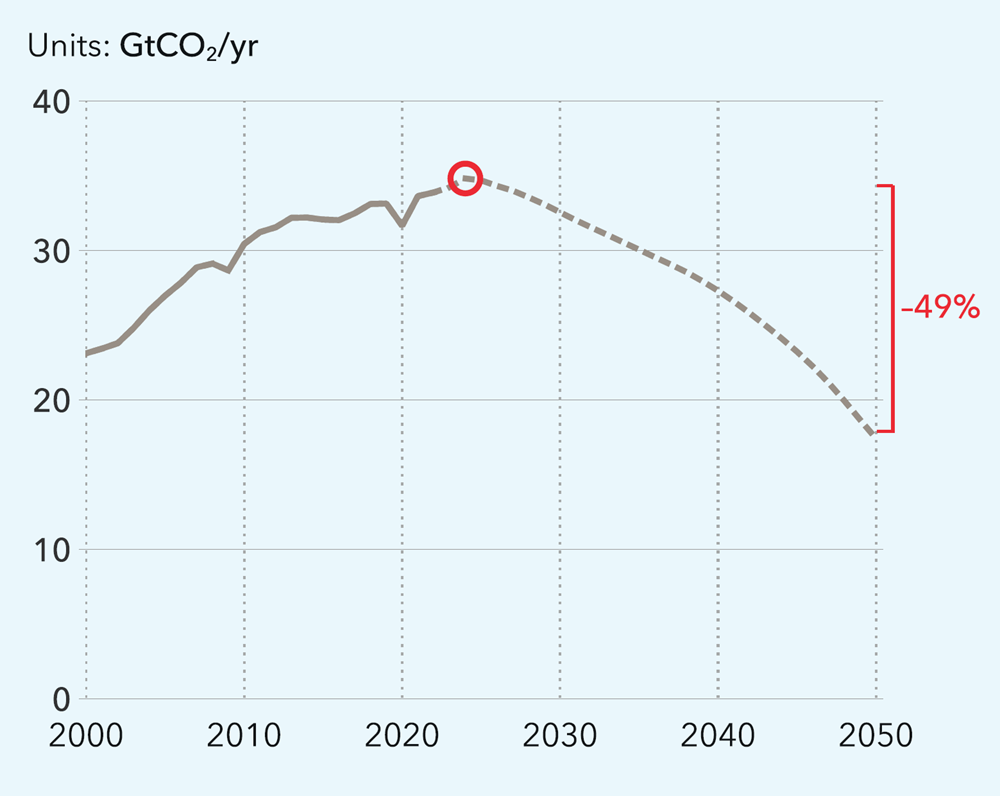

Finance Minister Chrystia Freeland announced guiding principles for a Canadian taxonomy on Wednesday that would define and categorize investments meant to advance the goal of reaching net zero emissions by 2050.

The guideline will include both low-emitting “green” activities and “transition” activities that enable decarbonization. Banks, insurers, pension plans and asset managers have asked for those definitions, the Finance Department said in a background document.

“The government does not anticipate new natural gas production to be eligible” for either category, the document stated. But activities associated with a “limited buildout” of existing gas projects — or that significantly reduce emissions at them — may qualify. Nuclear activities weren’t mentioned.

Many financial institutions have targets for green financing and green investments. Without a taxonomy, each institution is left to define for itself what fits, raising the risk of greenwashing.

The exercise is complicated by the fact that there’s no universal set of rules: as of June, some 21 green taxonomies have been published worldwide, with another 21 under development or announced by regulators, according to BloombergNEF.

“Canada has some catching up to do in the global race for climate capital,” Ryan Riordan, director of research with the Institute for Sustainable Finance at Queen’s University, said in an email.

Examples of green activities provided in the background document include hydrogen, solar and wind energy generation, as well as electrical transmission lines.

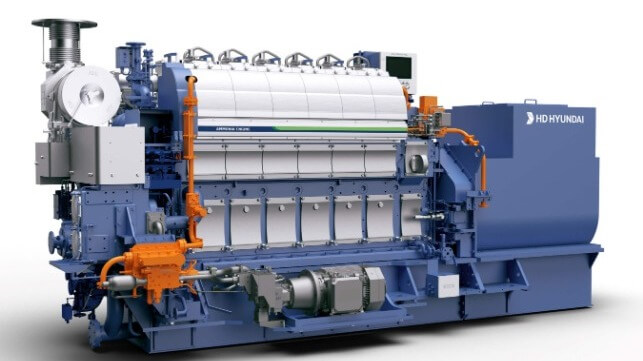

Installing a lower-emitting electric furnace to produce steel, meanwhile, was given as an example of a transition activity. Mining of so-called critical minerals, such as copper and lithium, might also be considered a transition activity.

The Canadian taxonomy will be developed and governed by a third-party organization, which will have the final say on eligible activities.

The government also announced it will require large, federally incorporated private companies to disclose climate-related financial risks — with details to come later.

Heather Exner-Pirot, special adviser to the Business Council of Canada, said the business community doesn’t need more regulation, especially as it reels from the anti-greenwashing provisions enacted via Bill C-59 in June.

“Adding more mandatory net zero regulations, and not saying what they are, is not compatible with a world of investor certainty,” she said in an interview.

The government plans to release more information on how it will harmonize its requirements with those of provincial securities regulators.

Incremental progress

The government launched a council of banks, insurers, pensions and asset managers in May 2021 to give advice on the development of the taxonomy. The group came up with a draft framework in 2023, and environmentalists have criticized the government for taking so long to finalize one.

The council “gave us some good advice; we’re building on it now,” Freeland said at the Principles for Responsible Investment conference in Toronto on Wednesday. “These are made-in-Canada guidelines for sustainable investing.”

The developments were welcomed by the PRI, which called the announcements “significant steps forward for investors.”

Barbara Zvan, chairwoman of the taxonomy council and president and CEO of University Pension Plan Ontario, also welcomed the new rules, which “will help companies and investors develop credible transition plans for their operations and portfolios, respectively.”

Julie Segal, senior program manager of climate finance with Environmental Defence Canada, said the taxonomy’s definitions must be rigorous and science-based to be effective.

A consortium of environmental groups that includes Environmental Defence, Ecojustice and Stand.earth criticized the government’s suggestion that existing natural gas projects may have a place in the framework.

“The government’s acknowledgment that new oil or gas projects are inconsistent with a safe climate is a positive step, but investments in any type of gas projects still risk locking Canada into an anachronistic economy,” Segal said in an email.

Exner-Pirot, however, said she’s “very annoyed” that new natural gas could be excluded from the taxonomy, in part because doing so would put Canada’s definitions among the strictest worldwide.

The European Union, Russia, Association of Southeast Asian Nations and China classify natural gas for electricity, heating and cooling as green, according to BloombergNEF.

(By Melissa Shin)