By Tsvetana Paraskova - Dec 07, 2024

The U.S. is currently the world's largest LNG exporter, but future growth is threatened by legal challenges, project delays, and a pause on new export permits.

The outcome of the 2024 U.S. presidential election could significantly impact the future of U.S. LNG policy and export potential.

Industry leaders are calling for an end to the permitting pause and streamlined regulations to support continued growth in the U.S. LNG sector.

![]()

The U.S. LNG export industry has recently hit several stumbling blocks. And who will be America’s president in the next four years may not even be the biggest.

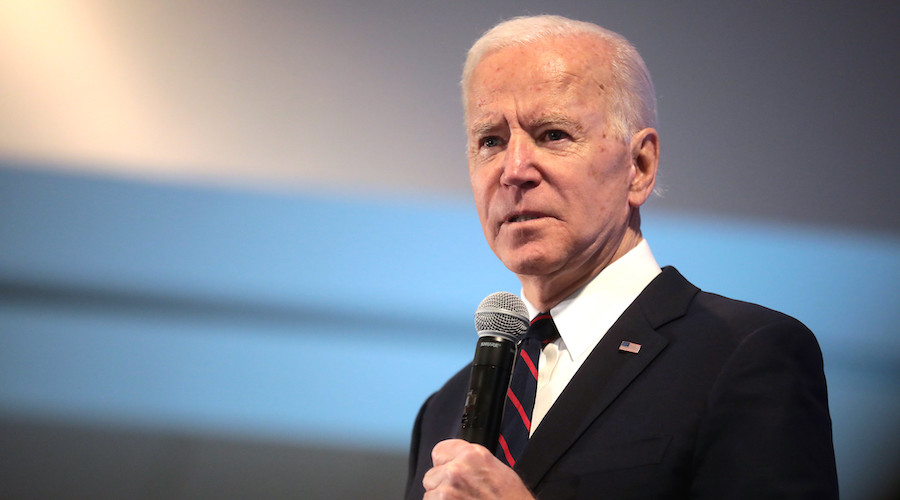

Litigation at court from environmental groups, a contractor bankruptcy, and President Joe Biden’s permit pause have combined to increase uncertainty for U.S. LNG project developers and exporters this decade.

Top LNG Exporter

The expansion of the LNG export infrastructure over the past five years and the flexibility in cargo destination of U.S. LNG have made America the world’s biggest exporter of liquefied natural gas. Soaring sales in Europe, which has scrambled to replace Russian pipeline gas, and more LNG projects coming online this decade boosted U.S. exports by 12% in 2023 from a year earlier. At 11.9 billion cubic feet per day (Bcf/d) of LNG exports, the United States easily beat its closest rivals – Qatar and Australia – to become the biggest LNG exporter last year, EIA data showed.

Utilization of U.S. LNG export capacity averaged 104% of nominal capacity and 86% of peak capacity across the seven U.S. LNG terminals operating in 2023 as relatively strong demand for LNG in Europe amid high international natural gas prices supported increased U.S. LNG exports last year.

This year, U.S. LNG exports are set to average 12.1 billion Bcf/d, slightly up from 2023, and 13.8 Bcf/d in 2025, per the EIA’s latest Short-Term Energy Outlook for October.

Two new projects, Corpus Christi LNG Stage 3 and Plaquemines LNG, are in the commissioning phase to start LNG export operations, and each of these facilities will begin exporting LNG by the end of 2024, the EIA said.

Uncertainties Lie Ahead

Going forward, delays at some fully-permitted projects have recently emerged, and they have nothing to do with the U.S. administration’s policy.

ExxonMobil and QatarEnergy have seen their $10-billion Golden Pass LNG export plant in Texas slip in the timeline to late next year after the project faced delays due to the bankruptcy of Zachry Holdings, the lead construction contractor. The U.S. Federal Energy Regulatory Commission (FERC) has just granted a three-year extension to ExxonMobil and QatarEnergy to build their export plant.

Earlier in August, Exxon said it is delaying the start-up of Golden Pass LNG to late 2025 from the first half of next year after work at the facility stalled following the bankruptcy of the lead contractor.

Then there is the Rio Grande LNG project of NextDecade, which also faces delays due to a court ruling over its FERC authorization.

In early August, a U.S. appeals court vacated the remand authorization of NextDecade’s Rio Grande LNG export project issued by the Federal Energy Regulatory Commission on the grounds that the FERC should have issued a supplemental Environmental Impact Statement during its remand process.

This case and other litigation add another layer of uncertainty for U.S. LNG developers.

Of course, the biggest one now is President Biden’s pause on permitting from January until the Department of Energy can update the underlying analyses for authorizations. Under environmentalist pressure, the Administration said early this year that during the temporary pause DOE will carry out a new updated review on the impact of such projects on health and communities

The consensus at Wood Mackenzie’s annual conference on ‘Gas, LNG and the Future of Energy’ last week was that the pause in LNG export authorizations would ultimately be seen as something between “a blip” and “a speed bump” for the U.S. LNG sector, wrote Ed Crooks, Senior Vice President, Americas, at WoodMac.

The 47th President and U.S. LNG

Some of the uncertainties for U.S. LNG could be cleared as soon as January when the 47th U.S. president takes office. Donald Trump has promised to immediately restart LNG permitting.

However, analysts have expressed concerns that the U.S LNG export boom could be undermined if a Trump administration slaps a promised 60% tariff on China’s imports, which could lead to Chinese retaliation with China avoiding new LNG purchases from the U.S. or re-selling U.S. cargoes.

After the U.S. election, “It seems highly likely that the pause will be lifted. But new requirements could be imposed on projects that would make securing an authorisation a slower and more complex process,” WoodMac’s Crooks says.

The industry is calling for the pause to be lifted.

