Czech Republic selects Rolls-Royce SMR for small reactors project

The Czech Republic has chosen UK firm Rolls-Royce SMR after assessing seven potential technology suppliers for its proposed small modular reactor programme.

The Ministry of Trade said that the applicants were approached "on the basis of their potential suitability for placement in the Czech Republic ... Rolls-Royce SMR emerged as the best company with which ČEZ (the Czech nuclear power company) wants to establish a strategic partnership". The government will now carry out a "safety assessment of the British company" as was done for those who bid for the recent large nuclear units contracts - involving the Ministry of the Interior, Security Information Service, ÚZSI, Military Intelligence and other key institutions to ensure it complies with the state's security requirements.

The first small modular reactor (SMR) is planned by ČEZ at a site near the existing Temelin nuclear power plant in the 2030s, "before the start up of the new large Czech nuclear unit which is planned for before 2040", the ministry said. ČEZ is also looking at other sites suitable for SMRs, including Tušimice and Dětmarovice where survey and monitoring work is taking place to see if they are suitable nuclear sites.

Rolls-Royce SMR's selection by the Czech Republic comes as the company waits to hear whether it will be selected by the UK as one of the preferred suppliers for its own SMR programme. It is one of five in the running, with the expectation that two technologies will be selected to be taken forward by the UK government's arms-length Great British Nuclear body for deployment.

The Czech government says it would be an "advantage ... that Rolls-Royce SMR is just forming its supply chain, and Czech companies thus have a unique opportunity to stand at its birth and participate to the maximum extent possible. Thanks to this strategic cooperation, local companies will be able to participate not only in the development and implementation of the new small modular reactor, but also in the supply of SMR abroad".

Prime Minister Petr Fiala said: "Small modular reactors can be a key technology for ensuring energy security in the future. That is why from the beginning we try not only to build them, but also to participate in their global production and development. In addition, the establishment of a strategic partnership between ČEZ and Rolls-Royce SMR will be a great opportunity for Czech companies that have many years of experience in the nuclear industry."

Minister of Industry and Trade Jozef Síkela said: "This technology can not only provide enough electricity at affordable prices, but also support our efforts to decarbonise and safely transition to clean energy sources. In addition, this cooperation is also a great opportunity for Czech industry. Our companies can be part of the global supply chain from the very beginning and contribute to the development of this promising technology."

ČEZ CEO Daniel Beneš said: "The strategic partnership with Rolls-Royce SMR will allow us to use our long-term experience in the field of nuclear energy in combination with the high technological maturity of the British company." He said that ČEZ would now negotiate specific terms of the cooperation with the British company.

CEO of Rolls-Royce SMR, Chris Cholerton, welcomed the decision and said: "Discussions are ongoing to finalise contract terms and the final agreements are subject to customary regulatory clearances. Details of the agreement will be published at signing. This important strategic partnership further strengthens Rolls-Royce SMR’s position as Europe’s leading SMR technology, and will put ČEZ, Rolls-Royce SMR and its existing shareholders at the forefront of SMR deployment. Rolls-Royce SMRs will be a source of clean, affordable, reliable electricity for Czechia - creating jobs, enabling decarbonisation, reducing the reliance on imported energy and supporting the global effort to reach net zero."

Nuclear Power in the Czech Republic

The Czech Republic currently gets about one-third of its electricity from four VVER-440 units at Dukovany, which began operating between 1985 and 1987, and the two VVER-1000 units in operation at Temelín, which came into operation in 2000 and 2002. In July, Korea Hydro & Nuclear Power (KHNP) was named the preferred bidder for up to four new units at the two existing nuclear power plants, with the target of the first unit entering commercial operation in 2038.

The Czech SMR roadmap was published and approved last year setting out options for technology suppliers and identifying a range of potential sites - 45 in total - as well as investor models. Its vision is for "SMRs to complement large nuclear untis from 2030s-40s onwards".

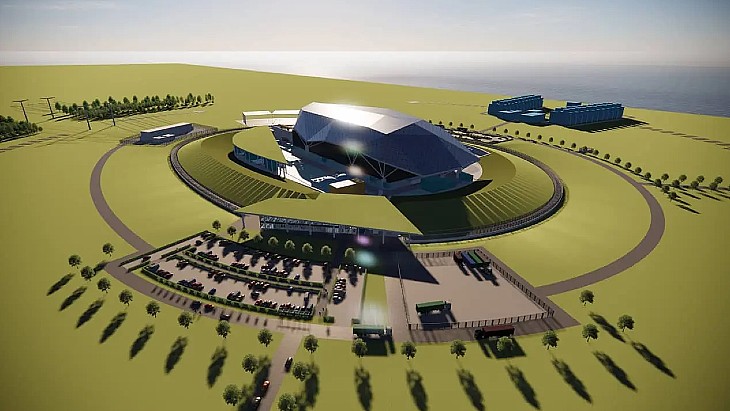

The Rolls-Royce SMR

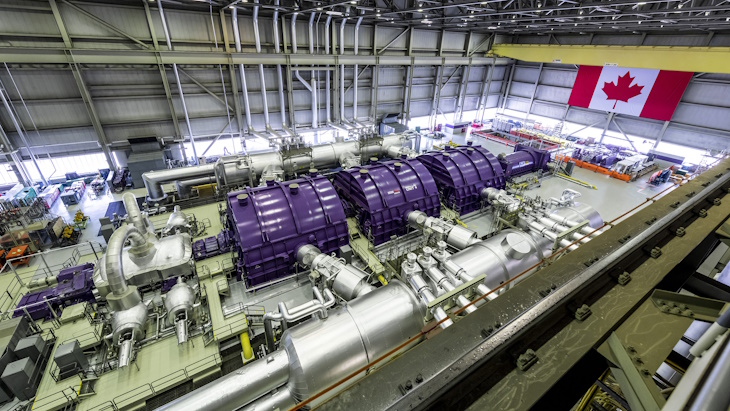

The Rolls-Royce SMR is a 470 MWe design based on a small pressurised water reactor. It will provide consistent baseload generation for at least 60 years. 90% of the SMR - measuring about 16 metres by 4 metres - will be built in factory conditions, limiting on-site activity primarily to assembly of pre-fabricated, pre-tested, modules which significantly reduces project risk and has the potential to drastically shorten build schedules.

Its capacity is larger than many of its SMR rivals - the general definition of an SMR is of a reactor unit with an output of up to 300 MWe. In July, it successfully completed Step 2 of the UK's Generic Design Assessment process and progressed to the third and final phase of the process which assesses the safety, security and environmental aspects of a nuclear power plant design that is intended to be deployed in the UK. The target date to complete that final stage is August 2026.

In July, the Nuclear Industry Association applied to the UK government for a justification decision for Rolls-Royce SMR's SMR, a decision required for the operation of a new nuclear technology in the country. It marks the first ever application for justification of a UK reactor design. If Rolls-Royce is successful in the UK's SMR selection contest, the aim is for a final investment decision to be taken in the UK in 2029.