“You gotta stop this crazy LNG pause from going forward,” Ryan Lance, chief executive at ConocoPhillips, said at the Gastech conference in Houston last month.

“We absolutely need permitting reform, and we need more infrastructure,” Lance added.

A Trump administration is widely expected to facilitate permitting and ease the regulatory burden on America’s oil and gas industry.

“But the primary determinants of US hydrocarbon production are the revenues and capital allocation strategies of the Majors and E&P companies, which are unlikely to be affected much by what happens in Washington,” according to WoodMac’s Crooks.

Even with a President Trump, or likely precisely because of a Republican in the White House, the environmental campaign against LNG at U.S. courts will gain momentum, and U.S. LNG developers may have to contend with fresh delays stemming from legal challenges.

By Tsvetana Paraskova for Oilprice.com

The U.S. is currently the world's largest LNG exporter, but future growth is threatened by legal challenges, project delays, and a pause on new export permits.

The outcome of the 2024 U.S. presidential election could significantly impact the future of U.S. LNG policy and export potential.

Industry leaders are calling for an end to the permitting pause and streamlined regulations to support continued growth in the U.S. LNG sector.

The U.S. LNG export industry has recently hit several stumbling blocks. And who will be America’s president in the next four years may not even be the biggest.

Litigation at court from environmental groups, a contractor bankruptcy, and President Joe Biden’s permit pause have combined to increase uncertainty for U.S. LNG project developers and exporters this decade.

Top LNG Exporter

The expansion of the LNG export infrastructure over the past five years and the flexibility in cargo destination of U.S. LNG have made America the world’s biggest exporter of liquefied natural gas. Soaring sales in Europe, which has scrambled to replace Russian pipeline gas, and more LNG projects coming online this decade boosted U.S. exports by 12% in 2023 from a year earlier. At 11.9 billion cubic feet per day (Bcf/d) of LNG exports, the United States easily beat its closest rivals – Qatar and Australia – to become the biggest LNG exporter last year, EIA data showed.

Utilization of U.S. LNG export capacity averaged 104% of nominal capacity and 86% of peak capacity across the seven U.S. LNG terminals operating in 2023 as relatively strong demand for LNG in Europe amid high international natural gas prices supported increased U.S. LNG exports last year.

This year, U.S. LNG exports are set to average 12.1 billion Bcf/d, slightly up from 2023, and 13.8 Bcf/d in 2025, per the EIA’s latest Short-Term Energy Outlook for October.

Two new projects, Corpus Christi LNG Stage 3 and Plaquemines LNG, are in the commissioning phase to start LNG export operations, and each of these facilities will begin exporting LNG by the end of 2024, the EIA said.

Uncertainties Lie Ahead

Going forward, delays at some fully-permitted projects have recently emerged, and they have nothing to do with the U.S. administration’s policy.

ExxonMobil and QatarEnergy have seen their $10-billion Golden Pass LNG export plant in Texas slip in the timeline to late next year after the project faced delays due to the bankruptcy of Zachry Holdings, the lead construction contractor. The U.S. Federal Energy Regulatory Commission (FERC) has just granted a three-year extension to ExxonMobil and QatarEnergy to build their export plant.

Earlier in August, Exxon said it is delaying the start-up of Golden Pass LNG to late 2025 from the first half of next year after work at the facility stalled following the bankruptcy of the lead contractor.

Then there is the Rio Grande LNG project of NextDecade, which also faces delays due to a court ruling over its FERC authorization.

In early August, a U.S. appeals court vacated the remand authorization of NextDecade’s Rio Grande LNG export project issued by the Federal Energy Regulatory Commission on the grounds that the FERC should have issued a supplemental Environmental Impact Statement during its remand process.

This case and other litigation add another layer of uncertainty for U.S. LNG developers.

Of course, the biggest one now is President Biden’s pause on permitting from January until the Department of Energy can update the underlying analyses for authorizations. Under environmentalist pressure, the Administration said early this year that during the temporary pause DOE will carry out a new updated review on the impact of such projects on health and communities

The consensus at Wood Mackenzie’s annual conference on ‘Gas, LNG and the Future of Energy’ last week was that the pause in LNG export authorizations would ultimately be seen as something between “a blip” and “a speed bump” for the U.S. LNG sector, wrote Ed Crooks, Senior Vice President, Americas, at WoodMac.

The 47th President and U.S. LNG

Some of the uncertainties for U.S. LNG could be cleared as soon as January when the 47th U.S. president takes office. Donald Trump has promised to immediately restart LNG permitting.

However, analysts have expressed concerns that the U.S LNG export boom could be undermined if a Trump administration slaps a promised 60% tariff on China’s imports, which could lead to Chinese retaliation with China avoiding new LNG purchases from the U.S. or re-selling U.S. cargoes.

After the U.S. election, “It seems highly likely that the pause will be lifted. But new requirements could be imposed on projects that would make securing an authorisation a slower and more complex process,” WoodMac’s Crooks says.

The industry is calling for the pause to be lifted.

“You gotta stop this crazy LNG pause from going forward,” Ryan Lance, chief executive at ConocoPhillips, said at the Gastech conference in Houston last month.

“We absolutely need permitting reform, and we need more infrastructure,” Lance added.

A Trump administration is widely expected to facilitate permitting and ease the regulatory burden on America’s oil and gas industry.

“But the primary determinants of US hydrocarbon production are the revenues and capital allocation strategies of the Majors and E&P companies, which are unlikely to be affected much by what happens in Washington,” according to WoodMac’s Crooks.

Even with a President Trump, or likely precisely because of a Republican in the White House, the environmental campaign against LNG at U.S. courts will gain momentum, and U.S. LNG developers may have to contend with fresh delays stemming from legal challenges.

By Tsvetana Paraskova for Oilprice.com